Summary:

- AGNC’s management discussed in clear detail the two internal business model measurements during the last call.

- They are paying the dividend off the lower returning view at 15% yields.

- Management’s expectation is that once a necessary refinancing is completed this coming year, that the actual returns will drop from the middle 20% yields to 15%.

- The overall cash balance minus the dividend seems in balance, i.e. the business is generating the cash needed to pay it.

- Investors should expect continued volatility.

Luis Alvarez/DigitalVision via Getty Images

AGNC (NASDAQ:AGNC), an Agency Residential Mortgage REIT, reported on April 22nd giving shareholders an even clearer picture of its path forward. Investors questioning the dividend safety with its high yield near 15% certainly have valid reasons. This article adds to our others such as Status Of AGNC Investment’s Dividend And Marketplace published the 1st day of February with a laser focus on the dividend health and offering a Buy rating. The stock performance has been lower by approximately 5% consistent with interest rate volatility induced from a Fed policy reversal in March. In our other publications, we included evidence that supported a continued $0.12 per month dividend, and that dividend continued. Management, with great clarity, communicated again the business status supporting their decisions. Like drawing on a glass board, investment decisions require clarity. The clarity we seek revolves around understanding dividend implications with the two converging models management presented during the 1st quarter Q&A. Let’s head to the AGNC glass and view from side to side and front to back as to what is going on, and why I’m maintaining my Buy rating.

The Business Models

Management outlined two models in which they follow for deciding its dividend policy. We believe that this is so important we included the description twice, once next and once later.

From the call question and answer, Rick Shane of JPMorgan, asked,

“Look, so one of the interesting facets of the portfolio as the contribution from swaps over the next several months, you have $8.5 billion notional rolling off. Those swaps essentially contribute about 20% to 25% of your spread income. As you look forward, given the opportunity, how do you replace that runoff?”

Peter Federico, CEO, offered, in our view, the most insightful answer yet articulated. In relevant parts,

“[B]ut I think you’re talking about swap spreads and swap spread performance to some extent. And that was an important driver of performance because swap spreads tightened a lot. . .. [adding] Our net interest margin has remained really, really robust. Last quarter, it was 298 basis points and that is not consistent with the economics that we just went through. If you think about that net interest margin at around 300 basis points, and you divide that and think about that from an ROE perspective, you’re going to get an ROE of 25%, 26% . . .. The economics of our business, as we just talked about, are in the mid to high teens. . .. we have about $8.5 billion [swaps] still maturing and we had about $5 billion mature, by the way, in the first quarter . . .. Those will roll off over time and our net spread in dollar – or our net interest margin because of those swaps rolling off will come down. We will put other swaps on that have positive carry on them…… So, as Chris and team roll the portfolio over, and we continue to move our assets around, we’ll end up seeing some uptick in our asset yield like you saw last quarter. But over time, that net interest margin over a longer time will come down more in-line with the economics of our business.”

We understand that the quote from the call is lengthy, but maybe also the most important comments given in our following of the company. In essence, he said, yes swaps will be replaced, and yes, when finished yields will be lowered, but the real business yield at this point in total equals 25%, while the company is paying its dividend based on a future performance of 15%, the long-term target of the company. Management believes through its experience that the long-term yield is not only achievable but the likely outcome. Our belief on this issue is generally congruent with a watchful eye on that glass board. With most of our share’s purchased at an equivalent price of $10, we aren’t afraid of letting lose if ours’s and management’s belief turns south.

Leverage, Cash & Hedges

A secondary understanding exposes itself with management’s practices dealing with equity, cash and income. This business buys longer-term assets and finances the purchases with shorter term assets of lower interest, netting the difference. With the model comes leverage, cash and hedges against the debt for protection. With lots of cash, higher hedging and lower leverage positions, in theory, once interest environments turn lower and more stable, this produces buying abilities in which income may increase. Management commented, “Well, we certainly have a lot of capacity the way I would describe it today, a lot of flexibility.” This comment followed next with “as Bernie mentioned, we have a very strong liquidity position of $5.4 billion. As a percent of equity, I think it maybe was one of our highest points. . .” The company is prepared for the next phase.

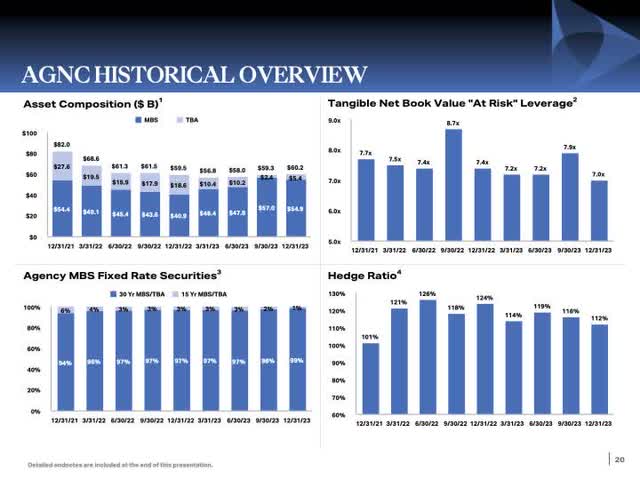

Now, some history seems in order. First, a slide comparing key metrics in the 1st quarter, quarter over quarter, is included.

AGNC 1st Quarter Summary

Of interest, the business duration gap changed from negative to slightly positive, a position which becomes slightly bullish for stable or lower rates and negative with increasing rates. Secondly, the company cut the hedges to 1. Adding depth to the hedge comment, Federico commented, “[We] would want to operate with, in a sense, some percent of our short-term debt unhedged, . . .” The company is looking for a level of stability before undertaking that position. Lower hedge ratios increased cash for investment.

Next, a review of cash positions and leverage follows. A table summarizes cash for several years, measured at the end of the 4th quarter.

| Cash | 2020 | 2021 | 2022 | 2023 * ** *** |

| 4th Quarter | $5.4B | $4.9B | $4.3B | $5.1B |

The cash ending in the 1st quarter equaled $5.4+ billion.

Continuing, a chart illustrating leverage is included.

AGNC 4th Conference

The leverage for the last quarter, shown upper right, equals 7.0, very low compared with past values (it is the lowest in recent history), leaving management additional room for growth at opportunistic times.

The company chose to sell common stock for raising capital also. Actually, it chose to sell a lot of stock over the past several quarters. In March, it raised $240 million. The difference in cash between December and March equaled approximately that difference. Also, last year, the company issued $1 billion worth of new common stock shares, 120 million, or a 20% dilution. The official company reasoning states:

“[W]e were able to raise capital through our at the money program, at the market program very accretively in the first quarter. And we’ll continue to look at those opportunities. The first quarter is a really good example of one, the cost-effective nature of that capital issuance, the book value accretion that can be generated by it, but also the flexibility that affords us.

Management immediately deployed raised capital into among other investments, adding $3 billion worth of mortgages in the quarter. Finishing the conversation, management stated,

“About half of those purchases if you will, went towards levering that new capital immediately. So, there’s no drag from a dividend perspective. It’s accretive to book value. That translates to value for our existing shareholders.”

Thus far, the increase in cash equals approximately the same value as capital raised from common stock sales. In the past year and a quarter, the balance equaled $5.4+ billion minus $4.3 billion in increased cash versus $1.2+ billion in common stock sales.

Again, this positioning results in a company possessing extreme flexibility. The plan going forward involves slow, disciplined and careful deployment. The Fed’s timing, in our view, is obtuse. Though with a level of unknown timing, a period of long-term durable and attractive investment opportunities is coming, a period in which the cash position offers massive amounts of opportunity. It is Fed-dependent, and they aren’t saying when, simply because they haven’t yet figured out the direction of inflation. Meanwhile, investors will collect a nice dividend.

Our Concern

Thus far, the approximate cash flow balance remains in check. In our view, with the sizable amount of new stock issued, the company placed a significant bet on the Fed cutting to take advantage of massive flexibility at some undefined future time. The timing for rate cuts depends on inflation. Control of inflation, heavily influenced by oil pricing shocks, might still be allusive. Standard Chartered predicts a significant increase year over year in global oil demand for the summer. This demand will add inflationary pressure. Noted above, the company added significantly to common share stock dilution. At the end of the March quarter, the number of shares outstanding equaled 700 million. At $1.44 per year in dividends, AGNC spends almost a billion per year. Yes, management claims that the increases are NOT dilutive regarding earnings per share. But, for us, it seems unclear how much the dividend might increase in the future. It is obvious that lower interest rates will lift asset values, increasing the stock price. It appears that the company has appreciation approaching, but we wonder about higher dividends at least anytime soon. We could be wrong, having missed an important result.

Risk

Risks exist. The AGNC business model requires a level of stability for returns to continue. From an article predicting interest rates through 2024, some analysts believe that the 10-year treasury might peak at 5.25% or even higher. The reasoning includes increased costs in crude oil from higher world demands, coupled with constrained crude production. “Futures markets showed investors now expect the Fed to deliver just 35 basis points in rate cuts this year, compared to the more than 150 points” once priced in.” Michael Purves, head of Tallbacken Capital Advisors, wrote a note to investors that the 5.22% reached in 2007 might be broken. This unstable marketplace doesn’t bode well for companies such as AGNC. Others feel different, claiming that the highs have already occurred. We believe that at best, inflation subsides toward the end of the 2024. It might be well into 2025.

Ending with our view, the biggest long-term risk resides with the company achieving its targets. In summary, management stated,

“If you think about that net interest margin at around 300 basis points, and you divide that and think about that from an ROE perspective, you’re going to get an ROE of 25%, 26% . . .. The economics of our business, as we just talked about, are in the mid to high teens. . ..“

But with the company thus far balancing cash flows even at the high-yield percentage, we continue our buy rating with a careful cash flow watch going forward. At the last reported quarter, Net Tangible Book value equaled $8.9, a share price in the low $9s is reasonable. Others such as Ares Capital (ARCC) trade consistently 10% above its asset values. Again, we also expect volatility, especially through the summer, with inflation likely roaring once again. The stock price will follow this volatility as it occurs, most likely creating better prices to buy. In every one of our articles, we have tried to enforce this concept. This isn’t a company for the faint of heart in a period of uncertainty. In our view, rate cuts won’t start until next year. Looking into the glass board from all angles creates a clear picture of management’s vision and a most likely landing point. In the meantime, we believe that the dividend is reasonably safe. The glass seemed quite clear.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.