Summary:

- I wrote in November that a single-digit share price was likely. It was reached in January and is now on the radar again.

- If you are an optimist, you will like the fact that the current market cap is equal to 2026’s projected sales.

- If you are a pessimist, you’d likely stay entirely away from Affirm.

- If you are a market-realist, you will like this risk-reward.

B4LLS

I reviewed Affirm Holdings, Inc. (NASDAQ:AFRM) in November, arguing that the stock was about to head to single digits and urging investors to be patient. Since then, the stock has lost nearly 15%, while the market has gained 3%. Recent market sell-off has hit Affirm more than the average stock and the stock is once again close to trading in single digits.

Is AFRM stock heading lower and should be avoided?

Is the sell-off overdone and the stock should be bought?

Or

Is there a middle ground?

Let’s get into the details.

Current Macro and Business Reality

I’ve stated in many articles that the market overshoots on both ends. Affirm Holdings, in hindsight perhaps, had no business being a $50 Billion company in 2021. Nor do I believe it is deserving of only a $3 Billion valuation today. But that does not mean I believe a bottom is in yet, despite the stock losing nearly 95% of its value from its highs in 2021. With inflation confounding the market with some recent numbers, The Fed is unlikely to make it any easier for the borrowers anytime soon, which hits Affirm and its consumers where it hurts the most.

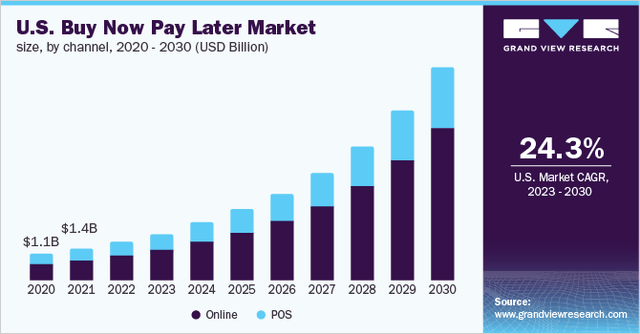

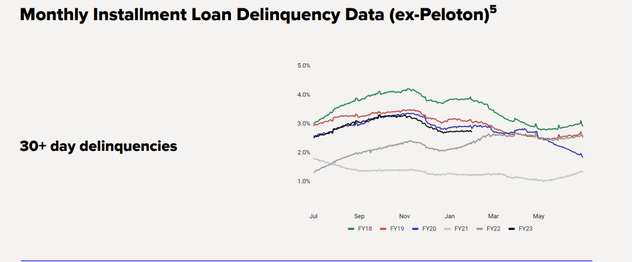

If you are optimistic about the Buy Now Pay Later (“BNPL”) space and Affirm Holdings, you may like the fact that the stock is currently trading in line (multiple of one) with its FY 2026’s revenue forecast. You may also like the fact that the BNPL market is still set to grow at 24.3%/yr (“CAGR”) till 2030. Being a philosophical student of the market, I also tend to believe the companies that come out alive after the market adjusts for its previous excesses tend to be long term winners. Affirm is already showing signs of improving fundamentals with 30+, 60+, and 90+ day delinquencies all better equal or better than pre-pandemic years.

If you are pessimistic, you’d be wondering if the company would even make it that far (2026 to 2030) given the worsening inflation worries, worries about increasing delinquencies, and Affirm’s own free cash flow woes. I do have these concerns in the short to medium term and hence why I am looking at the trade mentioned below.

BNPL CAGR (grandviewresearch.com) Affirm Delinquencies (Affirm.Com)

Still No Technical Bottom

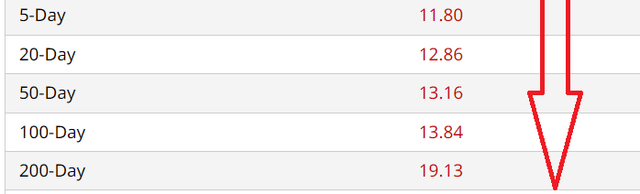

In a depressing revelation, Affirm’s stock still has no technical bottom in sight despite losing about 95% of its value from its all-time highs near $170. As a comparison, during the November review, the 200-Day moving average was at $30, while it has now fallen to $19 as shown below. The common theme in both instances (November and now), is that the 200-Day moving average represented a double bagger from the (then) current trading price. This once again confirms there is no bottom in sight.

AFRM Moving Avgs (Barchart.com)

The $5 Trade

I fully acknowledge that there is a risk that Affirm Holdings may not be around for much longer if the economy tanks and The Fed continues its monetary policies. At the same time, I also have a high regard for CEO Max Levchin’s FinTech experience and expertise. If I were to bet, I’d bet that Affirm will emerge on the other side of this on-going battle alive but mightily bruised (that is, even more than it is right now).

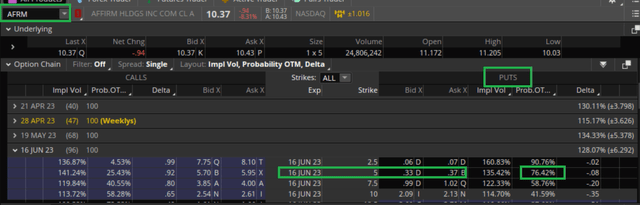

As a result, I am looking at trades like the one below that present a higher return for shorter time periods.

- Strike Price: $5

- Expiration Date: June 16th, 2023

- Premium: 33 cents per share, which means $33 for each contract of 100 shares

- Probability: The market assigns a 76% probability that Affirm’s stock will be above $5 by the expiration date

- Return: This is where things get interesting. As someone who regularly watches options chains for skewed risk-reward, this one gets my attention. The premium mentioned above means a return of nearly 7% in 3 months for setting aside $500 per each contract. And bear in mind, this is for an options chain that has more than 75% chance of expiring worthless

- At $5, Affirm’s market-cap of $1.5 Billion will represent a price-sales ratio of 1.15 based on 2022’s revenue of $1.3 Billion.

Conclusion

I am a fairly conservative investor with the bulk of my portfolio consisting of venerable dividend stocks, house-hold technology, financial, and healthcare names. However, I seek a little bit of thrill with companies like Affirm Holdings, which have large ambitions but not the means to pull them off. In addition, the macroeconomic conditions cannot be any worse for the niche within which the company operates. I’d bet more layoffs are also in the company’s future, unfortunately, before it finds a bottom. In short, Affirm’s risks are reflected in the market providing a 7% return in three months for a strike price that is more than 50% away from the current price.

On the positive side, Affirm and peers are also showing that they are finally getting a hang of operating in the current environment by tightening credit requirements and increasing prices. Despite the pressure on him, his company, and stock, Max Levchin is a picture of assured confidence, as evidenced by his opening remark in the recent shareholder letter. Personally, this type of confidence deserves the small allocation I’ve given Affirm in my portfolio. If the market sell-off continues this week, I look forward to selling the put (or similar) one this week.

“Affirm is an audacious idea, always has been. There is no well-traveled road to redefining the future of consumer finance, we are paving one. A convenient outcome for some would be for Affirm to fail – the status quo works for them.”

Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.