Summary:

- Sell-side estimates for this quarter’s revenue are too high and have begun to be cut.

- The guidance of 110m in revenue for the year is very unlikely to be achieved, which will result in even higher than expected cash burn.

- Sales of Rocklatan and Rhopressa to pharmacies and distributors exceed prescriptions, creating a demand headwind for the future.

- Strategic acquirers are unlikely to be interested in buying AERI in the near future.

AERI sell side estimates are too high

Both Rhopressa and Rocklatan are significantly underwhelming street expectations. Guidance is too high and will need to be cut.

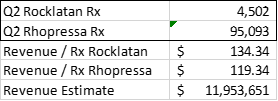

I’ll begin with an analysis this quarter’s sales of Rhopressa and Rocklatan using weekly prescription data from Bloomberg / Symphony Health. The dates do not perfectly line up with quarter ends, but the difference is minimal and the monthly data for June is not available yet.

Between the weeks ended January 4, 2019, and March 29, 2019, Bloomberg reports that there were 90,930 total retail prescriptions for Rhopressa. Since the company reported $10,852,000 in revenue for the quarter, that implies a $119.34 of net revenue per retail prescription reported on Bloomberg. Note that the Bloomberg data is an estimate of only retail pharmacy sales. However, I think the data is good enough for our purposes and it’s reasonable to hold this multiplier constant for the next quarter – this is equivalent to assuming that the share of total prescriptions captured by Bloomberg remains constant from this quarter to the next. It is also important to remember that the number of bottles sold is higher than the number of prescriptions.

For the first two months of Q2 2019, Bloomberg reports that there were 64,724 prescriptions for Rhopressa and 1,300 prescriptions for Rocklatan. For the first 4 weeks of June, Bloomberg reports 30,369 Rhopressa Prescriptions and 3,202 Rocklatan Prescriptions. The data series ends on June 28, but the final two days of the month were Saturday and Sunday so the number of missing prescriptions should be minimal.

As for revenue per prescription, I assume that the $119.34 revenue/prescription number from last quarter applies to Rhopressa, and add a $15 premium for Rocklatan based on Vincente Adino’s comments on the Q4 2018 earnings call: “From a pricing perspective, we do expect the price of Rocklatan at a slight premium to Rhopressa. Again, we’ve always talked about a $10 to a $15 premium or so, so we’re trying to make it as easy as possible for the plans to put Rocklatan on.”

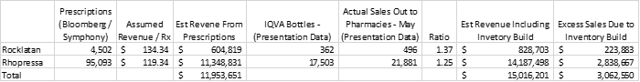

All this gets me to the numbers below:

Source: Bloomberg Drug Explorer weekly prescription data, company filings, my calculations

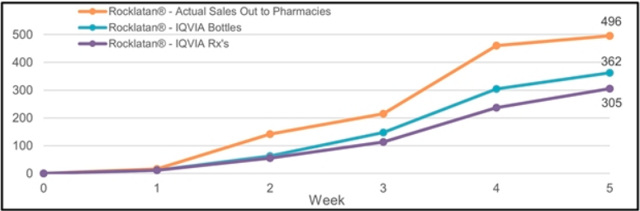

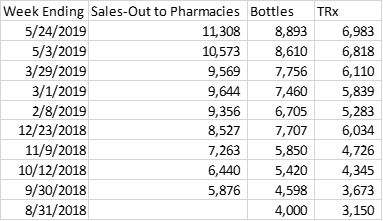

There is one further complication. AERI’s investor presentation includes the following charts, which show “actual sales out to pharmacies” significantly above prescriptions. This implies that pharmacies have built up some inventory.

Source: AERI investor presentation (linked above)

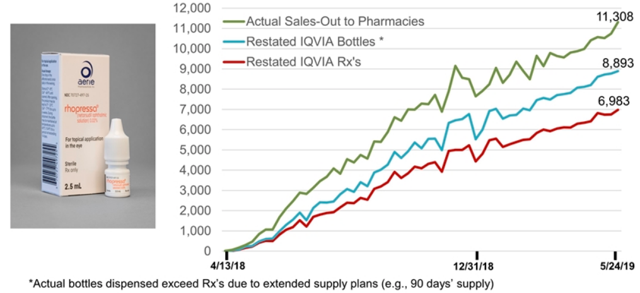

Going through the prior versions of this chart on the company presentation on EDGAR I was able to compile a table of cumulative Sales-Out to Pharmacies for Rhopressa.

Source: achieved AERI investor presentations found on sec.gov. Note that the data cited by the company comes from IQVIA, which is, of course, different than Bloomberg/Symphony Health so the numbers are slightly different from those that I used above.

In thinking about the excess sales to pharmacies, I rely on Steins’s Law: “If something can’t go on forever, it will stop.” I believe prescribed bottles represent sustainable demand and the inventory build will not continue to outpace sustainable demand for much longer. Burning through that excess inventory at pharmacies and distributors will reduce future sales. Still, in the short term, it seems reasonable to assume that AERI will get a revenue boost from the build up of inventory.

Source: Bloomberg Drug Explorer weekly prescription data, company filings, company presentations, my calculations

If sales-out to pharmacies exceed bottles prescribed by 25% for Rhopressa and by 37% for Rocklatan (as implied by the numbers for the two weeks in May in the table and the full period from the Rocklatan chart), I estimate total revenue of about $15.02 million for the quarter. It is very important to point out that the additional 3.06m in quarterly revenue from sales out to pharmacies is not bullish – it represents sales that has been pulled forward into the current quarter through inventory build.

As of this writing, the sell side consensus estimate for Q2 is $16.82 million. One can quibble with my assumptions, but no minor adjustments will bring the revenue estimate up to $16.8m. The sell side has been slow to update their numbers, but they are beginning to take their estimates down. JMP securities recently lowered their estimate from $19.4 to $13.7m, noting a “lower than forecast ASP [average selling price].” Their estimate was as high as $22.5m in February of this year. Piper Jaffray also lowered their numbers from $16.9m to $15.3m in note dated July 5, citing the updated IQVA prescription numbers. Interestingly, the Piper Jaffray note concluded by warning that, “For now, our 2H19 estimates remain unchanged, but [we] expect to reassess our numbers on the other side of 2Q earnings.”

Unless the sell side continues aggressively taking down their revenue estimates, AERI is probably is going to miss the consensus revenue estimate for this quarter. After that, there is no reason to believe that growth will significantly accelerate and the extra sales out to pharmacies will prove to be an additional headwind. Aerie’s Vincente Adino has described Rocklatan as a “game changer,” but it is nothing more than Rhopressa with a generically available prostaglandin analog mixed in. Rocklatan is presently growing off a small base, but it very well may be cannibalizing Rhopressa sales in the process, resulting in slowing growth for the latter drug. In fact, the Bloomberg / Symphony data shows fewer Rhopressa prescriptions for June 2019 than for the prior month, which is unusual coming from a relatively new drug launch.

One more fact about revenue is worth mentioning. Net revenue per bottle was reported as $100 but GoodRx reports that Rhopressa has a minimum retail cost of around $255. The 2019 first quarter 10-Q contains the following rather interesting footnote on revenue:

The Company calculates its net product revenue based on the wholesale acquisition cost that the Company charges its Distributors for Rhopressa® less provisions for ((i)) trade discounts and allowances, such as discounts for prompt payment and Distributor fees, ((ii)) estimated rebates to Third-party Payers, estimated payments for Medicare Part D prescription drug program coverage gap (commonly called the “donut hole”), patient co-pay program coupon utilization, chargebacks and other discount programs and ((iii)) reserves for expected product returns. Provisions for revenue reserves reduced product revenues by $16.2 million for the three months ended March 31, 2019.

The revenue reserve for Q1 of 2019 is greater than the reported revenue (~$10.9m). The 2018 10-K put the revenue reserve for the year at $19.6m (vs $24m of net revenue.) Aerie has adopted a strategy of selling Rhopressa and Rocklatan at steep premiums over the generic drugs like Latanoprost that dominate this market. The provision for revenue reserves as a percent of gross revenue has been high and increasing, which is a clear warning that AERI is unable to maintain these prices and is being forced to provide incentives to move its products.

The guidance looks unachievable

AERI reported $10.85m in revenue in Q1 2019. For the sake of argument, I’ll round my Q2 estimate of revenue attributable to final demand up to $12 million but assume that the excess sales to pharmacies and distributors will offset future demand in the second half of this year. That would put ‘true’ first half revenue at $22.85 million.

The full year FY2019 guidance is for $110 – $120 million dollars. Specifically, the company reiterated guidance when it reported the first quarter results:

Aerie reiterated that it expects full-year 2019 net revenues in the range of $110 million to $120 million on a U.S. GAAP basis for the combined net revenues for Rhopressa® and Rocklatan®.

Aerie also reiterated its net cash burn guidance for full-year 2019 in the range of $130 million to $140 million. This range includes the gross cash burn guidance of $210 million to $220 million, partially offset by estimated full-year 2019 revenue-related net cash inflows of $80 million, which includes accounts receivable collections and rebate payments.

I doubt that this guidance can be achieved. If my estimate is correct, revenue will have grown by about 10% from Q1 excluding the excess inventory built up by pharmacies and distributors. If revenue continues to grow at 10%, Q3 revenue will come in at $13.1m, far below the sell side consensus of $30.6m, and Q4 would come it at $14.4m, compared with a consensus estimate of nearly $48 million. Note that the sell side consensus is currently below the low end of company revenue guidance.

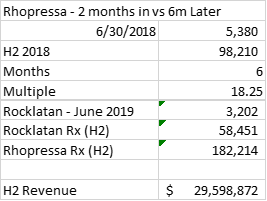

Another less crude way to estimate the revenue is to assume that Rocklatan will follow the same growth path as Rhopressa. In June 2018, the second full month after the Rhopressa commercial launch, there were 5,380 prescriptions, according to Bloomberg. Over the following 6 months, there were a total of 98,210 prescriptions, or 18.25x the month of June 2018. For June 2019, the second full month after the Rocklatan launch, Bloomberg reports 3,202 prescriptions. If I use the same 18.25x multiplier, I get 58,451 Rocklatan prescriptions for the second half of 2019. Assuming that Rocklatan prescriptions remain stable and the revenue per prescription stays the same, I get $29.6 million in revenue for the second half.

Source: Bloomberg Drug Explorer prescription data, my estimates

Note that this estimate for the second half is lower than the sell side estimate for just the third quarter. These estimates imply full year revenue of $52.4 million, far short of $110-120 million! Once again, I’ve made a lot of assumptions, some of which may be a bit too pessimistic for AERI, but small changes to any of them aren’t enough to bring the revenue estimate up to anything close to guidance.

If revenue falls well short of guidance, that $80 million of revenue related cash inflow is never going to materialize, and the net cash burn could be far worse than the expected $130-140m. The company had ~$149m in cash at the end of 2019 Q1. AERI will need to tap the capital markets soon just to stay in business.

My guess is that Aerie’s management has recognized their predicament and is looking to do an equity deal. According to Street Account, they will be on the road with Needham starting on July 10th, presumably to drum up interest for an offering.

Source: Street Account

They also amended their credit agreement with Deerfield Asset Management to increase the size of their undrawn revolver from $100 to 200 million. These are the actions of a company that understands that it will soon be facing a cash crunch.

There are good reasons why Rocklatan isn’t selling very well

The bull case for Rocklatain as a future blockbuster drug is that

- It reduces interocular pressure by more than any other eyedrop on the market

- It only requires one dose per day

Neither of these holds up to scrutiny.

At the end of the three-month double-blind clinical trial named Mercury-2, the efficacy difference between latanoprost monotherapy and Rocklatan was only 1.5 mmHg. While statistically significant, this reduction is not unique. Fixed dose combinations (FDCs) of Travaprost and Timolol, as well as Latanoprost and Timolol, have been studied. In both cases, the reduction in IOP was approximately 1.5 mmHg.

The clinical trials of FDCs of Travaprost and Latanoprost with Timolol enrolled far fewer patients than the Rocklatan FDC study. These studies all produced similar reductions in IOP but the Rocklatan study, which enrolled more patients than the other FDCs, reported a p-value <0.05 even though the magnitude of the effect was the same. I think you would be hard pressed to find an ophthalmologist who would testify that a similarly sized study of Travaprost/Timolol or Xalatan/timolol wouldn’t also produce a p<0.05 on all time points. Having established that you will very likely observe the same clinical outcome with generic prostaglandin plus generic timolol, the remaining advantage is the once daily dosing.

Everyone likes convenience, but it seems unlikely that glaucoma patients, who are mostly over the age of 60, will be willing to pay a substantial amount just to avoid taking more than one eye-drop. Rocklatan costs approximately $270 for one month of therapy whereas latanoprost and timolol cost $23 ($16 for latanoprost and $7 for timolol).

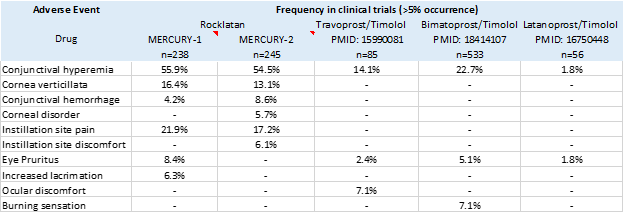

For a premium of nearly $250, you would expect that Rocklatan would have a better tolerably profile than other drug combinations. This not the case, as shown in the comparison table below using data compiled from the clinical trials. Notably, rates of hyperemia in Mercury-1 and Mercury-2 were more than double the highest reported rates observed with other combinations. Corneal deposits and conjunctival hemorrhage were also frequent occurrences in the Mercury trials and yet are not described at all with alternative drug combinations. Rocklatan’s poor tolerability resulted in a dropout rate of 33% over one year of therapy in the Mercury-1 trial.

Source: clinical trials and publications. Data and links to publications are available at clinicaltrials.gov

The bottom line is that Rocklatan is much more expensive than fixed dose combinations of competing drugs but no more effective, and it comes with more frequent side effects. It should not come as no surprise that it’s selling poorly.

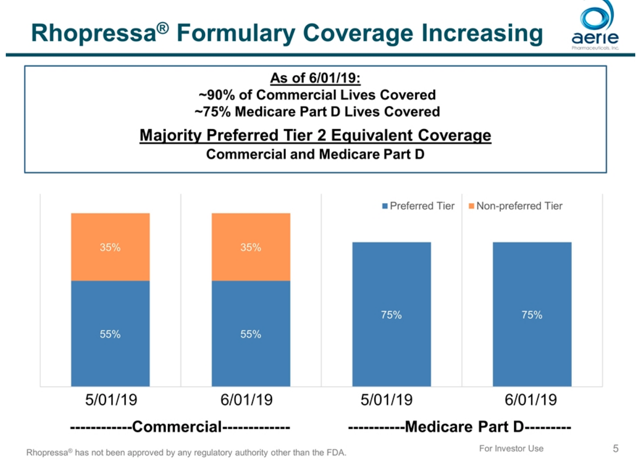

The reimbursement picture complicates sales even further. Aerie claims to have 75% coverage for Medicare Part D and 55% Tier 2 coverage for commercial insurance.

However, GoodRx indicates that “In general, Medicare plans do not cover this drug. This drug will likely be quite expensive and you may want to consider using a GoodRx discount instead of Medicare to find the best price for this prescription.” The Q1medicare website, which allows users to search for Medicare Part D plans by drug coverage, shows “No additional gap coverage, only the Donut Hole Discount” or “No gap coverage” for all plans in California, New York, and Texas.

For the 35% of commercial lives for which Rhopressa is a tier 3 drug, reimbursement requires pre-authorization. Even for the 55% where Rhopressa has tier 2 coverage, pre-authorization may be required if the drug is not on the formulary. Here are a few prominent examples of plans that do not list Rhopressa on their formulary (links point to pdf files).

- Cigna – Rhopressa is not listed on their 2019 formulary, and was listed as “Not Covered” in a document from Cigna in October 2018.

- UHC – Rhopressa is listed as step therapy under the community plan or w/ OptumRx

- Aetna Medicare – No Rhopressa listed at all, not even for step therapy or any other options.

- BCBS – Rocklatan and Rhopressa are included on the Non-Covered Drug List

CEO Vincente Anido alluded to this problem on the 2019 Q1 earnings call:

We do see signs of that already occurring, not just because we think we’re going to get extra coverage, but as I mentioned during the call, we have seen over the last 3 weeks or so a fairly nice bump-up in terms of the shipments from wholesalers to retail and we think that that’s a prime indicator for continued success. And the fact that the sales force has been able to overcome a lot of different things, which — we’ve had probably 40,000-plus prior authorizations written with Rhopressa. And I think folks are beginning to see light of day, or the end of — light at the end of the tunnel here, which is the fact that we’ll be able to get Rhopressa reimbursed. And so we do feel comfortable that the range is at $110 million to $120 million, and all we’ve seen is a little bit of blip from one quarter to the next.

Andio’s remarks do at least clarify that the company has struggled with insurance reimbursement, which is understandable given the high price of Rhopressa and Rocklatan and lack of a demonstrated advantage in efficacy over much lower priced drugs.

The current hope – expansion to Japan & Europe

Aerie is currently running a clinical trial in Japan in preparation for launching Rhopressa in Japan. On July 9, 2019, the company put out the following press release:

Aerie Pharmaceuticals, Inc. ((NASDAQ:AERI)) (Aerie), an ophthalmic pharmaceutical company focused on the discovery, development and commercialization of first-in-class therapies for the treatment of patients with open-angle glaucoma, retinal diseases and other diseases of the eye, today announced that enrollment for its Phase 2 clinical trial of netarsudil ophthalmic solution in Japan is complete, a milestone reached several months earlier than previously anticipated.

The first patients to enter this prospective, double-masked, multi-center, placebo-controlled, parallel group Phase 2 study were dosed in late March 2019. In approximately 3 months, a total of 215 patients were successfully randomized across four treatment arms: netarsudil ophthalmic solution 0.01%, netarsudil ophthalmic solution 0.02%, netarsudil ophthalmic solution 0.04%, and placebo, all administered once daily in the evening. Netarsudil ophthalmic solution 0.02% is known by the name Rhopressa® in the United States where it is approved for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension.

Since Rhopressa has been approved in the United States, it is likely that it will be approved in Japan as well. However, Aerie would be launching the second rho kinase (ROCK) inhibitor in that market. Ripasudil, which is sold by Kowa Pharmaceuticals, was first launched in Japan in 2014. There is also a Phase 2 clinical trial for this drug running in Oregon, which may eventually result in its launch in the United States and put further pressure on sales of Rockatan and Rhopressa.

Aerie is also working on expanding into Europe, starting with Rocklatan (it plans to call the drug Rocklandia in Europe for some reason). The company expects to complete a Phase 3 trial there by the end of the year and “have topline data sometime in 2020.” Aerie is going it alone in Europe for commercialization and hiring its own sales force. On the 2018 Q4 earnings call, Anido got a question about this:

Esther P. Rajavelu Oppenheimer & Co. Inc – Executive Director & Senior Analyst –

I’m just curious to understand some of the thought process and some of your considerations in deciding to pursue commercialization in Europe independently.

Vicente J. Anido Aerie Pharmaceuticals, Inc. – CEO & Chairman –

Yes. So it was pretty straightforward. We actually thought that we would go ahead and find a partner in Europe. And one of the things that we couldn’t determine, especially looking at the potential partners for Europe, is that there’s no real sort of European-centric companies. There’s one private one that’s available that has some presidents in many of the countries. Typically, the ophthalmic companies that are available in Europe are the Allergans and the Alcons of the world. And as you know, certainly here in the U.S. and many parts of the world, they’ve also been contracting their commercial operations in ophthalmology. So I didn’t want to get caught up given that my product and all of a sudden realize that they were considerably bringing down their infrastructure there. We did look at some of the European-only sectors. We thought about going country-by-country because there are some interesting companies that are available. But it was just sort of — it was turning out to be far more laborious than we expected it to be. And what we did find was quite a bit of talent available so that we can do it on our own. And so as way of derisking this thing, we will bring in our own commercial management team and the like. We could use a contract sales organization just out of the gate in order to make sure that we understand the dynamics of every country, and we are going to focus only on the top 5 in Europe. So I think that helps considerably. But it was really — the decision was driven by just — again, we did the math, and we could make a lot more money if we did it ourselves than if we try to find a partner.

So… just to reiterate, there are no “real sort of European-centric companies,” finding partners country by country turned out to be too laborious, but they are just going to focus on the top 5 countries in Europe and hire and ramp their own sales force, because doing that will be less laborious and more profitable. I’m deeply skeptical of these assertions. I think it’s far more likely that potential partners looked at the drug, its side effects vs the competition, and the disappointing sales in the United States and decided that the partnership just wasn’t worth it. Even if Aerie is able to launch Rocklandia in Europe, drug prices are far lower in Europe and thus profitability might be difficult to achieve.

Valuation and Potential Strategic Acquirers

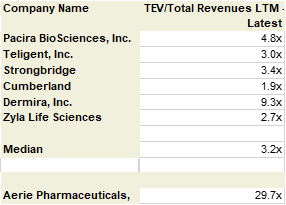

Currently, AERI trades at 29.7 EV/S on an LTM basis and 19.8x my estimate of 2019 revenue. This valuation makes no sense for a company that burns 9-figures of cash per year with muted growth prospects. I believe the significant premium above stand-alone fair value being ascribed to the shares is a function of unfounded takeout speculation occurring in the market.

Allergan (AGN) was supposedly interested in buying AERI, according to market rumors on twitter.

Source: Twitter

However, Allergan itself was recently acquired by AbbVie (ABBV) in a transaction involving up to $30B of debt. Given the leverage and integration focus, it’s highly unlikely that AbbVie would acquire AERI any time soon. By the time AbbVie gets its hands around Allergan, it’s likely that both Rhopressa and Rocklatan will be widely understood to be commercial failures.

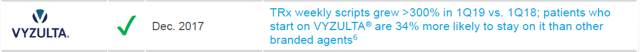

Another possible acquirer is Bausch Health Companies (BHC), formerly Valeant Pharmaceuticals. This is also highly unlikely. Bausch itself is straining under a heavy debt load of more than $24 billion, but even more importantly, Bausch recently launched Vyzulta, its own medication for glaucoma. Vyzulta prescriptions are presently growing quickly off a small base with a superior safety profile to AERI’s drugs.

Source: Bausch Health Companies Investor Presentation

There are certainly other big pharma companies but without evidence that either Rhopressa or Rocklatan sales are going to “hockey stick”, there’s no reason for any strategic buyer to pay a hefty premium above an already stretched market valuation for AERI.

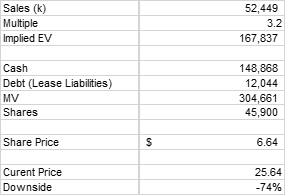

I estimate the value AERIE as a stand-alone company at 3.2x sales based on a quick peer analysis via Capital IQ.

Source: CapitalIq

Aerie is a money losing pharmaceutical company with essentially one drug that is in the process of falling short of expectations, so the 3.2x multiple may be generous. Even so, here’s the implied value using my FY 2019 revenue estimate.

Source: My calculations

$6.64 would be 74% downside from the current share price of $25.64. Of course, in the event that Rocklatan and Rhopressa never achieve the level needed to attain positive free cash flow, Aerie pharmaceuticals could be worth zero.

Conclusion

AERI traded over $70 in July of last year based on the hope that Rhopressa and Rocklatan would become blockbuster drugs. Hope is now colliding with reality. Rhropressa is priced at a significant premium over competing drugs and has an inferior tolerability profile, and Rocklatan is nothing more than a fixed dose combination of Rhopressa and a generically available prostaglandin analogue. The drugs are not selling nearly as well as expected and sell-side revenue estimates are coming down. When revenue disappoints, the cash burn is likely to be even worse than guidance. The story that sales are suddenly going to hockey stick in the second half is implausible.

If you’re long, you should get out before the price drops even further. If you’re looking for a short, AERI is worth your attention.

Disclosure: I am/we are short AERI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.