Summary:

- Agilent Technologies focuses on growing biopharma, PFAS testing, and advanced materials for semiconductors.

- Recent acquisitions and divestitures show mixed results, with potential for technological enhancement but concerns about fit in the portfolio.

- Despite challenges in the pharma market, Agilent’s diversified revenue streams and potential for growth in key areas make it a ‘Buy’ with a target price of $160 per share.

hapabapa

Agilent Technologies (NYSE:A) offers instruments, consumables, software and services to life sciences, diagnostics and applied chemical markets. Agilent has made significant efforts in transforming its business towards growth areas including biopharma, polyfluoroalkyl substances (PFAS) testing and advanced materials for semiconductor. I am initiating a ‘Buy’ rating with a one-year target price of $160 per share.

Growing Biopharma, PFAS & Advanced Materials

Agilent offers workflow solutions for extraction, screening, quantification, and reporting of PFAS in water samples. PFAS, also known as ‘Forever Chemicals’, have created significant water pollution over the past decades. In April 2024, the Biden-Harris Administration finalized the first-ever national drinking water standard to regulate PFAS. In addition, the Environmental Protection Agency (EPA) announced nearly $1 billion in newly available funding to implement PFAS testing and treatment in public water systems.

I view these newly developed regulations would be extremely positive to Agilent’s future growth, as their workflow solution is dedicated to PFAS testing and reporting. In Q3 FY24, their Environmental & Forensics segment grew by 4% in revenue, primarily driven by increasing PFAS testing workflows.

During a recent conference, the management indicated that FDA regulations for PFAS-free product might be forthcoming, potentially expanding the addressable market from water to food industry.

Agilent provides testing products for safety, quality, and compliance across the value chains of advanced materials including semiconductor industry. With increasing geopolitical tensions, China, U.S. and European countries are developing their domestic semiconductor fabs. Agilent’s products are well positioned to capture the semiconductor testing markets. In some regions, Agilent owns more than 50% of market share, which is quite remarkable. Due to the rapid growth of AI, EV and factory automation, I trust the overall semiconductor market will continue to expand quickly.

Lastly, Agilent serves global pharma and biotech companies with liquid chromatography (LC) systems, liquid chromatography mass spectrometry (LCMS), and other instruments. The beauty of the markets is the high proportion of consumable business, which can make Agilent’s business become more recurring.

In summary, I believe Agilent is well positioned in these high-growth areas.

Acquisition and Divestiture

Agilent has been very active in portfolio management, acquiring growth businesses and divesting non-core assets.

In FY23, they decided to exit Resolution Bioscience business within their diagnostics and genomics segment. Agilent purchased the business in 2021 for $695 million. Although I appreciate the company’s actions to divest this underperforming asset, it is evident that the acquisition did not meet expectations.

In July 2024, Agilent announced to acquire Sigsense, a startup that applies AI and power monitoring to optimize lab operations. It is a very small deal with no financial term disclosed. I view the small tuck-in deal as a strategic move to enhance Agilent’s technological capabilities.

In July 2024, Agilent acquired BIOVECTRA, a specialized contract development and manufacturing organization (CDMO) for $925 million. BIOVECTRA has the potential to strengthen Agilent’s portfolio, particularly in oligonucleotides and CRISPR therapeutics. However, the CDMO market is a capital-intensive business with many competitors in the market. I don’t think BIOVECTRA can fit well in Agilent’s existing portfolio. As such, I don’t favor this deal.

Overall, Agilent’s acquisition strategy is not quite impressive, in my view.

Recent Financial, Outlook & Valuation

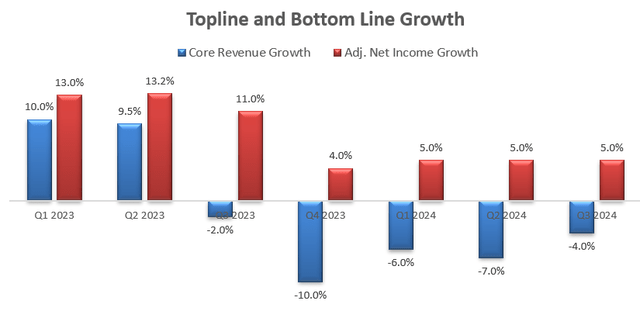

Agilent released its Q3 result on August 21st, reporting a 4.4% decline in core revenue, as depicted in the chart below.

The major challenge is their pharma business, which declined by 8% year-over-year. According to the recent financial reports from Thermo Fisher Scientific (TMO) and Danaher (DHR), the overall pharma and biotech markets continue to face capital constraints due to the current high-interest rates and weak private equity funding environment. However, both Thermo Fisher and Danaher anticipate the end-market will start to recover later this year or in FY25.

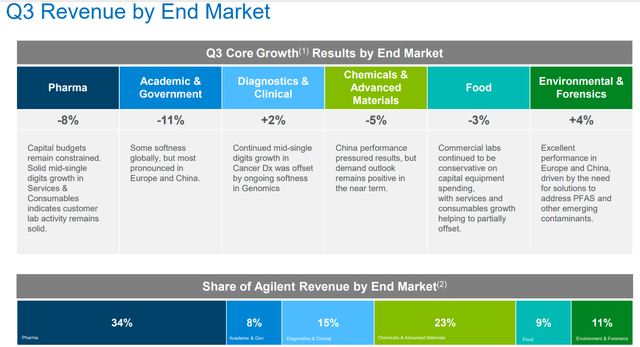

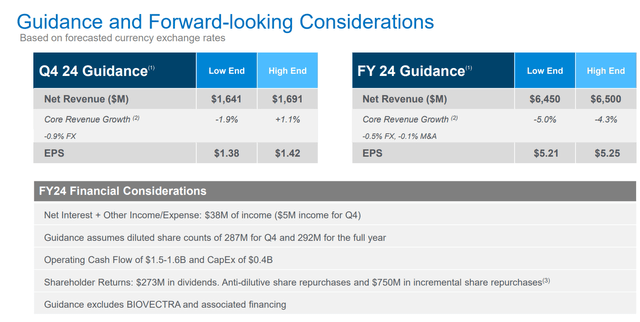

Agilent is guiding for 4.3%-5% decline in core revenue for FY24, as illustrated in the slide below.

For FY24’s growth, I am considering the following factors:

- Pharmaceutical and Biopharmaceutical: I forecast the market will decline by high-single-digit in FY24. It is unlikely for the end-markets to recover without an interest rate cut. While the Fed is more likely to cut the rate in September, it might take several months for the private equity market to recover.

- Chemicals and Advanced Materials: Agilent delivered a strong result in the U.S. market, but this was offset by weak China operations. I anticipate the segment will decline by 5% in FY24.

- Diagnostics and Clinical: The mass spectrometry market has been growing at mid-single digit in the past. Due to the current weak macro, I anticipate their growth rate will fall below the historical average.

- Environmental and Forensics: As discussed previously, I foresee PFAS testing will drive Agilent’s growth in the near future. I estimate the segment will grow by 4%.

- Others: I assume Food and Academia/Government will decline by 5% and 10%, respectively.

Summing these components, I calculate Agilent’s revenue will decline by 4.6% in FY24.

I estimate the normalized organic revenue will grow by 5% from FY25 onwards, assuming the following segment growth rates: Pharmaceutical and Biopharmaceutical 6%; Chemicals and Advanced Materials 5%; Diagnostics and Clinical 5%; Environmental and Forensics 5%; Food 3%: Academia/Government 3%.

Additionally, I forecast Agilent will allocate 5% of total revenue in acquisitions, resulting in 130bps growth to the topline.

I model 20bps annual margin expansion, driven by 10bps from new product launches with higher pricing; 10bps operating leverage from SG&A due to increasing mix towards direct-sales model.

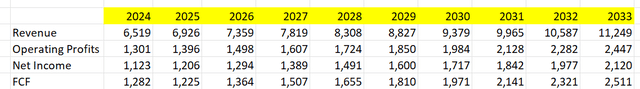

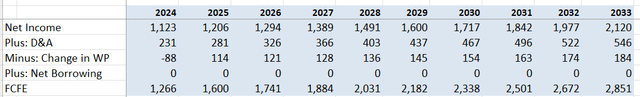

The DCF summary can be found below:

I calculate the free cash flow from equity as follows:

The cost of equity is calculated to be 12% assuming: risk-free rate 3.8% ((US 10Y Treasury)); beta 1.17 (SA); equity risk premium 7%.

The one-year price target is calculated to be $160 per share, as per my estimates.

Key Risks

- China: China is a crucial market for Agilent, with the Asia Pacific region accounting for more than 34% of total revenue. In Q3 FY24, China business declined by 11% year-over-year, due to the weak growth in services and consumables. In my view, the biopharma industry in China is unlikely to recover anytime soon, considering the weak economy in China.

- Diagnostics and Genomics Competition: In the Diagnostics and Genomics market, Agilent is facing strong competitions from Abbott (ABT), Thermo Fisher, Danaher and Roche (OTCQX:RHHBY). These competitors are quite strong in terms of R&D and sales team. Agilent may need to allocate more resources in the Diagnostics and Genomics business, either through internal development or external acquisitions.

- CDMO: Agilent has some business exposure in contract development and manufacturing organizations. As discussed previously, I don’t think CDMO fits in Agilent’s overall instruments + consumbales + software and service model. I would be concerned if the company continues to acquire CDMO players.

End Note

While Agilent is not a fast-growing company, they do have several promising growth areas, including biopharma, PFAS testing and advanced materials for semiconductors. The stock price is undervalued; therefore, I am initiating a ‘Buy’ rating with a one-year target price of $160 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.