Summary:

- Today, we will begin our review of Affirm Holdings, Inc. by articulating how it is a beneficiary of a dynamic known as The Innovator’s Dilemma.

- This is the most important component of the thesis, and, even if you’re bearish, it would benefit you to consider the concept generally.

- In short, Affirm now operates from its greatest position of strength in its corporate history, and it is poised to continue growing at a very healthy rate into the future.

hapabapa

Accelerating

In 2023, Affirm Holdings, Inc. (NASDAQ:AFRM) held an investor day in which it rigorously detailed the nature of its business and its future prospects.

To save you some time, the one, and most essential, idea shared that day was articulated by Affirm’s CTO. He remarked,

There’s over $1T of revolving consumer debt in this country, and there’s no reason for it to exist.

Libor Michalek, CTO, Affirm.

The presentation was hours long; however, I would argue that this was the most important quote among the thousands of lines of communication shared.

In this one quote, the entire Affirm thesis is articulated.

In Clayton Christensen’s critically acclaimed book, The Innovator’s Dilemma, he worked tirelessly to communicate the idea that new entrants succeed because the economics of incumbents are already established, and the economics of the new entrants create a situation where those already established incumbent economics must be restructured to effectively compete with the new entrant (which entails a lot of pain for the incumbent, financially and culturally).

Legacy credit card companies have established unit economics largely predicated on product elements such as late fees, compounding interest, deferred interest schemes, and high interest rates, all of which Affirm has eliminated in its product.

In order for legacy credit card companies to compete with Affirm one to one, they would have to totally restructure their economics, sending their earnings careening downward, leading to shareholder upheaval and a likewise downward careening stock.

For almost all the businesses we own, The Innovator’s Dilemma is a key component of the thesis, and Affirm is certainly a paragon of this idea.

So, in stating that none of the above-mentioned credit card debt should exist, Mr. Michalek was actually communicating that Affirm offers less expensive credit that credit cards simply cannot offer, lest they dismantle the unit economics of their current established business models.

He was communicating the essence of “The Innovator’s Dilemma.”

Since the very beginning of our partnership with Affirm, this has been our thesis for the business, and it remains the case more so than ever today.

With these ideas as our platform, let’s turn to a review of Affirm’s most recent quarter, from which we received a wave of new, noteworthy data.

Affirm In Charts

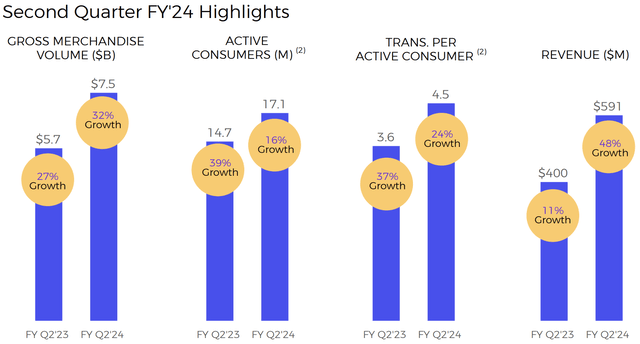

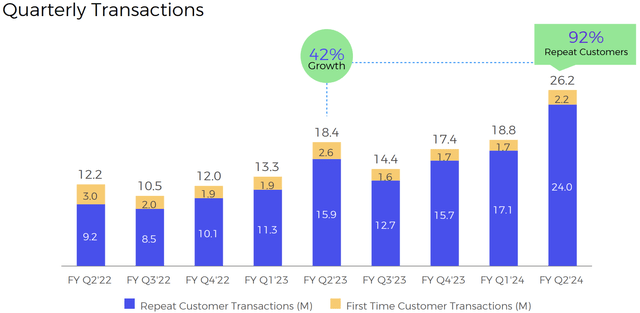

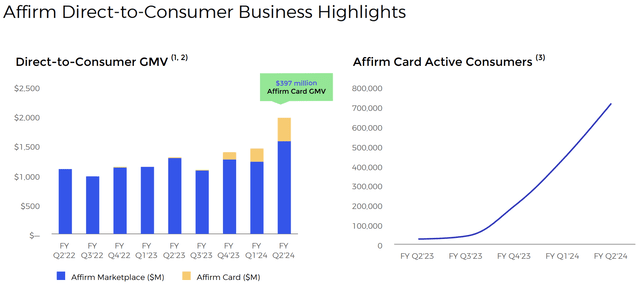

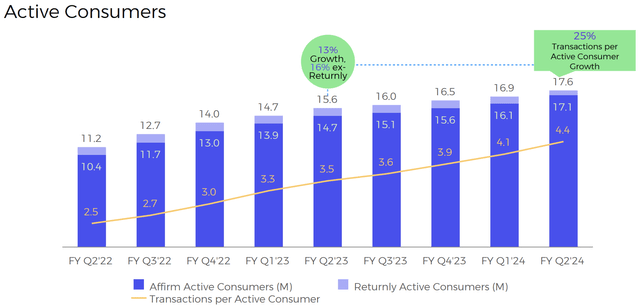

Below, we can see an overview of the business’ performance. Each KPI (key performance indicator) is worth being excited about; however, I would say Affirm’s “transactions per active consumer” [TPAC] is the most energizing.

Overview Of Affirm’s KPIs

Q4 2023 Affirm Investor Presentation

And this growth in TPAC is important because it represents growth in Affirm’s customer LTV (customer lifetime value), which directly feeds into the net present value of all future cash flows equation (and hence the fair value of the stock).

Affirm’s Transactions Per Active Accounts Growth Accelerates

Q4 2023 Affirm Investor Presentation

Growth in TPAC also represents the success of Affirm’s latest product, the Affirm Card, the growth of which can be seen below.

The Affirm Card Continues Its Parabolic Growth

Q4 2023 Affirm Investor Presentation

As I just mentioned, this has certainly been one of the most foundational pillars of the Affirm investment thesis, and it’s fantastic that Affirm has seen success so far in further locking its customers into its ecosystem (in which it can upsell them on future products or entice them to transact more, further increasing the LTV of the customer, and, by extension, the fair value of the business).

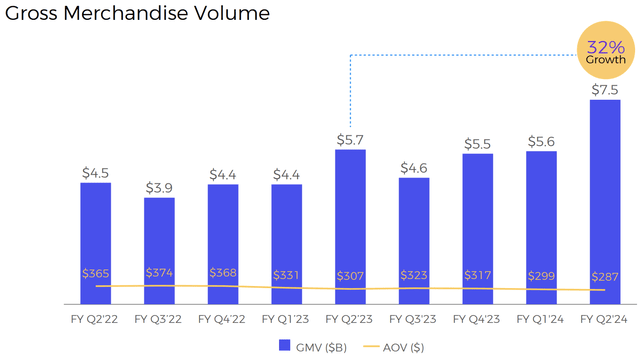

Turning to the other portions of the introductory chart, below, we can see that Affirm’s GMV, or the total value of merchandise purchased using Affirm, experienced an incredible acceleration in Q4 2023.

Affirm’s GMV Growth Accelerates To 30%+

Q4 2023 Affirm Investor Presentation

This is heartening to see, though it has been something we’ve always expected:

Affirm’s product is offered at over 60% of U.S. ecommerce point of sale volume. This represents massive distribution of its product, allowing it to both grow at elevated rates and maintain healthy credit metrics (which we will review in just a bit).

Additionally, it’s likely that Affirm’s Shopify (SHOP) partnership, which represents another vector for distribution, played a key role in the acceleration of Affirm’s GMV illustrated above.

Jill Shea: Good evening. Thanks for taking the question. I was wondering if you could provide us an update on the Shopify partnership and any stats that you could share with us, that would be great. Thanks.

Max Levchin: Hi. It’s one of the highlights of this last quarter is going unbelievably strong. It accelerated for the fourth consecutive quarter. The program is over three years old and the fact that it’s still picking up steam is just great, and they’ve been extraordinary partners to us and nothing but wonderful things to say about Tobi and CAS in Arlington team there, and there’s just been nothing but excellent in both our execution and the partnership that we had. I think already drop that stat.

But the program at Shopify grew twice the speed of the overall Affirm growth on the GMV side of things. They have aspirations off-line that they’re going after quite strongly and there’s still a lot of synergies and what we’re doing now there. We have a whole host of programs we’re contemplating going forward. So lots of with the job feeling very good. The fact that it’s accelerating suggests that there’s just more growth to be had for both of us.

Q4 2023 Affirm Earnings Call (emphasis added).

Incredible.

Turning to the next portion of the introductory chart, below, we can see that Affirm’s active accounts grew to a breathtaking 1M new accounts sequentially.

Affirm Adds 1M New Active Consumers In Q4 2023, The Most Five Quarters

Q4 2023 Affirm Investor Presentation

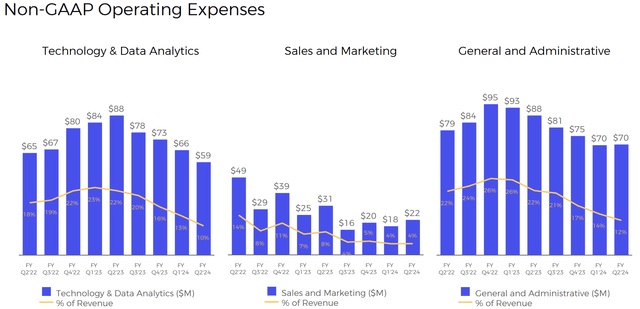

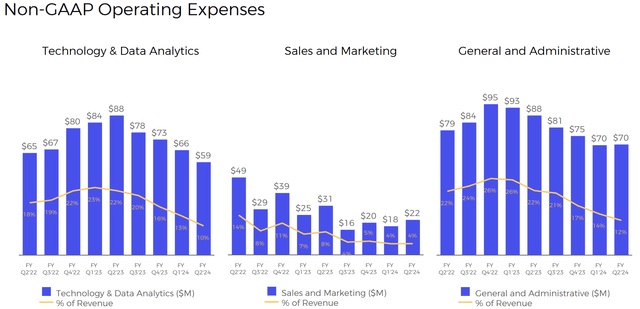

This incredible growth in active accounts (consumers) is particularly noteworthy because Affirm only spent $22M in sales and marketing in Q4 2023.

While Sofi spent $171M in sales and market in Q4 2023 to acquire 500k customers, Affirm only spent $22M in the quarter to acquire twice that number of customers.

Affirm Only Spent $22M In Sales & Marketing In Q4 2023

Q4 2023 Affirm Investor Presentation

It begs the question: How could Affirm achieve this level of customer growth with almost no sales and marketing spend, relatively speaking?

In short, distribution.

Because Affirm’s credit products are offered at over 60% of U.S. ecommerce point of sale volume, it has massive distribution of its product.

As I’ve remarked in the past, Affirm often actually gets paid to acquire new customers, i.e., it often has a negative CAC.

Hence, I called it a “Brilliant Business Model Atop A Giant Net Liquidity Position” in 2023 when it traded in the low teens/share.

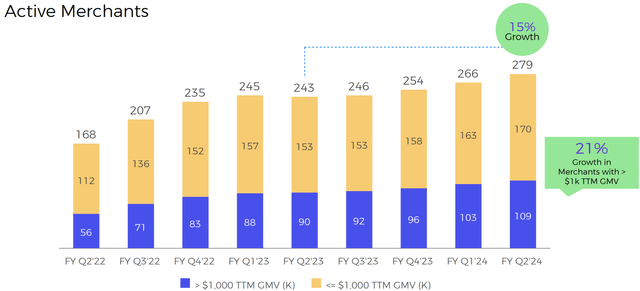

The fuel for this attractive business model is Affirm’s capture of new merchant accounts, the growth of which actually accelerated in Q4 2023, as can be seen below.

Affirm’s Active Merchants Continued To Grow At A Healthy Rate

Q4 2023 Affirm Investor Presentation

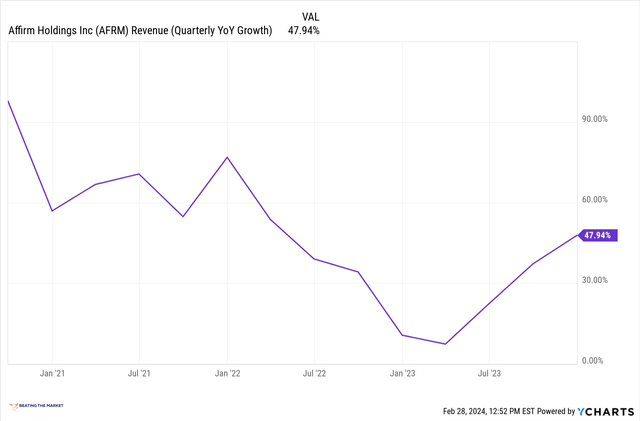

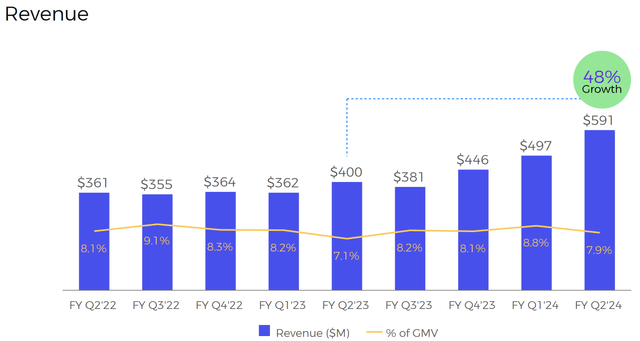

And, with all of this in mind, Affirm’s phenomenal revenue growth in Q4 2023 makes sense.

Affirm Accelerates Revenue Growth To An Eye-Watering 48%

Q4 2023 Affirm Investor Presentation

There are a number of forces driving this acceleration in growth, which I delineated for you in the discussion above. To summarize:

- Affirm’s placement at over 60% of U.S. ecommerce point of sale allows it to grow rapidly due to massive product distribution.

- Because its merchant customers often pay Affirm for Affirm to acquire new customers, i.e., Affirm often has a negative CAC, Affirm can devote spend to other areas of the business that will accelerate growth, such as the product development of the Affirm Card, whose GMV growth has been exceptional.

- Once Affirm has acquired a customer, it upsells that customer on various products, such as the Affirm Card or the Affirm Savings Account.

- Affirm can accelerate this flywheel by adding new merchants, which it has been successfully doing over the last year, fueling the above-illustrated acceleration in growth.

Profitability

As I noted two quarters ago, Affirm has become sustainably free cash flow generative, which has substantially de-risked the enterprise.

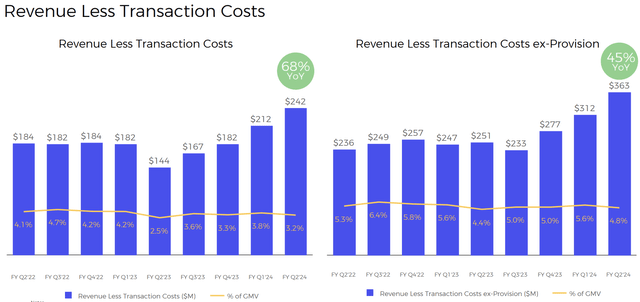

We can see this reality in the charts below.

In the first chart, we can see Affirm’s total revenue generation less transaction costs.

Q4 2023 Affirm Investor Presentation

So Affirm has $242M in RLTC (revenue less transaction costs) to play with.

Below, we can see Affirm’s cash expenses: Tech, S&M, and G&A add up to roughly $150M.

Q4 2023 Affirm Investor Presentation

$242M less $150M = Roughly $90M, and that is the amount of EBIT (operating income) Affirm generated in Q4 2023.

Q4 2023 Affirm Investor Presentation

In short, while Affirm must still work through a backlog of non-cash expenses associated with its commercial agreements (granting it the above-mentioned benefits of distribution), which pushes down heavily on GAAP profitability, the business is fundamentally free cash flow generative as of today.

Credit Health

Among the many interesting aspects of the Affirm thesis, its sustained healthy credit metrics, alongside hypergrowth, is one of particular note.

Affirm’s Credit Has Been Performing Exceptionally While The Business Grew At 48% In Q4 2023

Q4 2023 Affirm Investor Presentation

Alongside the Affirm Card release, and the positive impacts it has had on the business, I would say this dynamic is arguably the most important to the thesis, as it reflects the many attractive qualities of Affirm as a business, such as its distribution at 60%+ of U.S. ecommerce volume.

Affirm’s Credit Has Been Outperforming Its Peers

Q4 2023 Affirm Investor Presentation

Affirm can create such attractive credit outcomes because it has a very broad pool of applicants to whom it can choose to ultimately provide credit.

It can be selective about its underwriting while also helping its merchant partners achieve their goals and while also providing attractive credit assets to its funding partners.

I think it’s a reflection of the fact that the product is becoming more widely available more than anything. I think as we sign up some of the partnerships and expand them, the Shopify reference I made earlier, it does result in wider availability. The product is popular. It’s well liked by the users. One of our top questions in customer service is why isn’t Brand X supporting Affirm right now, and we work very hard to make sure there are fewer and fewer of those.

And so as we become more available, also as we become available offline in the form of the card as well as some of the integrations that we’ve done, you’ll naturally see more transactional velocity and frequency increase. The product is a better product in my highly biased opinion than that of a credit card and credit utilization goes up broadly, I think we are the under beneficiaries of that usage given the chance or choice, consumers opt in for more Affirm spend than private card spend and they’re rewarded by having no late fees, no compounding interest, all the good things that would bring.

Max Levchin, CEO, Affirm Q4 2023 Earnings Call (emphasis added).

Concluding Thoughts: Hypergrowth

Affirm’s guidance implied that it would grow at about 42% in Q1 2024. Should it beat on that guidance, as it did in Q4 2023, we could see between 45-50% growth, representing sustained hypergrowth for the business.

Affirm Re-Enters Hypergrowth

This is what we always expected, and it represents our thesis playing out exactly as anticipated.

In light of the many attractive attributes of Affirm that I described to you today, I believe it will sustain this hypergrowth (likely not ~50% growth, as that is so difficult to sustain) for the next decade.

The business, as of today, is firing on all cylinders, and I could not be happier with management’s execution.

To those that have stuck with the thesis, congratulations, as Affirm is certainly in its strongest position ever.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.