Summary:

- Airbnb beats Q1 revenue and EPS estimates, yet falls post-earnings due to a softer growth outlook.

- The company’s quality of business and management remain and provide solid footing to expand the business ‘beyond the core’.

- Near-term headwinds and an expensive valuation make it a current hold.

Flashpop

A Look at Q1

In my last article on Airbnb, Inc. (NASDAQ:ABNB), I argued Airbnb was a Buy ahead of earnings thanks to continued growth and operating leverage ahead of its Q4 results. Not much has changed in terms of the fundamental narrative of the company expect for moderating topline growth on the horizon. Airbnb beat analyst revenue and EPS estimates in Q1, yet the stock has tumbled 8% since reporting due to a softer Q2 growth outlook than expected. Let’s see if the market’s reaction is warranted by taking a deeper look at the company’s results.

Performance Snapshot

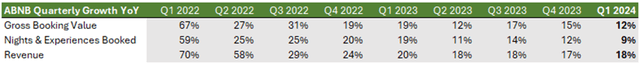

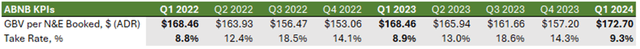

Airbnb’s growth has normalized since the post-pandemic travel boom. Gross booking value (‘GBV’) reached a quarterly record of $22.9B, growing 12% YoY and continuing to outpace the broader travel industry (which grows in the low to mid-single digits annually). Nights & experiences (‘N&E’) booked cooled slightly from recent quarters to 9.5% YoY, and overall revenue expanded 18%.

Airbnb’s strong Q1 revenue growth was helped by the timing of the Easter holiday as more nights booked were recorded this quarter in addition to an expansion in take rate and average daily rate (‘ADR’).

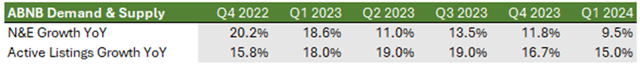

Underpenetrated markets in Latin America and Asia continued to be bright spots for growth, with N&Es booked climbing 19% and 21% respectively but still representing a minority of GBV. Airbnb tracks growth not only in demand but also supply. The company’s supply is comprised of all active listings which grew 15% to nearly 8M total, and this was after removing thousands of poor-quality listings in Q1.

Airbnb continues to generate meaningful operating leverage on its growth. Adjusted EBITDA, which tends to be lower in Q1 due to pulled-forward marketing spend, grew 62% YoY and represented a margin of 20%. Additionally, the net income and reported free cash flow grew 126% and 21% respectively. On the capital allocation front, the company bought back $750M in shares and announced another $6B buyback authorization as management seeks to deploy more of its $11B pile of cash.

In sum, Airbnb’s business looks as strong as ever with growth chugging along, margins expanding meaningfully, and management focused on generating long-term shareholder value. So, what drove the post-earnings pessimism?

Outlook

Management guided for Q2 revenue between $2.68-2.74B, or growth of 8-10%, vs consensus analyst estimates of $2.74B. The slower outlook is in part caused by the timing of Easter and other one-offs. The market is pessimistic about the near-term growth headwinds for Airbnb, yet it still is expected to outgrow close competitors Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) in the next few quarters which are guiding for 5-8% growth. Management also appears optimistic about the demand environment:

…which I see as frankly, a really strong statement in terms of both the stability and resilience of leisure travel demand so far this year. I think something that we’ve seen this year that is contrasting to last year there was a lot of volatility in terms of the timing of when people booked relative to their check-ins.

And so far this year, it’s been, frankly, much more stable. Lead times on our platform have been, frankly, generally in line with a year ago, and it just hasn’t been at the same level of volatility, again, that we saw a year ago. And so heading into Q2, our guidance reflects this continued stability of booking. Obviously, we’d like to deliver higher growth and stable growth, but our outlook obviously reflects the trends that we have seen quarter to date.

Even if Airbnb faces demand headwinds in the near term, the company is gaining more exposure to new growth verticals by leveraging its high-quality business model and differentiated brand.

Economic Moat & Strategy

As an investor, I look for owner-operator management, which tends to align the incentives between leadership and shareholders of long-term value creation. Airbnb insiders own nearly 13% of outstanding shares and both founders are actively involved in managing the company – that’s skin in the game. It especially piques my interest when leadership can lay out their long-term roadmap, which is what CEO Brian Chesky did in the Q1 earnings call:

You can think of a company as going through a few phases, especially to start a company. You have an idea, you get product market fit, that’s phase one. Phase two is when you try to go into hyper-growth. We’ve done that. Phase three, you become a real company, you go public, you generate a return for shareholders. And then the fourth frontier, and very few companies have ever done this, is you reinvent yourself and you go from offering one thing to many things.

Airbnb fits nicely between phases 3 and 4 currently, which aligns with the company’s current three-pronged strategy:

- Making Hosting Mainstream.

- Perfecting the Core Service.

- Expanding Beyond the Core.

Hosts are the lifeblood of Airbnb as they are the source of inventory or supply which tends to drive demand. The company has a host network of 5M+ and has added numerous features to onboard and keep hosts happy. This host network is part of a virtuous cycle where demand (guests, nights booked) drives supply (hosts, listings) which drives demand – both usually trend closely:

Here’s how management puts it:

…we would not expect supply and demand to grow exactly in line. But when we look over a longer time period, either the last decade or more specifically from pre-pandemic to today, what we do see is that over a period of years, they do grow generally in line. And I would say that continues to be the case.

Number 1 ties nicely to number 2, of which management is focused on the quality of supply and the guest experience, as well as the affordability and reliability of Airbnb vs hotels. The aim here is to continue taking share from hotels, which have a footprint 8-9x bigger than Airbnb – which also highlights Airbnb’s long remaining runway.

…for everyone who stays in Airbnb, somewhere around 8 or 9 people stay in hotels. And when you ask people, why are you staying in a hotel? Airbnb is typically more affordable. It’s a more local experience. It’s much better for groups and families. People say yes, but hotels are historically a more consistent experience. And so if we can just get one of those travelers from hotels to stay in Airbnb, that would double the size of our business to a billion nights a year.

Airbnb has introduced over 430 features to the platform to improve the product’s reliability and improve its affordability vs hotels. The company’s average daily rate, which measures the cost of one night in a one-bedroom room, was $114 in March vs. a hotel average of $148. As previously mentioned, Airbnb pruned several thousand listings to improve the quality of its inventory and still managed to grow overall supply 15%. Even though the growth of supply has outpaced demand recently, the dynamic improves the affordability of Airbnb which would lead to demand catching up again all else equal.

Airbnb’s supply-focused model also carries a somewhat hidden asset in unique inventory. Guests can stay almost anywhere and in almost any type of accommodation, which differentiates Airbnb from hotels which are closer to commodity status. This asset benefits Airbnb during special or local events where hotels might be sparse. The recent solar eclipse is just one example, where Airbnb accommodated 500k guests in mostly rural areas.

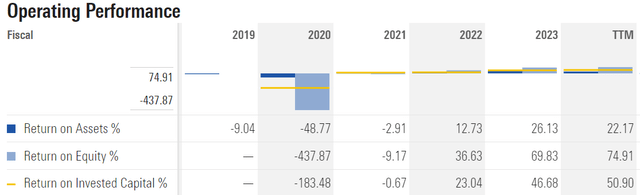

Airbnb’s brand recognition is hard to overlook as another competitive advantage, of which management is seeking to leverage by expanding beyond the core. We’re seeing the early innings of Airbnb ‘reinventing’ itself as it continues to perfect its core service, but its potential is compelling. The company released a product called ‘Icons’ which allows guests to book one-of-a-kind experiences with celebrities. Another opportunity is the recent acquisition of GamePlanner.AI with the goal of implementing generative AI into the Airbnb platform for a concierge-type experience. Airbnb’s massive host and guest network also gives it unique data to work with in this area. Lastly, the company has invested in locally placed marketing teams within various underpenetrated markets to further expand the brand’s international footprint. Airbnb’s brand is also underscored by a marketing strategy that relies mostly on word-of-mouth. The Airbnb app is continually number one in travel and 90% of Airbnb’s online traffic is direct or unpaid – allowing for a cheap way to continue scaling. From the financial side, management wants to maintain a 35% adjusted EBITDA margin while keeping up investment in these areas, and a cash pile of $11B gives them plenty of dry powder to use. This focus on profitable growth is attractive to me as an investor, especially as returns on capital have widened over the past two years:

Ultimately, Airbnb’s core model and brand is one of high quality and provides a nice foundation to expand into new verticals for continued growth, and management has the right balance of growth and profitability to drive long-term shareholder returns.

Risks & Uncertainty

Macroeconomic uncertainty continues to be a near-term risk for Airbnb, albeit a minimal one in my view. Inflation has shown some persistence and economic growth has cooled some, but consumer spending and corporate earnings remain resilient. Consumer sentiment, however, has dipped, and household savings have shrunk since the pandemic stimulus presenting a potential can be a headwind for travel demand. Yet, many consumers are opting for experiences over goods according to US Bank, playing to Airbnb. The company has shown durability in the past and $11B in cash is a good buffer against external risks.

Valuation

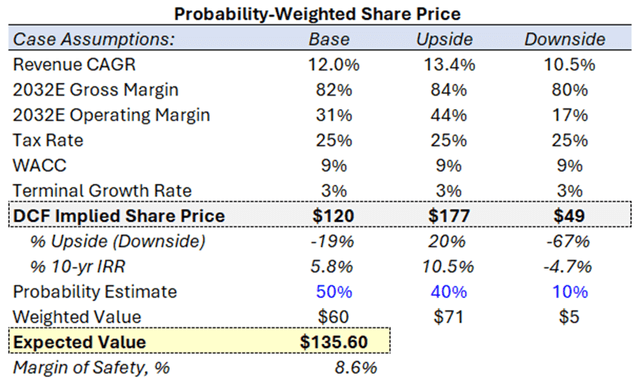

I forecasted Airbnb’s financial statements and free cash flows as inputs for a DCF valuation. My base case holds revenues growing at a 10-year CAGR of 12% as the company doubles down on ‘expanding beyond the core’. I expect the company to maintain high gross margins in the low 80s thanks to its proven pricing power. My base case also holds that operating margins will continue to expand from the low 20s to the low 30s by 2032, driven by cost disciplines and a scalable business model. Additionally, I expect fixed and working capital investment will moderate as the company continues to mature. As shown below, Airbnb is a very capital-light business.

- Capex at 0.2% of revenues.

- Depreciation & Amortization averaging 0.2% of total assets.

- Change in Net Working Capital averaging 1.2% of revenues.

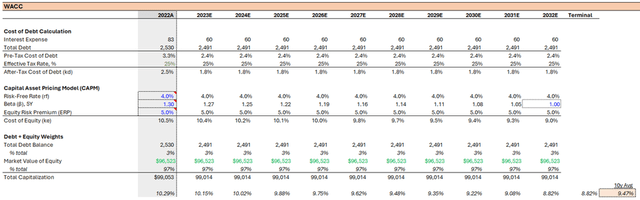

I estimated a long-term WACC and terminal growth rate of 9% and 3%. I expect WACC to fall slightly over time as Airbnb continues to mature, causing its beta to fall closer to a market beta of 1. Here are my calculations:

Lastly, I introduced an upside and downside case and assigned probabilities to each. This allows us to test a range of assumptions and estimate the likelihood of potential outcomes. Additionally, I assigned a probability to each case, with the heaviest weight given to my base case. As you can see from the below results, each case has wide variability in implied share price but an expected value about 9% below the current price – meaning Airbnb is slightly overvalued.

Conclusion

Airbnb’s differentiated business model, competitive moats, and future growth potential continue to keep it on my ‘to-Buy’ list, but I rate it a hold given its current valuation. Its premium valuation sets a high bar for growth and margins to justify the price, keeping me on the sidelines for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.