Summary:

- Affirm Holdings, Inc. comes off of a disappointing year.

- The fintech’s growth is slowing which is creating serious pressure for the fintech’s valuation. Losses are growing.

- A recession could put the fintech into even more trouble.

Userba011d64_201/iStock via Getty Images

Affirm Holdings, Inc. (NASDAQ:AFRM) is at a fork in the road. The fintech has lost the majority of its market valuation in the last year as growth has slowed and consumers have reduced their spending.

As a result, Affirm issued a very disappointing forecast for 2023, and the fintech experienced a significant slowdown in active merchant growth in the fourth quarter. At the same time, the fintech’s losses continued to grow, putting a strain on the company’s market valuation.

Finally, despite lower growth projections, Affirm remains highly valued. As a result, despite a significantly lower stock price, I don’t believe Affirm Holdings, Inc. is currently a compelling buy.

Growth Is Slowing And It Poses A Problem For The Fintech’s Valuation

The expansion of Affirm is inextricably linked to the expansion of the eCommerce economy. Affirm’s gross merchandise value grows as more transactions are processed. With an increase in gross merchandise value, which is essentially the dollar total of all transactions, Affirm’s chances of completing a buy now pay later (“BNPL”) transaction improve. The pandemic provided a significant boost to eCommerce transactions, but growth for Affirm slowed significantly last year, and the near future does not look promising.

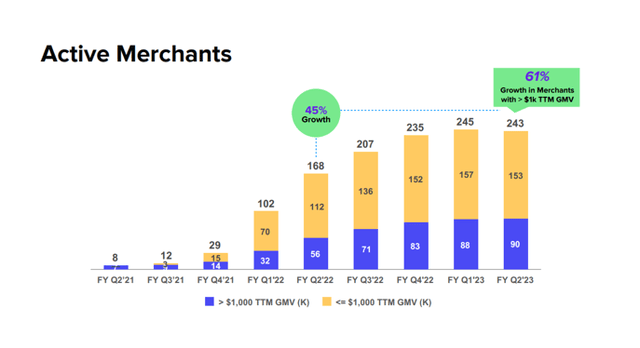

One example is the slowing growth of active merchants offering Affirm’s BNPL payment solutions to customers. In the second fiscal quarter, 243K active merchants used Affirm’s BNPL products, a 2K decrease QoQ. The decline in merchant accounts was primarily due to churn in the merchant cohort with less than $1K in gross merchandise value, but the slowdown is clearly a major concern.

Active Merchants (Affirm Holdings)

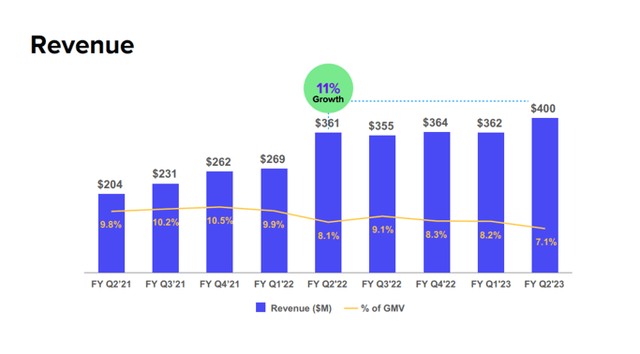

Following the pandemic, Affirm’s sales growth has also begun to slow significantly. Affirm’s sales growth reality is difficult to get excited about, even though the fintech is still growing its sales and gross merchandise value.

Affirm Holdings, Inc. generated $400 million in sales in 2Q-23, representing only 11% YoY growth. Affirm’s sales were up 77% a year ago, and the slowdown is having a significant negative impact on the fintech’s valuation.

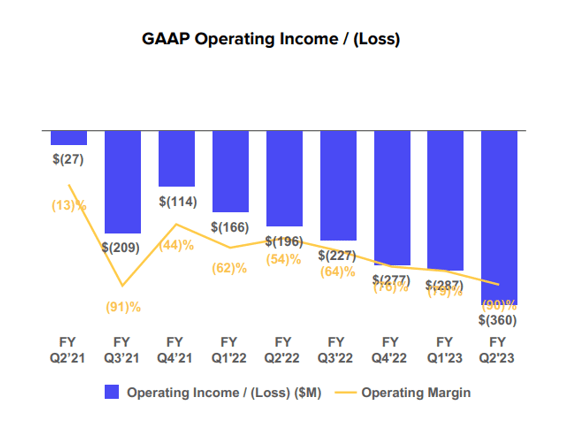

In addition to slowing growth, I see a pressing issue with the fintech’s profitability. Affirm is not only not profitable in terms of operating or net income, but its losses are increasing.

Affirm lost a staggering $360 million in 2Q-23, bringing fiscal 2023 losses to $647 million after only six months. This is a problem because, as growth slows, investors are becoming more concerned with a fintech’s profitability.

GAAP Operating Income (Affirm Holdings)

Long-Term Financial Outlook, Growth Assumptions, And Sales Multiple

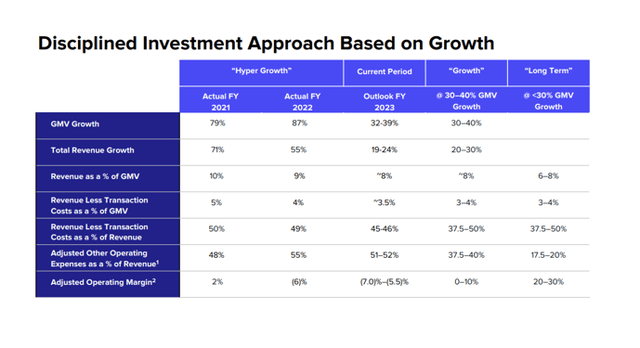

During the pandemic, Affirm’s buy now pay later business model saw supercharged growth rates, and the market, including myself, made the mistake of projecting this growth out in a linear fashion in 2021 and 2022.

As 2022 demonstrated, growth for the BNPL provider has slowed dramatically, and the long-term financial outlook is no longer as appealing as it was a year or two ago. Affirm is still expected to deliver solid revenue growth in the 20-30% range, but its valuation now appears stretched.

Disciplined Investment Approach Based On Growth (Affirm Holdings)

With slowing growth affecting the fintech industry, the market has revised its growth forecast for 2023. The market anticipates 12.9% sales growth in the current fiscal year, down from around 30% the last time I discussed the fintech’s value proposition. A recession in 2023 could exacerbate the already dire situation for the fintech.

Based on sales, the fintech is still highly valued: this year’s estimated sales of $1.52 billion imply a sales multiple of 1.8x. Given Affirm’s growing operating losses, this is a high multiple to pay for investors.

Revenue Estimate (Yahoo Finance)

Why Affirm Holdings Could See A Higher Valuation

Affirm Holdings, Inc.’s valuation could rise if the economic environment improves enough for the central bank to lower interest rates and bring inflation under control. All of this could encourage consumers to spend money again and support BNPL transactions.

Affirm is essentially a fintech bet on the growth of the eCommerce economy, so anything that increases consumer confidence in the future is likely to result in increased spending and transaction volumes. A recession, on the other hand, would almost certainly result in yet another low sales forecast.

My Conclusion

Affirm Holdings, Inc. is in a bind: the market has turned against the fintech at precisely the wrong time. Affirm has aggressively invested in expansion, but inflation and interest rates have thrown a wrench in the fintech’s BNPL business.

When merchant account growth and consumer spending slow down, the Affirm Holdings, Inc. valuation appears to be very high based on sales.

Right now, I continue to believe that the risk/reward ratio is unbalanced, and that a potential recession in 2023 could do more harm to both Affirm Holdings, Inc.’s business model and the fintech’s valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.