Summary:

- A.O. Smith Corporation’s revenue is expected to benefit from channel inventory normalization and the reopening of the Chinese economy.

- A.O. Smith has good long-term growth opportunities in the Indian market and is well-positioned to benefit from sustainability trends in the water heater industry.

- Valuation is reasonable.

Kameleon007

Investment Thesis

A.O. Smith Corporation’s (NYSE:AOS) revenue is poised to benefit from channel inventory normalization and easier Y/Y comparisons in the second half of 2023. In addition, the company’s revenue should also benefit as the Chinese economic reopening continues to gain momentum. The medium to long-term outlook also looks attractive, with benefits from secular trends towards high-efficiency and sustainable solutions in the water heater industry and long-term growth opportunities in the Indian market.

On the margin front, while there is some sequential pressure on margins due to higher steel prices in the back half, the company should be able to post Y/Y margin expansion considering the sales recovery in the 2H FY23. In the medium to long term, the margins should benefit from operating leverage from sales growth and cost-cutting measures. AOS’s stock valuation is also attractive, with it trading lower than its 5-year historical average. This, coupled with good growth prospects, makes AOS a buy.

Revenue Analysis and Outlook

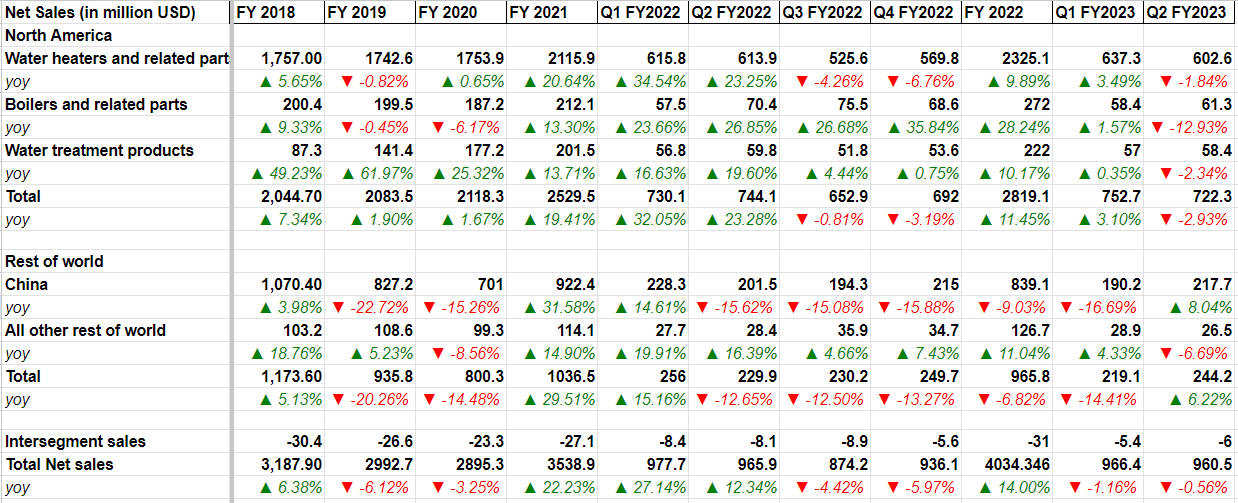

After seeing good growth in FY21 and early FY22, the company’s sales growth was impacted by weakening macroeconomic conditions and inventory destocking in the back half of FY22 and early 2023.

In the second quarter of 2023, AOS faced challenges due to elevated inventory levels of residential and commercial boilers as well as warmer-than-normal winter, resulting in a ~3% Y/Y decline in North America segment sales. However, the rest of the world segment (including China, India and Europe) saw sales increase by ~6% Y/Y to $244 mn. This was driven by strong demand in China as the economic reopening is gaining momentum. The company’s sales in both China and India were up 15% Y/Y in local currency. On a consolidated basis, AOS’s sales growth declined ~0.56% Y/Y in Q2 FY23.

AOS’ Historical Sales (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s growth prospects thanks to the channel inventory normalizing, easing comps, international growth opportunity, and a healthy balance sheet which should enable the company to pursue M&A opportunities.

In response to slowing demand, the company’s channel partners (dealers/distributors, retailers) started reducing their inventory levels starting in the back half of the last year. After four quarters of destocking, management mentioned on the last earnings call that the inventory levels were approaching normal levels at the end of Q2 2023. So, this should be one less headwind going forward.

Further, if we look at last fiscal year’s sales cadence, the Y/Y sales growth in Q1 FY22 and Q2 FY22 were up 27.14% and 12.34% respectively while sales in Q3 FY22 and Q4 FY22 were down 4.42% and 5.97%, respectively. So, Y/Y comparisons are much easier in the back half of this year and the company should return to year-over-year growth starting Q3 FY23.

The company should also benefit as the Chinese economy reopening continues to gain momentum. China accounts for the majority of the company’s international revenue, and the company has done a good job expanding its presence to even smaller towns and cities there. I believe the company’s execution in China combined with the recovery in end-market demand bodes well for its near to medium term growth prospects.

Another big international opportunity for the company is India. The company is in its initial phases of growth in the Indian market and the company is following a similar strategy to grow in this market as it has followed in China by expanding into Tier 1 and Tier 2 cities first and then penetrating to smaller towns and cities. While the company currently derives a relatively much smaller amount of sales from this market as compared to China, there is the potential for this market to contribute sales comparable to China in the medium to long term.

Further, as a leader in energy efficient water heater products, the company is well-poised to benefit from secular trends towards sustainability with countries across the globe increasing minimum efficiency standards for various products. For example, recently, the U.S. Department of Energy issued a proposal to raise minimum efficiency standards for residential water heaters which is expected to go into effect in 2029.

In addition to organic growth prospects, the company also has a healthy balance sheet, which should enable it to pursue bolt-on acquisitions. The company’s cash and cash equivalent and marketable securities were ~$410 mn at the end of the June quarter and long term debt was ~$196 mn giving it a net cash position of ~$204 mn.

Overall, the company’s near as well as long term sales growth prospects look attractive.

Margin Analysis and Outlook

Last year, the company’s margins were impacted due to supply chain constraints, higher material costs, and volume deleveraging in the second half of the year. However, with supply chain conditions and material costs easing, margins saw a nice rebound this year.

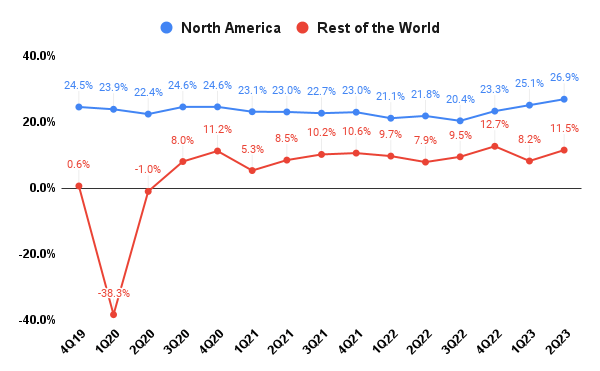

In Q2 FY23, the North American segment adjusted EBIT margin expanded by 510 bps Y/Y to 26.9% driven by improved price/cost. Additionally, the Rest of the World segment’s adjusted EBIT margin improved 370 bps Y/Y to 11.5% due to a sales recovery in the Chinese market.

AOS’ Adjusted segment EBIT margin (Company Data, GS Analytics Research)

Looking forward, the sequentially higher steel prices are a near-term headwind and management has guided for steel costs to be up ~20% in 2H FY23 compared to 1H FY23. This could adversely impact the price/cost relationship and the margins could sequentially decline in the back half. However, I am not too worried about it as it is just a short term headwind and the price/cost relationship should eventually adjust either by management raising prices or steel prices declining. Also, on a Y/Y basis, the company should still be able to grow margins given the sales recovery.

The medium to long term margin growth trajectory also looks good, helped by operating leverage from sales growth as well as management efforts to cut costs and drive production efficiency.

Valuation and Conclusion

AOS is currently trading at an 18.33x FY23 consensus EPS estimate of $3.60 and a 17.14x FY24 consensus EPS estimate of $3.85 which is lower than its 5-year average forward P/E of 21.44x. The company also has a good dividend yield of 1.82% and a history of increasing dividends regularly.

In 2H FY23, the company’s revenue should benefit from normalized channel inventory levels and easier Y/Y comps. Further, long-term growth opportunities in India, secular tailwinds from sustainability trends, and strategic M&A should drive revenue growth in the medium to long run. The margins should also benefit from operating leverage from sales growth in the long run. The company’s good long term growth prospects combined with its attractive valuation make AOS a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.