Summary:

- The pullback of Affirm’s common shares now looks overdone. This pushed me to start a new long position.

- Current macro headwinds are likely to wilt markedly towards the second half of calendar 2023. The company still expects to realize healthy growth against the forecasted economic disruption.

- Management is adamant they will turn a profit from fiscal 2024 and I believe them.

Bet_Noire/iStock via Getty Images

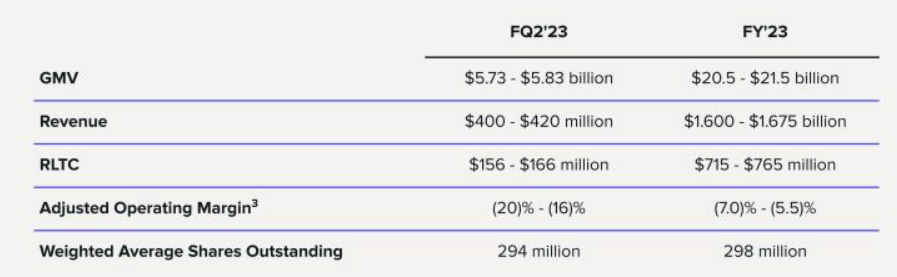

I’m back in Affirm’s (NASDAQ:AFRM) common shares close to a year after selling off my position due to facing some portfolio-level margin pressure. My inaugural article on the buy now, pay later fintech went back to the depths of the pandemic when the world was locked down and eCommerce was realizing a generational boom. 2022 has essentially been a disaster for all things fintech, with Affirm down an additional 36% since my last coverage. With the market cap dropping to $3.29 billion versus full fiscal 2023 revenue expected to not be less than $1.6 billion, the price to forward sales multiple of 2.06x is now in my buy zone.

Whilst revenue expected for fiscal 2023 is a slight downward revision on prior guidance, growth of 18.6% using the lower end of this is nothing to baulk at amidst what’s widely expected to be one of the worst years for economic growth. Indeed, Fed fund rates are expected to keep on rising into calendar 2023 with inflation likely only starting to fall more markedly in the second half of the calendar year. This begs the question, why am I back in Affirm’s commons?

Affirm

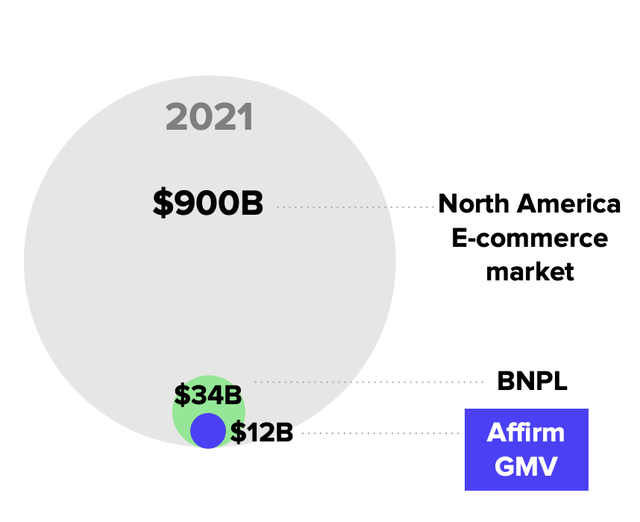

It has a dominant position in a rapidly expanding total addressable market set to ride the tailwinds of the secular growth of eCommerce over the next decade. The company is expecting a gross merchandise value of $20.1 billion to $21.5 billion for fiscal 2023, far ahead of GMV of $15.5 billion for its fiscal 2022. This is a business still growing rapidly but struck by broader macro weakness and a risk-off sentiment that seems transient to me.

Affirm

The Push To Profitability Is Kicking Off

Bears would be right to state that the company remains unprofitable even against its persistent growth rates. However, Affirm’s management repeatedly stressed during their last earnings call that they intend to get to profitability on a sustained basis from the first day of their fiscal 2024.

I’ve attempted to make some sort of read my lips joke, but I will not. We will hit profitability on schedule. We are not pushing off profitability.

Max Levchin, Affirm’s Founder and CEO

At a basic level, this will mean revenue minus transaction costs is greater than adjusted operating expenses. The company stated its pushing to optimize unit economics for this with controlled hiring waste control in place.

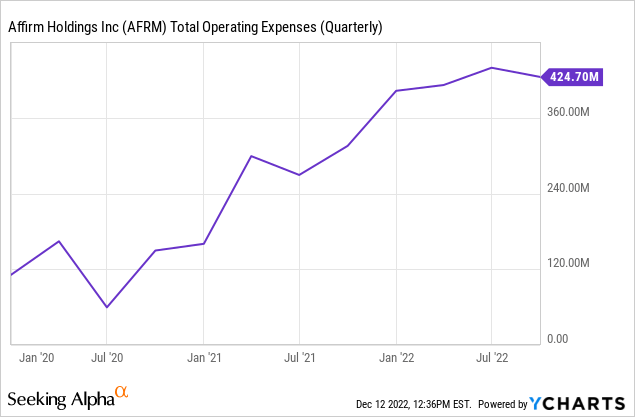

Bears would be right to flag that the trendline for total operating expenses does not support this push for profitability. Total operating expenses for the company last reported fiscal 2023 first quarter at $470 million was a 69% increase over the year-ago quarter with R&D expenses of $145 million during the quarter at a new record. SG&A was at its second-highest on record. Hence, there is a bit of faith with my long position in the shares, the company’s management has typically been prudent with their guidance and operating expenses don’t necessarily have to fall, they just have to be outpaced by revenue growth.

Affirm

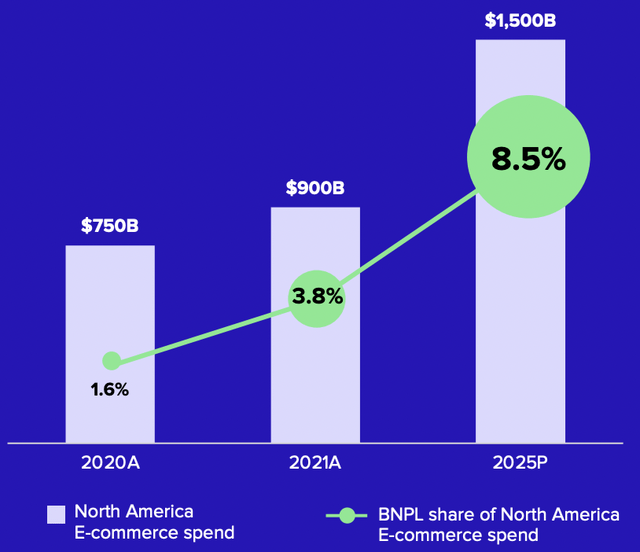

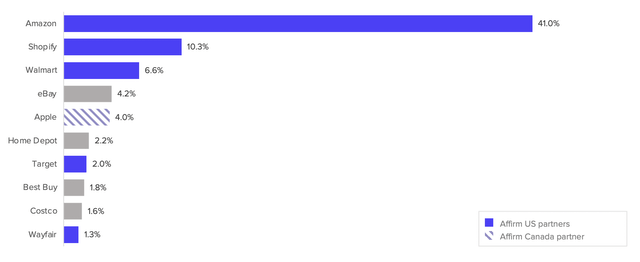

Hence, with BNPL as a share of North American eCommerce spending set to increase to 8.5% in calendar 2025, the structural demand drivers for Affirm are in place. This provides a level of comfort to my long position which is heightened by the company’s strong and diversified US partner base who all collectively hold just over 60% of US retail eCommerce sales.

Affirm

Some Core Measures Of Inflation Are Coming Down

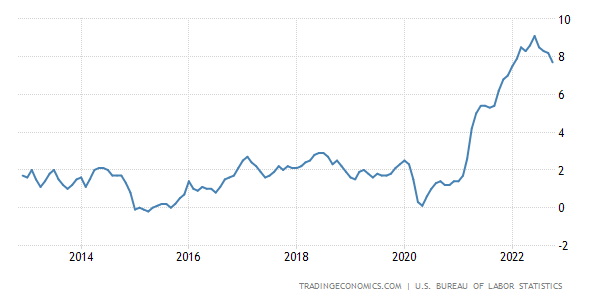

Further, some core measures of inflation continue to decline with gasoline having dropped significantly over the last few months. The trendline for US inflation now looks to have peaked with inflation slowing for a fifth consecutive month to 7.3% in November. Annual core CPI in the last month also only rose by 6.1%, down from 6.3% in October.

Trading Economics

Whilst these are still high, I believe the slowdown will provide a base for the Fed to be less aggressive with rate hikes. Expectations are for a 50 basis point hike when the FOMC meets later this week with some recent estimates stating inflation will fall closer to the 2% target towards the end of calendar 2023. This sets the backdrop for a change in sentiment as the collapse of valuations this year I believe has been primarily driven by higher interest rates meant to combat sticky inflation.

Fundamentally, the core driver of the success of my long position will be how astute Affirm is in navigating the macro headwinds of calendar 2023 whilst showing it can optimize operating expenses for profitability. BNPL will remain a core part of eCommerce and gaining exposure to this I think should drive portfolio-level alpha. With the valuation falling to a level that provides a long position with a level of protection, I look forward to how the Affirm story evolves over the next year.

Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.