UnitedHealth: Buy – May Not Be A SWAN, But It’s A SUN For Me

Summary:

- UnitedHealth has become a leader in creating a profitable business model to help bend the healthcare cost curve, and its business model is being adapted by its peers.

- UnitedHealth is a 4 for 1 winner, combining a preeminent health insurance company, a pharmacy benefits manager PBM, a provider of health services, and a health analytics franchise.

- The stock petered out in 2022 at $550. The latest retreat from this resistance has brought share prices down to $466, a 15% decline.

tumsasedgars/iStock via Getty Images

There is an acronym in investing that gets a lot of attention, especially during times of financial stress and bear markets: SWAN or Sleep Well At Night. The acronym is hung on investment choices which are “safe” enough to supposedly allow investors to sleep well at night vs an alternative of tossing and turning between the sheets, worrying if specific investment selections will survive. The SWAN mentality rivals the “set it and forget it” crowd of the 1980s. To me, having a SWAN implies falling into a REM-like comatose state, not to be awakened until the dog barks next door at 5:00 am. However, I believe the popularity of this acronym does a bit of disservice to investors as equity portfolio investments should not be left untouched and unreviewed by comatose shareholders. I prefer the acronym SUN or Snooze Undisturbed Nightly. UnitedHealth (NYSE:UNH) is a core SUN holding, anchoring my health care sector investments.

UnitedHealth is a 4 for 1 winner. UNH is the largest health care management company in the U.S., combining a preeminent health insurance company, a pharmacy benefits manager PBM, a provider of health services, and a health analytics franchise. Management has been on the forefront of creating a vertically integrated health organizations and UNH successful strategy has been emulated by others. For example, to play “catch up” with UNH, CVS (CVS) added Aetna’s health insurance assets to its retail drugstores and PBM business, and insurer Cigna (CI) added Express Scripts PBM to its health insurance business.

UNH is organized in two business segments: UnitedHealth ($187.4 billion or 57% of 2022 total revenue and 51% of 2022 pre-tax profits) which focuses on health insurance plans and Optum ($139.4 billion or 43% of revenue and 49% of pre-tax profits) which focuses on health care delivery, services, and care optimization.

UnitedHealth: United provides health insurance plans to more than 50 million individuals and members. The company’s strength is connecting customers to health services through its large provider networks, including 1.5 million physicians and approximately 7,000 hospitals and outpatient facilities.

An important aspect of United is to understand is the difference between risk-based and fee-based health insurance plans, and the implied consequences for UNH. For plans considered as risk-based, customers pay United a fixed premium and in turn United pays health care providers for covered medical service needed by the customer. In this case, United is “at risk” if the customer’s covered medical costs exceed the premiums paid, and UNH receives the resulting profits when customers make claims in a year totaling less than their premiums. Risk-based policies are typical of individual and small group health insurance plans. For fee-based plans, typical used by large employers and government agencies, UNH provides access to healthcare through its network of physicians and facilities, but the customer is self-insured and pays for the actual medical cost on behalf of their employees. Risk-based plans provide higher potential operating margins but require superior underwriting and premium collection is critical. UNH has thrived by excelling in its risk pricing, in addition to offering vertically integrated medical services to their self-funded health care plan customers.

United insurance reports in three operating segments: Medicare and Retirement offers risk-based Medicare Advantage and Medicare Supplement plans to seniors ($85.0 billion or 46% of segment 2022 revenues). UNH is one of the largest providers of health insurance plans for seniors with dominate market share in Medicare Advantage and Medicare DPD plans. Employer & Individual offers risk-based and fee-based health plans ($53.6 billion or 29% of revenue) and Community & State offers Medicaid management programs for state governments ($46.2 billion or 25% of revenue).

Optum. Optum offers a range of health services with the largest being a pharmacy benefit manager, Optum Rx ($74.5 billion in 2022 revenue). Scale is critical in the PBM market as the largest volume buyers of pharmaceuticals historically pay the lowest prices. Lower drug prices helps attract self-funding insurance clients and other payers to UNH’s stable of Optum Health services. The balance of Optum is Optum Health ($64.5 billion in revenues), a provider of direct medical services, such as physician’s groups and outpatient medical facilities.

As shown, UnitedHealth has built a multi-prong and diverse health care behemoth. In order of revenue size, the operating segments are:

Medicare Advantage and Medicare Supplement: $85.0 billion in revenue

Optum Rx: $74.5 billion

Optum Health: $64.5 billion

Employer & Individual: $53.6 billion

Community & State: $46.2 billion.

Two concepts jump out – the diversity of UNH’s revenue stream and the even distribution of revenue split among the five operating segments.

Historically, UnitedHealth Group has grown through acquisitions. First, UNH acquired other health insurers, then moved down the food chain to acquire health care providers, such as physicians’ groups and medical facilities, in addition to acquiring smaller pharmacy benefits managers. Since Jan 2022, UNH has announced or completed several acquisitions. UnitedHealth announced in March 2022 that it would acquire LHC Group for $5.4 billion. The acquisition will expand its at-home health care capabilities by combining LHC’s home services with the Optum unit. In Oct 2022, UNH announced it completed the $8 billion acquisition of Change Healthcare, a health care technology firm providing services to assist in migrating health records to the cloud and improving back-office services of medical groups. Investors should expect UNH to continue expanding thorough both organic growth opportunities and acquiring add-on businesses which dovetail with the company’s existing strengths.

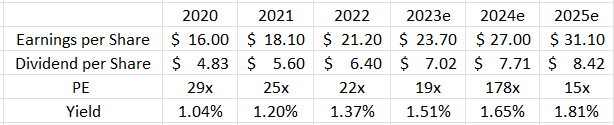

Below is a table of UnitedHealth Group earnings and dividends from 2020 to estimated 2025, courtesy of S&P Global Intelligence. As shown, UNH current trades at a 2023 forward PE of 19x, which is not much of a premium to the overall market. The table is based on the current UNH price of $466.00.

UNH Earnings & Dividends 2020-2025 (marketscreener.com, S&P Global Intelligence, GMI)

With long-term earnings growth pegged at 13%, UnitedHealth Group should continue to expand both its earnings and dividend as outlined above. Driving growth will be higher revenues and margins from its Optum Rx business. Earnings growth targets are primarily driven by increased coverage of pharmacy care services coupled with slightly higher margins from biosimilars for drugs coming off patent, such as Humira. Optum Health’s revenue per consumer served continues to improve with more patients using more services. UNH is on the forefront of a new trend in health care – VBC or value-based care. UNH has introduced “The Surest plan” for fee-based and self-insured health plans, such as large employers and governments, featuring 15% lower premiums with no deductible/coinsurance and a variable co-pay based on quality of physicians and outcomes. According to its investors day presentation of late last year, management expects The Surest plan to make a deeper connection between fee-based and self-insured customers and UNH’s Optimum Health services business. The goal is to generate a 44% out of pocket savings for members and up to 15% cost savings for employers.

UnitedHealth is a financially strong company. 2022 EBITDA was $30.8 billion, and free cash flow was $22.7 billion. Management exited the year with $23.3 billion in cash, $54.5 billion in long-term debt and $62.3 billion in total debt, not counting unpaid claims of $29.4 billion. Operating cash flow is expected to be stable over the next few years at ~$27 billion annually.

In a continuous push to manage health care costs, vertical integration will be one of the keys to suppress rising expenses. UnitedHealth Group has become a leader in creating a profitable business model to help bend the healthcare cost curve, and its business model is being adapted by its peers. Investors should continue to be amply rewarded by both the vertical and horizontal integration of UNH.

Since April 2022, UNH stock has petered out eight times at a price of $550. The latest retreat from this resistance has brought share prices down to $466, for a 15% decline. UNH is bouncing off its lows of the past 16 months and is 10% below its 200-day moving average of $512. I would consider UNH valuation fairly priced for long-term buyers. Price targets range from $550 to $700, sufficient to add UNH stock to a portfolio of stocks bought primarily for conservative growth and capital gains. I first added UNH in early 2015 and bought twice that year, adding once each in 2016 and 2017. For me, UnitedHealth is a core investment selection and I anticipate it will remain so for the foreseeable future. I have UNH on my watch list for further price weakness to add to my position.

Author’s note: SWAN vs SUN. I cringe whenever I hear investors comment they “will never sell” specific stocks or will let their heirs enjoy a stepped-up cost basis decades from now. These comments are usually tied to popular ‘Sleep Well At Night’ stocks. My portfolio management approach is to thoroughly review each holding at least once a year, with a maximum of a 3-year investing horizon. Forecasting further than the next 36 months becomes quite unclear and unpredictable, and most likely unreliable. I try not to drift into such a deep-sleep investing state that I miss a timely review. For this reason, I prefer to use the acronym SUN for ‘Snooze Undisturbed Nightly’ as I believe investors need to awaken quickly from a nice slumber to review portfolio positions. So, while UnitedHealth is a core holding, I will awaken at least annually from my ownership snooze to review its prospects, and from there to determine if it continues to deserve a place in my portfolio.

Disclosure: I/we have a beneficial long position in the shares of UNH, CVS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.