Summary:

- Adobe’s stock has experienced a remarkable 40% increase since May, driven in part by the mention of AI and investor optimism.

- I explore the bullish case, highlighting how AI can disrupt the industry and enhance creativity for Adobe’s users.

- Conversely, the bearish case is discussed, emphasizing the need for personal insights to form an informed opinion about Adobe’s future prospects.

- All the while Adobe’s management expressed excitement about their generative AI technology and received lavish positive feedback from analysts.

grinvalds/iStock via Getty Images

Investment Thesis

Adobe (NASDAQ:ADBE) is up more than 40% since the start of May. Think about it. This impressive run, with so much hope. All that Adobe had to do was say the words AI a few times, and investors would do the rest.

Needless to say that Adobe did say AI a few times, analysts gushed away, and the stock is up premarket.

In this analysis, I’m going to run through the bull case, of how AI will provide a technological disruption that will allow Adobe to continue to deliver its users with ever more creativity.

Then, I’m going to discuss the bear case. I hope that through my professional experience, I’m able to vicariously provide you with enough insights to allow you to formulate your own opinion.

Why Adobe? Why Now?

Adobe has two main segments:

- Adobe’s Digital Media segment includes many household names such as Photoshop, After Effects, Adobe Acrobat, and Adobe Sign. And I suspect that Adobe Firefly will be included in its Digital Media segment.

- Adobe’s Digital Experience is made up of analytics and commerce units.

Adobe kicks off its earnings call by describing how change ultimately benefits Adobe:

Every disruptive technology has presented exciting opportunities for Adobe to innovate and increase our addressable market opportunity.

This has been true for cloud computing, mobile and AI.

[…] Our ongoing R&D investments have enabled the rapid development and deployment of Firefly, our generative AI technology. We believe generative AI will drive both further accessibility and adoption of our products.

[…] We could not be more excited about our generative AI road map that will make Adobe products more accessible to an even larger universe of people, while dramatically enhancing productivity for existing customers.

Then, as we go through the earnings call, 7 out of the 9 analysts on the call congratulate management on a terrific quarter, or words to that effect. So was Adobe’s guidance truly remarkable? Let’s discuss this next.

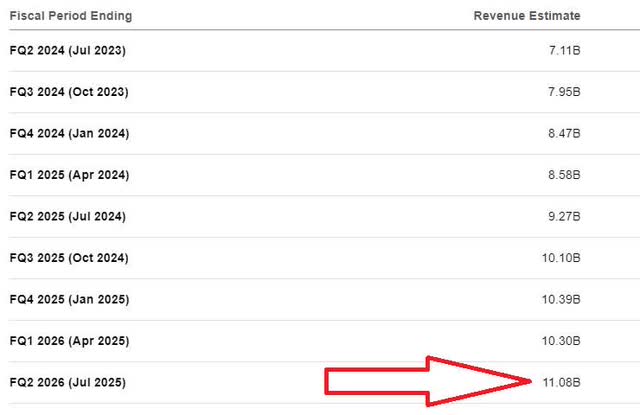

Revenue Growth Rates Have Moderated

ADBE revenue growth rates, GAAP figures

We can sprinkle words about AI as much as we want. But the revenue growth rates that Adobe is guiding for its next quarter are actually slower than in the same period a year ago.

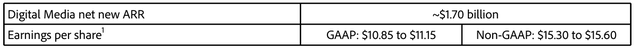

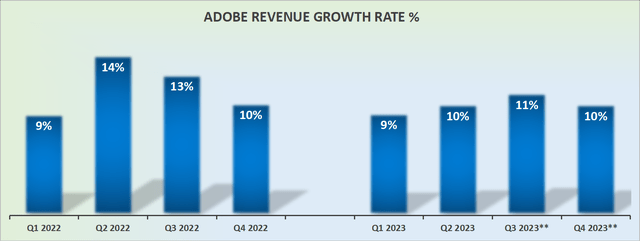

This is Adobe’s Digital Media full-year guidance Adobe provided back in the prior quarter.

And what follows is Adobe’s newly updated guidance that has analysts in awe.

Allow me to provide further context. When Nvidia (NVDA) spoke about AI in its most recent quarterly results, Nvidia had the numbers to back it up. I’m not advocating here whether or not Nvidia is cheap or not. I’m simply stating the facts.

The highly charismatic CEO Jensen Huang come out and described the future being here, how Nvidia was at an inflection point, and all the rest. But Nvidia had the numbers to back it.

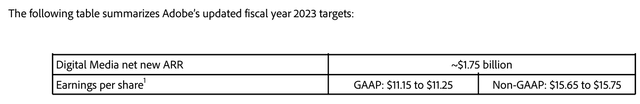

As Nvidia headed into its financial results, this was what analysts had been expecting from Nvidia.

And when Nvidia ultimately guided for the next quarter, it pulled forward two years of growth rates. There was a massive amount of acceleration on its topline, here Nvidia guided for $11 billion in revenues.

What about Adobe? Even if we presume that Adobe is being conservative with its guidance, we are talking here about 11% y/y growth. That’s hardly all that enticing.

Next, consider this.

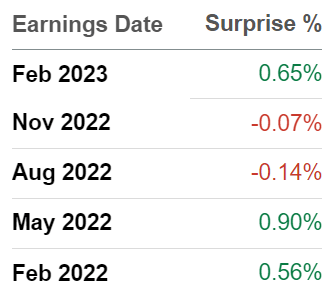

SA Premium

This is how much Adobe typically beats revenue estimates. Does this strike you as a company that has a history of being conservative with its revenue guidance in order to positively delight investors the next quarter? I believe this question largely answers itself by the way it was formulated. But these are the facts.

Next, we’ll discuss Adobe’s valuation.

How to Think About Adobe’s Valuation?

On the surface, if we presume that Adobe in the next fiscal year succeeds in growing its bottom line non-GAAP EPS by 15% CAGR to $18.11 this would put the stock priced at about 27x next year’s EPS.

I’m not going to declare that this is a shocking valuation. Not at all. I’ve seen massively worse in the past few years. But just because something is even more shocking, does this automatically mean that Adobe is undervalued?

I don’t believe that to be the case. Perhaps, I’m struggling with enough vision. Or perhaps, I’ve been through 2020 and saw firsthand how hopes and dreams can turn to despair and frustration, in a blink of an eye.

We saw this with cannabis stocks. We saw this with crypto. We saw this work with work-from-home stocks.

The Bottom Line

I believe there’s too much investor optimism, fueled by Adobe’s mention of AI, and the subsequent positive reactions from analysts.

Here I provide both the bullish and bearish cases for Adobe, focusing on the potential disruptive power of AI to enhance creativity.

Furthermore, Adobe’s revenue growth rates for the upcoming quarter are slower than the previous year. Additionally, I provide insights into Adobe’s revenue estimates and its historical track record.

I concluded by discussing Adobe’s valuation, acknowledging that while it may not be shockingly high, in the present AI hype, sometimes, it’s difficult to get much sense of what’s actually happening.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.