Summary:

- Adobe stock ticked higher after beating both revenue and earnings guidance.

- In spite of a tough macro backdrop, the company continues to execute strongly, perhaps in part due to its wide product portfolio.

- Adobe is aggressively buying back stock to take advantage of the low stock prices.

- With ADBE stock trading at 22x forward earnings, long-term investors may find the profitable secular growth highly attractive.

gorodenkoff

With stock prices and valuations being reset in the tech sector, Adobe Inc. (NASDAQ:ADBE) was able to deliver solid fiscal Q1 results that beat guidance. This is a macro environment in which there is great uncertainty, but ADBE’s business model is showing resilience. ADBE is one of the most profitable names in the tech sector and is taking advantage of the lower stock prices through aggressive share repurchases. Trading at 22x forward earnings, the stock remains highly buyable for those looking for profitable secular growth.

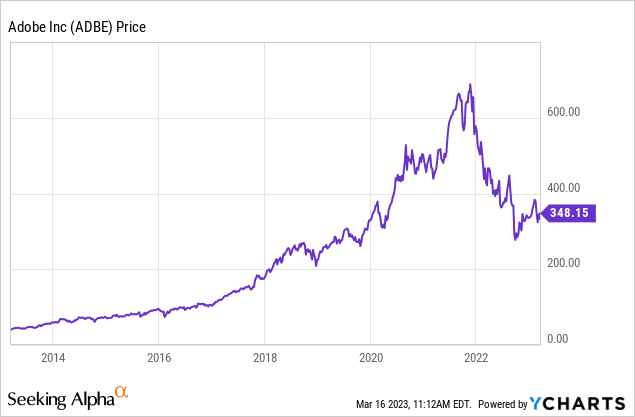

Adobe Stock Price

This tech crash has affected profitable and unprofitable tech stocks alike, as valuations and expectations were viciously reset.

I last covered ADBE in February, where I rated the stock a buy on account of the strong balance sheet, strong margins, and secular growth. The stock is little-changed since then, but the company continues to generate resilient top-line growth and robust bottom-line margins. ADBE’s strong performance amidst this difficult period may eventually help the stock realize greater multiple expansion gains over the long term.

ADBE Stock Key Metrics

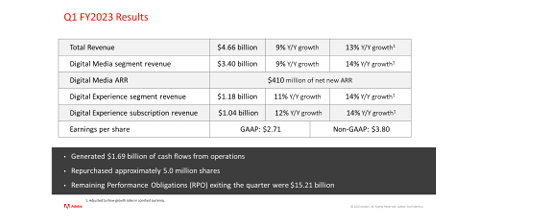

Adobe Inc. had been guiding for $4.64 billion in revenue and $3.70 in non-GAAP EPS. The company ended up beating on both of those metrics.

Q1 FY23 Presentation

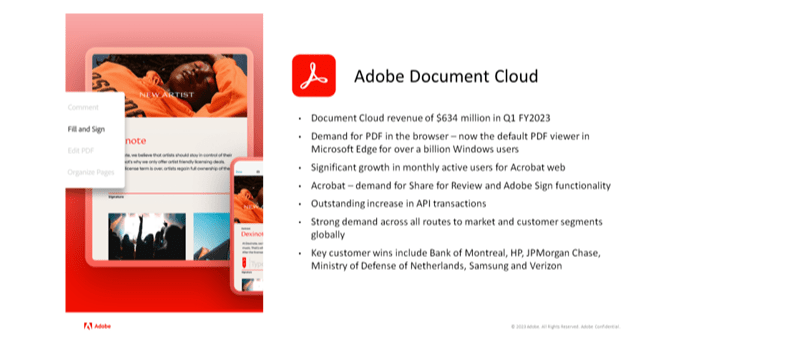

As usual, the Document Cloud division posted the strongest results, with 13% YOY growth (16% constant currency). Those who know ADBE mostly for its Photoshop-type products may find this surprising, but how could one forget ADBE’s dominant PDF position – ADBE may be able to post stronger long-term growth than e-signature incumbent DocuSign, Inc. (DOCU) due to that position.

Q1 FY23 Presentation

ADBE ended the quarter with $5.6 billion in cash versus $3.6 billion in debt. The company put all of the free cash flow towards share repurchases, buying back $1.4 billion in stock.

On the conference call, management noted that ADBE did not “hold substantial assets or securities at Silicon Valley Bank or any regional bank,” timely commentary given the recent turmoil among regional banks. Amidst a period in which most tech companies are dealing with longer sales cycles, ADBE seems immune to such headwinds. While it is difficult to pinpoint exactly what is driving that phenomenon, management stated that they attribute the strength due to ADBE’s wide product portfolio. In regard to their pending acquisition of Figma, management noted that they have “completed the discovery phase of the U.S. DOJ second request” and “the transaction continues to be on track for a close by the end of 2023.”

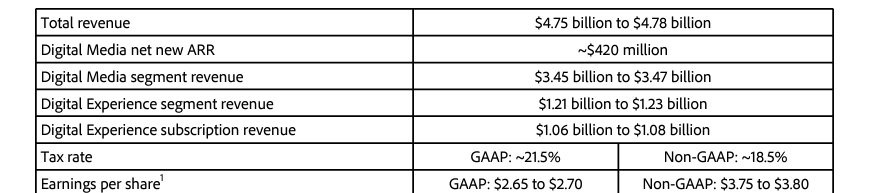

Looking ahead, ADBE increased guidance for Digital Media net new ARR from $1.65 billion to $1.7 billion and full-year earnings estimates to $15.60 per share (up from $15.45 per share). In the next quarter, ADBE is guiding for 8.9% YOY revenue growth and 13.4% non-GAAP EPS growth.

Q1 FY23 Presentation

The silver lining of poor stock price returns is that we can now view such results and guidance with a different perspective: it is incredible that ADBE is able to sustain secular growth and high profit margins in spite of such a tough macro backdrop.

Is ADBE Stock A Buy, Sell, Or Hold?

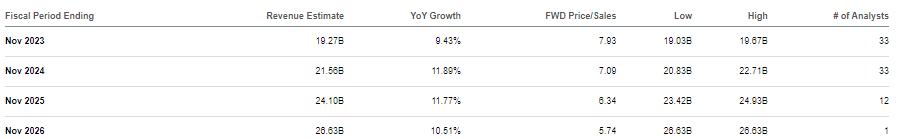

As of recent prices, ADBE might not look obviously cheap at around 8x sales versus low double-digit forward growth.

Seeking Alpha

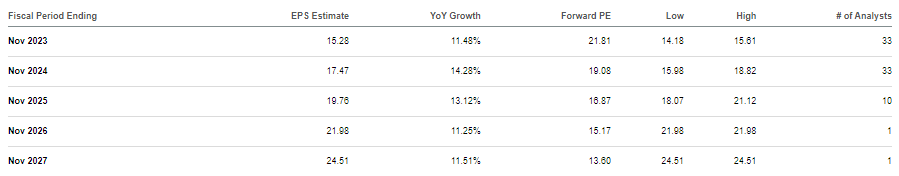

But the key point is that, unlike many tech companies, ADBE is highly profitable. On a non-GAAP earnings basis, ADBE was trading at just around 22x forward earnings.

Seeking Alpha

I note that stock-based compensation makes up around 24% of non-GAAP earnings, so ADBE is trading at around 30x GAAP forward earnings.

Based on my same fair value estimate at 28x earnings, I can see ADBE trading at $533 per share, representing a 50% potential upside over the next 12 months.

What are the key risks? ADBE is a much more mature company than most in the tech sector, not only in terms of margins but also in its revenue growth profile. It is possible that revenue growth slows down faster than expected, or that the company is unable to offset slowing top-line growth with faster bottom-line growth. There is also the risk that ADBE gets disrupted, and it may have the most to lose in such a scenario. If Wall Street loses confidence in ADBE’s ability to sustain its margin profile, then I could see the stock trading down as much as 50% just to trade in line with peers on the basis of sales. I find such a risk to be unlikely for now given the company’s history of high investment in R&D as well as the company’s commitment to its share repurchase program. I continue to view a basket of undervalued growth stocks as being a top strategy to position ahead of a recovery in the tech sector. ADBE fits in such a portfolio as it offers profitable secular growth at more than reasonable valuations. I rate Adobe Inc. stock a buy for long-term investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!