Summary:

- Affimed reported mixed Q2 earnings that revealed more milestone payments from their partnerships. In addition, Affimed reported a healthy cash position that is expected to last into 2H of 2022.

- Affimed continues to move their wholly-owned and partnered pipeline programs. However, 2022 has several catalysts on the docket that could improve the company’s outlook.

- Despite the progress, the share price has remained under pressure and is moving closer to my buy area.

- Finally, I take a look at the charts to find a few opportunities to add to my “house money” position.

luismmolina/E+ via Getty Images

Affimed N.V. (NASDAQ:AFMD) continues to move their pipeline and partnered pipeline programs forward. Unfortunately, the share price remains under pressure as SMID cap biotech and pharma sell-off endures into Q4. I believe the company’s recent Q2 earnings beat and company updates support a bullish outlook for the remainder of 2021 and 2022. In my previous AFMD article, I forecasted that the market would take the selling too far and would provide investors an opportunity to buy AFMD at a discount. I believe the share price is approaching those discounted levels and could be a great opportunity to reload my AFMD position.

I intend to review the company’s Q2 earnings and pipeline programs. In addition, I will discuss my views on the RO7297089 update and how it impacts my long-term thesis. Finally, I reveal my plan for taking advantage of this selloff and how it has altered my strategy for managing my AFMD position.

Q2 Numbers

Affimed recently reported their Q2 earnings where they revealed they pulled in €9.7M in total revenue, which is up from €2.9M in Q2 of 2020. The revenue came from the company’s Genentech and Roivant partnerships, but the company did report a net loss of €18.8M.

In terms of cash, Affimed ended the second quarter with €222.7M in cash and cash equivalents, which is down from €240.7M at the end of Q1 of 2021. Affimed expects their cash position “will support operations into the second half of 2023.”

Pipeline Updates

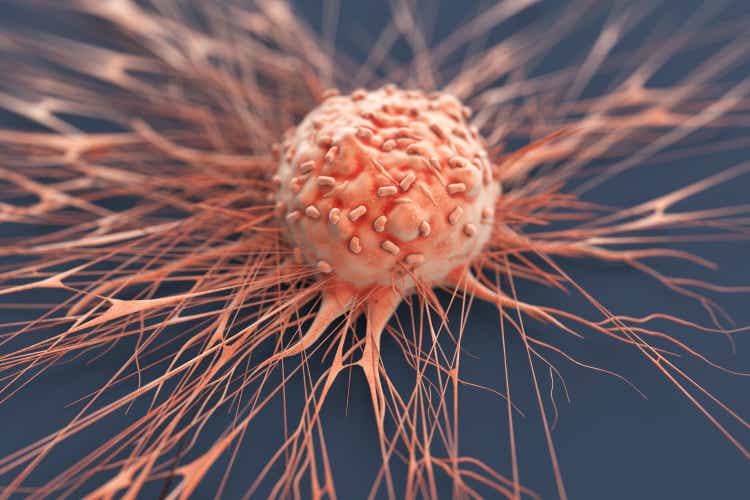

Affimed is maintaining the company momentum by continuing to execute well across all of the company’s wholly-owned programs – the company development strategy, their ICE candidates as monotherapies, and in combination with NK cells and in combination with PD-1 or PD-L1 products.

Figure 1: AFMD Pipeline (Source: AFMD)

AFM13’s registration-directed study in relapsed/refractory peripheral T-cell lymphoma is on track with Affimed expecting to complete enrollment in the first half of next year. In addition, AFM13’s Phase I study at MD Anderson Cancer Center for cord blood-derived NK cells pre-complexed with AFM13 is enrolled and they have completed the dose-escalation portion of the study. The three cohorts are 106 cells/Kg, 107 cells/Kg, and 108 cells/Kg. The company is currently enrolling additional patients in the 108 cells/ Kg. So far, there have been no dose-limiting toxicities and encouraging observed response rates. Affimed plans to provide an update at a conference this quarter.

Affimed is working on the combination of AFM13 with NK cells into a registration study. The company already has data on cryopreserved NK cells pre-complexed with AFM13, which showed that their innate cell engagers remained combined with the NK cells for days, which is superior to monoclonal antibodies. What is more, this combination is expected to be superior to monoclonal antibodies in activating the NK cells to kill tumor cells. We should see some of this data presented at the SITC Annual Meeting in November of this year.

AFM24 for advanced EGFR-positive solid malignancies is in a dose-escalation phase to determine the maximum tolerated dose in order to establish their Phase II dose. Once the company has their recommended Phase II dose, Affimed projects to begin their expansion cohorts in the second half of this year. Affimed is also looking to start two additional combination clinical studies for AFM24 in combination with Roche’s (OTCQX:RHHBY) anti-PD-L1 antibody TECENTRIQ.

Affimed believes they can display a synergistic effect with TECENTRIQ, which could deliver impressive clinical outcomes. Affimed plans to dose their first patient in a Phase I/IIa study in the second half of this year. In addition, Affimed expects to start a Phase I/IIa study for AFM24 in combination with NKGen Bio’s autologous NK cell product in the second half of this year.

As for AFM28, Affimed continues to advance the IND enabling studies and plans to submit the IND application in the first half of next year, and start a clinical study in the second half.

Bullish On 2022

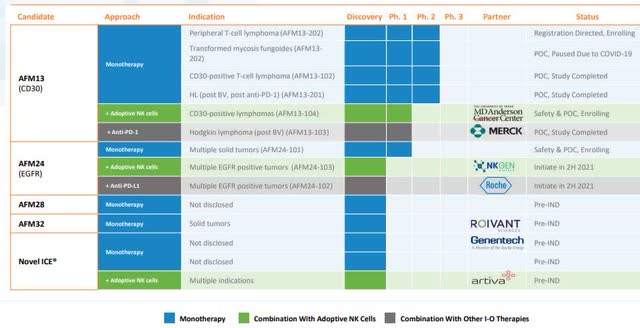

I have been bullish on AFMD’s long-term prospects due to its impressive platform and partnerships. Now, I am bullish on AFMD’s near-term prospects due to some expected catalysts and milestones. The company has several milestones scheduled anticipated in this last quarter of 2021 with even more throughout 2022 (Figure 2). The steady stream of catalysts could provide frequent injections of momentum into the share price. Personally, I’m going to focus on how these milestones could have a substantial impact on the company’s long-term outlook. Some of these catalysts might reveal a clearer picture of potential pivotal trials and a timeline for approval.

Figure 2: AFMD 2021-2022 Milestones (Source: AFMD)

Figure 2: AFMD 2021-2022 Milestones (Source: AFMD)

Essentially, 2022 may well confirm that Affimed is in a prominent position in the innate immune cell therapy arena. What is more, Affimed’s financials are healthy with a cash runway expected to last into the second half of 2023. As a result, I still have a bullish outlook for AFMD in the near term and long term.

My Plan

In my previous AFMD article, I discussed my strategy for reapplying some of my profits to rebuild my “house money” position.

Figure 3: AFMD Daily (Source: Trendspider)

Figure 3: AFMD Daily (Source: Trendspider)

Currently, the share price has dropped below the 200-Day EMA after making a momentary bounce up toward the $7.50 resistance and has made its expected move lower where I have been waiting to make some additions. I was looking at the $6.50 area, but the conditions didn’t align to click the buy button. Now, I see a potential long-term upward trend line forming with a potential bounce around $5.50.

I will keep an eye out for the bounce with the prospect of generating enough momentum to break the downtrend line created back in April. If the share price drops below the $5.00 mark, I will look for a potential bullish divergence in the Daily RSI in conjunction with some support in the $4.50-4.90 range. If I see a bounce, I will look to add once the share price closes above the $5.00 mark.

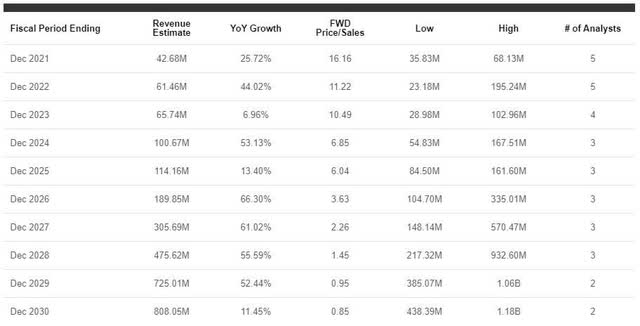

However, if the share price drops below $4.50, I will switch to a fundamental-based approach of buying “lunch money” additions every week until the charts show signs of a potential reversal. I am willing to employ this strategy due to my conviction in the company’s platform technology and partnered programs. I expect most of the company’s current programs to be approved and start bringing in significant revenue over the remainder of the decade (Figure 4).

Figure 4: Affimed Revenue Estimates (Source: Seeking Alpha)

As a result, I still plan to re-accrue a hefty position and hold onto the majority of this AFMD position for at least five years in the belief we will see an enormous return or a potential acquisition.

Thank you for reading my research on Affimed. If you want to learn even more about my method and how I discover these investment opportunities, please stand by because I am launching On The Pulse Analytics, a subscription marketplace service on Seeking Alpha in the near future and the initial wave of subscribers will be offered a lifetime discount. Further details are around the corner, so please keep an eye out and read my research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.