Summary:

- Amazon continues to operate as the market leader in almost all business segments the company pursues.

- Strong profit generation from its AWS subsidiary should provide for significant future cashflow diversification.

- Difficult retail environment hurting e-commerce profitability.

- Damaged fiscal margins have not compromised an outstanding business model and operations structure.

- Low share-price and negative market sentiment have led to a great opportunity for long-term value investors.

We Are

Investment Thesis

Amazon.com Inc (NASDAQ:AMZN) is a global name in e-commerce and cloud server technologies. Its operational prowess and devotion to ensuring an excellent customer experience has allowed the firm to operate on a truly unimaginable scale.

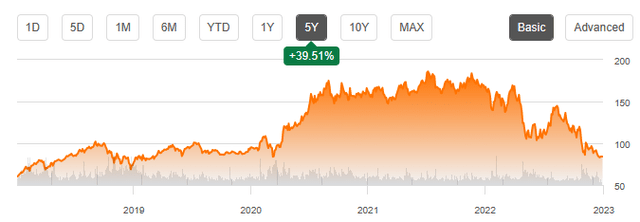

Historically high share valuations combined with negative macroeconomic conditions have led to a mass sell-off which has seen the firm’s stock price drop more than 50% YoY.

This leaves the company in a potentially attractive place for long-term value investors who seek to understand what true future cashflow generation is in store at Amazon.

Company Background

Amazon.com

Amazon is an American e-commerce and cloud/web service provider which dominates almost every market in which they operate. Their economic and social influence is realized across the globe through various business segments which give the company significant breadth and economic moat.

The bulk of Amazon’s revenues arise from their e-commerce sales with Amazon Web Services (AWS) being their second primary source of sales. Significant revenues are also realized through their Prime subscription service and through their offering of digital advertising solutions.

The immense scale on which Amazon operate has allowed the company to develop an ingrained presence in the lives of most Americans and Europeans.

The breadth of services offered by the firm makes it almost impossible for the average person to live their life without benefitting from Amazon related products or services in one way or another.

Recent bearish sentiments towards the firm combined with a significant previous overvaluation of the firms’ shares have left the company’s stock in ruins. After posting a YoY loss of -50%, could it finally be time to build a position in the mega-moat company that is Amazon?

Economic Moat – In Depth Analysis

Amazon has been the market leader in e-commerce services in most western nations for a good portion of the past two decades. Their continued innovation in the sector and focus on providing customers with great value has allowed the firm to remain the flagship store most consumers pivot to when purchasing products online.

Amazon harbors a true mega-moat status as their breadth of services and product offerings create significant long-term value opportunities for the company.

This huge economic moat is primarily built upon their e-commerce prowess and their market leading AWS digital services provisions.

Amazon.co.uk

When analyzing Amazon’s e-commerce segment, it is undeniable that they are the market leader. Approximately 50% of all products sold on Amazon are sold by their own fulfillment services. Amazon also allows third-party retailers to list items for sale on their e-commerce website thereafter taking a commission fee when their products sell.

This diversified approach to product listings has allowed Amazon to generate a truly incomprehensible catalogue of items which provides consumers with the most holistic and extensive shopping experience possible.

It is exactly this approach to offering customers the possibility to purchase almost anything at the click of a button which has propelled Amazon ahead of its brick-and-mortar competitors. Consumers and humans in general seek to find the simplest method of achieving a goal or desire. Amazon’s e-commerce business offers just that.

Whole Foods Market

The lack of physical store-space to manage and sales personnel to employ allows Amazon to sell the same products as brick-and-mortar competitors but at a lower price. Furthermore, their controlled expansion into physical retail outlets (particularly with the Whole Foods brand) is allowing the company to recognize the growing importance of omnichannel supply networks.

In 2019, Amazon surpassed Walmart (WMT) as the world’s largest retailer. The huge scale on which Amazon operates their e-commerce business has allowed the firm to take advantage of significant economies of scale in their operations.

These efficiencies are realized across their entire operations structure all the way from their server capacities to the unit economics of purchasing delivery vehicles.

Quite simply, Amazon continues to exhibit an operational masterclass delivering close to 8 billion packages annually. This absolutely earns their core e-commerce business the status of a wide moat.

Amazon Prime US

Furthermore, Amazon complements this business with their Prime membership subscription model. With Prime, customers have access to faster and free shipping with their purchases, as well as a video and gaming streaming service. Prime currently costs $14.99/month or $139/year in the US, with European pricing varying around the €8.99/month or €89/year mark.

Prime offers significant benefits to users and further ties consumers into the Amazon ecosystem. By being a subscriber, consumers also have access to more features in other smart-devices offered by Amazon such as their Alexa smart-home hubs or Kindle e-reader tablets.

Amazon Prime Webpage

This integration into consumer lifestyles makes cancelling the subscription service psychologically difficult for customers which helps Amazon develop an even deeper-moatiness for their business.

While the fiscal merits of Prime video warrant an entirely separate article of its own, from a moat perspective it undoubtably adds value to the Prime ecosystem. The platform has significant power in attracting new customers to the service through exclusive shows and movies.

The significant revenues and earnings generated by Amazon’s e-commerce business has allowed the firm to devote significant resources towards R&D.

Their strategy of “innovating on-behalf of the customer” entails generating new concepts, services and product offerings which improve the experience for a consumer, perhaps even without the consumer knowing they needed such an improvement.

Amazon.com | About

Such innovations in delivery vehicles, route selections, cloud-server infrastructure and website design further help to drive Amazon’s profitability. It also helps to further differentiate Amazon as an e-commerce site making their concept and execution even more difficult for rivals to mimic.

AWS is another significant source of moatiness and profitability for the company. This subsidiary of Amazon provides on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered, pay-as-you-go basis.

Amazon | AWS

Amazon essentially created the concept of enterprise cloud computing infrastructure-as-a-service. By being first to the market and through continued technological innovations, Amazon has outpaced fierce rivals such as Microsoft’s Azure product to become the outright leaders in the segment.

Once again, through offering a great product to enterprise level consumers, AWS has managed to obtain many high-profile clients such as Disney, Samsung, and The Vanguard Group.

The product of AWS pay-as-you-go cloud infrastructure presents companies with the opportunity to significantly reduce their own IT departments complexities. This incentivizes organizations to adopt AWS technologies.

Once incorporated in the AWS network, it would be almost prohibitively complex for a company to switch to a different product such as Azure by Microsoft or Google Cloud. Furthermore, firms with significant online media presence who rely on AWS would risk potential disruptions to consumer user experiences if issues were faced during a change in provider.

Therefore, it is absolutely evident that AWS generates a significant moat for Amazon thanks to its innovative product offering and high user switching costs. This is exhibited through AWS generating almost 60% of total profit in FY21.

Finally, it is worth briefly discussing Amazon’s advertising business. While the firm discloses little information about the business segment, it continues to grow at a rapid pace.

When the concept of digital advertising is combined with AWS technologies and the vast databases of consumer habits and preferences generated by their e-commerce platform, the opportunity for future value generation is clear.

Whether or not Amazon will pursue this segment as aggressively as AWS did with cloud-infrastructure services is yet to be seen. However, an expansion in their digital advertising business would act to increase the breadth of Amazon’s already hyper-expansive economic moat.

Financial Situation

Amazon has been a hugely profitable firm for much of their existence. Their consistent EBITDA margins of 12% combined with a 10Y average ROIC of 12.7% are just the first indicators of the profit generating prowess the company holds.

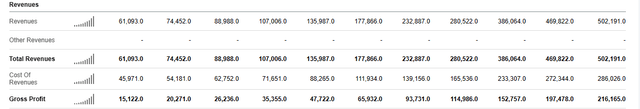

Seeking Alpha | AMZN | Financials

In FY21 Amazon generated revenues of $469B with YTD totals amount to over $500B. Their 2021 figures represented a growth rate of 21% compared to the previous year with current estimates showing FY22 values to be growing at around 7-10%.

While this growth rate has slowed slightly, the guidance for FY22 incorporates a 460 basis point hit due to foreign exchange rate impacts, something not even Amazon is able to shy away from. Furthermore, a softer than expected Christmas shopping season is expected to slightly impact total sales.

Amazon Investor Relations

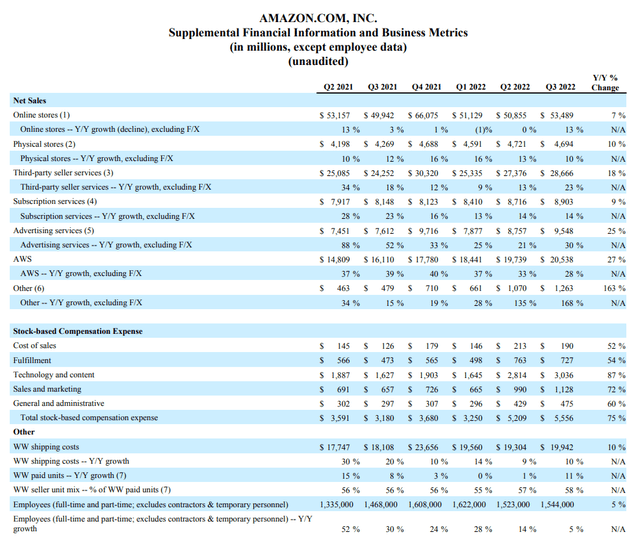

Approximately 67% of Amazon’s revenues are sourced from their e-commerce operations with around 47% of those sales coming from third-party commissions and fees. Growth in Q3 of FY22 compared to FY21 has slowed with little growth being realized in their e-commerce segment.

Given the difficult macroeconomic environment and the continuing strains rising interest rates and inflation have placed on consumers, I do no find this plateauing in growth alarming. While it is not the ideal news shareholders would have liked to see, it is not a sign of Amazon struggling with their business operations.

The primary element responsible for Amazon’s total revenue growth this year is the continued strength of their AWS subsidiary which has seen FY22 Q3 growth of 25% compared to the same period last year. This growth rate is replicated approximately across each quarter.

Amazon continues to excel in promoting and executing their cloud-infrastructure as-a-service product. AWS’s operating margins as a % of net sales for the first three quarters of FY22 averages at approximately 31%. Most of AWS revenue streams are also tied-up in long-term contracts which have a weighted average remaining life of 3.8 years.

This is welcomed news for the already profitable AWS segment as it guarantees a certain level of future returns.

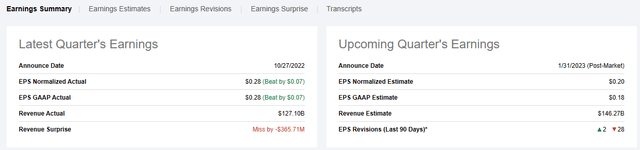

Seeking Alpha | AMZN | Earnings

EPS for Q3 beat consensus estimates by $0.07 representing a GAAP actual value of $0.28/share. While revenue surprise missed estimates by -$365M, this was once more primarily due to softening consumer spending.

Estimates for future EPS growth moving into 2030 predict YoY growth to be around 35%. Equally, while revenue growth is expected to be soft moving into 2023, the average YoY growth rates of approximately 13% will most likely return moving into 2024.

Of course, it is also important to note that should the expected 2023 recession be avoided, it is widely expected that technology and consumer discretionary stocks should bounce back with rapid force as spending picks up once more.

Even if the recession does arise, Amazon’s incredibly broad reach across varying markets should allow the company to remain competitive and profitable throughout.

From an overall profitability perspective, Amazon has not managed to generate the same growth in FY22 as they have seen in FY21 or the previous 10 years as a whole. Nonetheless, their business model remains sound and their revenue dependency on the cyclical e-commerce segment is decreasing each quarter thanks to the stellar growth of AWS and their advertising business.

While CAPEX was incredibly high in 2020 and 2021 to ensure their delivery network could match the incredible levels of demand, such exuberant spending is not expected to continue into the future.

It is equally important to note that this spending was not reckless and has allowed Amazon to build a truly first-class delivery network which takes advantage of vertical integration to reduce costs.

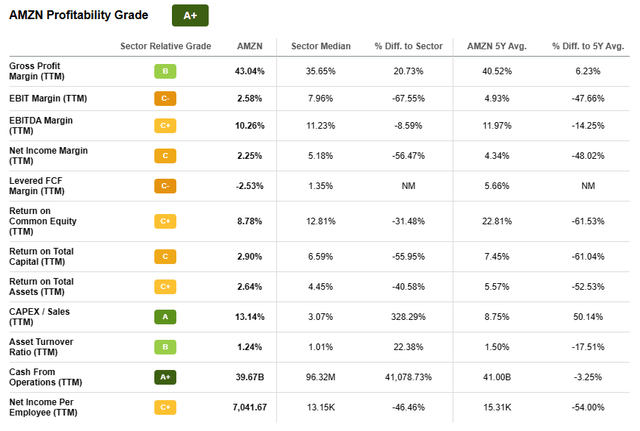

Seeking Alpha | AMZN | Profitability

This fundamental solidity in their operations models and continued profitability has earned the company an A+ Profitability rating by Seeking Alpha’s Quant. Nonetheless, I await the FY22 results to consolidate this year’s performance for the firm and to better gauge what FY23 holds for the company from a management perspective.

Amazon’s balance sheet looks to be in relatively healthy shape much akin to their income statement. Their total current assets for the TTM are $131.4B while current liabilities amount to $140.4B. This mean their debt/equity ratio is 0.93.

Their quick ratio (current assets minus inventory divided by current liabilities) is just 0.68.

While these fiscal stability metrics might indicate that Amazon technically faces illiquidity, the possibility of a scenario arising where this becomes an issue is incredibly minute.

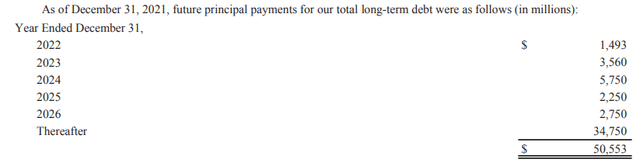

Amazon Investor Relations | FY21 Report

Amazon also has $48.7B in long-term debt as of December 31, 2021. By 2026, only $15.3B will be maturing. However, a large portion of their debts are on variable rates which has left Amazon particularly vulnerable towards the high interest rates currently prevailing in the economy.

Nonetheless, Amazon’s management has shown significant fiscal restraint to be deemed as having a stable financial status. Furthermore, the recent uptick in long-term debt by almost $10B is largely due to the firm increasing delivery capacity by over 50% as a reaction to the post-pandemic demand boom.

Therefore, it is safe to say the company’s balance sheets and overall liquidity do not raise any concerns, although they don’t raise any merits either.

Valuation

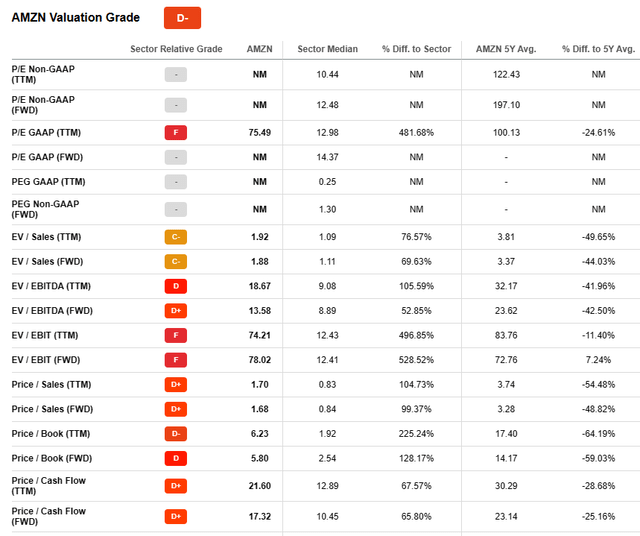

Seeking Alpha | AMZN | Valuation

Seeking Alpha’s quant assigns a D- Valuation rating for Amazon, which I find to be a rather pessimistic perspective given their current share price and company value. The firm is currently trading for historically low P/E ratios of 76.46 and an equally low P/CF ratio of 21.69.

Furthermore, with their revenues continuing to grow and a stable net margin of around 4.3%, I believe the share price fails to reflect the true value of Amazon’s business.

Seeking Alpha | AMZN | Summary

From an absolute perspective, Amazon shares are now cheaper than they were during the pandemic crash of 2020. The last time stable stock prices for the firm were around the $84 mark was back in 2018. At the time, revenues were less than half of those experienced in 2022.

The future for Amazon’s revenue streams looks increasingly positive as the firm is able to increase the revenues and profits generated by their AWS subsidiary. Significant investment into key supply network infrastructure should also allow Amazon to unlock increased operating margins in their e-commerce business too.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock will continue to exhibit some bearish tendencies moving towards the first quarter of FY23. However, thereafter much depends on the macroeconomic conditions and the ability of the US and Global economies to achieve a soft landing on inflation.

In the long-term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique industry knowledge combined with the potential for significant future growth places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

From a pure value perspective, it is absolutely possible to argue a historic undervaluation is present in Amazon. The negative sentiment currently present in the marketplace is largely unfounded and rooted in outdated information and speculation.

Risks Facing Amazon

The primary risks facing Amazon arise from the risk of failed execution of future innovations and development strategies. The company must continue to innovate market-leading products while expanding both their online and physical commerce businesses to ensure the competition is not given the opportunity to catch-up.

From an ESG perspective, Amazon must ensure their employees are better protected moving into the future to avoid negative social sentiment towards the company. Recent allegations of worker mistreatment and poor employment conditions have placed the company in hot water with pro-union social groups.

Mass-scale unionization of their warehouse and delivery workforce could harm short-term operating margins as wages and salaries would most likely increase. However, the long-term benefits of a workforce content with their positions would undoubtedly result in increased operational efficiencies.

Amazon’s current turnover rate for their delivery staff of eight months is incredibly short and suggests something is amiss in their employee management style. This could mean future hiring may become more difficult as the firm could fail to attract a younger, more socially conscious workforce.

AWS also harbors some more unique risks for Amazon due to the incredible amounts of data their servers process both on individual shoppers and their commercial customers. Ensuring the possibility of a cyber-security breach is mitigated should remain a top priority for the firm.

Summary

Amazon has had an incredibly impressive history from an investor standpoint. Their robust business fundamentals, borderline monopolistic foothold in the e-commerce segment combined with the capital necessary for significant growth has placed the company in an attractive position for potential investors.

Current share prices have left the company trading at a relative undervaluation to the company’s past and expected future value. The promise of strong cashflow generation combined with a diversified revenue generation portfolio should mean significant returns are on the horizon.

As a short-term investment, I believe there is some volatility in-store for the stock as negative sentiment combined with tricky macroeconomic conditions continue to dominate the marketplace. However, in the long-term I believe their undeniable position as a market leader places Amazon in the perfect position for a much-awaited rebound.

I will most likely begin building my position in Amazon once share prices hit the $82 mark. If you are looking for a blue-chip stock trading at discount prices, Amazon might just be a pretty good choice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.