Summary:

- Aerie has 2 marketed products and decent pipeline after a recent acquisition.

- Aerie unfortunately still has extremely high cash burn for a company of its size.

- Despite this, Aerie shares appear to be somewhat undervalued at present even after accounting for the almost certain dilution that will be needed to raise cash.

Aerie Pharmaceuticals (NASDAQ:AERI) is a stock I’ve owned for a while, and lately I wanted to revisit my prior analysis to see if it was worth buying more to average down my cost basis after a substantial share price decline from higher levels in 2018 and 2019. Although it’s a fairly close call, I do think Aerie offers some potential upside for long-term investors from its current levels.

Aerie’s 2 Marketed Products Should Start to Show Substantially Increasing Sales in the Coming Years

Aerie has 2 marketed products, Rhopressa and Rocklatan. Rhopressa was first to hit the market, launching in April 2018. Rhopressa is a once-daily eye drop for the treatment of open angle glaucoma. Rhopressa is a Rho kinase inhibitor which works to lower intraocular pressure by directly impacting outflow through the trabecular meshwork, rather than targeting aqueous humor outflow like the prior standard of care class of drugs, prostaglandins. Rhopressa’s launch represents the first new class of drugs approved to treat glaucoma in years. Rhopressa appears to have a better safety profile and more universal efficacy versus prostaglandins as well as reducing the required number of daily drops for 2 to just 1.

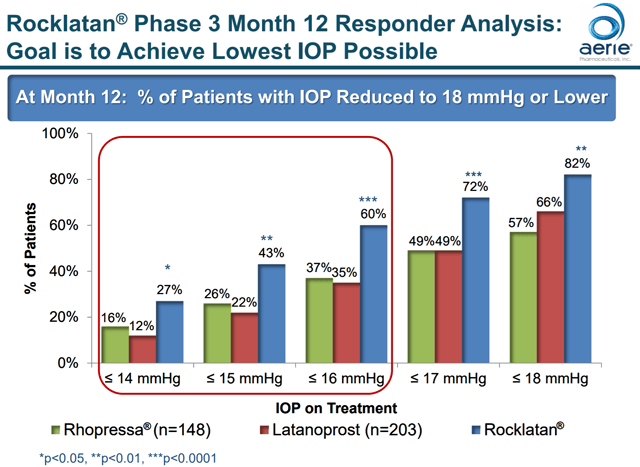

Rocklatan is a very similar product to Rhopressa — in fact, Rocklatan is actually just a combination of Rhopressa and one of the prostaglandin drugs, latanoprost. Rocklatan in particular, though, appears to compare favorably with prior standard of care therapies like latanoprost.

Figure 1: Efficacy Comparison for Rhopressa and Rocklatan (source: corporate presentation)

Rocklatan was launched in May 2019, and sales have continued to grow since release for both drugs, albeit at a slower pace than originally projected.

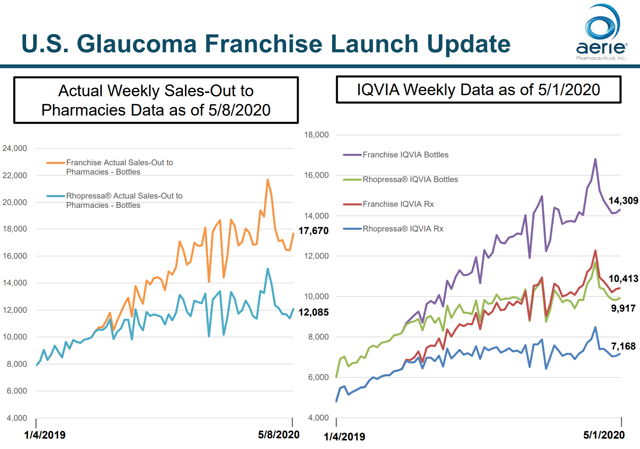

Figure 2: Rhopressa and Rocklatan Sales Charts (source corporate presentation)

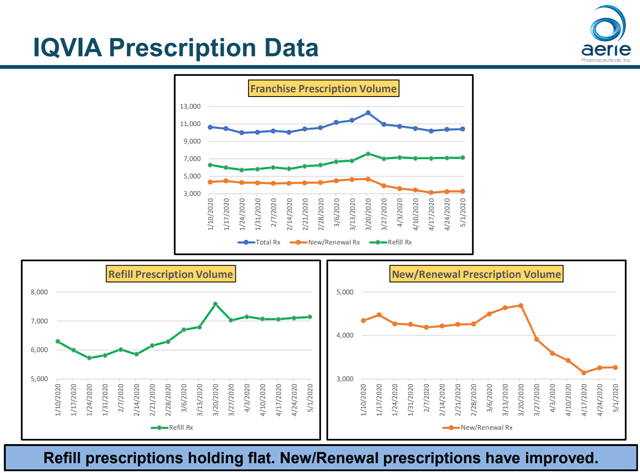

As you can see from Figure 2, it appeared Aerie’s drugs might be picking up some momentum earlier this year, but then there is a clear sales dip due to the COVID-19 pandemic. This led Aerie to withdraw its 2020 guidance. Thankfully, though, it seems as if prescription volumes have already started heading back in the right direction again, although there is still work to be done to get back to the prior rate of increase.

Figure 3: Prescription Volume Data for Aerie’s Glaucoma Franchise (source corporate presentation)

Any continued COVID-19-related effects are worth watching because the speed of Rhopressa and Rocklatan sales increases will be largely determinative of the size of future cash raises for Aerie. Additionally, these therapies should both have strong IP protection until at least 2030, so Aerie should have meaningful sales from both of these products for years to come.

Aerie is also trying to commercialize both drugs in Europe and Japan. A new Rocklatan plant in Ireland just received FDA approval, and the company intends to market both Rhopressa and Rocklatan on its own in Europe, albeit under different trade names. Marketing authorisation was granted for Rhokiinsa (Rhopressa) in November 2019, and Aerie’s MAA for Roclanda (Rocklatan) was accepted for review in December 2019. To support those efforts, Aerie is also conducting a 6-month Phase 3 safety and 90-day efficacy registration trial in Europe, Mercury 3, which compares Rocklatan to another combination therapy for non-inferiority. The top-line data readout from the trial could potentially be in late 2020.

Unlike in Europe, Aerie is actually seeking a partner for a potential approval and launch of these drugs in Japan. Aerie has both drugs ready for Phase 3 studies and hopefully will initiate at least one of the trials later in 2020 regardless of its progress on the partnership front.

Aerie has Expanded its Pipeline to Include a Number of New Potential Therapies in Large Markets

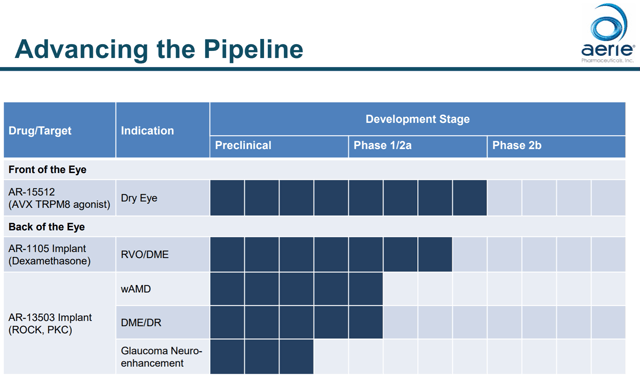

In addition to Rocklatan and Rhopressa, Aerie is developing a dry eye therapy as well as a sustained-release implant platform for retinal diseases.

Figure 4: Aerie’s Pipeline (source: corporate presentation)

The latest-stage drug in Aerie’s pipeline comes from its November 2019 acquisition of Avizorex. AR-15512 is a TRPM8 agonist eye drop for dry eye. This drug is supposed to work by activating cold thermoreceptors in the cornea which increases tear production and blinking rate while decreasing subjective levels of discomfort. Long-term toxicology studies are currently underway, and Aerie is planning to start a Phase 2/3 in the second half of this year.

Aerie also has a sustained-release implant platform. AR-13503 is a Rho kinase and protein kinase C inhibitor implant for wet age-related macular degeneration and diabetic macular edema. Aerie started a first-in-human trial in Q3 2019. Minimum enrollment is already complete, and the company has said the trial is on track for a 2021 data readout.

The other therapy in the sustained-release implant platform is AR-1105, a dexamethasone steroid implant for macular edema due to retinal vein occlusion. A Phase 2 clinical study was commenced Q1 2019, and a data readout is expected sometime later this year.

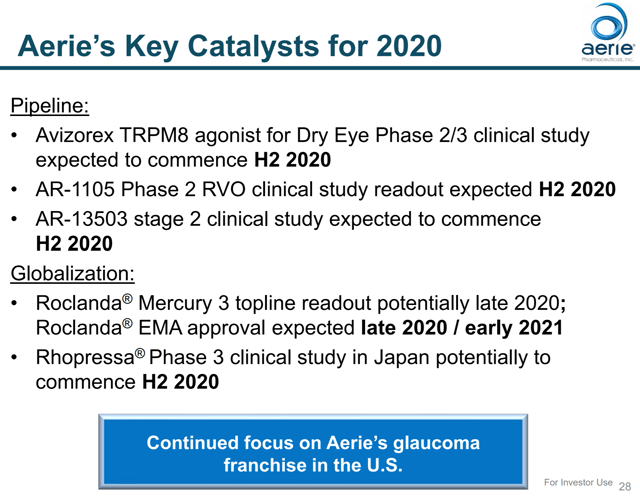

Between the pipeline and the broader global rollout for Rhopressa and Rocklatan, Aerie has several catalysts coming up in 2020.

Figure 5: Aerie’s 2020 Catalysts (source: corporate presentation)

The AR-1105 Phase 2 data readout in particular would seem to hold the potential to move the price of Aerie’s stock. On the flip side, any failures for Aerie out of these catalysts could be a major setback to the company and result in a decreased share price.

The Slow Rollout of Aerie’s Marketed Products Will Almost Certainly Result in Significant Dilution

At first glance, Aerie would appear to be a reasonably well-funded company — Aerie’s balance sheet showed $264.7 million in cash at the end of the first quarter. Unfortunately though, Aerie also burned $49.1 million in cash in the first quarter. This annualizes to just under $200 million, implying Aerie has a runway to early-to-mid 2021 depending on what Rhopressa and Rocklatan sales look like over the coming year. This rate is also exactly in line with Aerie’s 2019 loss of $199.6 million. On top of that, Aerie also has some debt in the form of $194 million in convertible notes.

Given that Aerie’s products brought in just $69.9 million in revenues in 2019, Aerie is still a long way from being cash flow positive. This almost certainly means that Aerie will have to raise a substantial amount of dilutive capital. In my view, this cash raise — and the potential for it to be far larger than currently estimated — represents the biggest threat to the success of an investment in the company.

Aerie Looks Modestly Undervalued Despite the Threat of Dilution

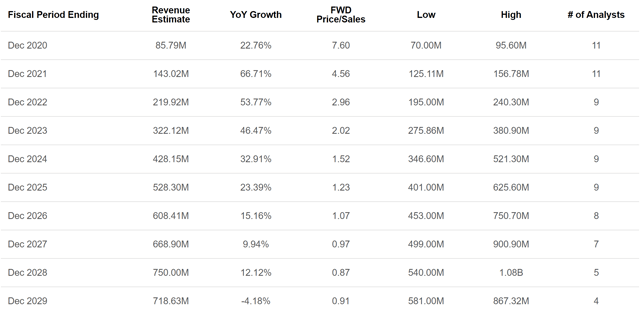

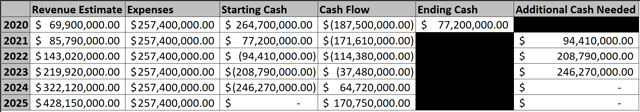

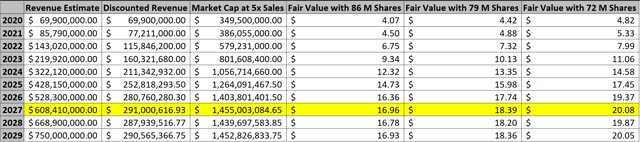

Even with the likelihood of substantial dilution, Aerie still looks undervalued based on the sales and earnings estimates of multiple analysts. Again, Aerie had $69.9 million in revenue in 2019 and that number should still grow in 2020 despite headwinds from COVID-19.

Figure 6: Aerie Sales and Earnings Estimates (source: Seeking Alpha)

The numbers from 2023-2025 stand out the most to me because the estimates for these years are within the next 5 years and are based on 8+ analysts for the sales data and 5+ analysts for the earnings. The estimated P/E and P/S ratios for those years are well below the 15 and 5, respectively, that are often considered to be average values.

It’s also worth noting that sales growth has been underwhelming so far, and revenue and sales estimates have been cut on multiple occasions. That’s why it’s particularly significant to me that these estimates are from multiple analysts rather than just wild speculation. It’s also important that, at the current level where Aerie shares have been trading, the company would still look undervalued even if actual sales and earnings numbers were well under these estimates.

The biggest counterargument to Aerie as a buy that I’ve heard is the high current cash burn and additional dilution that is almost certain to follow. I don’t disagree that those are big concerns, but the stock still looks undervalued to me based on sales and earnings estimates even after explicitly factoring in substantial dilution in the future.

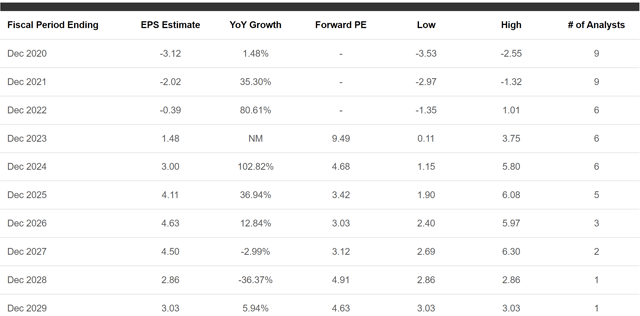

Aerie said in its initial 2020 guidance that expenses were expected to stay consistent with 2019 levels, which were $257.4 million in total. For my analysis, I assumed that Aerie will have zero sales growth in 2020, which is almost certainly overly conservative, so I just bumped back analyst estimates for the next several years by one year. I also used that 2019 expense number to project cash flow needs over the next few years.

Figure 7: Chart Showing My Projection for Aerie’s Cash Flow Needs (source: Seeking Alpha, Aerie’s 10-K, and my calculations based on that data)

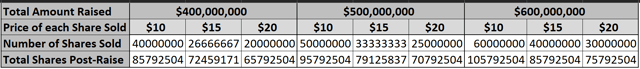

As you can see from Figure 7, I project Aerie to end up needing just under $250 million in additional cash for operations. This is because as sales pick up, Aerie will have more cash flow coming in to offset expenses, and Aerie should have positive cash flow starting in 2024, if not sooner. What also has to be factored in, though, is Aerie’s debt, which will mature in 2024. Because of that, I estimate Aerie will need something closer to $400 million in total. I then modeled what the impact of dilutive cash raises could be on Aerie’s total share count at various different total amounts raised, including ones above my estimate of Aerie’s cash needs, and at several different share prices above and below where the stock is currently trading.

Figure 8: Chart Showing My Projection for Aerie’s Total Shares Outstanding After Another Cash Raise (source: Seeking Alpha, Aerie’s 10-K, and my calculations based on that data)

Aerie currently has 45,792,504 shares outstanding, so I think it’s pretty safe to say they will end up with at least 65 million shares unless the share price goes substantially higher before cash has to be raised next year.

Figure 9: Chart Showing My Calculation of a Potential Fair Value for Aerie Based on Discounted Sales Estimates (source: Seeking Alpha, Aerie’s 10-K, and my calculations based on that data)

Even with up to 86 million shares outstanding, though, Aerie still looks somewhat undervalued at present. As you can see in Figure 9, Aerie’s sales several years in the future are expected to be large enough that — even after discounting them at 10% per year back to the present — they result in a fair value estimate of about $17/share at a 5 P/S which is about average in this industry. If Aerie can get by with a smaller raise or at a higher price per share, then the company’s fair value could be substantially higher.

Figure 10: Aerie’s Stock Chart (source: finviz)

Aerie’s stock has spent about 3 months now trading below that $17 level. Although it doesn’t have a particularly wide margin of safety, there seems to be some potential upside in the stock from the current level.

Conclusion

Based on my analysis of the impact of the near-certain dilution, I do think Aerie is undervalued at present. I personally did buy some additional shares recently to average down my cost basis, although I have still not accumulated what I would consider a full position in my portfolio. Despite having 2 marketed products, I do think an investment in Aerie is riskier than one might expect due to the high cash burn, so I plan to keep my position smaller than normal for now.

Disclosure: I am/we are long AERI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor the timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself without notification. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance as financial circumstances are individualized.