Summary:

- Adobe was an AI darling, viewed by the market as one of the biggest early beneficiaries of AI with its timely Firefly launch.

- Almost a year went by, and Firefly has yet to have a meaningful impact on ADBE’s results.

- The company is seeing increasing competition from the likes of OpenAI, Midjourney, Microsoft, Apple, and Google.

- The legacy business is experiencing growth deceleration as Adobe is no longer a 20%+ growth story.

- I rate ADBE a Hold, as it trades at what I find to be a justified discount below its 5-year average.

AaronP/Bauer-Griffin/GC Images via Getty Images

Adobe (NASDAQ:ADBE), initially viewed as one of the bigger beneficiaries of the AI revolution, has seen its shares decline materially from their highs, amid fears of increasing competition and lower-than-expected contribution from its AI initiatives.

With the stock regressing back to October 2023 lows, investors are now asking, is AI good or bad for Adobe and its shareholders?

Adobe’s Roller Coaster Ride In A Nutshell

In March 2023, Adobe launched Firefly, a generative AI model that allows customers of all experience levels to generate high-quality images and text effects.

At first, Firefly was received with good impressions, although similar products like Dall-E and Midjourney gave it a fight for its money, with some critics claiming Firefly might be inferior in certain aspects. Still, when Adobe made its Firefly strategy clear, the market was clearly enthusiastic.

Adobe emphasized Firefly’s differentiation based on its commercial viability, meaning that customers can safely rely on Firefly-generated content for commercial use without the fear of legal claims against them.

In addition, management coined a new term, the content supply chain. In essence, Adobe described the process of ideation, creation, and use of digital content as a supply chain. With Adobe Firefly, advertisers, creators, marketers, and designers, who consistently rely on digital content, will be able to enhance the capacity of their content creation, producing more effective and more personalized results.

At first, Adobe’s well-defined strategy was received extremely well by investors, as the company was perceived as a first mover in AI productization, similar to Microsoft.

However, as of late, the market is becoming more cautious.

Explaining The Recent Selloff

I think it’s safe to say the number one catalyst for the recent selloff was the introduction of OpenAI’s Sora, a generative AI model that can create realistic and imaginative scenes from text instructions.

Simply put, Sora is similar to Midjourney, Firefly, or OpenAI’s own Dall-E, only it creates videos, rather than photos. And let me tell you, Sora is breathtaking.

But that’s not all the competition Adobe is facing. Google (GOOG) and Apple (AAPL) already provide plenty of smart editing tools powered by AI and are very engaged in that space. Microsoft consistently introduces new competing features through its Copilots, and there are many other players as well.

Until recently, Adobe was a differentiated, somewhat secluded company, which was able to avoid the pressure of big tech. It seemed like Adobe was the unquestionable leader in a relatively small market, which wasn’t attractive or penetrable enough for the Microsofts of the world to invest heavily into.

However, with the expansive capabilities of LLMs, it seems that investments that aren’t aimed directly toward digital creative tools are producing solutions that answer complex editing and creating needs, especially for day-to-day use cases.

Stacking all of these competitors on top of each other, it’s clear Adobe is facing challenges at a level it never faced before.

This brings me back to the content supply chain strategy.

Monetization & Viability Of The Content Supply Chain Strategy

One thing that Adobe has going for it is that the majority of its competitors are providing their tools as a nice-to-have added value.

Apple and Google are improving their operating systems and hardware, but it’s not like they’re monetizing creative tools as a standalone product.

Microsoft’s Copilots can generate pictures and turn a Word document into a PowerPoint presentation, but they don’t necessarily solve the problems people use Adobe for.

OpenAI and Midjourney are making very cool products, but no movie director is using Sora to edit a film as of now, and I don’t think many ads we’re seeing on social media are created by Midjourney or Dall-E.

Simply put, Adobe is still the number one option, by far, for professional editing and creating. And as a reminder, besides the Creative Cloud, Adobe has another significant arm in Adobe Experience, under which the company provides marketing and analytics tools, primarily for marketers and advertisers.

The content supply chain strategy, and the commercialibility of Adobe Firefly, should make the interlink between the creative arm and the experience arm as important as ever.

If Adobe is correct in the sense that commercial content generation is going to increase materially, it is uniquely positioned to profit from both the generation of such content and the managing of the use cases (marketing campaigns, mobile applications, websites, etc.) that rely on it. Such synergies can turn Adobe into a differentiated one-stop shop that could fulfill all the needs of a marketing team.

That being said, so far, there’s nothing to really show for it.

Adobe’s Fourth Quarter Results

Adobe had a decent fourth quarter, with results that beat expectations on both the top and bottom lines. Revenues grew 11.6% Y/Y and reached $5.0 billion, while net income reached $1.5 billion, reflecting a 340 bps margin improvement over the prior year period and a 70 bps improvement Q/Q.

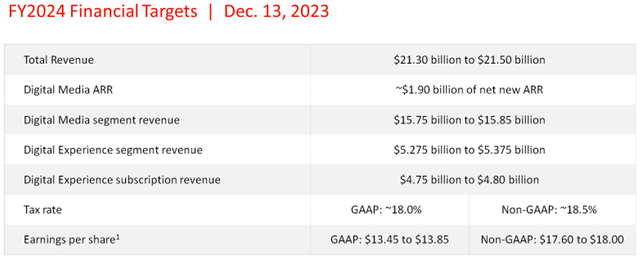

Although growth accelerated in the quarter, it was still relatively bound in the low-double-digit range. Looking at the company’s outlook for 2024, management isn’t setting targets that are that ambitious, either.

At the mid-point, Adobe is expecting to generate growth of 10.2% for the full year, with flat margins. This is far below the growth rate Adobe’s investors got used to prior to 2022, and the margin expansion story has apparently reached a peak as well.

So, despite the major waves AI was supposed to make for the company, it seems like it’s still business as usual, and not in a good way.

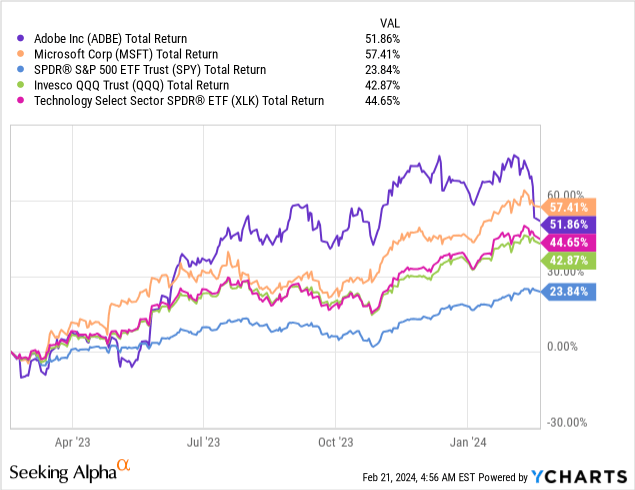

For comparison, Microsoft, another AI leader, has seen its revenue growth accelerate to 17.6% in the three months ended in December, with an observable, quantifiable, and material contribution from AI-related products.

Valuation

With Adobe’s AI story losing steam, it is becoming more and more unclear if AI is a headwind or a tailwind for the company. It remains to be seen if Adobe is able to monetize Firefly in a meaningful accretive way, but so far, it seems investors are justifiably losing confidence.

Today, Adobe is trading at roughly $542 a share. Based on the high-end of their guidance, they are expected to generate $13.85 in GAAP EPS in 2024.

Note: I discussed Intuit’s Non-GAAP numbers extensively in a different article, and Adobe’s case is almost identical. In short, they add back SBC expenses, and I don’t think it’s a relevant metric to look at.

So, Adobe is trading at a forward P/E of 39.1x, which is 14% below its 5-year average. Even after the selloff, Adobe is trading way above Microsoft which is at 34x, while the latter is expected to outgrow Adobe in upcoming years, despite its much larger size.

Historically, Adobe received a premium due to its differentiation, wide moat, and high growth expectations.

With competitive threats increasing and Adobe’s growth decelerating, I’m not sure Adobe deserves a similar high-forties multiple like before, and I’m not entirely sure it deserves a premium over the faster-growing Microsoft as well.

At best, I find Adobe fairly valued at these levels, which in my view, still prices in success at a higher probability over failure in AI.

Conclusion

Adobe was always protected by a wide moat, which resulted from its high-quality products, but also its relatively small target market. A market that was growing and profitable, but not big enough for big tech to interfere.

Since 2022, we can see Adobe’s growth has slowed, due to macro uncertainty and pull-forward demand, but also due to the larger scale it achieved, reflecting it has reached somewhat of a ceiling.

Adobe Firefly, the company’s AI promise, was initially received with enthusiasm, but as time goes by, the AI effect on Adobe is becoming more and more uncertain.

Despite that, the stock is trading at a relatively high 39x multiple, which is only slightly below Adobe’s 5-year average. I find this discount justified considering the risks we discussed, and rate Adobe a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.