Summary:

- The Coca-Cola Company should face continued forex headwinds and the company’s recent double-digit price increases aren’t sustainable long term.

- The company has managed the pandemic and inflationary pressures well, but the company is still growing earnings at anemic rates.

- The Coca-Cola Company valuation levels leave little room for upside.

Anne Czichos

Strong companies don’t always make good investments. Few brands are more iconic in the world today than The Coca-Cola Company (NYSE:KO). Coke is one of the most well-recognized brands in the U.S. and around the world, and the company sells products in more than 200 countries and territories.

Coke outperformed during the pandemic, and the company also dealt well with supply chain issues and rising costs that follow the end of the Covid protocols.

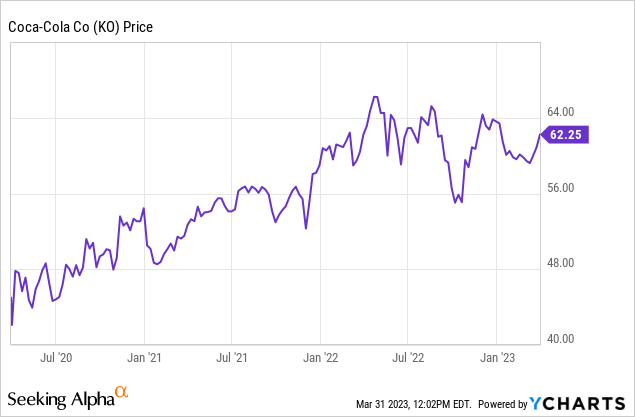

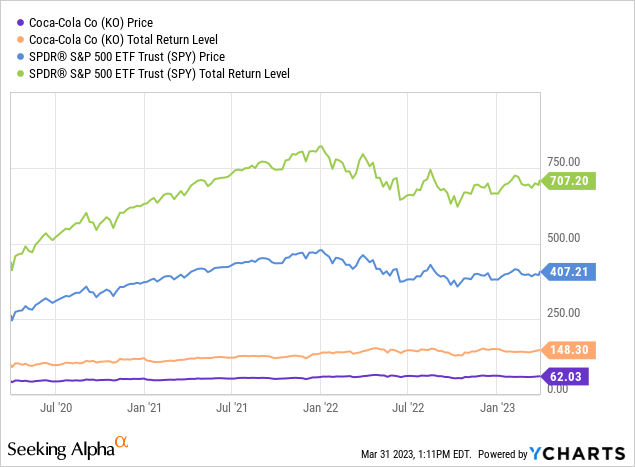

Coke is up 50.8% in the last three years. Still, the company has underperformed the S&P 500 (SP500) since 2020 by 8%, and some of the company’s peers, such as PepsiCo, Inc. (PEP), have also outperformed Coke over the last 3 years.

Today, The Coca-Cola Company is a sell. The company will likely continue to face Forex headwinds and management’s pricing power should be more limited moving forward as well. The Coca-Cola Company is only expected to grow revenues at a mid-single digit rate over the next several year, and the stock also looks overvalued at current levels using several metrics.

Coke’s most recent earnings report show the continued challenges that the company faces in the current economic environment. Coke reported solid net revenue growth of 7%, and solid year-over-year net revenue growth of 11%. Management also stated that organic revenue growth was 16%. Still, the company’s fourth quarter earnings report was still disappointing overall. Coke reported that GAAP earnings per share actually fell year-over-year by 3% to $2.19. The company also disclosed that full year earnings per share were negative even though management bought back nearly $1 billion in shares in 2022.

The reason Coke’s GAAP earnings per share were negative on a year-to-year basis was because of the significant currency headwinds that wiped out the company’s solid underlying performance. Management stated that the full year forex impact was negative 11 points for GAAP earnings, and the non-GAAP currency impact to earnings was 10 points. These forex moves are particularly significant, because Coke is only expected to grow earnings at 6% per year-over-the next four years, and analysts are also forecasting the company’s sales growth to be just 4.5% this year, and 5.2% next year.

Predicting short-term currency fluctuations is difficult, but there is a strong case for the dollar continuing to rise against the Euro and most major currencies over the next several years. Powell has made clear the Fed is going to keep raising rates until inflation reaches the Federal Reserve’s stated target of 2%, and the U.S. economy also remains more stable than Europe and China.. The U.S. also has significant oil and gas reserves, well Europe continues to deal with an energy crisis, China also continues to struggle with a housing crisis and rising consumer debt levels. Chinese household debt levels have reached an alarming 61.9% of nominal GDP.

Coke’s pricing power that drove most of the revenue growth the company saw in 2022 is also likely will be more limited moving forward. Coca-Cola’s management team stated that only 5% of the company’s revenue growth was driven by product mix, even though overall revenue growth was 16% last year. The company saw an 11% increase in revenue last year solely because of significantly and likely unsustainable price increases. Coke is obviously a strong brand, but management won’t be able to consistently increase prices at a double-digit rate long-term. The company still faces fierce competition in their core divisions within the U.S. and abroad, and Coke isn’t as cheap for consumers in emerging markets.

This is also why Coke’s stock looks overvalued using several metrics. The company currently trades at 23.87x likely forward Non-GAAP earnings, 20.68x projected forward EBITDA, and 22.62x forecasted cash flow. The industry average is 18.81x forecasted Non-GAAP earnings, 12.11x forward EBITDA, and 13.07x projected cash flow. Even though this company’s business model is generally recession resistant, the stock is still pricing in high-single digit growth over the next several years. Analysts are only forecasting the company to grow earnings at mid-single digit over the next 4 years, and the company’s earnings per share growth was negative last year despite the continued share buyback.

Coke is obviously one of the strongest brands worldwide, but it is also a mature brand that has reached saturation levels in many markets. While The Coca-Cola Company was able to rely on price increases to offset rising costs last year, forex headwinds still wiped out the company’s earnings per share. The dollar should remain strong over the next several years, and Coke’s pricing power also likely more limited moving forward, so The Coca-Cola Company pricing is in unrealistic growth expectations.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.