After Rerating, PayPal Stock Is Nearing My Buy Price

Summary:

- I warned investors about PayPal’s overvaluation back in February of 2021 before the price fell more than -70%.

- As earnings have come in worse than expected over time, I have steadily lowered my buy price for the stock.

- Currently PayPal stock is going through a rerating and multiple compression cycle.

- These types of cycles can be very lucrative for investors who are willing to buy during the darkest hours.

- PayPal is getting very close to my buy price, and I share the conditions under which I would buy the stock.

Sean Gallup

Introduction

I always like to start my articles by reviewing any previous coverage I’ve had of a stock. In PayPal’s (NASDAQ:PYPL) case, I have covered the stock three times previously, once via YouTube, and two via Seeking Alpha. I think there is a lot that investors can learn from analyzing PayPal’s history regarding topics that don’t get covered much, like overvaluation, rerating, multiple compression, and buying with a margin of safety. I intend to hit on all these topics in this article.

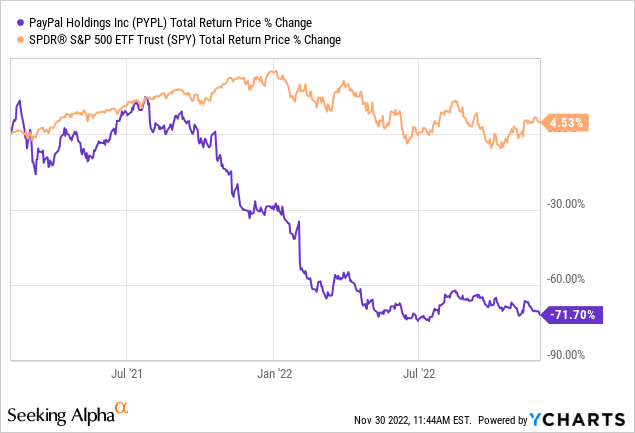

On February 6th, 2021 I performed a valuation analysis of PayPal stock for my YouTube channel titled “It’s Time To Take Profits In PayPal“. In that video, I explained why PayPal stock was extremely overvalued and why investors should take profits in it. Here is how the stock has performed since:

Since then PayPal has lost over -70% of its value while the S&P 500 has produced a 4% total return over the same time period.

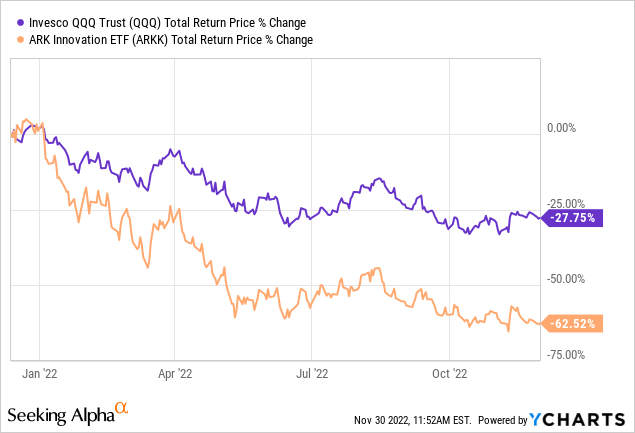

About 9 months later, after PayPal stock had fallen about -35% off its highs, I published my next PayPal article on Seeking Alpha, which contained a broader warning that went beyond PayPal to many other expensive stocks titled “PayPal’s Recent Price Decline Will Eventually Happen To Nearly All Overvalued Technology Stocks“. The title pretty much says it all. Here is how the tech-heavy QQQ ETF (QQQ) and ARK Innovation (ARKK) have done since that December 13th, 2021 article:

Additionally, in that article, I shared the price at which I would potentially be willing to buy PayPal stock. At the time, the buy price that included a margin of safety was $112.10 per share, assuming earning came in as expected.

About six months later, PayPal’s earnings had not come in as expected and the stock price had fallen below my previously published buy price, so I wrote an update article on May 13th of this year titled “Is PayPal Stock Worth Investing In? Almost. But Here Is Why I Haven’t Bought, Yet” In that article, I updated my valuation for the stock since earnings expectations had drastically declined.

…the price would need to drop to about $66.00 per share in order to trigger a buy, assuming earnings expectations do not drop even more from here. And that’s the price I’m currently looking to buy the stock at right now. At its current price of around $72, that makes PayPal a “Hold” for now…

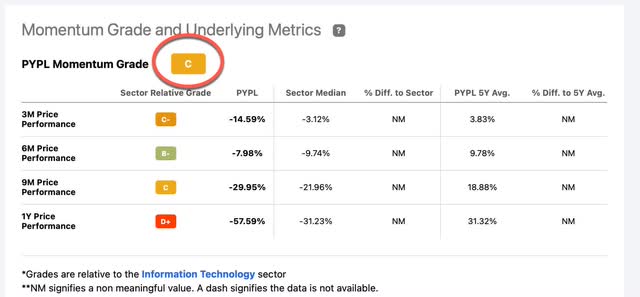

…Currently PayPal has a “D” grade for momentum, so even if the stock hit my buy price, I would hold off buying until the momentum rose to a “B+” or better.

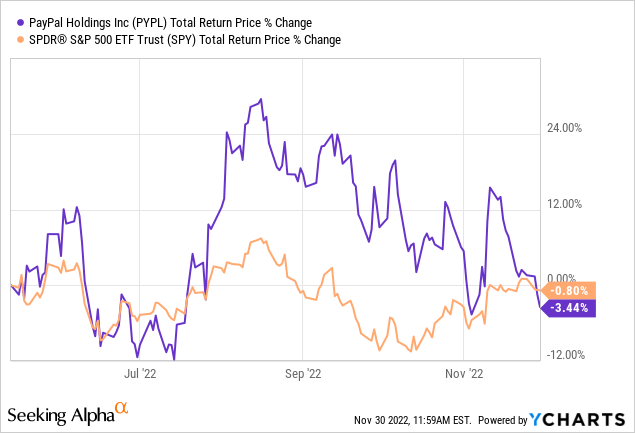

Since that article, here is how PayPal stock has performed:

PayPal stock ended up bottoming this summer at a price of $67.58, just above my $66.00 buy price at the time. The stock price ended up rallying more than +45% off that bottom, before falling down to around $75 per share where it is trading right now, back within striking distance of my old buy price, so I figured now was a good time to review the stock again to see where currently things stand.

Understanding PayPal’s Multiple Compression Cycle

PayPal is a pretty tricky stock to analyze using my standard valuation analysis. The first issue that arises is that PayPal only has earnings data going back to 2015 because before that, it was part of eBay (EBAY). Typically, for most steady-earning businesses like PayPal I like to have data from at least one recession so I can judge how cyclical earnings might be in a future recession. (I call my analysis a “Full Cycle Analysis” precisely because I usually use data from a full economic cycle that includes a recession. Because of the unusual nature of the 2020 pandemic recession, I don’t typically count that as a “normal” recession.)

I usually reject out of hand those businesses for which the recession data is unavailable, but because PayPal actually had been around in 2008/9, and was part of eBay, I have decided to make an exception for them. But, it means that right out of the gate, PayPal is a more complicated analysis than a standard S&P 500 stock would be.

The next issue that comes up with regard to estimating the future returns of the stock is that it is probably going through a “rerating”, or, what I call a “multiple compression cycle”.

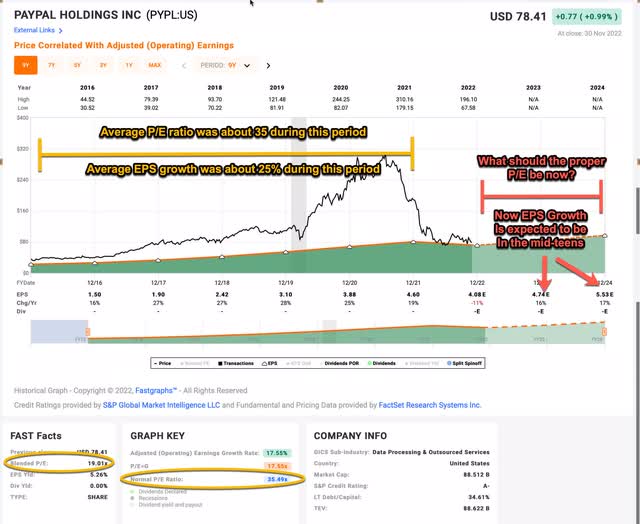

Essentially what has happened with PayPal is that, before this year, earnings were growing at roughly +25% per year, and so the market was willing to pay a fairly rich 35 P/E ratio for that kind of earnings growth. Back in February 2021 when I made my warning video about PayPal the market actually valued it at roughly a 70 P/E ratio, and that overvaluation is part of the reason why the stock has fallen so far off its highs.

The other reason the stock price has fallen is that EPS has actually declined by -11% this year. So, PayPal went from roughly +25% earnings growth to an earnings decline year-over-year. This abrupt change caused the stock price to plummet. The more practical implication for me is that my valuation process usually includes a mean reversion factor, but what eventually happens with all fast-growing businesses like PayPal’s is they eventually grow enough to fill a lot of their addressable market, so future earnings growth slows down. And when that happens, the stock price is unlikely to continue trading at high P/E multiples like 35 P/Es (and especially 70 P/Es). I call this dynamic a multiple compression cycle because the average P/E multiple the stock is likely to trade at in the future is much smaller than what it has historically traded at. This means it does not make sense to assume the stock price will ever revert to a 35 P/E ratio again. For these reasons, I will omit the mean reversion portion of my typical analysis for PayPal, and I will only focus on the likely business returns going forward. This will significantly lower the price I would be willing to pay for the stock, and it explains a lot of why I dropped my buy price from $112 per share last year to $66 per share earlier this year.

Business Earnings Expectations

In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so, the Earnings/Price ratio). The current earnings yield is about +5.19%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $5.19 per year on my investment if earnings remained the same for the next 10 years.

The next step is to estimate the company’s earnings growth during this time period. Taking into account 2022’s earnings decline, I get an earnings growth rate of about +17.81% since 2015. At the time of my last PayPal article in May, analysts expect EPS to grow +22% in 2023 and +23% in 2024. However, I noted in that article:

I decided a while back to lower my expectation for earnings growth to 15%. That could still be a little on the high side, but I certainly think there are ways PayPal can improve and expand their business and continue to grow again. If a person wanted to slap a 10% growth rate assumption on it, I wouldn’t argue too much with them, though.

Now, analysts have lowered their EPS growth expectations for 2023 and 2024 to 16% and 17%, respectively, much closer to my original estimate of 15%. I still think it’s reasonable to stick with that 15% EPS growth estimate for now, but if analysts were to lower their 2023 earnings expectations before I buy the stock, then I would be inclined to lower my expectations as well.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought PayPal’s whole business for $100, it would pay me back $5.19 plus +15% growth the first year, and that amount would grow at +15% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $221.28 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +8.27% 10-year CAGR estimate for the expected business earnings returns.

Is PYPL Stock A Buy, Sell, Or Hold?

When I include the Mean Reversion factor in my analysis, I typically have my buy threshold set at a 12% expected 10-year CAGR, but when I take out mean reversion altogether as I am doing with PayPal, I lower that threshold to a 9% CAGR. Currently, PayPal is just below that threshold at 8.27%, and the price would need to drop to about $69.70 per share in order to trigger a buy, assuming earnings expectations do not drop even more from here. That’s the price I’m currently looking to buy the stock at right now. At its current price of around $75, that makes PayPal a “Hold” if a person already owns it.

Under What Conditions Would I Buy PayPal?

I think the next earnings report could create a buying opportunity for PayPal because at that point I will start pulling forward 2023’s expected earnings for my analysis, and right now those earnings are expected to be quite a bit higher. So, my first scenario is that earnings come in close to in line with expectations for the current quarter. In something close to that outcome, my buy price would rise to $81 per share if I assume 15% earnings growth. The more negative scenario is that earnings or guidance disappoints. If that happens it’s likely the stock price sells off deeply. In that scenario, I would probably lower my future earnings growth expectation to 10%, and that would lower my buy price to about $61 per share. So, basically, if things look pretty decent, but the market doesn’t recognize it, I will likely be a buyer, or if earnings disappoint and the market overreacts I could be a buyer as well. The stock price is right in the middle of those expectations right now.

We still have about two months, until the end of January, when we get the next earnings report, so I have a plan as to what to do between now and then as well. As I noted above, my current buy price for the stock is $69.70, but the stock and the company’s earnings are both still in a downtrend. Because I think there will probably be a recession next year, and we don’t have historical recession data for PayPal, it’s possible earnings could fall farther than anyone expects right now. For that reason, it makes sense to be cautious. When I get into situations where a business is going through a multiple compression cycle and we are expecting lower baseline growth in the future at the same time a recession is hitting, I find that using some sort of simple momentum factor can help me get lower prices than I would otherwise be willing to wait for.

Right now using Seeking Alpha’s quant metrics, PayPal has a “C” grade for momentum. I would like this to be a “B-” or higher while the price is also below my $69.70 buy price before I would buy. So, we have two factors that need to be met. The price needs to be below my buy price and the momentum needs to be positive as well.

Conclusion

The reratings that occur during multiple compression cycles can be very difficult for investors to deal with who own the stocks. Almost every investor who bought this stock during the past 5 years is currently underwater. These sorts of situations make for very negative stock sentiment and it can be difficult to judge where the ultimate bottom in the stock price will be. I try to do my best to get as good of a price as I can, and I’m very happy this is a stock I was able to warn investors about near the top, and now potentially have a chance to buy the stock -75% lower. The best way to think about it is not to try to catch an exact bottom, but instead to try to predict what the returns could look like 3-5 years from now if our estimates are close to being correct. It’s possible I get a chance to buy the stock in the $60s somewhere and it keeps falling to the $40s. But over time, as long as earnings find their footing at some point and continue growing, the potential for very good returns is pretty high. I used this very same style of analysis with Netflix (NFLX) during its multiple compression cycle back in May when I bought the stock, and it’s now up +75% while the wider market is flat. Not every investment works out so well, but you can get the odds on your side by buying solid businesses when everyone else has given up on them. I think it’s possible PayPal could end up being one of those stocks over the next 3 to 6 months, so I’m watching it closely.

Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $30/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.