Summary:

- Adobe reported its Q2 FY24 earnings where revenue and earnings grew 11% and 11.9% YoY respectively, beating estimates as it drove robust innovation across its solution suites.

- Aside from a suite of AI features, it also rolled its Firefly Services and Custom Models into general availability to drive monetization from its enterprise customers as they deepen adoption across use cases.

- However, the company is likely to face growing competition from Canva as they look to capture a share of Adobe’s enterprise segment from its latest product launches at its annual event.

- Although I believe that the company is well positioned to reach its $30B revenue target given its product roadmap and competitive positioning, its current valuation looks capped.

- Therefore, in order for the stock to gain substantial upside from its current levels, Adobe has to showcase revenue acceleration. Till then, I will rate it a “hold”.

David Tran

Introduction & Investment Thesis

Adobe (NASDAQ:ADBE) drives creativity, productivity, and digital experiences through its Creative Cloud, Document Cloud, and Experience Cloud offerings. The company has underperformed the indices YTD, although jumping 14.5% after its latest Q2 FY24 earnings, where it grew its revenue and earnings by 11% and 11.9% YoY, respectively, beating estimates.

While investor sentiment was subdued before the earnings call, its Q2 report showcased strength across its solutions suites with new customer acquisition and growing adoption across customer segments as it launched new AI features to boost user engagement and drive superior digital outcomes. Particularly, I am optimistic about the general availability of Firefly Services and Custom Models that it announced at Adobe Summit, which I believe will help drive monetization from its enterprise customers, allowing them to build personalized content and campaigns at scale.

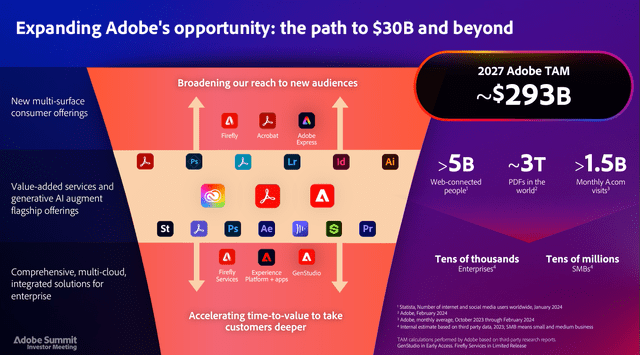

During the Summit, the management laid out its $30B projection by FY27, which would require the company to grow at a CAGR of 12.6% during this period of time. Although the growth rate is at par with the management’s expectation of its total addressable market (“TAM”) expansion rate from $205B in 2024 to $293B in 2027, I believe that the stock is fully priced at its current levels from a risk-reward standpoint. Therefore, I believe in order for the stock to substantially rise from its current levels, the company will be required to grow at a faster rate than currently projected. In the meantime, I will be saying on the sidelines and rating it a “hold”.

The good: Net new subscription growth and renewal strength across Document, Creative & Experience Cloud; Firefly Services and Custom Models launched into general availability; Strong financial discipline

Adobe reported its Q2 FY24 earnings, where revenue grew 11% YoY in constant currency to $5.31B, exceeding expectations as the company continued to attract an expanding universe of customers across Creative Cloud, Document Cloud, and Experience Cloud given their robust AI-led product delivery, allowing creators, students, entrepreneurs, and businesses to unlock their creativity and productivity to drive superior digital outcomes. In terms of revenue distribution by solutions, Creative Cloud contributed 59% to Total Revenue, growing 11% YoY, while Document Cloud and Experienced Cloud contributed 14.7% and 26.3% to Total Revenue, growing 19% and 13% YoY, respectively.

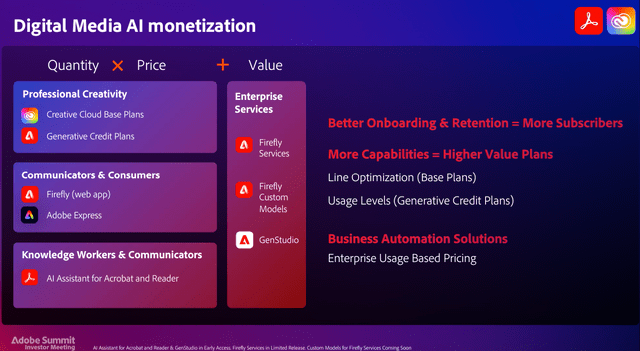

When it comes to its Digital Media segment, I will break it down with some of the highlights in Document Cloud and Creative Cloud solution suites. Starting with Document Cloud, the company saw steady growth in Monthly Active Users (“MAUs”), with continued strength in free-to-digital conversions driven by seat expansion and new account wins across SMBs and Enterprise Customers, as it added $165M of net new Document Cloud ARR. During the quarter, the company also rolled Acrobat AI Assistant into general availability, which will enable users to extract summaries and insights from PDFs by having conversations with it, which I believe will unlock productivity gains while streamlining workflows at the same time. Over the coming quarters, I expect to see growing adoption of its Acrobat AI Assistant as use cases expand for both knowledge workers and communicators, leading to a higher conversion rate from freemium to paid, thus improving monetization opportunities for Adobe across its customer segments.

Turning to Creative Cloud, which is the second solution suite within the Digital Media segment, its innovations within Creative Cloud flagship applications, Express, and Firefly services are positioning the company to catalyze individuals, solopreneurs, SMBs, and enterprises to stand out by creating differentiated content and designs across various formats. Within Creative Cloud flagship applications, the company continues to release new AI features with Adobe Firefly foundation models across Photoshop, Illustrator, Lightroom, and more to supercharge content creation. During the earnings call, the management discussed that they have significantly improved user onboarding onto Creative Cloud flagship applications, and I believe that as the company continues to innovate on this front, it will lead to deeper user engagement and retention, allowing it new revenue streams with Generative Credits. Simultaneously, Adobe also announced the general availability of Firefly Services and Custom Models at Summit, which I believe will help it better monetize the volume of content created through usage-based pricing as adoption increases, leading to higher Average revenue Per User (“ARPU”) while allowing enterprises to build personalized content and campaigns at scale.

Adobe Summit Slides: Adobe’s path to AI Monetization in Digital Media Segment

Finally, let’s turn our attention to the Adobe Experience Cloud, which is part of the Digital Experience segment, where the management sounded optimistic with customer interest and adoption of their Adobe Experience Platform AEP AI, which is a genAI-powered conversational interface that will enable its customers to automate tasks and simulate outcomes, thus boosting productivity and time-to-value. For instance, during the earnings call, the management discussed how Marriott International is leveraging AEP to orchestrate a highly personalized guest experience across online reservations and their mobile app. As the company continues to innovate to build new capabilities in audience insights, content workflows, and customer journey orchestration in the Experience Cloud, it should see continued momentum as it can drive seat expansion among existing customers while offering scaled pricing based on the number of seats and usage in higher value tiers.

Shifting gears to profitability, the company generated $2.44B in non-GAAP operating income, which grew 11.9% YoY with a margin of 48.2%, which is flat YoY. Despite the company growing its R&D spend by 12% YoY (on a GAAP basis) given the state of its current product innovation roadmap, the management ensured that it remained financially disciplined in delivering strong profitability, as it was able to drive demand across its solution suite, with strong new subscription growth coupled with growing adoption as customers expand their use cases, leading to growing usage of its new capabilities on the platform.

The bad: With Canva taking up market share in the enterprise segment, Adobe’s growth trajectory can be dampened

In the previous quarter, the stock had fallen drastically after it delivered a light quarterly revenue forecast. While this had sparked fears that its AI monetization ramp would be slower than expected, its Q2 earnings report proved that the company has a growing number of vectors for monetizing genAI, not to mention Firefly, which is one of the most widely used genAI offerings with multiple paths to monetization.

However, I would like to point out that Adobe is increasingly facing a formidable amount of competition from Canva, where it launched a suite of brand management products and AI-powered design tools focused on helping enterprises streamline their content creation processes at the Canva Create Event. Canva has rapidly grown over the years, last valued at $26 billion, slightly over 10% of Adobe’s market cap, but ramping up the pressure on Adobe.

Canva’s main target used to be the retail market, but with the launch of new features based on what I observed from their annual product launch, Canva is quickly encroaching on Adobe’s core target market as it increasingly sells to large corporations and enterprises. Plus, Canva is also taking advantage of a small but gradual trend where creators are increasingly flocking towards platforms like Affinity to volume license software to avoid monthly subscriptions. Affinity’s maker, Serif, is now acquired by Canva.

I believe there is some push-and-pull currently in the market, the ramifications of which are not fully clear, and could dampen Adobe’s path to AI monetization over the coming years.

Tying it together: Adobe is a “hold”

Looking forward, the company raised their revenue guidance, which it now expects to grow at approximately 10.5% YoY to $21.45B as the management revised its lower bound across Document Cloud, Creative Cloud, and Experience Cloud, with non-GAAP earnings per share expected to grow 12.6% YoY to $18.1.

During its Adobe Summit, the company had estimated its TAM at $205B in 2024, which means that should it reach its FY24 revenue target of $21.45B, it would represent 10.4% of total market share. Simultaneously, the management had also outlined that it expects its market share to grow at a CAGR of 12.6% YoY to $293B which is calculated by adding the total estimated TAM of Document Cloud, Creative Cloud, and Experience Cloud at $47B, $91B and $155B respectively. During this period of time, the management has projected to reach a revenue of $30B, which I believe will be achievable as it requires it to grow at the pace of its TAM expansion while it drives new user growth and adoption across its solution suites, with Firefly playing a key role in driving deeper user engagement, higher usage, and ARPU.

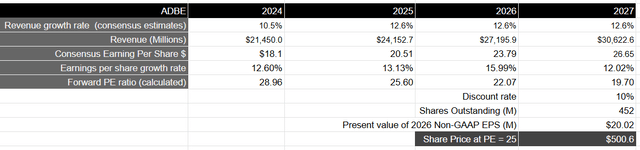

From a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $26.65 in FY27, we can see that it will be growing more or less at the same pace as revenue growth, which is reflective of management’s focus on its financial discipline. This will be equivalent to a present value of $20 in non-GAAP EPS when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Adobe should be trading at 1.4-1.5 times the multiple given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 25 or a price target of $500, which is roughly 5% lower than where it is currently trading at.

I believe that while Q2 showed progress on Adobe’s genAI monetization roadmap, it is yet to see acceleration. Based on the management’s $30B revenue target by FY27, the growth rate doesn’t reflect a sizable acceleration from its genAI product roadmap. While it is possible that the management is guiding in a conservative fashion to manage investor expectations, I believe that the stock’s upside will be capped, given its current valuation, unless the company can demonstrate a revenue acceleration from its genAI product roadmap. As a result, I will be staying on the sidelines for a better opportunity from a risk-reward perspective to initiate a position and rate it a “hold”.

Conclusion

While Adobe outperformed in its Q2 earnings on both revenue and profitability fronts, as it demonstrated strong user growth and adoption across its Digital Media and Digital Experience segments given its ongoing product innovations, I believe the stock is fully priced at current levels given its expected revenue growth rate into FY27.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.