Summary:

- AECOM is well-positioned for growth with a healthy backlog of $23.7 billion, exposure to high-growth markets, and increasing PFAS-related work.

- Revenue growth outlook is positive with strong demand in end markets, government infrastructure investments, and incremental projects from disaster-related work.

- Margins are expected to improve with operational efficiency, cost-saving initiatives, and increasing international margins, making AECOM a buy with growth potential.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

AECOM (NYSE:ACM) is well-positioned to continue delivering good growth ahead. The company’s revenue growth should benefit from a healthy backlog of $23.7 billion. In addition, increasing PFAS-related work, the company’s exposure to high-growth markets, and healthy infrastructure investments globally should also increase revenue growth. On the margin front, the company should benefit from improving international margins, operating leverage, and cost-saving initiatives.

Moreover, the company is also trading below its historical average. I believe as the company delivers good growth in the near and long term, thanks to the company’s exposure to a high-growth market and a high-margin project mix, the P/E multiple should re-rate. This re-rating opportunity and the company’s good growth prospects make it a buy.

Revenue Analysis and Outlook

Over the last couple of years, the company’s revenue growth has been benefiting from good demand in end markets driven by secular trends from increasing energy transition needs, reshoring of manufacturing post-pandemic, and climate resiliency. In my previous article in November last year, I noted that these secular demand trends along with increased government infrastructure investments like IIJA and IRA should support the company’s growth in the coming year. As I anticipated, these growth dynamics continued to benefit the company in the last couple of quarters.

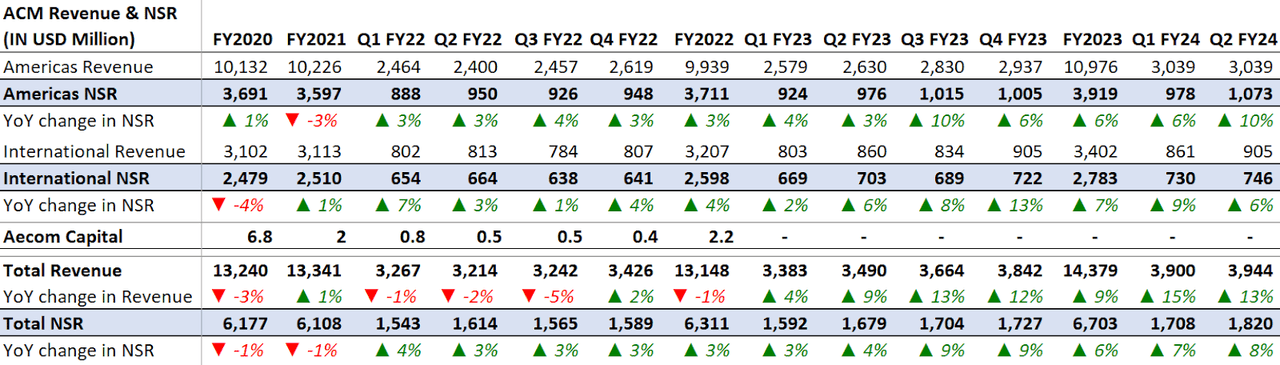

In the second quarter of fiscal 2024, the company’s revenue benefited from good demand in the end markets, especially in the water, environment, and transportation sectors driven by trends arising from the need for upgrading and modernizing aging infrastructure, energy transition, water scarcity, climate change, and emerging contaminants. This was further supported by good backlog execution, strength in the design business, and an increase in funding from IIJA. This resulted in a 13% YoY growth in total revenue to $3.94 billion, reflecting an 8% YoY NSR growth on a constant currency basis. The NSR growth also includes a 1 percentage point headwind from fewer working days as compared to the previous year’s quarter.

ACM’s Historical Revenue (Company Data, GS Analytics Research)

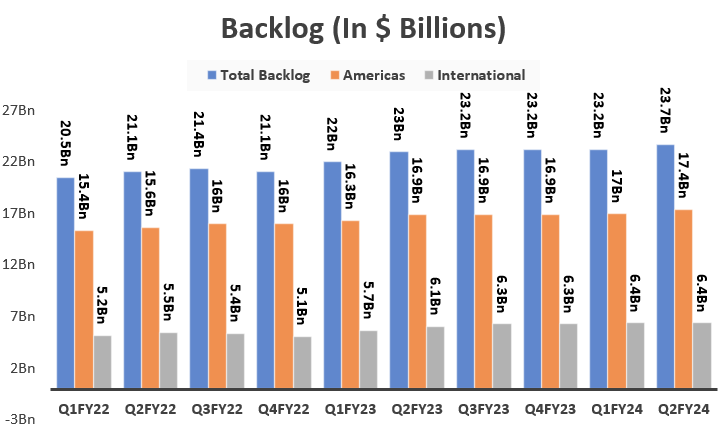

Looking forward, AECOM is set to report its Q3 results next month, and I am optimistic about its near as well as long-term revenue growth outlook. AECOM’s backlog of $23.7 billion, which was up 3% Y/Y in the second quarter, provides good visibility for revenue growth in the coming period. The company’s design business, which accounts for 90% of its Net Service Revenues (NSR), saw its backlog increase by an even better 6% Y/Y. A company’s backlog is a leading indicator of its revenue growth, and a healthy increase in backlog makes me optimistic about its revenue growth in the coming quarters.

ACM’s Historical Backlog (Company Data, GS Analytics Research)

In addition, I also expect incremental projects from disaster-related work as a result of Hurricane Beryl. The company has been working with the Federal Emergency Management Agency (FEMA) for several years now and recently, in June, it was further awarded FEMA’s U.S. nationwide Public Assistant program under which the company will be providing services for repairing and replacing damaged infrastructure from major disasters. So, I expect the company to see incremental project wins from Hurricane Beryl in the coming quarters, further boosting the backlog for future revenue growth.

In the medium to long run, the company is well-placed to benefit from its exposure to several high-growth markets as well as the company’s strategic initiatives to drive growth. For e.g., the company is enhancing the design business by integrating advanced solutions and fostering global collaboration. This transformation includes investments in digital technology and the integration of global design centers, which improves efficiency and the quality of deliverables, positioning AECOM to win larger and more complex projects, and gain share.

The company is also increasing its focus on emerging growth markets. A good example is PFAS-related projects. The company reported a 50% growth in backlog for PFAS-related projects in the second quarter, with expectations for substantial growth ahead after the finalization of EPA water rules.

While currently, PFAS-related revenue is a small portion of ACM’s total revenue, one of the company’s peers, Tetra Tech (TTEK), views the PFAS market to be a $200 bn plus after recent regulatory developments. So, this is going to be a big long-term opportunity for AECOM as well.

The company is also well-placed to benefit from long-term growth drivers in its other markets. The investments in electrification and renewable energy are driving a record pipeline of opportunities, as ACM has had notable wins in the UK for SCAPE power utilities consulting frameworks and the great Grid upgrade. In the U.S., funding from IIJA and strong federal state, and local spending supported a solid 1.4x book-to-bill ratio in the second quarter. In Canada, the government released a $56 billion 10-year infrastructure investment program, doubling the previous multi-year plan, while Australia’s ongoing $120 bn infrastructure program is advancing well and the company is working on several key projects.

Overall, I remain optimistic about AECOM’s near as well as long-term prospects and expect a positive commentary from the company as it reports its third-quarter results next month.

Margin Analysis and Outlook

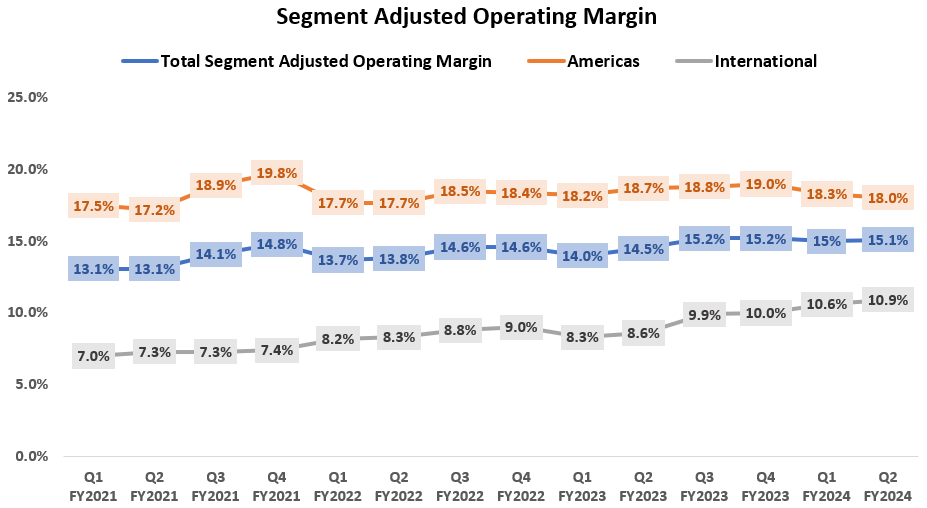

In the second quarter of fiscal 2024, the company’s margins continued to benefit from good operating leverage, operational efficiency, and higher margins in the backlogs. This resulted in a segment-adjusted operating margin of 15.1%, a 70 bps YoY increase. On a segment basis, the Americas Segment’s adjusted operating margin declined by 70 bps YoY due to an increase in business development investments. The International segment saw a 240 bps YoY increase in adjusted operating margin as a result of lower business complexities, improving efficiencies as well as high margin backlog

ACM’s Historical Segment Adjusted Operating Margin (Company Data, GS Analytics Research)

Moving forward, AECOM’s margin outlook is positive. The company is making good progress in terms of improving its international margins and over, a period of time, it aims to bring international margins in line with Americas margins lifting overall company’s margins.

The company’s good revenue growth prospects should also result in better leveraging of fixed costs and help margins.

Further, the company is implementing various cost-saving initiatives to improve margins. The company has created Enterprise Capability Centers, which serve as hubs of expertise, and has adopted advanced digital technologies to streamline workflows, which have replaced labor hours with automated solutions. These technology integrations have been implemented globally and are significantly enhancing efficiency, reducing costs, and improving project timelines. So, I remain optimistic about the company’s margin growth prospects.

Valuation and Conclusion

AECOM is currently trading at an 18.03x FY25 (ending September) consensus EPS estimate of $4.99 which is lower than its historical 5-year average forward P/E of 20.31x.

Over the past years, the company has enjoyed a good P/E given its strong execution around its strategic initiatives and its efforts to build a high-margin business. I believe the company has many positive drivers that should drive upside for the stock moving forward. The company’s healthy backlog and its exposure to high-growth end markets, as well as increasing infrastructure investments both domestically and internationally position it well to deliver good revenue growth over the long term.

Moreover, while some investors are worried about the contraction in the Americas margin Y/Y last quarter due to high business development investments, these investments are important for AECOM to increase its win rates of larger high-margin projects, and once the benefit of these investments will start showing in the numbers, the company’s investor sentiment should once again turn positive. In addition, improving international margins and cost-saving initiatives should further drive overall profitability and help the company deliver its long-term target of double-digit EPS growth.

I believe AECOM’s good growth potential and lower-than-historical valuations present an attractive opportunity for investors. Hence, I continue to rate ACM stock as a buy.

Risks

-

Any delay in the release of funds related to the Federal government stimulus or other spending may impact the near-term backlog/results.

-

Any execution failure on cost-saving initiatives can impact margin growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Gayatri S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.