Summary:

- Adobe is a growth and quality company, and given the current share price, it represents good value. We assign a BUY rating.

- The intrinsic value derived using Cash Flow Returns On Investment based DCF analysis tools points to a value higher than the current share price.

- Q1 Revenue and EPS beat expectations.

- Conventional valuation ratios, the P/E, and P/S also point in the same direction as our DCF analysis, concluding the company is undervalued.

- We examine companies using our affiliate ROCGA Research’s Cash Flow Returns On Investment based DCF valuation and modeling tools.

hapabapa

There is very little doubt that Adobe Inc (NASDAQ:ADBE) is a growth stock and a value compounder. We will demonstrate why we think this is also a high-quality stock, and given the current price, represents good value.

Adobe is a leading SaaS company that has been innovative and adaptive to the changing needs and technologies. What it can’t innovate, it acquires. The most recent being the $20bn announcement for the acquisition of Figma, its most expensive to date.

On Sept. 15, 2022, Adobe announced the acquisition of Figma to be paid using cash and stock. The market reaction was not positive. ADBE stock prices fell from the previous day’s close of $372 to $309, a steep fall of 17%. The slide continued for a couple of more weeks bottoming out at $275 on Sept. 30, a total fall of 26%. At $20bn, the price to be paid for Figma seemed high (50x price to sales) but Adobe lost approximately $45bn in total value. In our opinion, a little bit of an overreaction. Prices began to recover as the market digested the news and the logic behind the acquisition. Adobe was looking to buy out its potential rivals to secure its potential growth, as well as buying into a high-growth company. Figma’s revenue is expected to grow from $200m this year to a projected $400m. What is more interesting is that prices fell 8% on the news that the DOJ may be looking to stop the acquisition.

The company’s Q1 results were announced on March 15, 2023. Revenues came in strong at $4.655bn, $40 above expectations, and an increase of 9% over the same period last year. Non-GAAP EPS came in at £3.80, beating expectations by $0.12, and up 12.8% over the same period last year.

Q2 guidance for revenue is in the range of £4.75bn to $4.75bn, and EPS between $3.75 to $3.80bn. This is a potential improvement of a minimum of 8% over last year’s revenues and a 12% increase in non-EPS.

The fiscal year 2022 saw Adobe’s revenue increase 12% to $17.6bn and non-GAAP EPS increased by 10% to $13.7. Gross and EBITDA margins remained reasonably consistent at 88% and 48%, respectively.

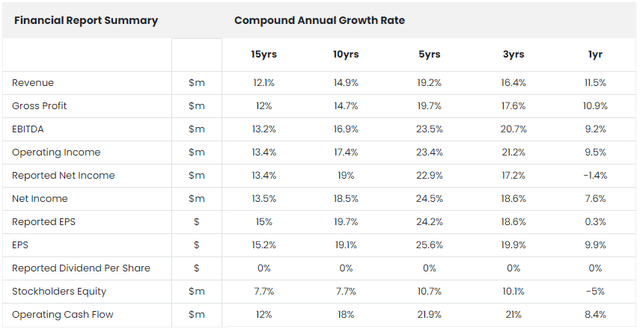

Looking at longer-term historical growth numbers, we can see that Adobe has had a very respectable 15yr compound annual growth rate in revenues of 12%, and EPS of 15%.

Adobe Financial CAGR (ROCGA Research)

Margins and profitability on all measures have been constant or have been improving.

Adobe Profitability (ROCGA Research)

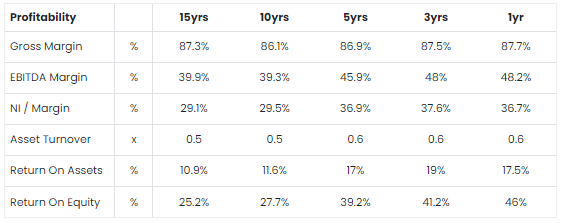

Gross asset utilization has also been improving, particularly for the past 10 years.

Gross asset utilization (ROCGA Research)

If you combine improving asset utilization with stable or improving margins, you get higher returns. If you add growth to the mix, you get higher valuations.

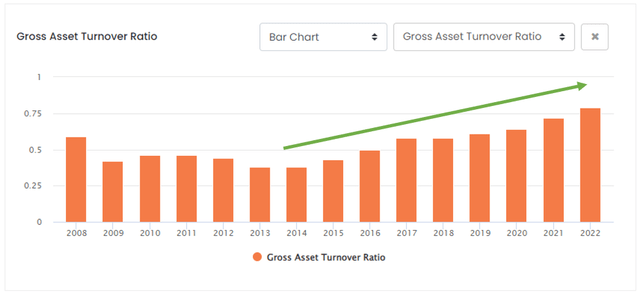

Let us have a quick look at some of the quality features of this company before we move on to valuation.

Quality Measures (ROCGA Research)

Negative net debt, improving EPS, improving ROE & a debt service coverage greater than 1, all point to Adobe scoring high on quality measures.

Risks

Right off the bat, we can say that the creative content landscape is positioned to ride out any significant macroeconomic and industry-specific risks. Regardless of the mini-bubble in tech stocks during the covid-19 era, there has been an increase in the speed of adaption of technology. Adobe’s shift to a more subscription-based model also makes its revenue more resilient.

The most prominent risk Adobe faces are new technologies, competitors, ever-evolving industry standards, and distribution models.

Adobe is a larger and diversified software company with an array of products and services. They cater to an equally large and diversified audience ranging from freelancers in digital content to large businesses. According to Datanyze, Adobe is the absolute market leader in graphics software. This dominance is maintained by Adobe’s deep market penetration via its distribution model. Adobe also sets aside a massive 17% of its revenues for innovation and R&D. As mentioned earlier, what it can’t create, it acquires. This seems to be keeping Adobe ahead in innovations and its competition.

The company also highlights interest rates and foreign exchange risks. In our opinion, these are transitory and would not affect the long-term growth and profitability of the company.

Valuation

As we mentioned earlier, by improving asset utilization with stable or improving margins, you get higher returns and add constant growth to the mix, you get a value compounder.

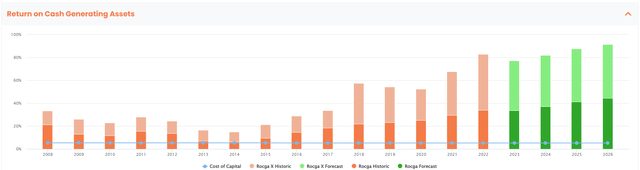

Along with the history, we use consensus estimates for the forecast for the returns profile of the company. We will use our proprietary research, ROCGA, Returns on Cash Generating Assets, a framework built using the Cash Flow Returns On Investments methodology. This is an economic measure of performance and should give us a better understanding of the drivers of value.

Returns On Cash Generating Assets (Seeking Alpha Consensus & ROCGA Research)

We see a healthy and improving returns profile, especially over the last 10 years.

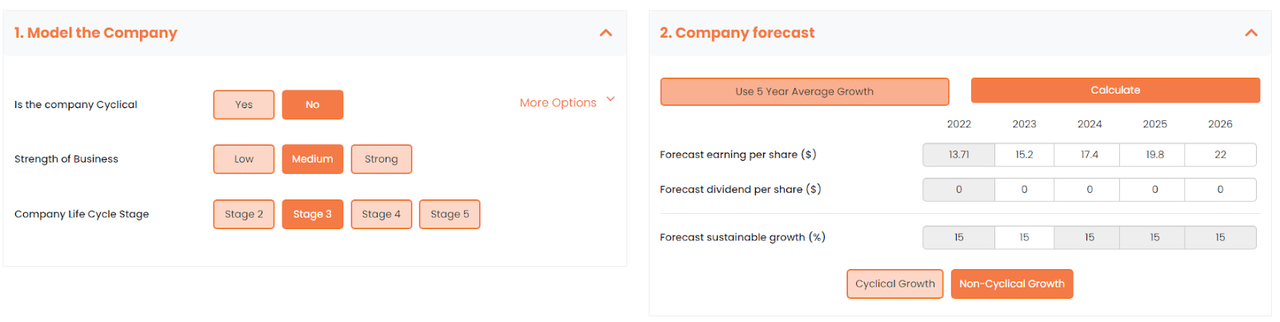

To value the company, we model, back-test the valuation with the historical prices, and then forecast forward using the same model. More detail on how the modeling components work can be found here. We use non-cyclical, with medium strength and a life cycle stage of 3.

Default Valuation Model (Model created by the author on ROCGA Research platform)

With forecast EPS estimates and a default model, we see Adobe significantly undervalued.

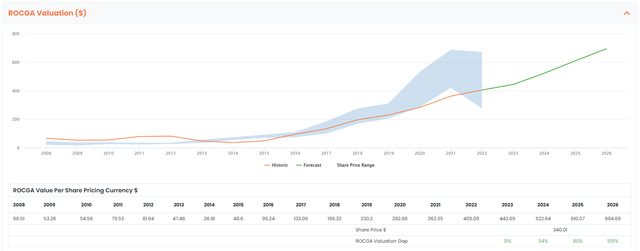

The default model works reasonably well historically where the derived valuation stays with the share piece range (better over the last 10yrs). During the pandemic, the share price was significantly higher than the derived value, but they reverted to the warranted value.

Default Valuation (Created by the author on ROCGA Research platform)

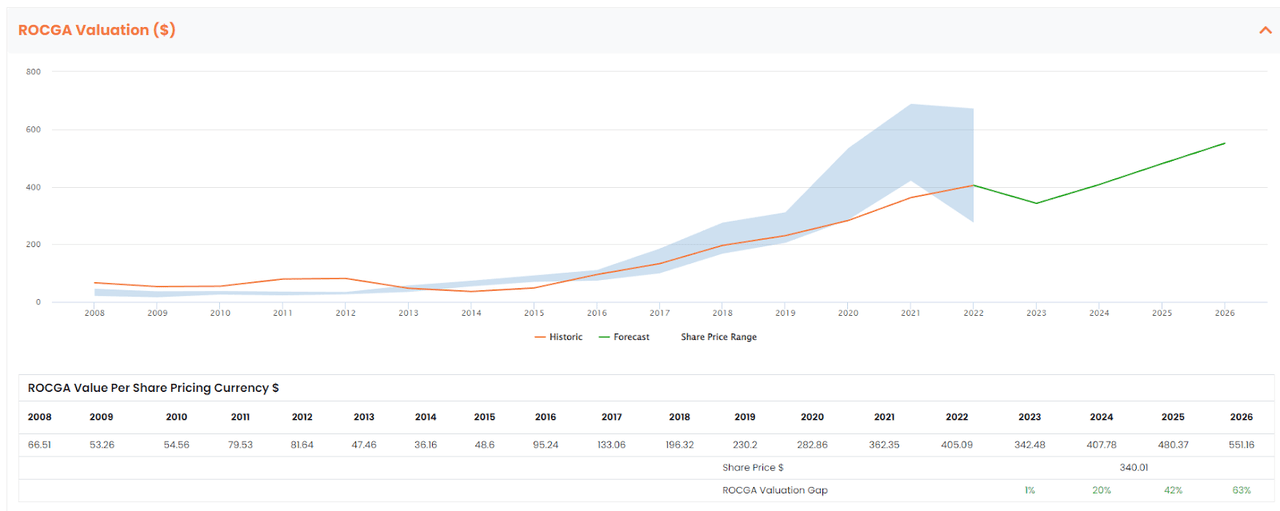

Stress Testing: By increasing the WACC by 1% at a time we stress-tested the default valuation. The model gave us a 2023 valuation equal to the share price with an additional 2% WACC, up from 5.2% to 7.2%. Even under these conditions, the model gives us a valuation north of $400 for 2024 and onwards.

Valuation with 2% higher WACC (Created by the author on ROCGA Research platform)

Conclusion

Our Cash Flow Returns On Investment based systematic DCF valuation tools point to Adobe being significantly undervalued. If we use conventional valuation ratios, Adobe again looks undervalued. The 10-year historic average P/E was 36x and the price to sales was 10.7x. Using the FY23 EPS estimates of $15.2 and revenues of $19.2bn, we see FY23 P/E of approximately 21.7x and PS of 7.8x. These also point to Adobe being undervalued by at least 30%.

In our opinion, Adobe is a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.