AdTheorent: Fair Value With Or Without A Deal

Summary:

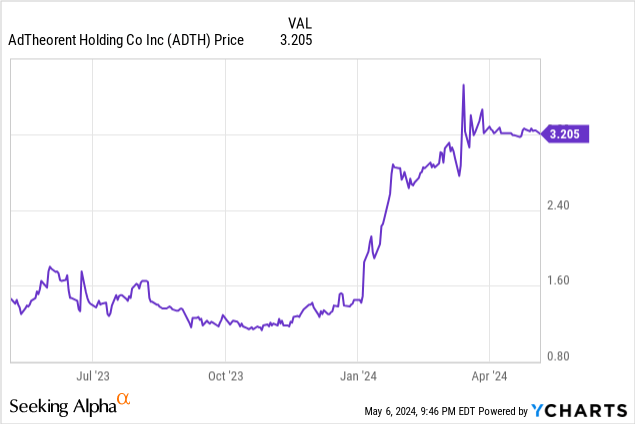

- ADTH shares have more than doubled since I first covered the stock last August.

- The company agreed to a buyout at $3.21 per share, and a 33-day “go shop” period expired May 4th.

- During the Go-Shop Period, a second potential buyer emerged with a non-binding offer at $3.35 per share.

- While the balance sheet is in great shape, AdTheorent’s Q1-24 performance missed on both the top and bottom line.

- Given the current share price proximity to both potential buyout offers, I suspect ADTH is essentially at fair value at this point.

da-kuk

When I last covered AdTheorent Holdings (NASDAQ:ADTH) for Seeking Alpha, the company’s stock was trading at a discount to book value. As a company that has already benefited from the technological innovation that has fueled a lot of hype elsewhere in the market, I felt longing ADTH shares was a solid speculative opportunity at a low valuation multiple. This is what I said in my closing summary:

For a company that utilizes machine learning and has a real functioning product that generates revenue in the market, there is absolutely no hype whatsoever with this name from where I sit. I like that. Especially considering the froth we’re currently witnessing in other AI-linked equities.

That call turned out to be a good one and ADTH shares more than doubled a few months later. Currently, we find a very different setup in ADTH shares. In early April, the company announced that it had a take-private buyout offer from Cadent, LLC at $3.21 per share. In the time since that offer, the company has received a second buyout offer from a different entity for $3.35 per share. In this update, we’ll go over the specifics of the proposed deals, Q1 earnings, and why I think the company’s shares are fairly valued at this point.

Buyout Offers

On April 1st, AdTheorent announced it had reached an agreement to be bought out by Cadent, LLC for $324 million in cash, or $3.21 per share. The company noted the offer price represented a 17% premium to the volume-weighted 60-day average stock price of ADTH shares as of March 28th. However, that bid may have actually been unwelcomed by ADTH shareholders as the offer represented a 6% discount to the $3.41 closing price on March 27th.

Nevertheless, Cadent’s buyout of AdTheorent Holdings was unanimously approved by AdTheorent’s board of directors and it was expected that the deal would be finalized within 90 days of the agreement assuming regulatory approval and shareholder vote approval. In the time since the buyout announcement, ADTH shares have generally traded in a tight range between $3.20 and $3.30. To some degree, there is a bit of logic in paying more than the buyout price to own the stock.

As part of the agreement with Cadent, AdTheorent had a 33 day “go shop” period where the company was allowed to solicit higher bids from prospective buyers. That period ended on May 4th. On May 6th, AdTheorent announced that the company had indeed received an additional offer from an undisclosed third party to acquire all outstanding common shares for $3.35 – a 4% premium to May 6th closing price.

According to the press release disclosing the second offer, the “Go-Shop Proposal” is non-binding but allows for the second prospective buyer to engage in due diligence before negotiating a definitive agreement:

If and when AdTheorent notifies Cadent that the board of directors has determined that the Go-Shop Proposal constitutes a Superior Company Proposal, and that it intends to terminate the Merger Agreement in favor of the Go-Shop Proposal, Cadent will be entitled to certain “match rights” under the Merger Agreement prior to any such termination.

Should the Go-Shop Proposal ultimately lead to a definitive agreement, Cadent can match the offer at $3.35. Given the original offer price was actually below market from prior sessions and the subsequent non-binding offer was just 6% higher than Cadent’s, I suspect the gains have been had here. Furthermore, AdTheorent’s latest quarterly earnings wasn’t exactly stellar.

Q1-24 Earnings Miss

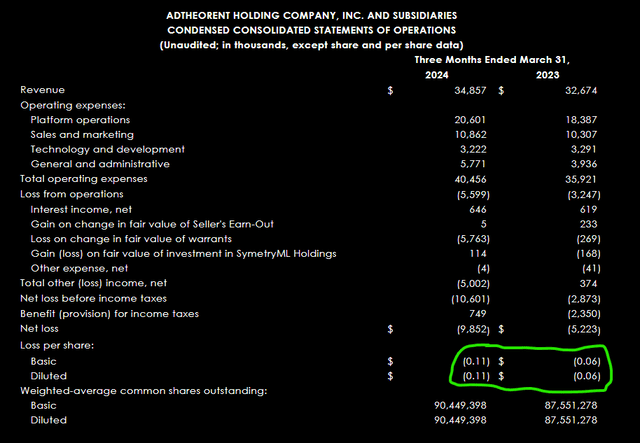

At $34.9 million in quarterly revenue, AdTheorent grew revenue by 6.7% year over year. While there was growth, topline missed analyst estimates by over $6 million in the quarter and Q1-24 revenue was down by 41.5% sequentially. We’ve seen AdTheorent produce large fourth quarters before but this was actually a larger sequential decline from Q4 to Q1 than was observed from Q4-22 to Q1-23.

In addition to the disappointing topline number, quarterly opex grew nearly twice as fast as revenue and the company reported a $9.9 million quarterly loss – nearly double the net loss from the prior year. That said, a large portion of that loss was attributable to a $5.8 million change in fair value of warrants. Regardless, operating loss in the quarter was still larger than the prior year by about $2.3 million. Balance sheet-wise, AdTheorent is still in good shape:

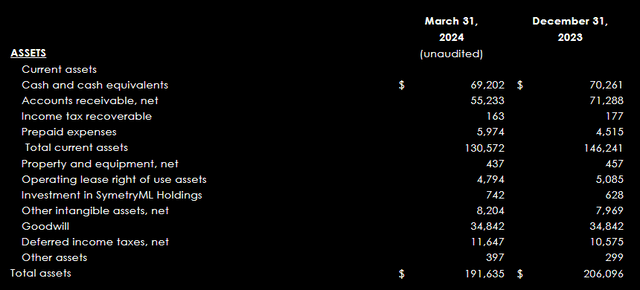

With over $69 million in cash and equivalents in addition to $55.2 million in accounts receivable, the company has more than enough capital to manage quarterly cash burn through at least the next year. Furthermore, with just $35 million in total liabilities, AdTheorent’s financial position is terrific. As I see it, the question is what would this company be worth without the Cadent offer or the Go-Shop Proposal?

Valuation

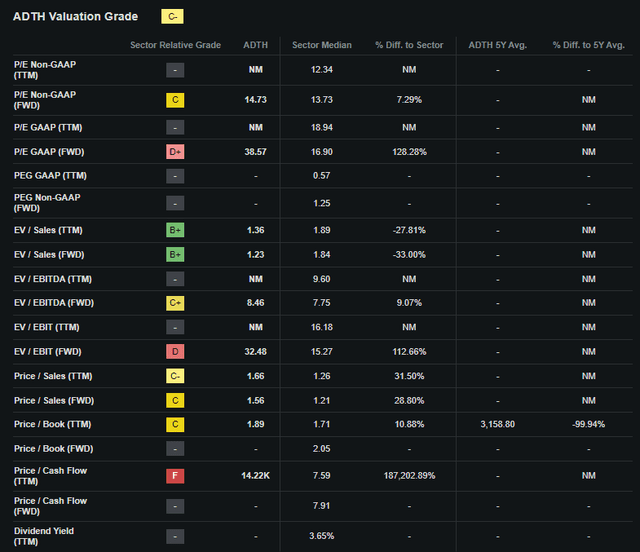

On the valuation side of things, I don’t think we can reasonably argue the stock is cheap any longer as it was when I covered the stock last summer:

Reminder, when I covered the stock last August, Seeking Alpha’s Valuation Grade was “B+.” Now the stock gets a “C-” grade as the share price has rerated to a more reasonable level. While the company trades below sector median in forward EV/Sales, forward GAAP P/E is more than 38x and forward price to sales is 1.56x. The latter of which isn’t egregious. The company’s trailing book value is on par with the sector.

One could argue AdTheorent’s valuation should be richer than sector median as an emerging growth stock. But in that case I would expect better than a 6.7% year over year increase in revenue for an innovative ad tech business that uses machine learning. Thus, I think one could argue we’re at fair value based on the company’s latest business performance. And this brings us to the scenarios from here.

Possible Scenarios

As I see it today, there are three realistic scenarios at play for ADTH holders.

- The company agrees to a formal buyout agreement with the Go-Shop Party at $3.35 and the Go-Shop Party transaction closes.

- The company agrees to a formal buyout agreement with the Go-Shop Party and Cadent matches the $3.35 offer.

- The Go-Shop Party passes on a definitive agreement and the original Cadent deal closes at $3.21 later this year.

I’m not going to attempt to handicap which of these scenarios would be the most likely but I think it’s safe to assume whatever AdTheorent’s board wants to do will be what ultimately happens. The company’s board and management control about 40% of ADTH shares. Meaning it would take a resounding “no” from the rest of the company’s shareholders to derail any buyout arrangement and I don’t see that happening after a disappointing Q1 earnings report. Especially since the company’s stock was trading under $2 as recently as last year.

Final Takeaway

Considering the company’s Q1 performance and what I view as slower growth than would be expected for an innovative ad tech company, I’m actually not all that surprised that AdTheorent managed to only generate one additional buyout proposal during the 33-day Go-Shop period. Given the fact that it’s a non-binding proposal that requires additional due diligence before any potential definitive agreement is reached, I wouldn’t say it’s a guarantee that ADTH shareholders get the exit at $3.35. But whether the exit is $3.21 or $3.35, if you rode this thing up from $1.40 it might be best to just take the win now before any unforeseen negative events derail either the Go-Shop Proposal or the original Cadent agreement. In my view, the stock is already fairly priced given the current underlying business. I’m certainly not calling the stock a “sell,” but I don’t see all that much upside remaining.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.