Adobe: Listen To Terry Smith, It’s A Hold (For Now)

Summary:

- Adobe Inc. operates in a unique segment of the software sector and is the unquestionable leader in graphics and creativity platforms.

- With Q1 2023 results that beat expectations all across the board, Adobe’s core businesses are showing no signs of weakness, and the company continues to grow with industry-leading margins.

- The Figma acquisition has many red flags surrounding it, or as Terry Smith said: “I can’t figure out whether I’ll be happy or sad if this deal goes through.”

- Cash cows like Adobe that don’t pay a dividend are fertile ground for inefficiency and “diworsification,” as management’s desire to prevent growth deceleration could result in bad decisions.

- As Adobe is trading at a 4.8% free cash flow yield and a 30.3 forward P/E, I rate the stock a Hold (for now), with a fair value of $370 per share.

gorodenkoff/iStock via Getty Images

Adobe Inc. (NASDAQ:ADBE) is the leader in creativity and design software. The company is the embodiment of a successful SaaS (Software as a Service) model, as its industry-leading gross margins reflect. The stock is 52% below its all-time high, as investors are questioning Adobe’s future due to a margin decline in 2022, along with a very expensive Figma acquisition. The company’s Q1-23 results were great all across the board. The company beat revenues and earnings expectations and increased its EPS guidance for the year, at a time when most companies are seeing significant margin declines and negative growth.

I estimate Adobe’s fair value at $370 a share, reflecting an 11.0% upside. I believe the Figma acquisition is expensive, but if complete, it will open a huge market for Adobe. A market that the post-acquisition Adobe will completely, undeniably, dominate. However, until we get more clarity regarding the acquisition and see the company’s margins stabilize, I rate Adobe Inc. stock a Hold.

Company Overview

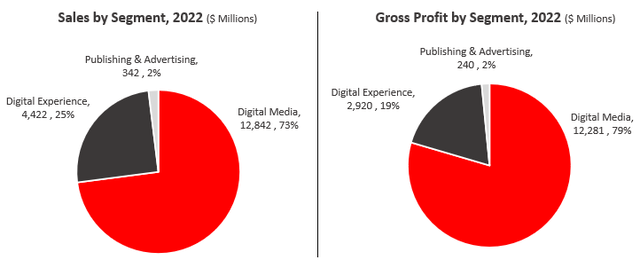

Adobe Inc., together with its subsidiaries, operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers solutions that enable content creation and Document Cloud, which is a cloud-based document services platform. The Digital Experience segment provides a platform and a set of applications and services that enable businesses to create, manage, execute, measure, monetize, and optimize customer experiences from analytics to commerce. The Publishing and Advertising segment offers products and services, such as e-learning solutions, technical document publishing, web conferencing, document and forms platform, web application development, and high-end printing, as well as advertising cloud offerings.

Created by author using data from Adobe’s 10-K

As we can see, Digital Media is not only the largest segment, but it’s also the most profitable one. This reflects the differentiation of Adobe in the creativity and design markets, as opposed to the more competitive markets in which the Digital Experience segment operates. This is also representative of the nature of the two businesses. While the Digital Experience offerings require personalization which comes with additional costs, the Digital Media offerings are easily and cheaply duplicable.

Q1 2023 Results

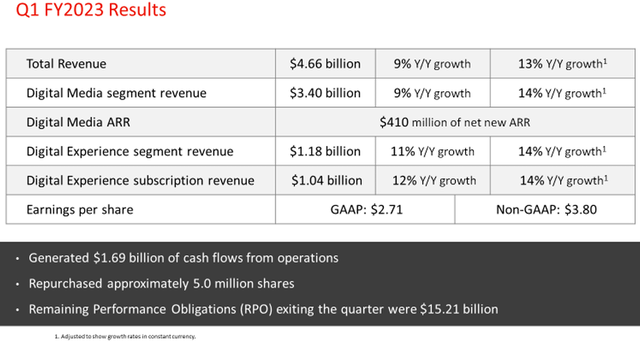

The company’s Q1-23 results were very impressive, as they came above revenue and earnings expectations, and reflected mid-double-digit growth in constant currency:

Adobe’s Q1-23 Earnings Presentation

The Red Flags

Adobe is a mature company, which has been around for a little over 40 years. Adobe is very profitable and its operations generate a lot of cash. Yet, the company isn’t paying a dividend and its high stock-based compensation expenses are constantly growing. Additionally, the company’s margins are showing signs of decreasing, and the Figma acquisition raises a lot of question marks.

Not Enough Cash Returned To Shareholders

The fact that a mature company like Adobe does return significant amounts of cash to its shareholders, even though it generates a lot of it, is a big red flag for me. Adobe is the only holding in my portfolio that does not pay a dividend. I bought the stock after it dropped to a Peter Lynch range (P/E ratio lower than EPS growth rate). Dividends and buybacks are important to me because: (1) they provide a significant portion of the stock market’s total return; (2) cash-returning companies, especially ones that aspire to grow their payouts every year, tend to be more focused when it comes to capital allocation and operational efficiency (also a known Peter Lynch rule). Thus, such companies are less likely to pursue diworsification.

Stock-Based Compensation

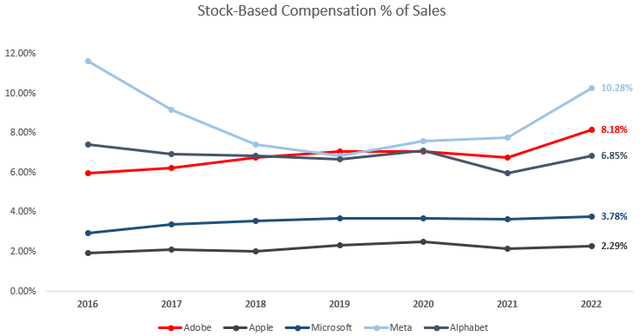

Adobe’s constantly increasing SBC is a cause for concern. In terms of SBC as a percentage of sales, Adobe is in the higher range compared to other tech companies. It’s not as low as Apple Inc. (AAPL) or Microsoft Corporation (MSFT), but not as high as Meta Platforms, Inc. (META). It is, however, higher than the scrutinized Alphabet Inc. (GOOG).

Created and calculated by author using data from Seeking Alpha

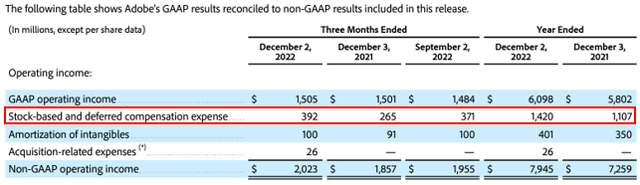

Not only Adobe is in the higher range and constantly growing (Q1-23 SBC as % of sales grew to 8.9%), but the company is also one of those who provide Non-GAAP profit numbers and exclude SBC expenses from it.

Adobe’s Q4-2022 Earnings Press Release

While Adobe does not dilute shareholders in the process, as the company repurchases its shares in excess of SBC issuances, investors should know that the gap between the company’s real earnings and its Non-GAAP earnings is huge. How huge? in 2022, it was approximately 40.3%. The company’s guidance for 2023 is for a GAAP EPS of $11, compared to a Non-GAAP EPS of $15.45. To put it into context, this projects an 8.9% GAAP growth, compared to a 12.7% Non-GAAP growth.

Decreasing Margins, Increasing Headcount

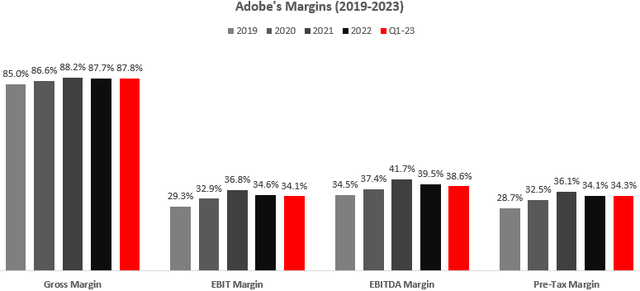

After a major increase in Adobe’s margins during 2020-2021, we saw a decline in the company’s margins all across the board in 2022 continuing to Q1-23.

Created and calculated by author using data from Adobe’s financial reports

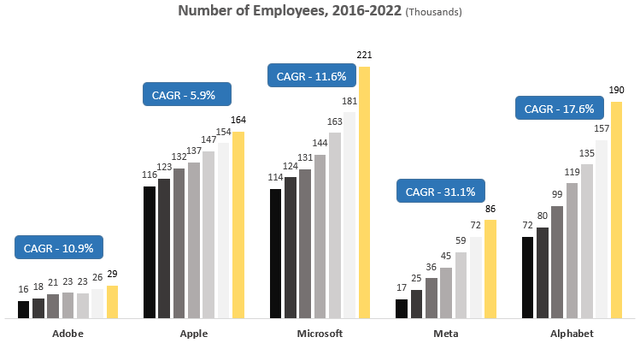

The main contributors to the margin declines are worrisome, as it comes from an increase in SG&A and R&D expenses, which are part of the company’s core cost base, and are hard to cut out. Adobe, like many other tech firms, has seen its headcount grow at a double-digit CAGR in the past years, resulting in lower efficiency:

Created by author using data from the companies’ financial reports

Among this list, we see Adobe is at the lower end of headcount growth. However, Adobe is the only one besides Apple that did not announce any major cost-reduction initiative, and no layoffs. This could be a positive sign, reflecting the management didn’t over-hire. This could also mean that Adobe’s management is less focused on profitability in the short term, which is questionable given the current environment in the markets.

It should be noted that some of the declines are a result of FX, as most of Adobe’s expenses are in dollars, yet it derives revenues from all across the world.

Overall, I don’t think Adobe has derailed when it comes to efficiency and capital allocation strategies. However, I do think the company has room for improvement.

The Figma Acquisition

During the Fundsmith Annual Shareholders’ meeting, Terry Smith said what every Adobe investor, including myself, is thinking (emphasis added):

We bought Adobe, the leader in creative and graphics software in the world. You almost certainly all use Adobe products. It’s a very good business. We bought it after tech companies had a rather bad spell, and then they announced the acquisition of a firm called Figma, which allows people to collaborate on the web with the use of creative software. This is problematic. They’re almost certainly paying too much and it almost certainly reveals a view on their part of a competitive weakness in their business. At the moment, I can’t work out whether I’ll be happy or sad if they don’t get it because competition authorities rule it out, and you can imagine what happens to a share where I can’t figure [that] out. So we’re not very happy with that purchase at the moment

— Terry Smith, Fundsmith Manager, Fundsmith Annual Shareholders’ Meeting, February 2023.

I won’t even try to put it in better words. Just additional context, Adobe already has a collaborative platform in Adobe XD, which we can assume is losing to Figma in that space, as Adobe’s CEO described its revenues as “de minimis.”

What we know about Figma is that Adobe estimates its total addressable market (“TAM”) at $16.5 billion by 2025. The company is expected to add approximately $200 million in net new ARR this year, surpassing $400 million in total ARR exiting 2022, with net dollar retention of greater than 150 percent. Additionally, Figma’s gross margins are approximately 90 percent and it has positive operating cash flows. We can infer that the deal values Figma at EV / Gross Profit of 55, or 50 times its 2022 ARR. Although Figma is currently very small compared to the entire Adobe, it will be immediately accretive.

Overall, I think Adobe has got to complete this deal. It’s obvious Adobe is threatened by Figma, and the synergies between the two make a lot of sense. As much as Adobe is paying, I think the merged entity would provide a good return on investment and would provide Adobe with an unbreakable moat for the foreseeable future. I believe most investors prefer that the deal will materialize eventually, as we saw a significant drop after it was reported the DOJ is going to sue Adobe over the deal. Still, according to Adobe’s management, they expect to close the deal by the end of 2023.

Competitors & Multiples

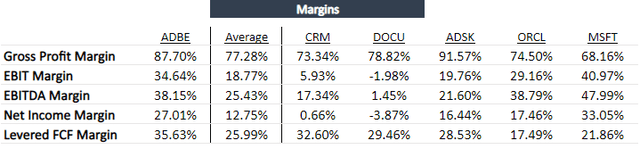

It’s hard to find public companies which are direct competitors and comparable to Adobe, as it operates in a specific segment of the information services sector. It does compete with Salesforce, Inc. (CRM) directly on the business solutions front, and with DocuSign, Inc. (DOCU) with its Document Cloud. Besides these two, I included Microsoft, Autodesk, Inc. (ADSK), and Oracle Corporation (ORCL), which are somewhat comparable based on their products or end customers.

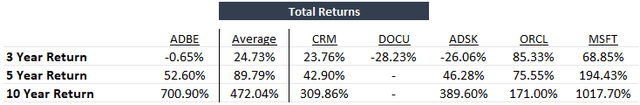

Created by author using data from Seeking Alpha; Data as of March 15th, 2023

Besides Microsoft, Adobe outperformed all its peers in the last decade. The company also outperformed the Nasdaq 100 index by more than 2X and the S&P 500 by more than 4.5X. On the contrary, we see the stock has significantly lagged during the last 5 years, after dropping 52.0% from its 2021 highs. However, unlike other tech companies which experienced significant drops, Adobe continued to deliver excellent fundamental results. I would say the main reason for the downturn was extreme overvaluation.

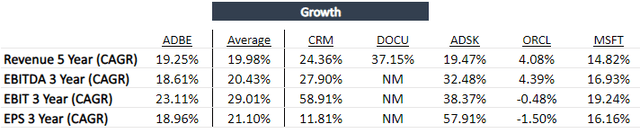

Created by author using data from Seeking Alpha; Data as of March 15th, 2023

Adobe’s growth was immense, with revenue and profit CAGRs of around 20.0%. Adobe’s numbers are pretty close to the peers’ average and are by far above the market average.

Created by author using data from Seeking Alpha; Data as of March 15th, 2023

When it comes to margins, it doesn’t get much better than Adobe. The company’s margins all across the board are industry-leading, second only to Microsoft. Oracle does have better EBITDA margins, but this is a result of twice as high depreciation, as we can learn from the EBIT margins of both companies. This puts the decreasing margin red flag under context. Adobe is still way above the average and should remain there.

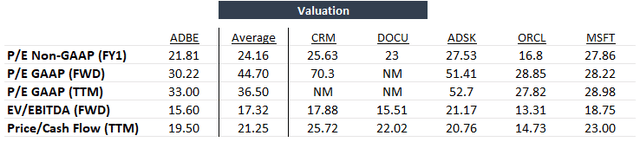

Created by author using data from Seeking Alpha; Data as of March 15th, 2023

The most important metric I advise investors to look at here is the GAAP P/E ratio. As aforementioned, Adobe and some of its peers exclude SBC from their Non-GAAP profits, which is extremely misleading. As Microsoft is the only one in the list that doesn’t do that accounting trickery, look at the gap between Microsoft’s GAAP and Non-GAAP ratios, and then look at the other companies.

Putting all the above together, I find Adobe to be slightly undervalued based on its relative multiples. Due to the company’s secluded segmentation and faster growth, I believe it deserves a premium over Oracle and Microsoft.

Overall, I find Adobe’s numbers compared to its peers to support a Hold rating. There are some headwinds and red flags, but most of it is already priced in. Let’s not forget Adobe is still a very high-quality company with extraordinary margins, that is projected to grow by double-digits in the foreseeable future.

Valuation & Near-Term Projections

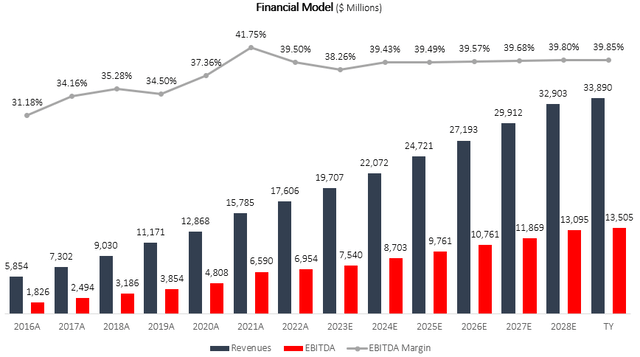

I used a discounted cash flow methodology to evaluate Adobe’s fair value. I forecast Adobe will grow revenues at a 10.9% CAGR between 2022-2028, which is close to the consensus but significantly below Adobe’s past 7-year CAGR of 20.1%. I estimate revenues will grow at this pace due to a growing customer base, as Adobe continues to grow ARR and subscription revenues at a double-digit pace. In addition, the introduction of market-ready AI solutions will increase the company’s total addressable market, and I believe Adobe is ready to capitalize on that trend.

I project EBITDA margins will increase incrementally up to 39.8% in 2028. In my view, this is a conservative projection as the company already surpassed this number in 2021 and would have surpassed it in 2022 if it didn’t experience FX headwinds.

Overall, my assumptions result in EBITDA growth in line with revenue.

Created and calculated by author based on data from Adobe’s financial reports and author’s projections

Taking a WACC of 8.0%, I estimate Adobe’s fair value at $370 per share, which represents an 11.0% upside compared to the market price at the time of writing. While this does represent an arguably high forward P/E ratio of 32.2, the E in the equation is expected to increase significantly in the upcoming years and the multiple is much lower than the company’s historical ratios.

Near-Term Projections

I find it important to provide additional details regarding my near-term financial projections in order to provide both the readers and myself with the ability to measure the accuracy of the investment thesis. This allows me to easily assess whether an earnings report is good or bad, and what adjustments I have to make in my model.

For Q2-23, my projections are pretty much in line with Adobe’s guidance. For 2023, I project revenues of $19.7B, an EBITDA of $7.5B, and a net income of $5.3B, which are all slightly more positive than both the consensus and guidance.

Risks

A cause for concern for every company nowadays is the economic environment. In the case of Adobe Inc., its offerings are distinguished and mission-critical for its customers, as they offer a wide variety of solutions to answer their needs. Adobe started 2023 with an existing ARR of approximately $14B, which means 73.0% of its projected $19B in revenues is essentially already accounted for. The deteriorating macroeconomy could result in somewhat prolonged sell cycles, but overall, I believe Adobe is actually positioned to win over its competitors in this kind of environment.

When I take a step back and I think about what is driving that differential performance in this environment, I think our products are mission-critical to our customers. We are on the critical path of them generating revenue. But as the world goes digital and those investments are prioritized, not only do we help companies drive top line growth, but we help them with the underlying productivity gains that go with that.

— Shantanu Narayen – Chairman and CEO, Adobe’s Q3-21 Earnings Call.

What we believe is that as we go through this time, single product companies are going to come under a lot of scrutiny. So, while we definitely see deals getting scrutinized and going up to higher levels for approval, we also see that customers really want to invest in a market leader like us for their investments.

— Anil Chakravarthy – President, Digital Experience, Adobe’s Q4-22 Earnings Call.

Another cause for concern is artificial intelligence technology. For years people have been scared that their jobs will be overtaken by machines. With Adobe’s significant customer cohort being content makers of all sorts, investors might be worried about the possibility that AI will take away the jobs of content makers, thus making the content creation process too simple and too accessible, resulting in a decrease in demand for Adobe’s products. Well, I would say this is the wrong way to look at it. First of all, Adobe already has AI-based offerings in Adobe Sensei and other features. Secondly, AI solutions should enable people who lack the relevant knowledge to be able to create content and increase the number of use cases for Adobe.

This is really about increasing the total number of users, we believe, very strongly. As we talked about at MAX, this is about enhancing human creativity, not replacing it. And ultimately, whether you are an individual solo printer SMB or enterprise, we are hearing the same thing, which is that you need to create more content than you are able to create today. And so this really plays well into our core strengths. As you know, we have got a decades-long focus on AI, things like neural filters and object selection. And hundreds of other features have been based on AI for us, and they have increased creativity, and they have increased productivity, and they have helped people keep up with the demand for content. They have also made it easier for people to onboard into the experiences, and so we have been able to broaden the opportunity for people to start leveraging and using our core products.

— Shantanu Narayen – Chairman and CEO, Adobe’s Q1-23 Earnings Call.

Lastly, regarding the regional bank scare, I will note that this isn’t a direct risk for Adobe, as it does not hold substantial assets or securities at Silicon Valley Bank or any regional bank.

Conclusion

Adobe Inc.’s mission-critical and unique products are leading the company to great results even at tough times, as its Q1-23 results reflect. I believe ADBE shares are slightly undervalued, and estimate Adobe’s fair value at $370 per share, representing an 11.0% upside.

Adobe Inc. has always been looked at as a company with a wide moat, and as the undeniable leader in creativity and design. However, the Figma acquisition raises question marks regarding the company’s position. Investors can’t figure out whether it would be better for Adobe to pay a very expensive price, or keep the cash, but lose all the advantages the acquisition could provide. Additionally, the company is showing signs of inefficiency, with small margin declines and increasing share-based compensation expenses. Thus, I rate Adobe Inc. stock a Hold, until we get more clarity.

Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.