Summary:

- We are bullish on Adobe based on our belief that the company’s capitalization on its cloud platforms will boost top-line growth.

- We expect Adobe to see significant demand tailwinds in its Creative Cloud, Document Cloud, and Adobe Experience Cloud products as global digitalization intensifies.

- In the near term, we expect Adobe to feel pressure from the softer user spending within the computing market and foreign exchange headwinds.

- We believe Adobe provides a favorable risk-reward profile as it builds its cloud products platforms and improves its average revenue per user.

David Tran

We are bullish on Adobe (NASDAQ:ADBE) based on our belief that the company’s capitalization on its cloud platforms will boost top-line growth. Despite the stock dropping more than 50% over the past year, we believe Adobe remains a leader in the digital media space. We attribute the YTD drop to the rough macroeconomic environment and weakening consumer spending in the computing market. The stock dropped even further after the company announced its $20B acquisition of Figma. We believe this significant pullback has opened an attractive window to invest in the company and its cloud platforms.

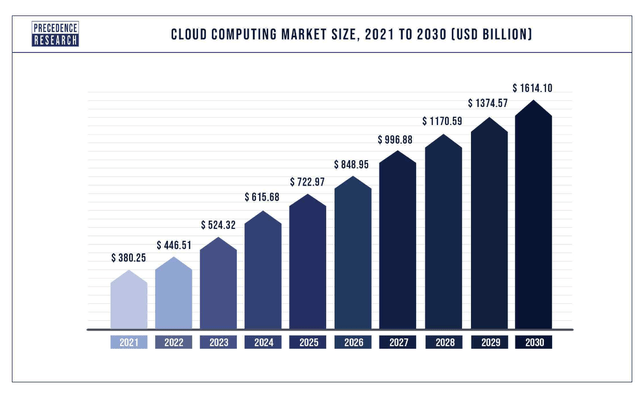

Adobe provides digital media design and publishing solutions, allowing customers to securely edit, create, share and scan digital documents across devices. While the stock sell-off has scared many investors, we believe it creates an opportunity. Our bullish sentiment on Adobe is because we expect the company to see significant demand tailwinds in its Creative Cloud, Document Cloud, and Adobe Experience Cloud products as global digitalization intensifies. We expect Adobe to benefit from its cloud platforms as the global cloud computing market is forecasted to grow CAGR of 15.7% between 2022-2030. Adobe delivered a solid quarter in 3Q22, demonstrating that its products are critical to its customers on an international level. While near-term macroeconomic headwinds remain present, we believe the company is well-positioned to grow meaningfully through 2023 and recommend investors take advantage of the pullback.

Cloud: Adobe’s buzzword

Our bullish thesis is based on our belief that Adobe will benefit from demand tailwinds in its cloud segment. Adobe operates in three segments: Digital Media, Digital Experience, and Publishing and Advertising. We’re constructive on the company’s market share within the booming cloud industry. Adobe incorporated cloud platforms into each of its segments. Digital Media is the umbrella for Adobe’s creative cloud, Digital Experience for Adobe’s Experience Cloud, and Publishing and Advertising for Adobe’s Advertising Cloud. We expect its cloud platforms to be a major growth catalyst for the company as the world becomes increasingly digitized. Around 81% of companies use a multi-cloud strategy in their business, and about 67% of enterprise infrastructure is based on the cloud. While there are concerns over Adobe’s over-dependence on cloud platforms for revenue, we believe the company’s advantage is its cloud services. We expect Adobe to benefit from the increased digitization of advertising, entertainment, and other content-creative markets.

The following graph outlines the cloud computing market’s growth.

With the introduction of Creative Cloud, Adobe has shifted its industry-leading graphic design and production services to the cloud. We’ re excited about Adobe’s new cloud-based platform, diversifying into digital marketing services and helping businesses measure page views, purchases, and social media sites. We expect Creative Cloud customers to purchase products from the Marketing Cloud, accelerating Adobe’s revenue growth.

Weak spending on the computing market continues

Adobe operates within the global computing market, and we believe that the inflationary pressures and harsh macroeconomic environment have created weaker consumer spending in the computing market. We expect Adobe’s Acrobat software and the digital computing peer group at large to feel the pressure of weakening consumer spending. Hardware, software, and service providers can use Adobe technologies under license. We believe that software developers are hesitant nowadays to invest in new software unless there are large operational improvements due to the weak economic environment. Despite the macroeconomic headwinds, we are constructive on Adobe because of the company’s cloud platforms which we expect will continue to enjoy demand through 2023.

Multi-regional exposure may pressure the stock in the near term

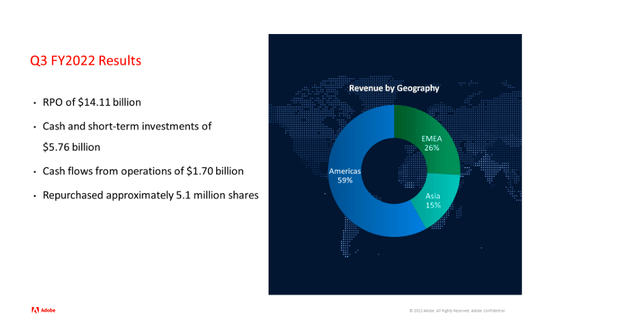

We expect near-term foreign exchange headwinds due to the strong dollar. Adobe is significantly exposed to Europe, the Middle East, and Africa (EMEA). These regions made up almost 40% of Adobe’s sales in 3Q22. We expect Adobe’s FY2022 results to be impacted by foreign currency headwinds. Despite current headwinds, we believe Adobe provides a favorable risk-reward profile as it builds its cloud products platforms and as it improves its average revenue per user.

The following chart outlines Adobe’s revenue by geography.

Subscriptions & Adobe’s Acrobat

One of Adobe’s most popular product lines, Acrobat, has a sizable installed base of happy users. We expect Adobe’s broad and satisfied customer base through Acrobat to strengthen its position in the digital media market. We believe Acrobat previously grew on the back of strengthening IT investment in the US and Europe and the improved economic conditions helped this segment. Now, we’re more constructive on the segment as workflow becomes increasingly digitized on enterprise fronts. We believe the increased digitization in the world is leading to the success of the Acrobat business, specifically in the last quarter. We’re excited that, in general, paperwork and record-keeping functions are now being carried out in the cloud with the help of cloud-based EchoSign Solutions. Accelerating subscription and services revenues contributed to 3Q22 growth, with subscription revenues growing 13% Y/Y.

The following images show Adobe’s products.

Figma Acquisition: not that dramatic

The market reacted negatively to Adobe’s Figma acquisition; the stock dropped 4% after management announced the $20B acquisition. We’re not too worried about Adobe’s acquisition because we believe Figma, a collaborative design software company, fits well into Adobe’s business. While we believe that Adobe did, in fact, overpay this acquisition, we believe that Figma will be a positive asset to the company. Figma has a positive cash flow and growth with a reputation for great quality products.

Stock Performance

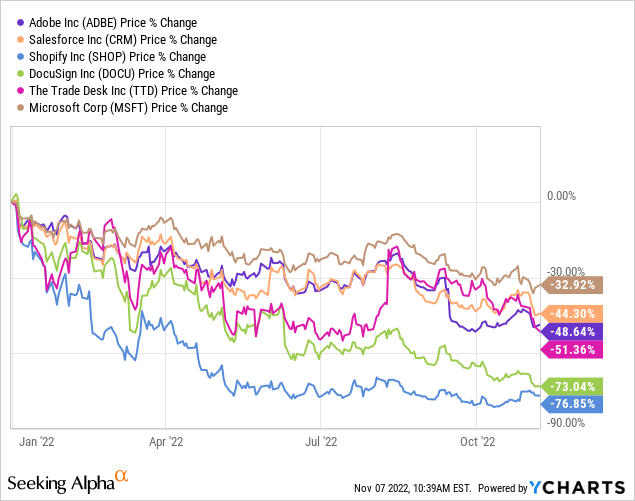

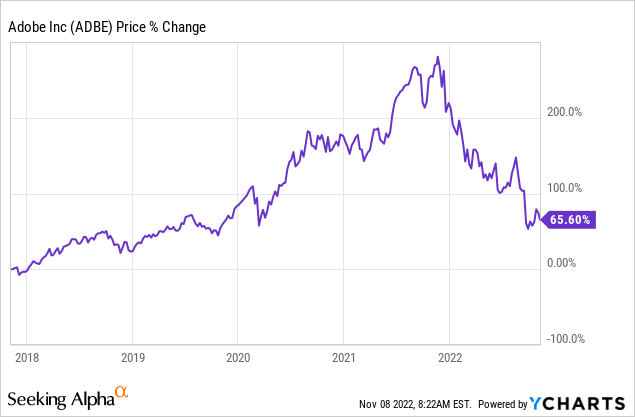

Over the past five years, Adobe is up around 66%. YTD, Adobe is down around 49%. The company underperforms the competition on the YTD metric, with Salesforce (CRM) down around 44%, Shopify (SHOP) about 77%, DocuSign (DOCU) about 73%, The Trade Desk (TTD) around 51%, and Microsoft (MSFT) around 33%. We attribute Adobe’s YTD drop to the harsh macroeconomic environment and inflationary pressures causing weaker spending on the computing market.

The following graphs show Adobe’s performance among competitors YTD and its performance over the past five years.

Tech Stock Pros Tech Stock Pros

Valuation

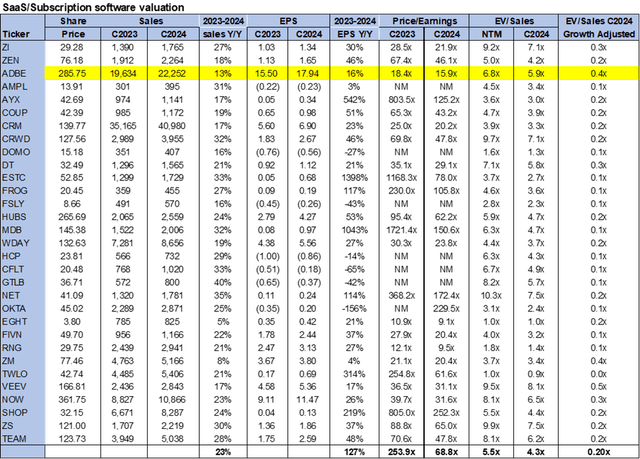

We believe Adobe is cheap for its venture into the booming cloud industry. On a P/E basis, Adobe is currently trading at 15.8x C2024 EPS of $17.94 compared to the average peer group of 68.8x. On an EV/Sales, Adobe is trading at 5.9x C2024 sales versus the peer group average of 4.3x.

The following chart illustrates Adobe’s valuation relative to its peer group.

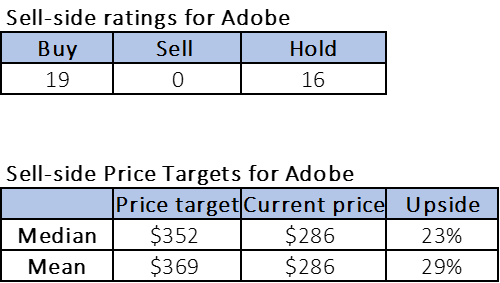

Word on Wall Street

Of the 35 analysts covering the stock, 19 are buy-rated and 16 are hold-rated. Adobe is currently trading at around $286. The median price target is $352, and the mean price target is $369, with a potential upside of about 23-29%. The following chart indicates the sell-side ratings and price targets.

Tech Stock Pros

What to do with the stock

We are bullish on Adobe despite the Figma deal and softer guidance for 4Q22. We believe Adobe is well-positioned in the digital media market due to the demand tailwinds in the cloud computing industry. We expect the company to grow meaningfully in 2023 as workflows become increasingly dependent on the cloud and recommend investors buy the pullback.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.