Summary:

- AGNC Investment Corp. is a mortgage REIT with a high yield but also a history of dividend cuts.

- Its reliance on leverage and long-term fixed-income assets makes it vulnerable to interest rate fluctuations and margin calls, which lead to permanent losses.

- AGNC is currently trading at a fair value and isn’t a Buy until the share price reflects a discount to book that can benefit from cyclical tailwinds.

Klaus Vedfelt

AGNC Investment Corp. (NASDAQ:AGNC) is a well-known mortgage REIT, which often draws the attention of income investors. I’ve even seen some theses that recommend it as part of an income portfolio. Currently, the shares trade at over a 14% yield, which naturally gets a lot of attention.

Yet, given the long-term history of this REIT and its strategy, I don’t see this as a viable income investment for those seeking steady, durable cash flow in their portfolio. Rather, I will argue that this is a cyclical play at best and only a Hold, given the uncertainty about interest rates going forward.

Dividend History

As a REIT, AGNC is obligated to distribute 90% or more of its earnings to avoid the tax impact, which is then “passed through” to shareholders. Thus, the default assumption with any REIT is that we buy it for the income, as opposed to the stock of a traditional corporation, which offers more room for appreciation.

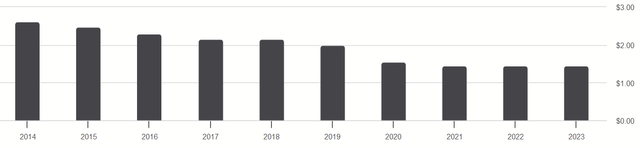

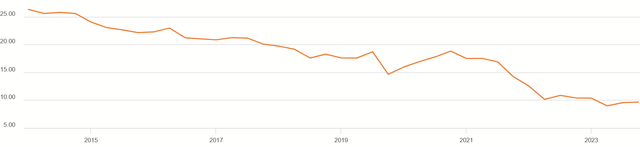

When we look at the history of AGNC’s annual dividend rate, it’s marked by a streak of cuts.

AGNC 10Y Dividend Rate (Seeking Alpha)

Starting at $2.61 in 2014, it fell to $1.44 by 2021, where it has since remained.

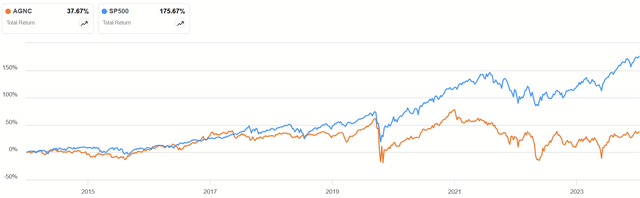

AGNC vs. S&P 500 10Y Total Returns (Seeking Alpha)

Consequently, even factoring dividends reinvested, the long-term, total return of AGNC has been a pittance compared to the broader market. So whether someone wanted to compound their savings or have a reliable source of income, AGNC has not been a resource for that, and it’s worth examining why.

Investment Strategy

As they disclose in the opening of their 2023 Form 10K, they earn their REIT status not by owning real estate or originating mortgages on such transactions. Rather, their role is post-origination, primarily by investing in Agency pass-through securities.

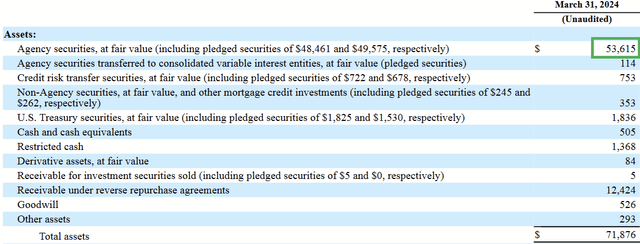

Balance Sheet (Q1 2024 Form 10Q)

As of Q1, Agency issues make up a majority of the assets on their book. In addition to their equity, these assets are purchased with leverage.

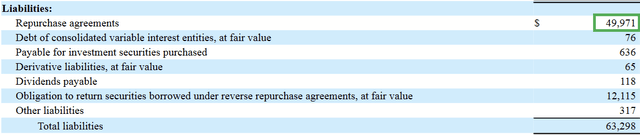

Balance Sheet (Q1 2024 Form 10Q)

The primary means for this is a repurchase agreement. In essence, AGNC functions like a leveraged, fixed-income fund, and its distributable earnings are a matter of the spread between interest income on the Agency assets and the interest expense on their leverage.

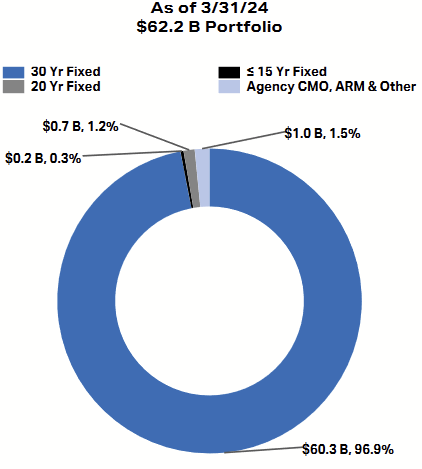

Agency Maturities (Q1 2024 Company Presentation)

As seen above, nearly all the loans in the Agency assets are fixed-rate mortgages. This means that as interest rates increase, AGNC’s interest income mostly remains unchanged, while their interest expense rises, thereby squeezing the spread for their net interest income.

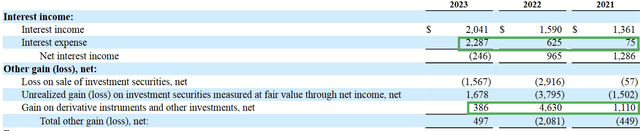

Income Statement (2023 Form 10K)

As seen above, this occurred from 2021 to 2023, mirroring the impact of the Fed’s interest rate hikes. To mitigate this risk, AGNC also purchases derivatives as hedges against interest rate fluctuations, and the income statement shows that this helps to buff out the dents in NII.

Of course, it’s not just to protect the earnings for their dividend that they hedge. While Agency assets (backed by the faith and credit of the U.S. federal government) aren’t seen as having credit risk, new risks are created when these assets are purchased with leverage. In their 2023 Form 10K (pg. 12), management explains:

Leverage also exposes us to the risk of margin calls and defaults under our funding agreements, which may result in forced sales of assets in adverse market conditions. The risks associated with leverage are more acute during volatile market environments and periods of reduced market liquidity.

If you look at my snip of the income statement again, you’ll see that such realized losses on sales of assets have occurred. Less assets mean less interest income than could have been.

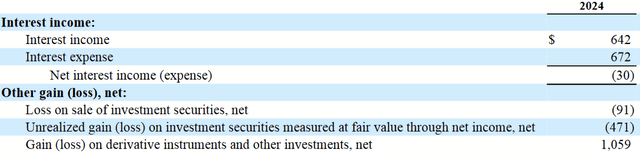

Income Statement (Q1 2024 Form 10Q)

To be clear, tighter interest expenses and losses on sales have continued in Q1.

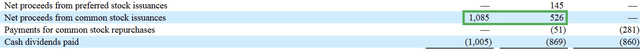

Cash Flow Statement (2023 Form 10K)

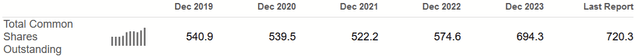

In 2022 and 2023, equity had to be issued as well to provide liquidity, further diluting shareholders and splitting the dividend obligation. This has continued in Q1 and has been an issue for many years.

Total Shares Outstanding History (Seeking Alpha)

To tie it in a neat bow, AGNC’s strategy is mostly investing in 30-year mortgage Agency securities for their strong credit profile (as well as a handful of similar investments), which can provide interest income over decades. In order to magnify returns, leverage is used. This, however, introduces other risks, as long-dated fixed-income is volatile and therefore vulnerable to margin calls. The long-term effect is lost capital and/or diluted shareholders for a smaller dividend per share.

The Cyclical Factor

Knowing the strategy, we can work out the logic of AGNC as a cyclical play. Some of this would be true for any fixed-income asset, as interest rates fluctuate and affect the yield for that asset in the market. AGNC’s leverage means that both the ups and downs will be magnified. The question, then, is where we are currently in the interest rate cycle.

Fed Funds Rate History (fred.stlouisfed.org)

It’s easy to tell where the top is for AGNC. If interest rates are near-zero, that’s as much as their fixed-income assets can be pushed up to market yields. They are unlikely to enjoy many leveraged gains, but have plenty of room to fall and experience margin calls. Whether we’re currently at the bottom is another question.

In Q1 earnings, CEO Peter Federico remarked on some of the uncertainty:

In his testimony before Congress, Chairman Powell characterized the Fed’s position as waiting for a bit more data and that rate cuts may not be far away. Importantly, the Fed also indicated that it would reduce the pace of runoff on its treasury portfolio at an upcoming meeting. This initial balance sheet action is a positive development for fixed income investors. The negative development was stronger-than-expected economic data. Inflation indicators did not show the continued decline that the Fed was hoping for and growth in labor readings remain surprisingly robust. As a result, the timing and magnitude of future rate cuts became considerably more uncertain.

Later on, he did give his own opinion on what was going to happen:

I think the Fed is looking for 2 or 3 months in a row of better data to have sufficient confidence. And once they get that data, then everybody will be pricing in the eases again and the direction of monetary policy will be clear again. Right now, it’s a little uncertain, but we think the repricing is largely over.

He seems to think we’re near this cycle’s bottom. It all depends, however, on what happens with inflation and how the Fed wants to respond to it. Then it depends on how precisely management levers and hedges based on those predictions. I’d like to say Federico or anyone else on AGNC’s team has a good idea of this, but then that would make it tough to explain why the previous years of forced asset sales, shareholder dilution, and dividend cuts ever occurred.

Price/Book History (Seeking Alpha)

Consequently, this is why AGNC never trades at a premium to book, and its winners have been those who buy after a drop, which leads to a Price/Book discount, exiting when the share price reaches book again. At best, we can say AGNC is fairly valued at its current price of $9.73, with some potential for growth of book value if rates start to decrease.

Book Value Per Share History (Seeking Alpha)

History shows us the gains in book value per share are short-lived, and if one wants to play this like buying into the low end of a cycle, perhaps a price that reflects it is in order first, as well as a swift exit plan.

Conclusion

Invested in Agency securities with long maturities, AGNC doesn’t have risky assets, but it does have risky financing, the kind that can magnify gains and losses on its portfolio. This necessarily makes it a cyclical play, primarily driven by interest rate movements and management’s ability to position the portfolio accordingly.

In the long run, the company has endured the forced sale of assets to satisfy margin calls and had to raise additional capital through new shares to maintain liquidity, leading to serial dividend cuts. It isn’t a buy-and-hold, and despite being a REIT, a winning thesis requires investors to view the dividend as a formal obligation and an informal distraction. Emphasis belongs on the balance sheet and how interest rate cycles will help or hurt book value per share.

Until the share price more compellingly reflects a discount that can rebound on cyclical tailwinds, AGNC is, at best, a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.