Summary:

- Agilysys is a key player in the hospitality sector, offering software and solutions such as point-of-sale and property management systems.

- AGYS has shown strong historical performance with double-digit revenue growth and margin expansion.

- The anticipated growth in hospitality solutions and tourism activities is expected to strengthen the outlook.

Dimensions/E+ via Getty Images

Synopsis

Agilysys (NASDAQ:AGYS) is a prominent key player in providing state-of-the-art software and solutions in the hospitality sector. Their expertise lies in hospitality products such as Point-of-sale, property management systems, and inventory and procurement.

In this post, I am recommending a buy rating for AGYS. My recommendation stems from a number of factors. AGYS’s historical performance has shown its ability to grow, and it is growing at double-digit rates. In addition, this robust growth did not come at the expense of margin contractions. When I take a deeper look at its 2Q24 results, the numbers also sing the same song as its past performances. In addition, the anticipated growth in the PMS market is also expected to bolster its growth outlook. Last but not least, the rise in tourism activities and investment in hospitality also offers AGYS substantial opportunities for revenue growth. When I did a relative valuation of AGYS, my target price also indicated an upside of ~21%. Hence, all these factors led me to my recommendation.

Historical financial performance

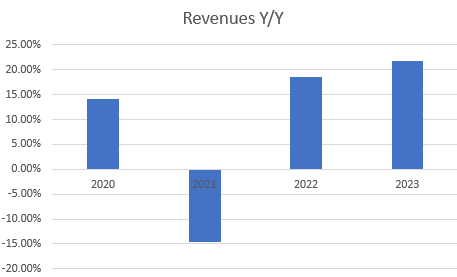

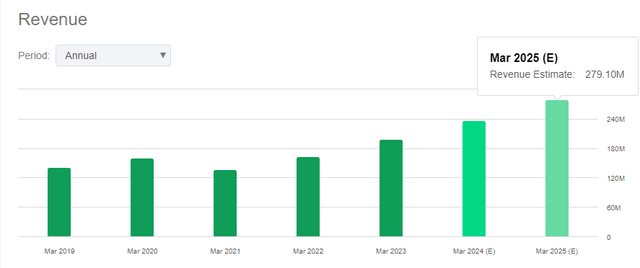

Over the last four years, AGYS revenue has been growing very strongly, as it has been growing in the double-digit range with the exception of 2021 due to the impact of the COVID-19 pandemic. In addition, the chart also clearly shows growth acceleration from 2020’s ~14% to 2023’s ~22%.

Author’s Chart

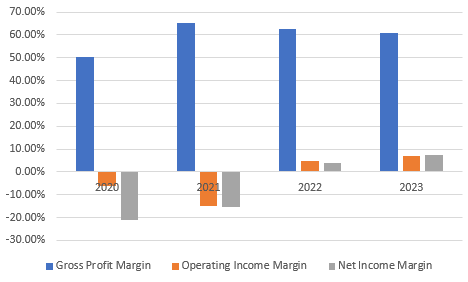

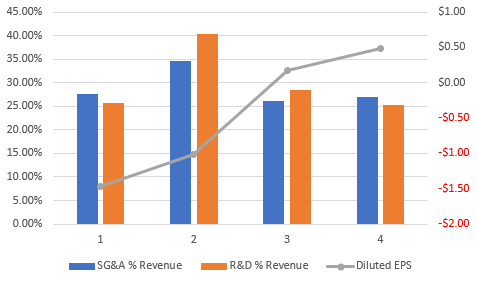

Apart from profitability, it is essential to analyze its margins as well. In terms of gross profit margin, it managed to improve from 2020’s ~50% to 2023’s ~61%, which represents an improvement of ~11%. For its operating margins, it improved from 2020’s negative 6.14% to 2023’s positive 6.78%. AGYS is able to do so by improving its gross margins instead of sacrificing its SG&A and R&D. Over the last four years, both SG&A and R&D have remained consistent relative to total revenue. By doing so, it allowed AGYS to constantly innovate and improve on its products and, at the same time, capture more sales by maintaining its sales force.

As AGYS’s interest expense is almost negligible, it doesn’t take its toll on its net margin. 2020’s net margin was negative 21.19% vs. 2023’s positive 7.36%. This translates to an improvement in diluted EPS as well, from 2020’s negative $1.47 to 2023’s positive $0.49.

Author’s Chart Author’s Chart

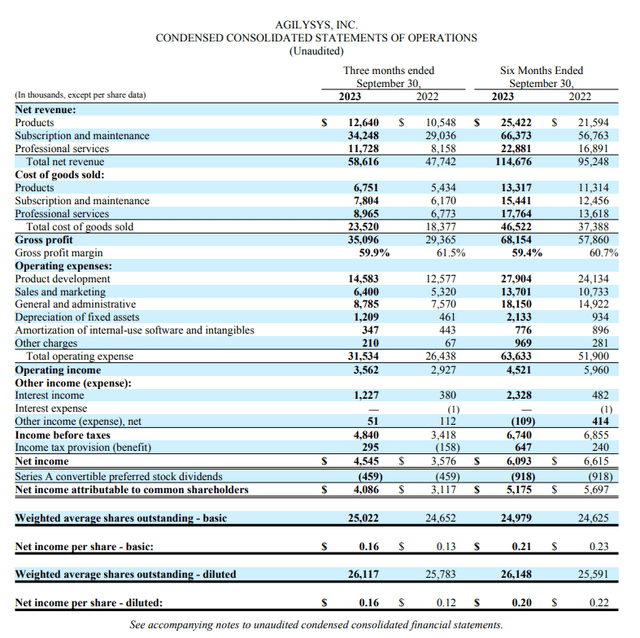

Analysis of AGYS strong 2Q24 results

AGYS reported extremely strong 2Q24 financial results. Its total revenue grew ~22% year-over-year. On top of that, its recurring revenue grew 18% year-over-year, driven by a 29% year-over-year growth in subscription revenue. In this quarter, subscription revenue accounts for ~53% of total recurring revenue, up from 2Q23’s ~48%. This quarter also saw the highest sequential increases in both subscription revenue of $1.6 million and overall recurring revenue of $2.1 million.

Moving down the P&L, its gross margin of 59.9% dipped slightly when compared to 2Q23’s 61.5%, but it is not much of a concern as they are still very close to each other. Moving on to its operating income margin, 2Q24 is ~6%, which is in line with 2Q23’s. Last but not least, 2Q24’s net income margin is ~7.7%, which is in line with 2Q23’s. Overall, AGYS’s margin for the latest quarter remains very consistent. This is a testament to the scalability of its business, where its top line grew double digits without sacrificing margins in order to achieve such high growth.

PMS Market Expansion Opportunities Expected to Bolster AGYS Growth Outlook

AGYS reported robust growth in customer acquisition and product development, particularly in its property management system [PMS] segment. A noteworthy achievement was securing a contract with Black Rock Oceanfront Resort. In my opinion, I believe this win is significant as Black Rock was ranked 13 in Best Victoria and Vancouver Island hotels, which speaks volumes about its size and reputation. Therefore, the resort’s selection of AGYS’ PMS and various software modules demonstrates the robustness and attractiveness of AGYS’ integrated offerings.

AGYS’S re-engineered Visual One PMS, now rebranded as Versa, marked another milestone with its deployment in approximately 20 properties. This indicates a successful introduction and market acceptance of its updated product. AGYS emphasized that while it is in the early stages of establishing its cloud-native PMS in the market, there is significant growth potential ahead for PMS and related modules.

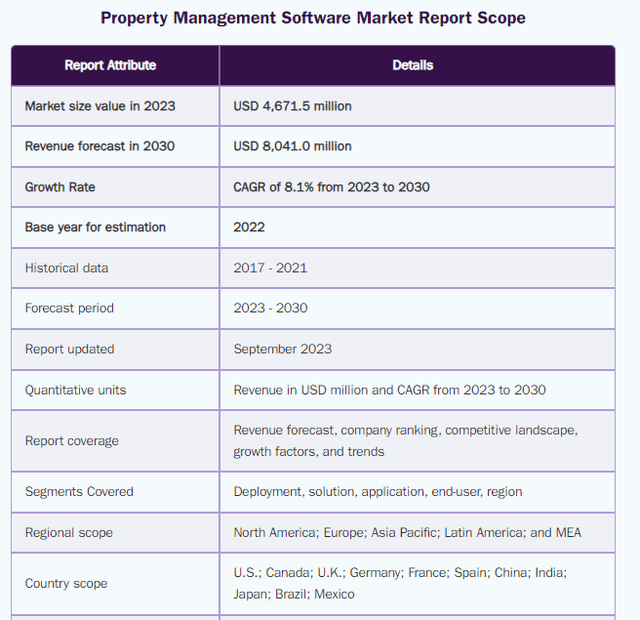

Based on the following table, it’s clear that the PMS market still has a lot of room for growth. In 2022, the market was valued at ~$4.4 billion. By 2030, it is expected to almost double its size to ~$8 billion. This represents a CAGR of ~8.1%. Hence, the PMS market, with its projected growth, offers AGYS substantial opportunities for revenue growth.

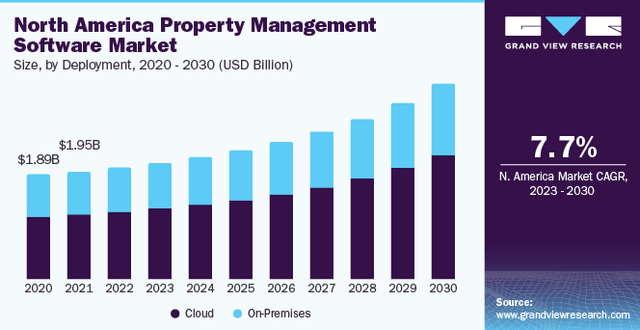

In addition, I believe it is a good strategic move to make its PMS cloud-based. Based on the following chart, it shows that the demand for cloud-based PMS has outpaced that of on-premises systems since 2020. As North America’s PMS market continues to grow at an anticipated CAGR of 7.7%, the demand for cloud PMS is expected to continue to outpace on-premises until 2030.

Tourism Rise and Investment in Smart Hospitality

It is projected that Travel and Tourism Revenue will grow at a CAGR of 4.42%, with an estimated volume of ~$1.016 trillion by 2027. The largest market within the Travel and Tourism group would be its hotel segment, which is estimated to reach $410 billion by the end of this year. It is also estimated to accumulate up to 1.33 billion patrons.

By 2027, online sales will account for 74% of hotels’ total revenue. Hence, this digitalization shift will necessitate the usage of software and systems so that hotels can better manage their sales and end clients’ user experiences. In addition, the use of software, such as the one provided by AGYS, will also increase sales volume and reduce operating costs as it reduces manual labor. If the software is able to provide a good user experience, it might also improve the hotel’s passenger return rate.

Smart hospitality consists of hospital operation management, automation, guest service, and security management systems. As a result of the digitalization shift, there is an anticipated growth in smart hospitality. Its CAGR is estimated to grow at 22%, with a forecast period from 2021 to 2031. With this rapid growth, I expect it to bolster AGYS’s future growth outlook since it provides hospitality solutions as part of its offerings.

After the pandemic, when the travel ban was lifted, “revenge travel” became an occurrence that drove travel and tourism growth and, thus, smart hospitality. Now that we have gone way beyond that stage, the current challenge to the growth of the travel and tourism market is its inflation and travel costs.

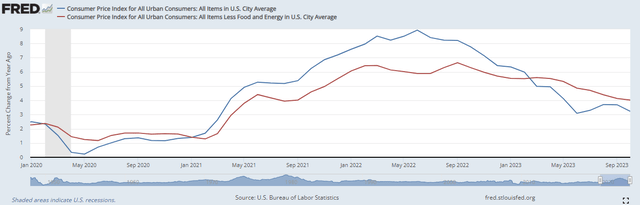

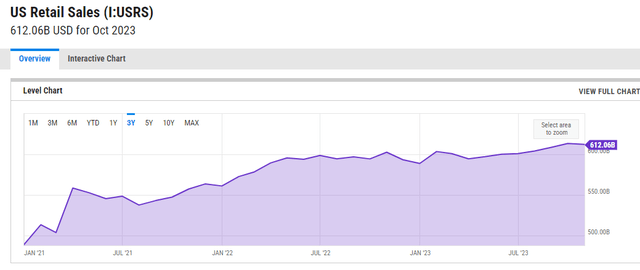

Based on the chart provided by FRED, it is clear that inflation has been subsiding since June 2022. With lower inflation, it tends to spur economic growth and retail spending. As you can see, US retail sales have been rising. I believe that this trend is going to bolster tourism, and its benefits will definitely trickle down to AGYS.

Relative Valuation

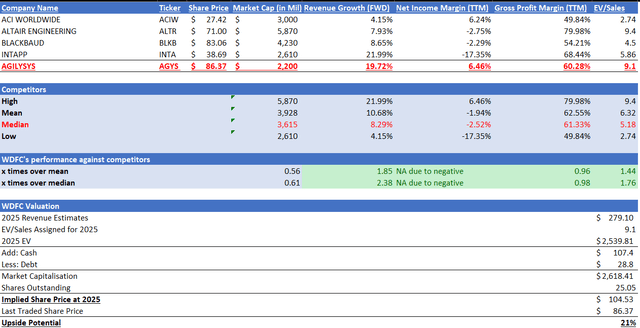

AGYS operates in the application software industry, and the competitors I have gathered in the table below are based on this. In addition to them being in the same industry, these stocks are also followed by people who follow AGYS. Hence, I do believe this group is a good representation of the industry in which AGYS operates.

Firstly, let’s compare AGYS’s company size before we compare the other metrics so that it gives you a better picture and impact of its performance when compared with its competitors. Based on AGYS’ market capitalization of ~$2.2 billion vs. competitors’ median of ~$3.6 billion, AGYS is only 60% of competitors’ size.

Despite its smaller size, it outperformed competitors in all areas. In terms of forward revenue growth, it dominated its competition by almost double at 19.72% vs. competitors’ median of 8.29%. Moving onto profitability, AGYS also outperformed its competitors. Although its gross margin was in line at ~61%, it clearly outperformed its competitors in terms of net margins. While competitors reported a median of negative 2.52%, AGYS reported a strong net income margin of positive 6.46%.

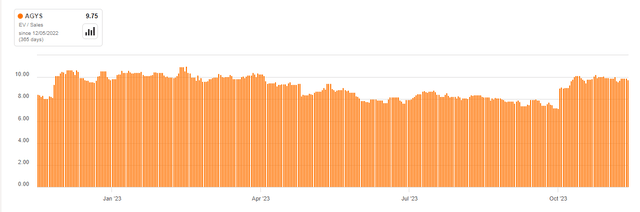

Hence, I argue that it should be trading at a higher forward EV/Sales compared to the competition’s median of 5.18x. Currently, AGYS is trading at 9.1x forward EV/Sales. Given its superior financial performance and growth outlook that I have discussed in detail above, I believe AGYS’s current forward EV/Sales is fair. In addition, if we look at its 1-year EV/Sales average, it is ~9x as well.

The market revenue estimate for AGYS is $237.06 million in 2024 and $279.10 million in 2025. I believe these estimates to be reliable, as they are in line with management’s 2024 guidance at the midpoint. In addition, my discussion on its strengths and growth catalysts above also supports this positive outlook. By applying its current P/E, which I have discussed above, to its 2025 revenue estimates, my 2025 price target is $104.53, and this represents an upside potential of ~21%.

Author’s Relative Model Seeking Alpha Seeking Alpha

Risk

As evidenced by its historical financial performance, COVID has had a massive impact on its top-line revenue because it offers solutions for companies in the hospitality industry, which is very susceptible to such a crisis. If any unforeseen pandemic were to rise again, it would severely impact its growth outlook.

On top of that, inflation also plays a big part, as it affects retail spending. If inflation were to rise again, it might dampen the hospitality industry yet again, and its impact would flow down to AGYS.

Conclusion

In conclusion, AGYS has shown strong historical financial performance due to its strong revenue growth and margin expansion. The most impressive feat would be its ability to turn its net margin and EPS positive. On top of that, its 2Q24 results continue to show robust revenue growth and consistent margins. This speaks volumes in regard to its ability to scale its business. Apart from this, I believe the anticipated growth in the PMS market and the shift towards cloud-based PMS will bolster its growth outlook. In addition, the rise of tourism activities and investment in hospitality will also bolster its growth outlook.

When I take a look at current inflation and retail spending trends, both signs are very promising, as they are moving down the path of recovery. I expect the abating inflation and rising spending to bolster the hospitality industry and, ultimately, AGYS. When I did a relative comparison with its competitors, it was clear that AGYS outperformed all of them. With an upside potential of 21%, I am recommending a buy rating for AGYS.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.