Summary:

- Eli Lilly has several products with growth potential and especially recently introduced Mounjaro could reach blockbuster status quickly.

- The company is also a recession-resilient business.

- Eli Lilly reported mediocre quarterly results.

- The results themselves are not a problem, but don’t match a company trading for 50 times free cash flow.

- The stock is clearly overvalued and is facing a huge downside risk.

Michael Vi

My last article about Eli Lilly and Company (NYSE:LLY) was published in August 2021. Back then I rated Eli Lilly as a sell, but the stock increased about 19% in the meantime and clearly outperformed the S&P 500 (SPY), which declined almost 13% during the same timeframe.

And although my rating was clearly wrong one year ago, I remain bearish about Eli Lilly and will argue once again why the stock remains rather a sell – at least for the next few years – despite the solid and recession-resilient business model. And although Eli Lilly will probably be able to increase revenue during the next recession (due to several recently introduced great products), the stock is not a good investment and will face huge downside risk in the coming quarters.

Growth Potential

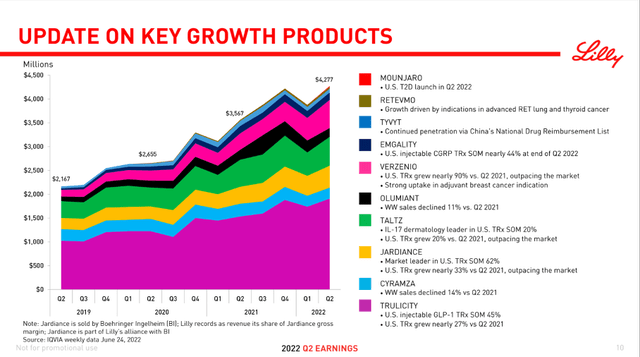

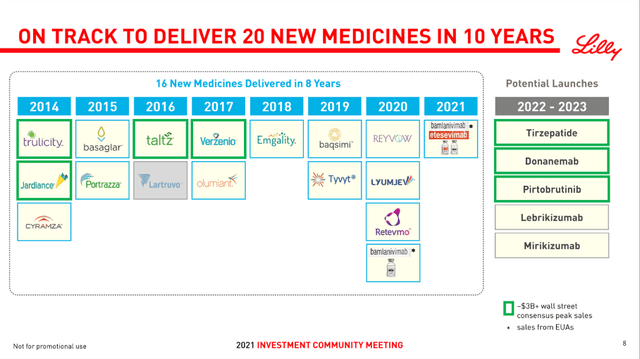

But let’s start with the positive aspects about Eli Lilly and look at the last few years in which the company introduced several key growth products that reached blockbuster status. And in the last five years, Eli Lilly could grow revenue with a solid CAGR of 6% and management is seeing continued strong demand for these products. During the last earnings call, CEO David A. Ricks actually announced two new manufacturing sites:

Last month, we announced plans for a $2.1 billion investment in 2 new manufacturing sites here in Indiana to support increasing demand for existing products as well as demand for potential new medicines in our pipeline.

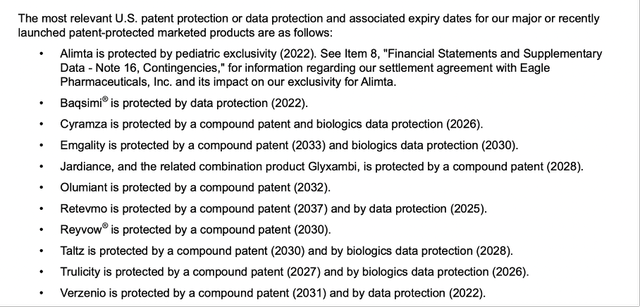

With these key growth products getting more and more important, revenue from these products that have been introduced since 2014 was about 66% of total revenue (in the second quarter of fiscal 2022). And it is good to know that many of these products are still patent-protected – Trulicity for example has still compound patents till 2027 and biologics data protection until 2026. Taltz is also protected by compound patents till 2023 and by biologics data protection until 2028. Jardiance is protected by a compound patent until 2028 as well (patent protection data for the United States).

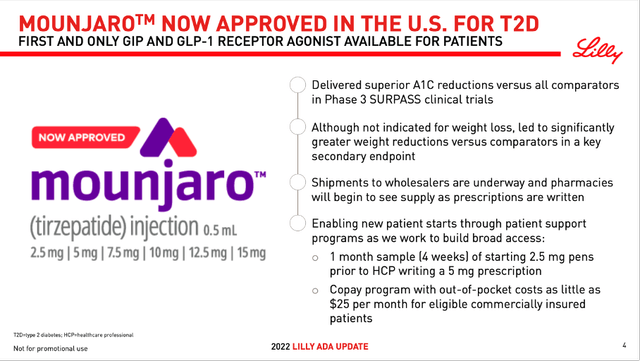

Recently, Eli Lilly launched another potential blockbuster – Mounjaro, which was approved for the treatment of type 2 diabetes. In the second quarter, it only generated $16 million in sales, but analysts are not only expecting Mounjaro to become a blockbuster – peak sales estimates range from about $5 billion to about $13 billion. And when looking at competitor Novo Nordisk (NVO) and sales for Ozempic (which is comparable), these estimates are not completely unrealistic. Ozempic sales in the first half of 2022 were DKK 26.38 billion ($3.55 billion at current exchange rates) and Ozempic sales were still growing 87% (reported numbers) and 73% in constant exchange rates. At this point it seems likely for Ozempic to generate $10 billion in sales and Eli Lilly might be able to reach similar levels with Mounjaro.

Eli Lilly Diabetes & Obesity ADA Presentation

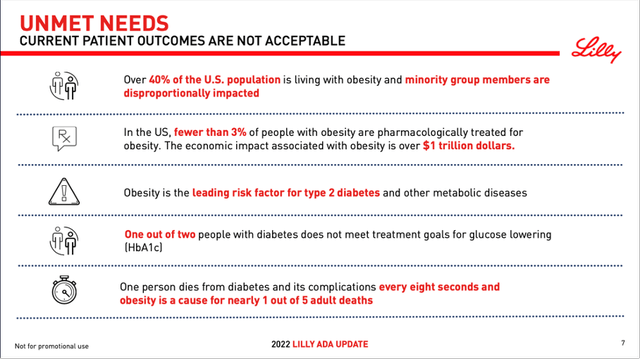

In June 2022, during a presentation for the American Diabetes Association (ADA), Eli Lilly announced that its prior focus was on people with diabetes and the goal was to improve and simplify glycemic control. But now the focus is on diabetes and obesity and Eli Lilly is going down a similar path Novo Nordisk has already entered a few years ago. Both companies are emphasizing that obesity is a gigantic problem (and a gigantic market). Over 40% of the U.S. population is living with obesity, but only fewer than 3% of people are pharmacologically treated and the negative economic impact associated with obesity is over $1 trillion.

Eli Lilly Diabetes & Obesity ADA Presentation

And similar to Novo Nordisk, which is selling semaglutide under the brand name Ozempic (for type 2 diabetes) as well as Wegovy (for obesity care), Eli Lilly is trying to do the same with tirzepatide. Aside from getting it approved to treat type 2 diabetes (Mounjaro), Eli Lilly might also try to approve it for obesity treatment and try to enter the market in which Novo Nordisk is already quite successful.

Eli Lilly 2021 Investment Community Meeting Presentation

But growth expectations in the next few years are not just relying on Mounjaro. Eli Lilly is expecting to launch four more blockbuster products in the next few quarters and two of them are expected to generate at least $3 billion in peak sales.

Recession-resilient Business

Eli Lilly seems like the typical recession-resilient business. It is a healthcare company producing pharmaceuticals and these are products that must be purchased during every economic condition. Even with disposable income declining and people cutting spendings on many other products and services, people still get sick (probably even more during recessions) and will have to buy pharmaceuticals. And as Eli Lilly is offering pharmaceuticals mostly for chronic illnesses – like diabetes – people will have no choice but continue purchasing pharmaceuticals (like insulin).

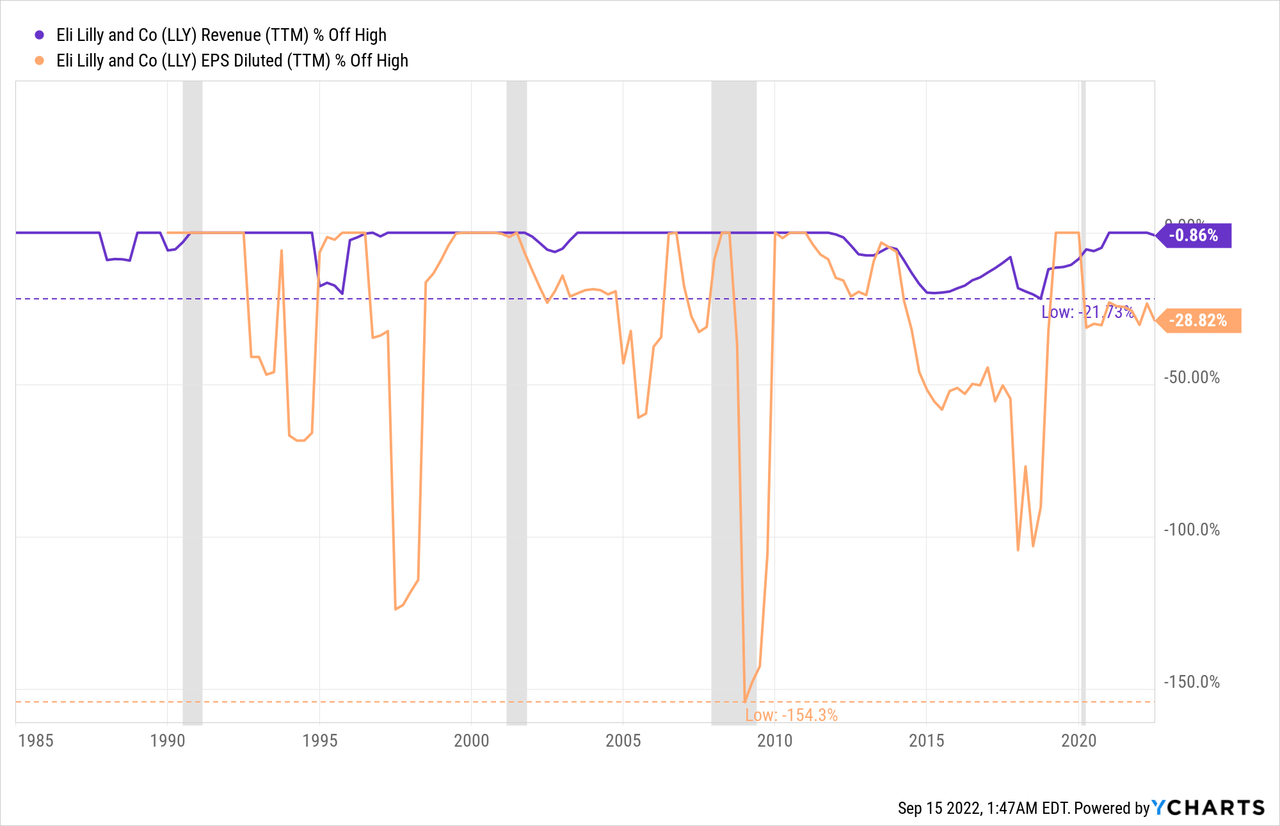

When looking at the performance during the last few decades, we can see revenue declining on several different occasions. But the declining revenue can’t really be associated with a recession. And while earnings per share declined during a recession on several occasion, earnings per share seem to fluctuate quite a bit in the last few decades. Eli Lilly is certainly not a business growing earnings per share with stability and consistency, but it seems to be able to handle recessions quite well.

Quarterly Results

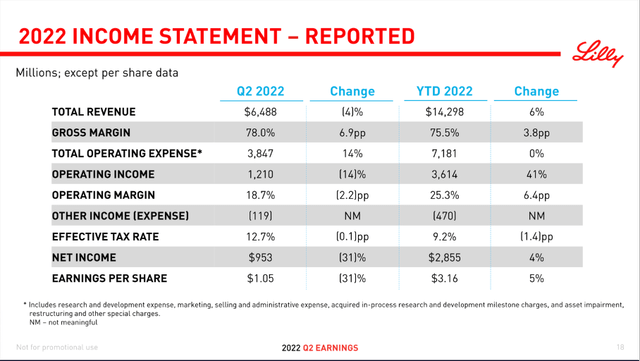

When looking for bad news we don’t have to look very far and can start with the last quarterly results. Revenue in the second quarter of fiscal 2022 declined 3.7% year-over-year from $6,740 million in Q2/21 to $6,488 million in Q2/22. Operating income also declined from $1,403 million in the same quarter last year to $1,210 million this quarter – a decline of 13.8% YoY. And diluted earnings per share declined even 31.4% from $1.53 in Q2/21 to $1.05 in Q2/22.

And although exchange rates had a negative effect on the top line, revenue also decreased slightly on a constant currency basis. The reasons were lower realized prices and especially lower revenue for Alimta (because of the entry of generics).

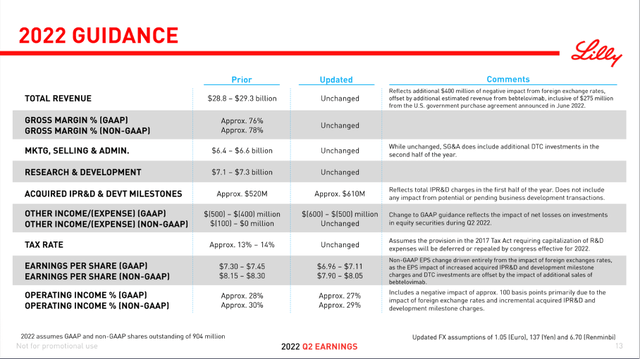

Eli Lilly also had to lower its guidance for fiscal 2022. While revenue is still expected to be in a range between $28.8 billion and $29.3 billion the company is now expecting earnings per share to be in a range between $6.96 and $7.11 (instead of $7.30 to $7.45 before). However, the guidance was not lowered due to fundamental reasons, but rather due to other factors like foreign exchange rates.

Of course, one mediocre quarter and lowered guidance is not reason enough to make Eli Lilly a bad company. However – and this is important – a business trading for 56 times free cash flow is expected to grow with a high pace and high consistency. In my opinion, a valuation multiple above 50 can’t hardly be justified, but when trying to justify it, extremely high and especially consistent growth would be a good starting point.

Intrinsic Value Calculation

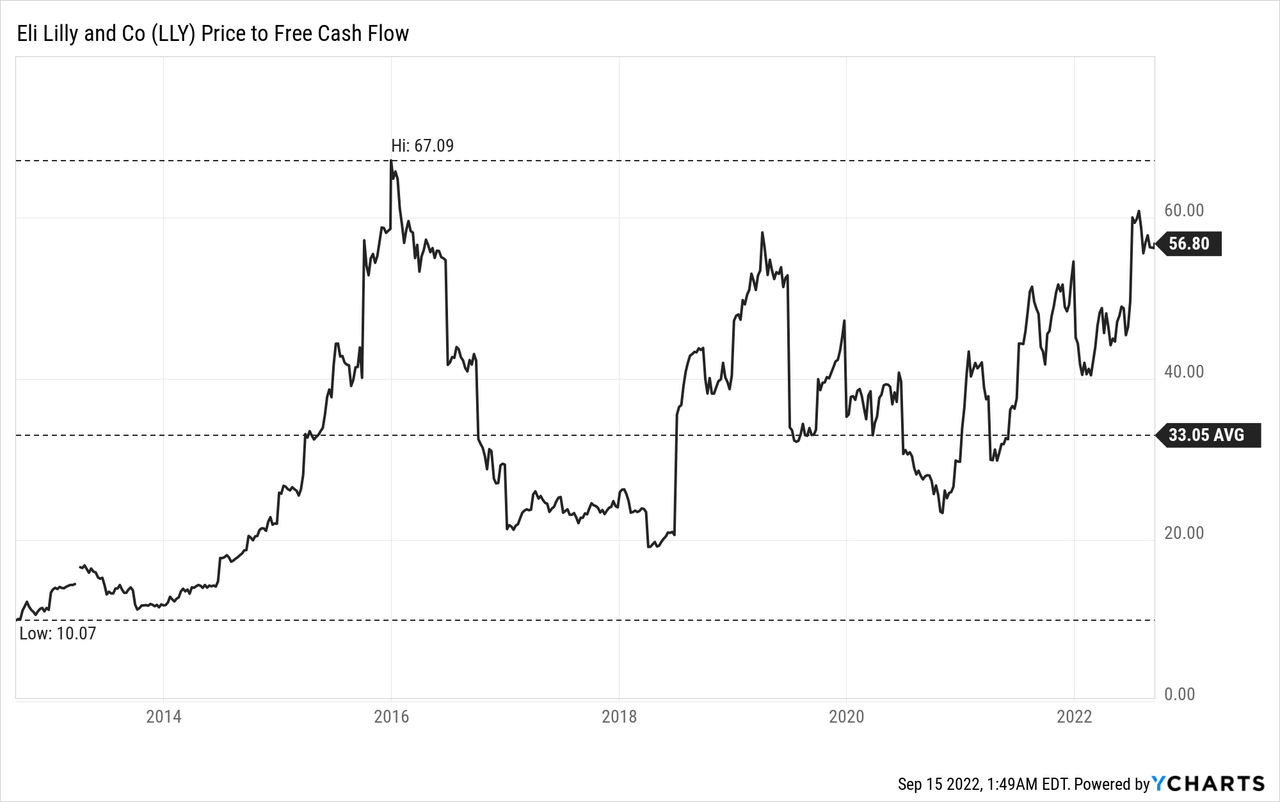

In the last ten years, Eli Lilly was seldom cheap. On average, the stock was trading for 33 times free cash flow and considering that Eli Lilly is now trading for almost twice that P/FCF ratio it must be called extremely expensive. In retrospect one can say investing in Eli Lilly in the past few years was a good idea as the stock increased (and outperformed the S&P 500). But considering the P/FCF ratio in the last few years, investing in Eli Lilly was not always a good idea. The price-free-cash-flow ratio is indicating that investors might have overpaid in the last few quarters.

We can also try to determine an intrinsic value by using a discount cash flow calculation. As basis we can use the free cash flow of the last four quarters, which was $5,743 million. When taking 902.9 million in diluted outstanding shares and a 10% discount rate, Eli Lilly must grow its free cash flow about 15.5 % annually for the next ten years (followed by 6% growth till perpetuity) to be fairly valued right now.

Seeking Alpha Eli Lilly EPS Estimates

When looking at the growth potential Eli Lilly has in the years to come, we have every right to be bullish about the fundamental business, but these growth rates seem overly optimistic, and I don’t think Eli Lilly will be able to achieve them. When looking at analysts’ assumptions for the years to come, they expect earnings per share to grow with a CAGR of “only” 11.5% in the next ten years and these assumptions can already be described as optimistic. When calculating with 11.5% growth for the next ten years (all other assumptions being equal), the intrinsic value for Eli Lilly would be $234.60 and the stock is clearly overvalued.

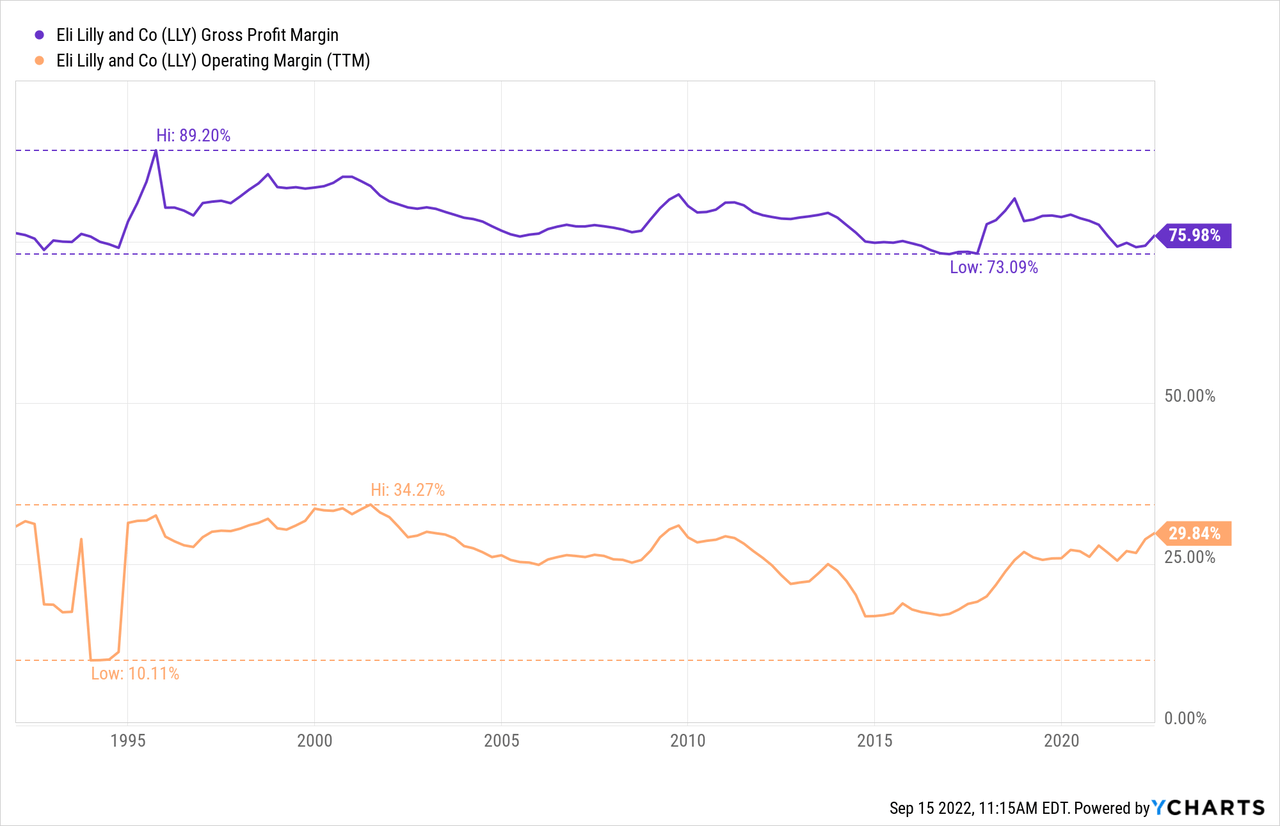

No matter, how we spin it, Eli Lilly is clearly overvalued at this point, and I see almost no way how the company can achieve growth rates in the low-to-mid teens in the next ten years. Eli Lilly can continue to purchase shares in the years to come, but at current stock prices this is not only a horrible idea, it has to spend a lot of money to make a significant impact on earnings per share growth. And when looking at margins in the last 30 years, I don’t see much room to improve margins as the operating margin is already rather high.

Therefore, almost all growth must come from revenue growth and despite Eli Lilly being able to increase revenue with new blockbuster products, I don’t think it can achieve revenue growth in the double digits for the next ten years. If Eli Lilly wants to grow revenue only 10% in the next ten years, it must generate $17 billion in additional revenue by 2027. And although we can be very optimistic about Mounjaro and tirzepatide as potential anti-obesity drug, I don’t think it will be easy for Eli Lilly to achieve $17 billion in additional revenue. Additionally, we must keep in mind that Eli Lilly lost patent protection for Alimta, which generated $2,061 million in sales in fiscal 2021 (7.3% of total revenue). Revenue from insulin (Humalog, Humulin or Basaglar) was also declining in 2021 and continued to decline in the first half of 2022 as more highly rebated segments made up a large portion of the business. And pressure on Eli Lilly and Novo Nordisk to lower insulin prices remains high.

Just Overvalued

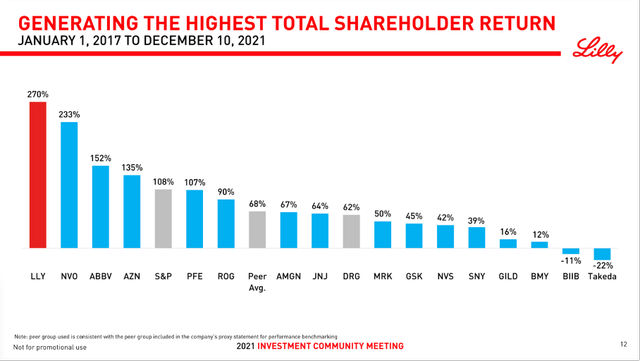

During the last “Investment Community Meeting” Eli Lilly “bragged” that it generated the highest total shareholder return in the last five years. And a great performance in the last few years is great for shareholders, but we also must realize that the stock performance in the past decade was not just based on fundamental performance. A huge part was based on multiple expansions (which is not so great).

Eli Lilly 2021 Investment Community Meeting Presentation

In the last ten years, Eli Lilly increased revenue only with a CAGR of 1.55% (of course, we should not forget or ignore that Eli Lilly split off its animal health business for example which had its IPO as Elanco Animal Health (ELAN)) and earnings per share increased only with a CAGR of 4.61% in the last ten years. But the stock price increased 552% in the last ten years – resulting in a CAGR over 20%.

I don’t want to bash Eli Lilly in any way – the company has a very solid business model and management made several great decisions from a strategic point of view in the last few years that will pay off in the years to come and generate high amounts of revenue. But I don’t get the extreme optimism that is reflected by the stock price. While Eli Lilly must grow in the mid-teens for 10 years in a row to be fairly valued right now, it came not even close to these growth rates in the past (we must select data very carefully to get several years in a row with consistent high growth rates in the mid-teens).

And I know that stocks are trading based on future expectations and Eli Lilly has the potential to grow with a high pace in the years to come. But investors and analysts must return to reasonable growth assumptions which will result in a more reasonable stock price – and in my opinion Eli Lilly should not be bought for a higher price than $200.

Conclusion

Eli Lilly is a high-quality business, but it is trading for completely unreasonable valuation multiples. And although Eli Lilly will be rather recession resilient, a valuation multiple around 50 is not justified and the risk of setbacks is high. It is possible that Eli Lilly will grow into its current valuation and the stock might just stagnate for some time (we are probably talking about several years) but it seems more likely that investors will at some point ascribe a much lower valuation multiple to Eli Lilly and the stock could easily be cut in half.

Disclosure: I/we have a beneficial long position in the shares of NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.