Summary:

- Airbnb’s stock has experienced a recent dip along with other tech stocks, but there is potential for further upside.

- The company has shown strong growth in travel demand and profitability, and has expanded its offerings to appeal to a wider range of customers.

- Airbnb is well-positioned to benefit from pent-up travel demand, the rise of digital nomads, and the opportunity to compete against high-fee OTA giants.

- Profitability is soaring as double-digit bookings growth is layered on top of pandemic-era cost cuts.

Johnce/E+ via Getty Images

Like most tech stocks over the past month, Airbnb (NASDAQ:ABNB) has lost some of the wind in its sails as interest rate expectations have continued to creep up. And while it’s difficult to justify investing in barely-profitable tech stocks when risk-free interest rates are yielding 5%, it’s also a great time to consider selectively buying into high-quality, long-term growth names while they’re suffering from recent dips.

Even after its recent fall, shares of Airbnb are up more than 60% on the year: in spite of this, I think there’s further upside ahead.

I wrote a bullish note on Airbnb last quarter when the stock was trading in the mid-$150s. Since then, a number of things have occurred. First, notably, the stock has fallen in sympathy with other tech names. Second, Airbnb notched the distinction of being added to the S&P 500 in mid-September, which provided a temporary kick to its shares. And the company also released strong second-quarter results, which showed continued growth in travel demand and huge gains to Airbnb’s bottom line.

I also like the fact that the company has continued to boost listing diversification efforts to appeal to a wider array of customers. Airbnb Rooms (launched in May 2023) is an example of this, offering lower-priced rooms in houses which is more in keeping with the original spirit of the product. The company is also bolstering its pool of long-term stays, as more and more people are staying in Airbnbs for weeks at a time.

As a reminder for investors who are newer to Airbnb, here is my full long-term bull case on the stock:

-

Pent-up travel demand – As people get back into the swing of travel, Airbnb is well-positioned to absorb that demand and gain market share, thanks to its growing pool of hosts, its broader network of availability in different regions, and its various “Experiences” offerings.

-

Airbnb may not just be for vacation anymore – With so many companies announcing permanent remote or hybrid work structures, many workers have leaped at the chance to become digital nomads and work from anywhere. In the spirit of this trend, even Airbnb itself has also announced that it is allowing its staff to work from any location (including up to 90 days internationally, limited for tax purposes). This trend may see Airbnb picking up not just travel demand, but essentially “rent” budgets from digital nomads as well. As a result of this trend, average trip lengths are increasing quite substantially.

-

Chance to absorb hotel business through promoted listings – It’s not a great time to be in the hotel game right now. After facing two years of heightened vacancy, hotels have always dealt with high third-party booking fees through platforms like Expedia (EXPE) and Booking (BKNG). Airbnb already allows boutique hotels to list on its platform for a fee; over time, Airbnb could fully throw its hat in the ring to compete against the high-fee OTA giants.

-

Profitability in mind – During the immediate aftermath of the pandemic, Airbnb laid off about 20% of its staff. While it is now continuing to hire, this profit-centric mindset and the fact that Airbnb is structurally leaner than it was pre-pandemic has allowed the company to make sizable profitability gains.

Stay long here and use the dip as a buying opportunity.

Q2 download

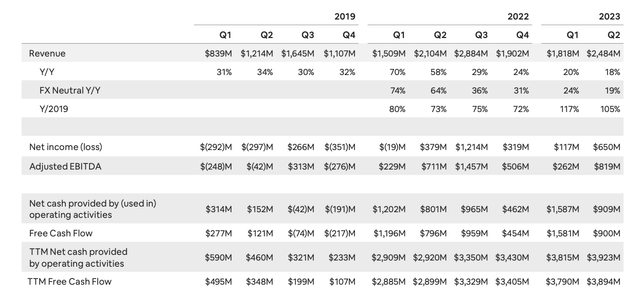

Let’s now go through Airbnb’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Airbnb Q2 highlights (Airbnb Q2 earnings release)

As can be seen in the snapshot above, Airbnb’s revenue grew 18% y/y to $2.48 billion in the quarter, a record for the company and beating Wall Street’s expectations of $2.42 billion (+15% y/y). Note that revenue growth is compressing sequentially (from an FX neutral standpoint) largely as Airbnb starts to comp the resurgence of travel demand last year.

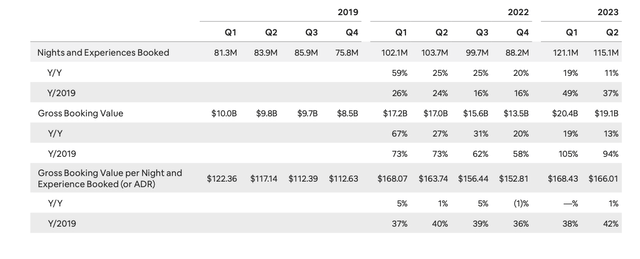

Room night bookings grew 11% y/y to 115.1 million. ADRs, meanwhile, are still rising (+1% y/y to $166.01) but seems to have found a near-term ceiling as travel prices (across airfare plus lodging) are at record highs and consumers feel the pinch in their wallets.

Airbnb booking metrics (Airbnb Q2 earnings release)

One of the company’s core strategies to pursue growth is by encouraging supply expansion, as well as diversification (such as into lower-priced Airbnb Rooms and into longer-term stays with discounts for stays over 28 days). The company has also invested into new pricing tools to help Hosts set an optimal daily rate. Per CEO Brian Chesky’s remarks on the Q2 earnings call:

In Q2, supply growth is 19% year-over-year, and this is actually up from 18% in Q1. In fact, in every quarter since we’ve gone public, we’ve seen an acceleration in total active listings growth. And we’re continuing to see strong supply growth across all regions, all market types, and all price points.

In fact, we added a record number of new listings in Q2, and we ended the quarter with more than seven million total active listings. Second, we’re perfecting our core service. We want people to love our service, and that means obsessing over every detail. Millions of people have given us feedback on how to improve Airbnb. We’ve listened. On May 3rd, we introduced over 50 new features and upgrades as part of our 2023 summer release.

Now many of these new features and upgrades were aimed at addressing affordability, starting with new pricing tools for hosts. Hosts told us that our pricing tools are difficult to use. So we redesigned our tools, and we made it easier for hosts to add discounts and promotions. They also told us that they had trouble setting competitive prices. So we added a new feature called similar listings to help them see listings in their area so they know what to charge. Now we received very positive feedback from our hosts, and the changes are already having an impact. Hosts have started lowering their prices, and with more of them offering weekly and monthly discounts. And as more hosts adopt these tools, we believe we’ll be able to drive greater affordability and value for guests.”

On the profitability front, the combination of double-digit top line growth plus sharp headcount reductions have led Airbnb to generate record Q2 profitability. The company hit a GAAP net income of $650 million (or $0.98 diluted EPS per share, beating Wall Street’s $0.78 expectations with 26% upside).

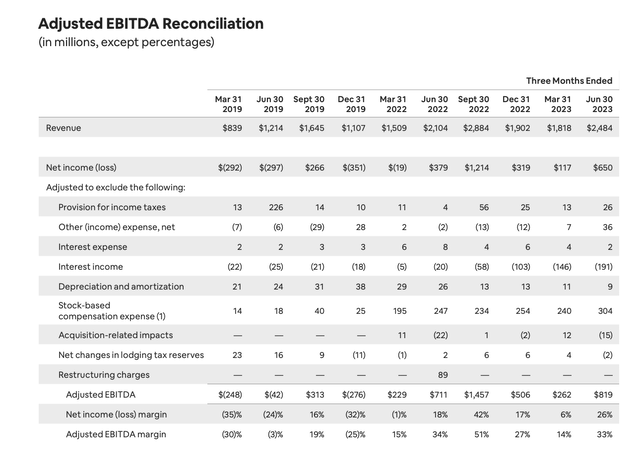

It also drove 15% y/y growth in adjusted EBITDA to $819 million, another Q2 record for the company and representing a rich 33% margin:

Airbnb adjusted EBITDA (Airbnb Q2 earnings release)

Key takeaways

There are a lot of things to like about Airbnb: record bookings, supply growth and diversification, ongoing expense management efforts, and soaring profitability, not to mention secular tailwinds supporting Airbnb’s business ranging from “work from anywhere” to increased frequency and consumer wallet share attributed to travel. Stay long here and use the dip as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.