Summary:

- Airbnb, Inc. is facing mounting challenges as some operators in cities like Denver, Austin, and Phoenix appear to be experiencing significant revenue declines.

- The company’s stock has also seen some recent and large insider selling, and Airbnb should be vulnerable in a recessionary environment.

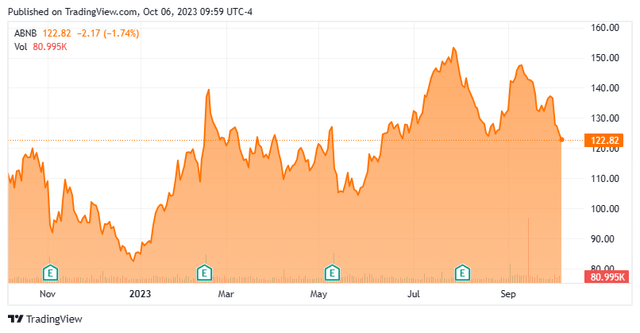

- The stock has started to trend down heavily over the past month and the analyst community has also gone negative on the company over that time as well.

- What’s next for Airbnb? An analysis follows below.

aldomurillo/E+ via Getty Images

The impulse to travel is one of the hopeful symptoms of life.” ― Agnes Repplier.

Today, we take a look at a firm that have revolutionized the travel industry as well as had a tremendous impact on residential real estate investing. I am talking about Airbnb, Inc. (NASDAQ:ABNB). The stock has seen some considerable insider selling (I,II) here early in October and is beset by multiple challenges. An article in ZeroHedge this week highlighted how some Airbnb operators in cities like Denver, Austin, and Phoenix are facing 40% to 50% revenue declines. Here in South Florida, I have noticed a considerable uptick in Airbnb properties being listed for sale on Zillow (Z) and Redfin (RDFN) over the past several months.

Company Overview:

Airbnb, Inc. is a San Francisco-based online platform matching guests (typically travelers) with hosts (typically homeowners), boasting over seven million active listings as of June 30, 2023. The broker of homestays and experiences generated gross booking value (GBV) of $63.2 billion in FY22 from 394 million guest nights. The company was founded as AirBed & Breakfast in 2008 and went public in 2020, raising net proceeds of $3.7 billion at $68 per share. Rallying on a recent announcement that it would be added to the S&P 500 (SP500) on September 18, 2023, Airbnb’s stock trades just below $125.00 a share now, translating to an approximate market cap of $80 billion.

The company is essentially and currently capitalized by three classes of stock: 426.4 million shares of publicly traded Class A stock that confer economic interest and one vote per share; 211.7 million shares of privately held Class B stock that confer economic interest, 20 votes per share, and convertibility into Class A shares; and 9.2 million shares of Class H stock (issued for charitable purposes) that has no voting power but is convertible into Class A shares when sold to a non-company subsidiary.

Operating Model

Airbnb’s business model considers hosts and guests as customers, as it collects fees from both, which include use of its platform, customer support, and payment processing. It does not recognize revenue until check-in, and it does not set pricing (executed by the host). However, when a guest books with a host, he or she does so by providing full payment in advance. As such, Airbnb holds the money until check-in, at which point it disburses the booking value to the host – less host fees. Concurrently, it recognizes guest fees as revenue, which are also paid up front. As of June 30, 2023, this “float” totaled $9.1 billion.

Since, in most instances, hosts and guests are perfect strangers, the company has designed safeguards, including host and guest reviews, account protection, risk scoring, secure payments, and booking restrictions. It essentially provides insurance for hosts, with guest property damage protection up to $3 million per stay and $1 million in liability coverage in the event of personal injury at a host property. It also protects guests with a “get-what-you-booked” guarantee. These offerings somewhat act as disincentives to hosts and guests circumventing Airbnb’s platform and directly interacting with each other – cutting out the middleman – after their initial transaction.

The company generates approximately half its top line from North America with ~35% derived from Europe, the Mideast, and Africa. Approximately 18% of its business is generated from monthly or longer stays.

Pandemic Effects and Stock Price Performance

It goes without saying that the platform has been an enormous success, with the term “Airbnbing” now part of the American (and global) lexicon. From FY16 to FY19, the company’s GBV surged 173% to $38.0 billion, setting the stage for the largest IPO of 2020, although it was postponed from April until December due to the pandemic and post-election uncertainty. Not surprisingly, Airbnb experienced a 37% decline in GBV to $23.9 million in FY20. That performance did little to dampen enthusiasm, as shares of ABNB surged to $146 on their opening trade, providing a tidy 115% return for those fortunate enough to obtain shares on the IPO. The market was focused on its rebound, which was quicker than hotels, as travelers who were still concerned about crowded environments opted for the relative solitude of an Airbnb rental.

This dynamic introduced ever more individuals to the concept, with GBV rebounding 96% to $46.9 billion in FY21. Shares of ABNB raced to an all-time high of $219.94 in February 2021 and last traded above $200 in November 2021, about the time inflation fears crept into the macroeconomic narrative. The market feared inflation’s impact on consumer disposable spending, even though Airbnb was benefitting from the “work from anywhere” concept, which would lead to another 35% surge in GBV to $63.2 billion in FY22 on a 31% rise in nights and experiences booked to 394 million. Furthermore, the company went solidly into the black, producing FY22 EPS of $2.79 a share (GAAP) on revenue of $8.4 billion versus a loss of $0.57 a share (GAAP) on revenue of $6.0 billion in FY21. Despite these positive financial developments that also featured 23% net income and 40% free cash margins, shares of ABNB closed 2022 at $85.50, down 60% in slightly more than 13 months.

Airbnb stock has since rallied 66%, as the consumer continues to show resiliency in the face of a challenging macroeconomic backdrop. Even though 50% of Americans are living paycheck-to-paycheck, they spent 1.2% more on travel in each May, June, and July of 2023 than they did in the prior year. This increased outlay was a function of demand, as travel prices have been relatively flat versus 2022 – individual components notwithstanding – according to the U.S. Travel Association.

Q2 2023 Earnings & Outlook

The company’s Q2 2023 financial report on August 3, 2023 reflected this dynamic when it posted earnings of $0.98 a share (GAAP) and Adj. EBITDA of $819 million on revenue of $2.48 billion versus $0.56 a share (GAAP) and Adj. EBITDA of $711 million on revenue of $2.10 billion in 2Q22, representing year-over-year improvements of 75%, 15%, and 18%, respectively. The bottom line was $0.20 a share above consensus, while the top line was $60 million better.

Furthermore, GBV increased 13% year-over-year to $19.1 billion, nights and experiences grew 11% to 115.1 million, while the average daily rate (ADR) remained flat.

Management’s outlook for the balance of the year remained buoyant, forecasting revenue of $3.3 billion to $3.4 billion in Q3 2023, which was slightly better than Street consensus of $3.22 billion. The company expects Q3 2023 Adj. EBITDA to exceed the $1.46 billion generated in Q3 2022 and FY23 Adj. EBITDA margin to modestly outperform the 35% achieved in FY22.

Balance Sheet & Analyst Commentary:

Airbnb is a cash generation machine, kicking off 2Q23 free cash flow of $900 million, some of which has been earmarked for share repurchases. Since its first program was announced in August 2022, the company has repurchased $2.5 billion of its stock, with an additional $2.0 billion remaining on its current authorization. As of June 30, 2023, Airbnb held cash and short-term securities of $10.3 billion against debt of $2.0 billion. It does not pay a dividend.

Sentiment has shifted to the negative noticeably over the past month. Bernstein stuck with their Buy rating and $168 price target on September 8th. Since then, BTIG, Truist Financial ($126 price target), Mizuho Securities ($150 price target) and Wells Fargo ($111 price target) have reissued Hold/Sell ratings while KeyBanc downgraded the shares to Hold.

Their median twelve-month price objective is $145. On average, analyst firms expect the company to earn $3.78 a share (GAAP) on revenue of $9.85 billion in FY23, followed by $4.20 a share on revenue of $11.15 billion in FY24, representing relatively tepid increases of 11% and 13% FY24 vs FY23, respectively.

Verdict:

Airbnb, Inc. is a rare company, generating free cash flow higher than Adj. EBITDA. This output is a function of very low capital expenditures and high interest income. The company generated interest income of $337 million in 1H23, thanks in large measure to high short-term interest rates. In fact, an argument can be forwarded that management is leaving money on the table, with a substantial and relatively stable float and a three-month treasury yielding ~5.3%. Either way, the significant free cash flow generation should engender a premium P/E ratio, although 32.6 on FY23E EPS of $3.78 and 29.4 on FY24E EPS of $4.19 is rich. From an EV/TTM Adj. EBITDA perspective, it trades at an even gaudier 23.6.

Despite the current inverted yield curve, these same high short-term rates translate to high mortgage rates, which essentially trap homeowners. A lateral transition to a new home would mean forsaking their low-interest mortgage, likely resulting in at least a double in monthly payments. This higher mortgage rate undercurrent incentivizes homeowners to become Airbnb hosts, where they can take a vacation while renting out their homes. The same dynamic holds true for those who can afford to move but see the benefit of converting their existing low-mortgage rate homes into revenue-generating Airbnb destinations. Thus, high interest rates produce more supply for Airbnb, which engenders its growth.

However, more Airbnb homes means more competitive pricing and lower ADRs, especially as consumers, who collectively possess a record level of credit card debt, are more wont to look for bargains.

That said, supply growth is facing an existential threat from cities that wish to curtail short-term rentals due to a number of factors, including the belief that Airbnb reduces affordable housing supply. New York City acted this summer by effectively banning its residents from renting out spare rooms and studios for less than a month beginning September 5, 2023. [There are exceptions and plenty of red tape.] According to Skift, New York City accounts for ~22,500 Airbnb rooms and ~1% of its total revenue. If this trend were to spread, the company’s ability to grow revenue and cut into hotel market share could be significantly hampered.

In short, I like Airbnb, Inc. as a company, but this seems the wrong time in the economic cycle to buy the stock. If/when the country enters its next recession, this is a name I would look to pick up when the nation seems ready to emerge from that contraction. And hopefully when insiders are buying, not selling, the stock.

The journey not the arrival matters.”― T.S. Eliot.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: This is your chance to try us out – without any strings attached. Activate your two-week free trial period now and see if The Insiders Forum is right for you.