Airbnb: Go To The Hotel

Summary:

- We continue to be sell-rated on Airbnb.

- We expect Airbnb’s revenue to be pressured as post-pandemic demand tailwinds are replaced by inflationary pressures and a looming recession, causing weaker consumer spending.

- We continue to expect the stock to have more downside ahead with impending multiples compression.

- In the longer run, we’re bullish on Airbnb but expect to see more downside from current levels and recommend investors wait for a better entry point at a reasonable valuation.

Dimensions

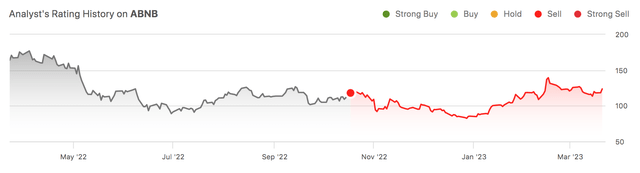

We remain sell-rated on Airbnb (NASDAQ:ABNB). We’re guarded on Airbnb’s revenue growth in the first half of 2023 due to the weaker spending environment caused by persisting inflationary pressures. Our bearish sentiment is also based on our belief that the stock is due for further multiple compression. We see the stock pulling back from current levels as fewer consumers prioritize spending in the current macroeconomic backdrop. The stock’s valuation has compressed since our last note in mid-October, but we still believe the stock is overvalued at current levels. The following graph outlines our rating history on Airbnb.

The stock dropped nearly 26% over the past year, but we’re seeing a slight recovery this year, with the stock growing 45% YTD after the company beat bottom and top growth lines in 4Q22 and guided revenue above consensus for 1Q23. Airbnb is a Tech Stock Pros favorite in the online travel industry, mainly because its business model builds on itself, what we coined as the flywheel – the more customers demand listings, the more hosts sign up with new listings. Still, we don’t believe it’s immune to near-term macro headwinds. We believe the company’s flywheel business model may be in imbalance as customers have less disposable income to allocate to traveling amid a rough macro environment. We recommend investors against jumping into the stock yet. The stock price remains volatile in the near term and is trading well above the peer group average; hence, we recommend investors wait for a better entry point toward the end of the year.

4Q22 & what to expect next

Airbnb’s 4Q22 inspired long-awaited investor confidence in the stock; the company reported GAAP EPS of $0.48, beating expectations by $0.21, and revenue of $1.9B, above expectations by $40M. We believe Airbnb experienced demand tailwinds in the post-pandemic, driven by pent-up travel demand during the pandemic. Airbnb didn’t feel the post-pandemic demand tailwinds alone; Delta Air Lines (DAL) and Hyatt (H), among others in the travel industry, surged this year from pandemic levels. The company posted FY2022 revenue rising 40% Y/Y, and net income was $1.9B, marking the first FY of profit for the company on a GAAP basis. Now, we believe the post-pandemic demand tailwinds are slowly being replaced with near-term headwinds due to the rough macro environments.

Airbnb forecasted that the average rates for rentals would “fall slightly in the current quarter and remain pressured through 2023, as vacationers return to lower cost urban rentals.” We expect tourism and travel to take a step back due to inflationary pressures. Business travel is expected to take a backseat as companies tighten their spending budgets; Atmosphere Research expects corporate travel to soften in 2023. The recent wave of tech layoffs also doesn’t inspire much confidence in consumer spending picking up in 1H23 either; around 121,205 employees from tech companies have been laid off in 2023 so far.

Management is still putting up an upbeat front, expecting to “continue hiring at a judicious pace in 2023.” Currently, the company’s headcount is down 5% from 2019 levels, likely due to cost cuts during the pandemic. The company expects revenue in 1Q23 to be between $1.75B to $1.82B, above estimates of $1.69B. On the surface, Airbnb reported stellar 4Q22 earning results, triggering a buying frenzy; the company wrapped up the year with 6.6M global active listings, 900,000 more than it had at the start of the year. The real question, however, is if revenue growth will continue amid a weakening spending environment and as the hype for travel has been replaced by inflationary pressures and spiked interest rates. Airbnb is a discretionary stock at its core and relies on consumer spending, and we expect weaker discretionary spending to pressure the company in the near term. We remain cautious about Airbnb growing meaningfully in the first half of the year and recommend investors sell the stock at current levels.

Valuation

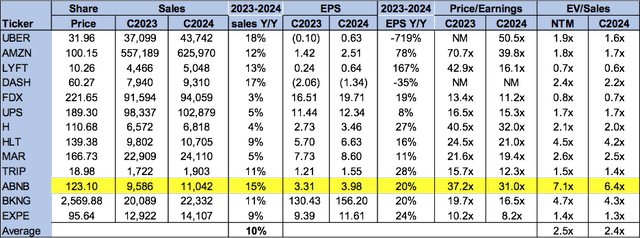

Airbnb is not cheap, trading well above the peer group average. On a P/E basis, the stock is trading at 31x C2024 EPS $3.98 compared to the peer group average of 22.8x. The stock is trading at 6.4x EV/C2024 sales versus the peer group average of 2.4x.

The following table outlines Airbnb’s valuation.

Word on Wall Street

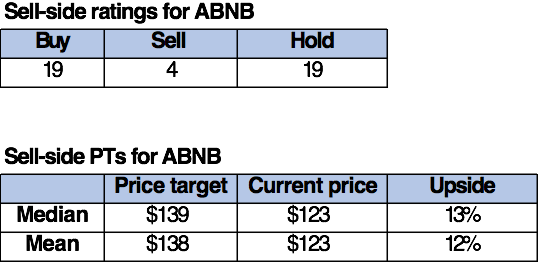

Wall Street is divided on Airbnb stock. Of the 42 analysts covering the stock, 19 are buy-rated, another 19 are hold-rated, and the remaining are sell-rated. We attribute the split in ratings between bullish and bearish to market uncertainty about how the current macroeconomic environment will impact Airbnb’s earnings and the stock’s high valuation.

The following table outlines Airbnb’s sell-side ratings.

TechStockPros

What to do with the stock

We’re sell-rated on Airbnb. We recommend investors sit out the buying mania for the first half of the year. We see the stock dipping in the near term as macroeconomic headwinds pinch consumer budgets and continue to wait for the stock’s valuation to compress. We’ll continue to monitor Airbnb closely to see how the weaker consumer spending impacts revenues in the first half of the year. The stock is trading 33% higher than its 52-week low of $81.91; we recommend investors take advantage of the stock rally post earnings, exit the stock at current levels, and wait for a better entry point towards the second half of the year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.