Summary:

- Want stock capital-gain profits? You better find good forecasters of coming stock prices.

- We know where they are, and better still, how to get them to tell us what their forecasts are for AGYS and related investment alternatives.

- And maybe best of all, what their investment net profit & loss score has been on prior forecasts when they previously had expectations like they do today. Read on.

Pgiam/iStock via Getty Images

Investing Thesis

Think back to the changes your grandparents lived through from their childhood: Atomic power, radio displaced by television, discovery of DNA biology, evolution of the internet, wireless telephones, . . .

Technological progress hasn’t slowed down, instead it appears to be increasing and we are chasing to keep current. As investors our progress is even more dependent on anticipating coming technology and human behavior evolutions, in the midst of increasingly complex surroundings.

The forecasters who can help us are the pros who everyday “fry the fish” we want to “eat” in our investment portfolios. They have to deal with the huge and irregular anticipation appetites of “institutions” with multi-billion-$ portfolios demanding transactions to adjust for their today’s anticipation of technology. Expectations likely to soon appear to we ten-or 100-share investors maintaining the continual open-interest demands seen in exchange bid and offer quotes.

Those pros employ the well-educated and continuously-informed profit- anticipating researchers and information-gatherers active world-wide (on a 24x7x365 basis) needed to do their essential market-making-transaction jobs.

But they don’t want us in front of them in the buying and selling appetite-lines they intend to profit from by their disruptions. It’s what pays their rents and retirements and those of their employed staffers. So, efficient market transactions have to be quick and clean.

What makes them that way are stock-price-change “insurance” speculators willing to hedge-protect the Market-Makers during the temporary risks that must be taken in the periods of brief disruption. The costs of that protection reveal the coming-price expectations of that community, on both sides of each trade.

For those derived price forecasts we keep score on how the active markets subsequently reward or punish the expectations of prior experiences. That is this article’s job of presenting alternative investing choices for a not-certain near future of the next 3-5 months.

Description of the Primary Investment Candidate

“Agilysys, Inc., together with its subsidiaries, operates as a developer and marketer of hardware and software products and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India. It offers point of sale, property management systems, inventory and procurement, payments, reservations management, and seat solutions to enhance guest experience. The company also provides technical software support, maintenance, and subscription services; and professional services. It offers its solutions for gaming, hotels, resorts and cruise, corporate foodservice management, restaurants, universities, stadium, and healthcare. The company was formerly known as Pioneer-Standard Electronics, Inc. and changed its name to Agilysys, Inc. in 2003. Agilysys, Inc. was founded in 1932 and is headquartered in Alpharetta, Georgia.”

Source: Yahoo Finance

Yahoo Finance

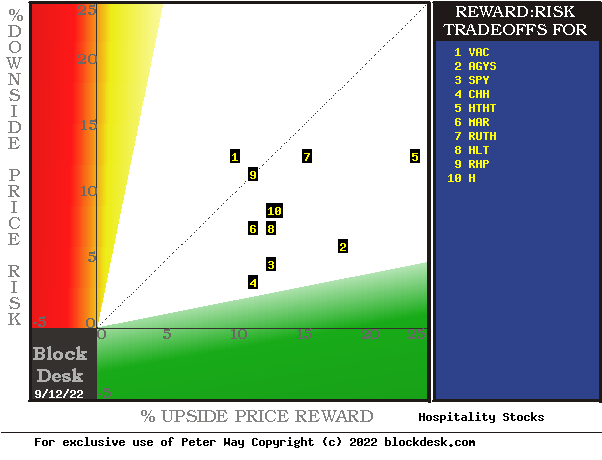

Present Reward & Risk Prospects of Alternative Investments

Figure 1

blockdesk.com

(used with permission)

Expected rewards for these securities are the greatest gains from current closing market price seen worth protecting short positions. Their measure is on the horizontal green scale.

The risk dimension is of actual price drawdowns at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain attractive to-buy issues are in the directions down and to the right.

Our principal interest is there in NASDAQ:NASDAQ:AGYS at location [2]. A “market index” norm of reward~risk tradeoffs is offered by SPY at [3]. The most appealing (to own) by this Figure 1 view is AGYS at location [2].

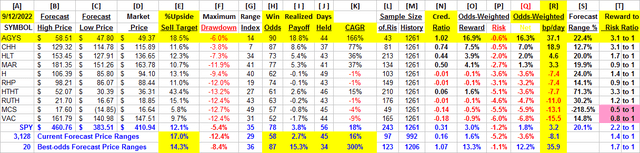

Comparing features of Alternative Investment Stocks

The Figure 1 map provides a good visual comparison of the two most important aspects of every equity investment in the short term. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely’ are present other comparative tables, like Figure 2, may be useful..

Yellow highlighting of the table’s cells emphasize factors important to securities valuations and the security AGYS, most promising of near capital gain as ranked in column [R]. Pink cell fills indicate inadequate proportions of essential performance competitive requirements, as in [H], [L-N] and [T].

Figure 2

The price ranges implied by the day’s transactions activity are in columns [B] and [C], typically surrounding the day’s closing price [D]. They produce a measure of risk and reward we label the Range Index [G], the percentage of the B to C forecast range which lays between D and C.

Today’s Gs are used for each stock’s past 5-years of daily forecast history [M] to count and average prior [L] experiences. Fewer than 20 of Gs or a shorter history of Ms are regarded as statistically inadequate.

[H] tells what percentage of the L positions were completed profitably, either at range-top prices or by market close above day after forecast close price entry costs. The Net realization of all Ls is shown in [ I ].

[ I ] fractions get weighted by H and 100-H in [O,P, & Q] appropriately conditioned by [J] to provide investment ranking [R] in CAGR units of basis points per day.

The pink cell highlighting provides fatal investment evaluation conditions for several candidates, occasionally including the market-index ETF SPY. Additional market perspective is provided by the 3,000+ securities for which price range forecasts are available. They currently suggest that while market recovery is under way, it is still far from generally attractive.

On the other hand, R column scores for AGYS and the top 20 forecast population support the primary candidate’s competitive capability.

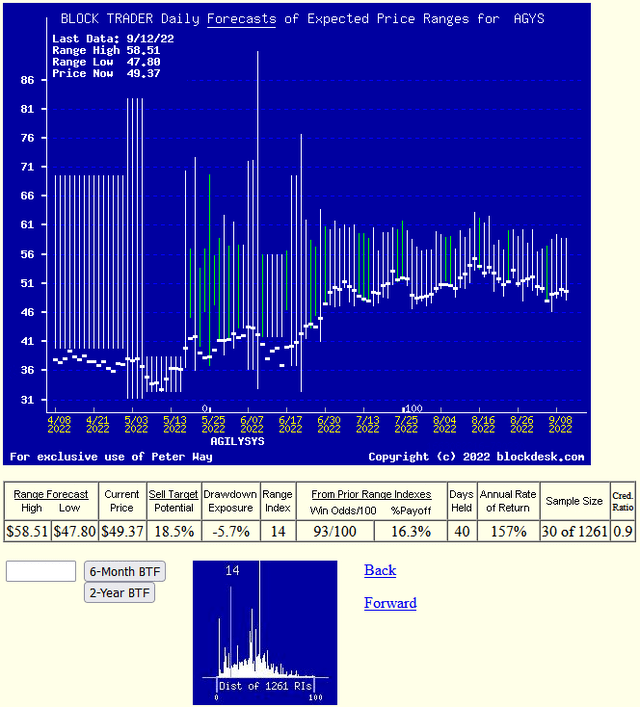

Recent Trends of PriceRange Forecasts for AGYS

Figure 3

(used with permission)

This IS NOT a typical “technical analysis chart” of simple historical (only) observations. Instead it pictures the daily updated Market-Maker price range forecasts implied by live real-capital commitments in real time. Its communicative value is present here by visual comparisons at each forecast date of the proportions of upside and downside price change expectations by the market-making community, as influenced by the actions of an interested and involved big-$ institutional investing community.

Those forecasts are typically resolved in time horizons of less than a half year, and often in two months or shorter. This one states that of the 30 prior forecasts like today’s, most were completed in 40 market-days (8 weeks) profitably at average +16% profits, a CAGR rate of 157+%. No promises, just fun with history.

Investor Takeaway

Comparison of the performances of near-term Market-Maker forecasts for Agilysys, Inc. (AGYS) with similar forecasts of other technologically-active securities pursued by investor referencing, it seems clear that this stock can be an attractive investment choice for investors pursuing near-term capital gain strategies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AGYS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Peter Way and generations of the Way Family are long-term providers of perspective information, earlier helping professional investors and now individual investors, discriminate between wealth-building opportunities in individual stocks and ETFs. We do not manage money for others outside of the family but do provide pro bono consulting for a limited number of not-for-profit organizations.

We firmly believe investors need to maintain skin in their game by actively initiating commitment choices of capital and time investments in their personal portfolios. So our information presents for D-I-Y investor guidance what the arguably best-informed professional investors are thinking. Their insights, revealed through their own self-protective hedging actions, tell what they believe is most likely to happen to the prices of specific issues in coming weeks and months. Evidences of how such prior forecasts have worked out are routinely provided, both on blockdesk.com and on our Seeking Alpha Contributor website. Pls see SA articles numbered 1495621 and 1936131.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.