Summary:

- Both Airbnb and Booking are leading travel booking companies with strong brands and competitive advantages.

- While Booking is the bigger company, Airbnb is mounting a formidable challenge, and has also entered the hotel booking business.

- Mostly based on valuation, we had previously favored Booking over Airbnb. Things are less obvious now that the valuation of both companies are much closer.

AJ_Watt/E+ via Getty Images

Booking Holdings (NASDAQ:BKNG) has long been the dominant player in the online travel industry. With a portfolio of well-known brands, including Booking.com, Kayak, and Agoda, the company has a commanding presence in the travel market. However, Airbnb (NASDAQ:ABNB), the home-sharing platform that has disrupted the traditional hotel industry, has recently made a push to expand its presence in the broader travel market. The question on many investors’ minds is whether Airbnb can take the travel crown from Booking Holdings.

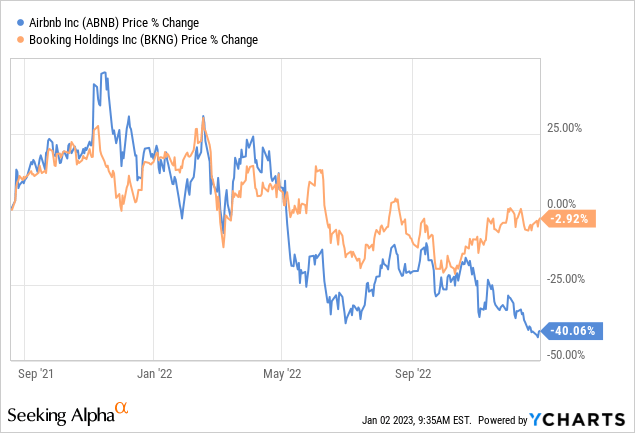

In the past, we favored investing in Booking over Airbnb, mostly due to a more attractive valuation. Since then, Booking shares outperformed Airbnb, and now it is time to reconsider if maybe a switch to Airbnb is warranted.

Competitive Advantages

To understand the potential for Airbnb to overtake Booking Holdings, it’s important to consider the strengths and weaknesses of both companies. On the one hand, Booking Holdings has strong brands and a massive customer base. Booking Holdings has a diversified portfolio of brands that cater to a variety of different segments, including luxury travelers, budget travelers, and business travelers. On the other hand, Airbnb has a number of strengths that could give it an edge over Booking Holdings. Airbnb has a much larger inventory of properties available for booking. This gives it a wider range of options for travelers and makes it easier for the company to capture a larger share of the market. The company has also made a number of strategic acquisitions, including Luxury Retreats and HotelTonight, that have helped to expand its reach in the travel market.

In terms of competitive moats, both share similarities in that both companies benefit from network effects, economies of scale, and intangible assets. The network effects are the result of both companies being two-sided marketplaces, with travelers on one side and accommodation providers on the other. Travelers will tend to go to the platform with most accommodation options, while property owners will prioritize listing in the platform with the most travelers. Two successfully operate their type of business, scale is critical, which makes it incredibly hard for small companies to compete with them. Finally, their strong brands, app, user interfaces, and technology strongly differentiate both companies from smaller players.

Financials

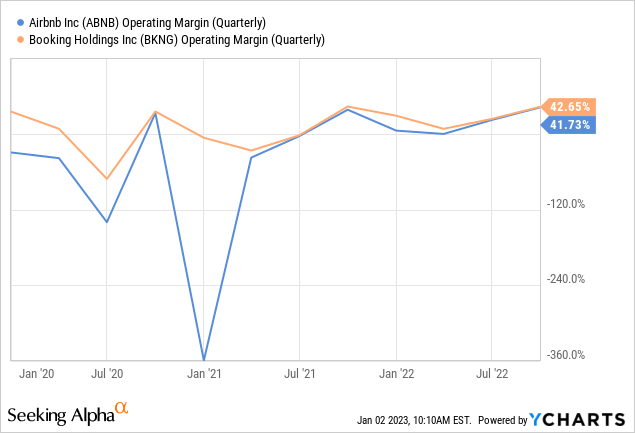

Given their strong competitive moats, it is therefore no surprise that both companies benefit from terrific financials. Both currently have operating margins above 40%, which is a level that few companies manage to exceed.

Growth

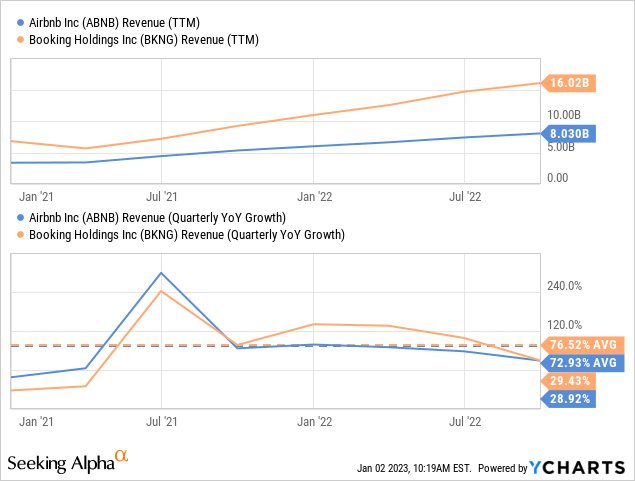

Booking remains by a wide margin the bigger company in terms of revenue, and since both are growing at relatively similar rates it will take a long time for Airbnb to pass Booking, if it ever manages to do so. In that sense, Booking’s crown is safe for now.

There are reasons to believe that Airbnb’s growth could manage to accelerate past Booking’s growth rate, however. For example, Airbnb has been very focused on the US market, and if it replicates its success outside the US, it could turbo-charge growth. Its new focus on longer stays is also promising, as well as its diversification into luxury accommodation, boutique hotels, and experiences. That said, Booking is fighting back and is also getting into the alternative accommodation space.

Balance Sheets

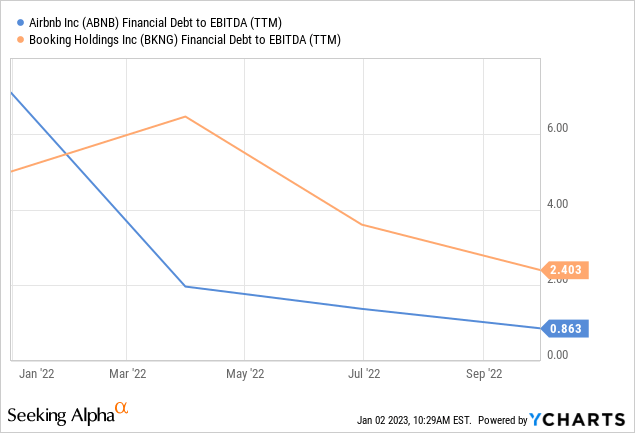

Both companies have strong balance sheets with plenty of liquidity and billions in cash and short-term investments. Airbnb has significantly less leverage, given that it has considerably less total long-term debt.

Valuation

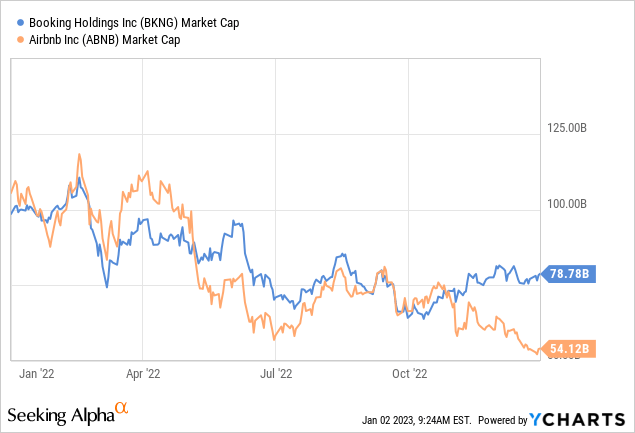

Through a combination of a lower share price, and improved profitability, Airbnb’s valuation has become a lot more reasonable. Booking now has a higher market cap compared to Airbnb, but in terms of valuation, they are both trading at relatively similar multiples.

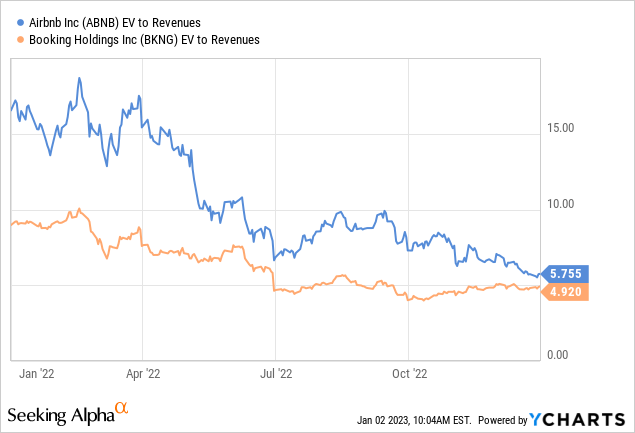

For example, looking at EV/Revenues, they are both trading very close to a 5x multiple. Airbnb’s valuation has compressed significantly, given that it was trading closer to an EV/Revenues of ~15x a year ago.

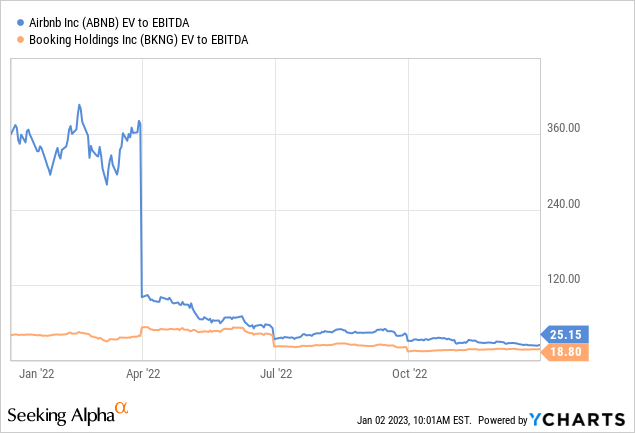

The EV/EBITDA multiple has been converging for both companies as well, with Airbnb at ~25x and Booking at ~18x. These may seem like relatively high multiples, but given the expected earnings growth for both companies, they are still within a reasonable level.

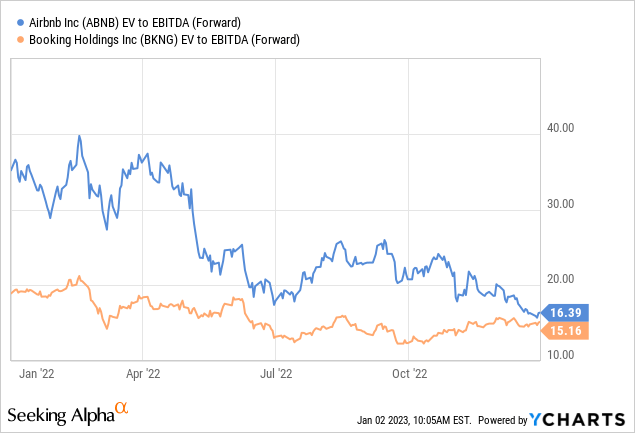

Looking at the forward EV/EBITDA, the multiples are even closer to each other, with Airbnb at ~16x and Booking at ~15x. We can therefore conclude that valuation is no longer the main factor to decide on which company to invest in, and that other aspects of the business should be given a lot more weight when making a decision.

Risks

Airbnb still faces a number of challenges as it looks to take the travel crown from Booking Holdings. One major challenge is the issue of trust. Some travelers are still hesitant to book a property on Airbnb, due to concerns about the quality and safety of the accommodations. Both companies also face regulation risks, but these are more important for Airbnb given its bigger focus on alternative accommodations. Another important risk is that of new travel restrictions, which had an enormous impact during the Covid lock-downs.

Conclusion

Last time we compared Airbnb and Booking, it was clear that Booking’s valuation was significantly more attractive. This time around, the valuations for both companies are quite similar, and deciding on which one to choose will depend more on other factors. Booking remains the larger company in terms of revenue, and given the relatively similar growth rates, it looks like it will retain its travel crown for still some time. We believe there are some reasons that might help Airbnb’s growth accelerate past Booking’s, and that is why we would now favor Airbnb shares. That said, it is a very close call, and we believe investors will probably do well with both in the long-term. Airbnb and Booking Holdings are both high-quality platform businesses that will likely continue to benefit from the increase in online travel bookings and both are likely to continue being key players in shaping the future of travel.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.