Summary:

- Adobe stock is down more than 45% over the last year, and the risk/return profile is finally attractive.

- The stock was punished by the fall of tech stocks from nosebleed valuations and the massive price tag to acquire Figma.

- There are several positives to the Figma acquisition, despite the cost.

- Let’s look at the acquisition in detail and be ready if this market rally fizzles.

Kimberly White

What Happened?

Software giant Adobe (NASDAQ:ADBE) released pedestrian earnings on September 15th, 2022, and dropped a bombshell on the market. The company announced it was acquiring online design enterprise Figma for $20 billion, about half in cash and half in stock.

Figma is a cloud-based design software that competes directly with Adobe XD. Many professionals prefer Figma because of its superior collaboration functionality. Multiple users can edit in real-time, similar to Google Docs (GOOG, GOOGL). For those interested in more detail, check out this link.

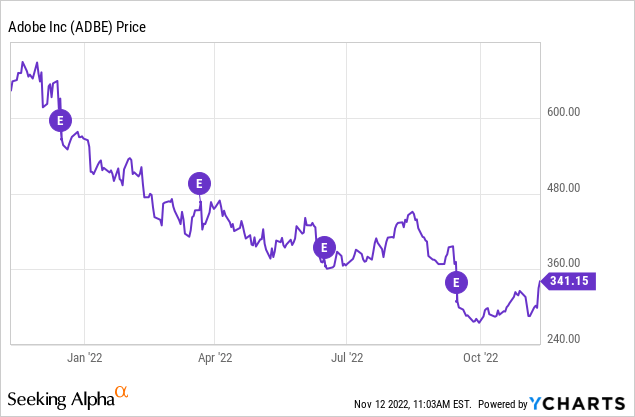

The stock was already down 35% on the year before the announcement and cratered on the news, as shown below.

Numerous analysts rushed to lower price targets and cut ratings. Of course, the stock was already trading under $300 per share as these rolled in. The stock reached its 52-week low of $275 per share in late September.

After researching the stock’s valuation and the nuances of the Figma acquisition, I averaged into a near-full position with an average cost of $287 per share. This looks prescient after last week’s rally; however, the rally could fizzle quickly, and this is a long-term play.

Another dip in Adobe stock should be tempting to long-term investors who understand the long-term implications of bringing Figma on board. Dollar-cost averaging could also be a wise choice because the price is still historically low even after the rally.

Here are three reasons the Figma acquisition and stock price look compelling.

Reason #1: The Microsoft Dilemma

Microsoft (MSFT) and Adobe have enjoyed a healthy relationship for years. Both are among the largest software companies in the world by market cap. While they are rivals, Microsoft is an Adobe customer, and they have formed strategic partnerships and integrations over the years.

Microsoft employees have been using Figma for years and apparently don’t just like it; they LOVE it. Integration with Microsoft Teams app was also recently added.

In fact, Figma’s customer base is a who’s who of corporate tech companies, from Netflix (NFLX) to Spotify (SPOT) to Alphabet.

The decision to purchase Figma for $20 billion becomes apparent through this lens.

- Adobe can’t afford to allow Figma to continue infringing on its space with its 100% revenue growth expected in 2022.

- Microsoft is no stranger to massive acquisitions. Its recent $69 billion purchase of Activision Blizzard (ATVI) is under regulatory review. If Adobe doesn’t purchase Figma, another software giant might, and this could significantly affect Adobe’s future profits.

- Figma could go public. The company drew a $10 billion valuation in 2021. It would likely attract more during an IPO, becoming an incredibly well-funded competitor in Adobe’s creative space.

$20 billion is steep, but it may cost much more to do nothing.

Reason #2: Figma

Figma didn’t receive a $10 billion valuation in 2021 for nothing. It is a fantastic product by all accounts. It is expected to pass $400 million in annual recurring revenue (ARR) in 2022 on 100% sales growth and a 90% gross margin. Its 150% net retention rate is incredible and indicates that growth will continue rapidly.

Figma is also cash-flow positive, so it won’t be a drain on resources. The $20 billion price seems ridiculous now, but it may seem like a bargain in five years.

Reason #3: Buy Vs. Develop

Companies spend billions researching and developing (R&D) new products. Internal R&D is costly, and there is no guarantee that successful products will develop. Adobe has spent $8.9 billion on R&D since 2019. Sometimes purchasing a ready-made product for a premium price is the best option.

Salesforce (CRM) is a prime example of a company successfully building out acquisitions. The company has acquired Slack, Tableau, MuleSoft, and many others. After making the investments, Salesforce successfully grew each division’s value beyond the initial purchase price.

As mentioned, the Figma acquisition will be about half in cash and half in stock. Adobe has a strong balance sheet with $8.5 billion in current assets and has produced $5.5 billion cash from operations through three quarters this year.

The acquisition may need short-term financing, but won’t saddle the company with tons of long-term debt. Finally, Adobe has repurchased $4.8 billion in shares so far this year, so shareholders aren’t being hung out to dry.

Adobe stock’s valuation

Negative sentiment has driven down the price of Adobe stock. Pessimism about the acquisition and a potential recession may give long-term investors an opportunity.

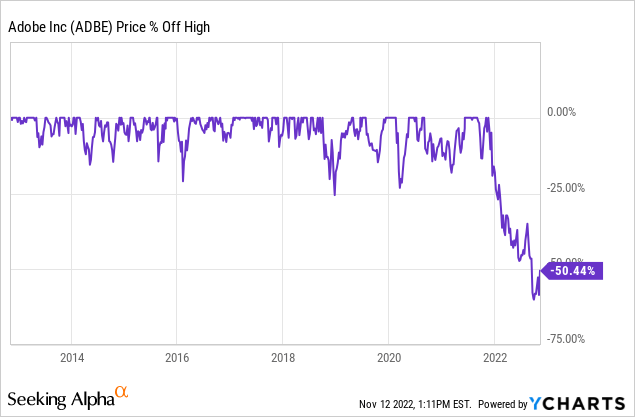

The stock is currently at its highest percent-off-high decline in ten years, as shown below.

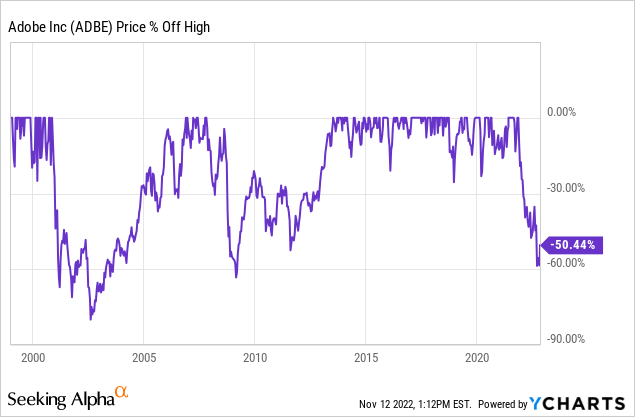

The last time the stock was this far from high was the financial crisis, and before that, the dot-com crash. The stock recovered as the economy did in both cases, as shown below.

The recovery isn’t always overnight, which is why this should be a long-term play. We could see new lows before seeing new highs. Dollar-cost averaging is an excellent tool.

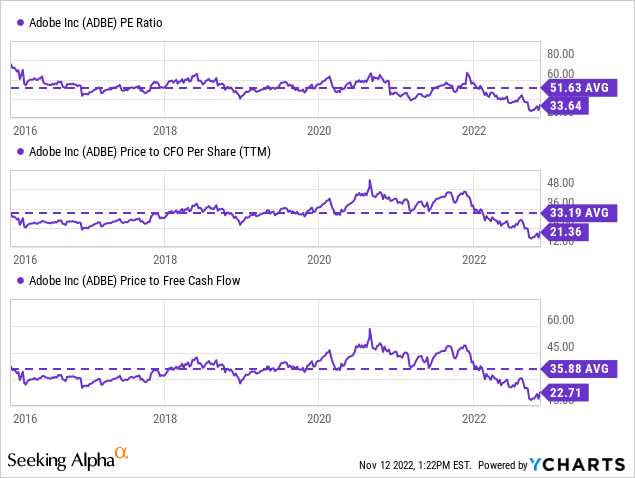

Adobe is discounted based on historical multiples as well. Its price-to-earnings (P/E) and price-to-cash flow metrics tell similar stories, as shown below.

Finally, more than $20 billion has been shaved off Adobe’s market cap since right before the Figma announcements. New investors can essentially buy Adobe with the acquisition price discounted.

The summation of these metrics points to a tremendously positive risk/reward proposition for long-term investors.

Disclosure: I/we have a beneficial long position in the shares of ADBE, MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.