Summary:

- Airbnb is the king of online travel booking and has posted a blockbuster fourth quarter of 2022.

- Its revenue and earnings growth surpassed analyst estimates, with Q4 ’22 being the most profitable ever.

- Airbnb has bought back $1.5 billion worth of stock of its $2B share repurchase program. This is a positive sign for Airbnb, as it reduces the number of shares outstanding.

- Airbnb’s stock is undervalued intrinsically according to my discounted cash flow valuation model.

AJ_Watt

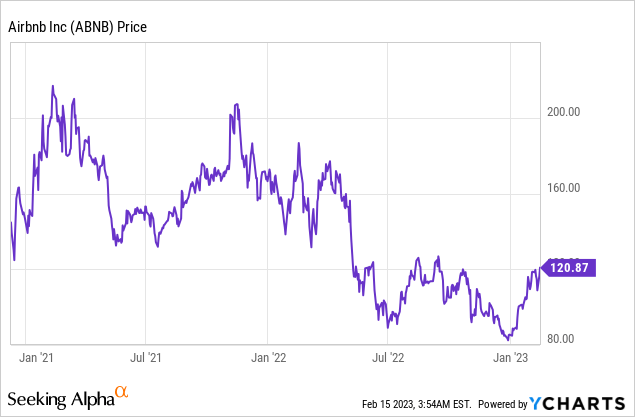

Airbnb (NASDAQ:ABNB) runs one of the world’s most popular tech based travel marketplaces. The company went through “death valley” in 2020, as travel was locked down, but it has since been resurrected in an exceptional manner. Airbnb reported strong financial results in the fourth quarter of 2022, as it beat both top and bottom line growth estimates, and boasted its first full year of GAAP profitability.

Airbnb also continued to grow its supply of listings by over 900,000 in 2022, making a total of a staggering 6.6 million. To put the scale of Airbnb into perspective. Hilton hotels has just over 7,000 properties globally, while Marriott has close to 8,000 properties. Now of course, we know Airbnb doesn’t actually own its properties, which is the positive part of its business model as it means it inventory can dynamically adjust to trends (city or rural trips) or even crisis (2020 pandemic). In addition, new properties don’t require capital investment and its inventory can continue to grow infinitely. In this post, I’m going to break down Airbnb’s Q4 earnings, the tailwinds and its valuation using my discounted cash flow model, let’s dive in.

Growing Financials

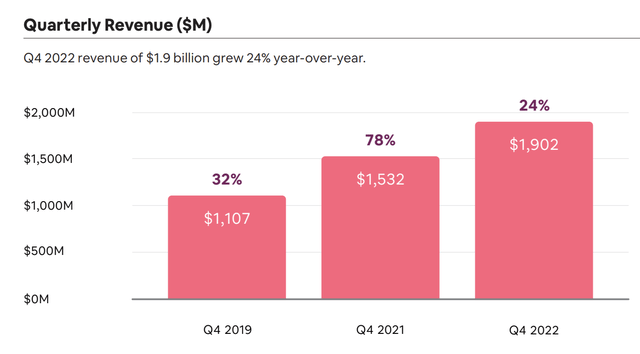

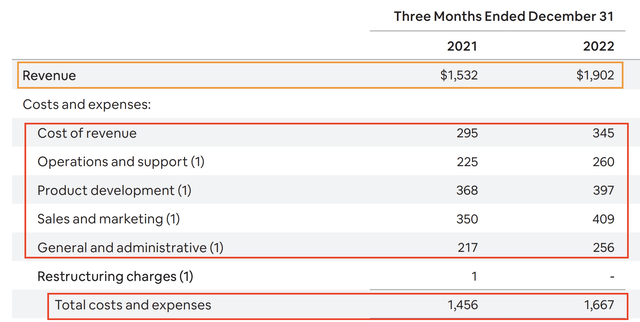

Airbnb reported strong financial results for the fourth quarter of 2022. Its revenue was $1.9 billion which rose by 24% year over year and beat analyst estimates by 2.2% (Google finance data). For the full year (which includes the peak travel season), Airbnb reported even faster growth of 40% year over year or 46% on an FX neutral basis to $8.4 billion.

Revenue (Q4,22 report)

This solid top line growth was driven by a record number of nights and experiences booked which totalled 88.2 million, up 20% year over year. This was driven by the strong demand across the travel sector as the economy continued to “reopen”. Taking a step back, in 2020 we know travel was locked down completely and many people traveled for the first time in both 2021 and 2022. Travel uncertainty was still abundant in 2021, with various restrictions in place, thus it does not surprise me that 2022 was a record year for Airbnb. The company also benefited from a travel habit changes over the past couple of years. For example, people began to travel more in their own country, in rural areas and discover new areas as a result. From my personal experience (in the U.K), I know many people who booked Airbnb’s inside rural huts, treehouses in their home country. Pre Pandemic this would have been extremely rare for U.K travellers, who are very international focused, but now it is has become the norm. However, Airbnb has now benefited from a “return to cities” and “cross border” travel.

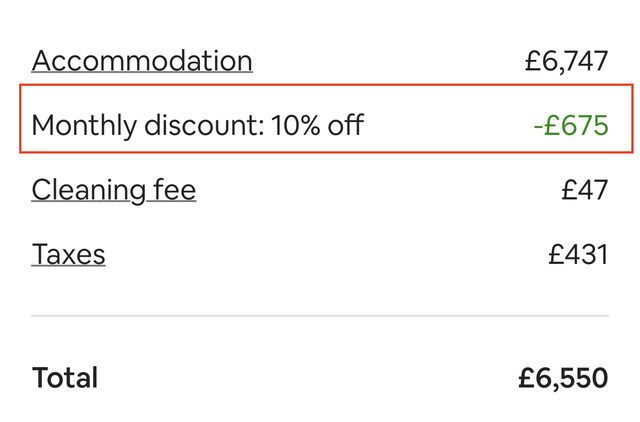

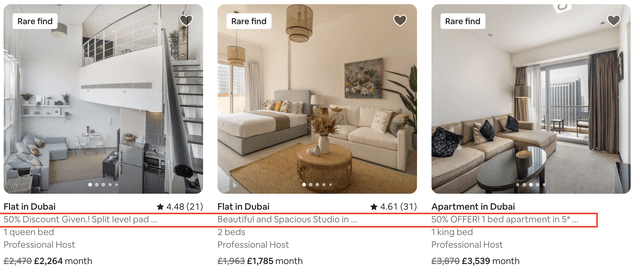

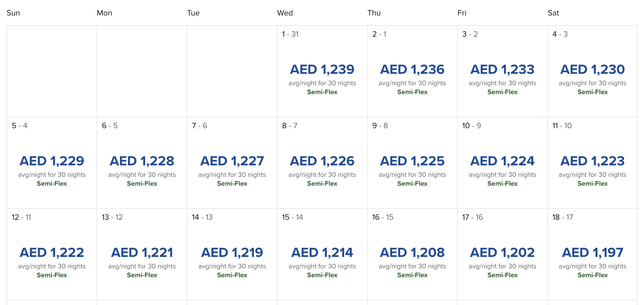

Its Cross border gross nights booked rose by a staggering 49% year over year, while urban city locations booked increased by 22% year over year. Therefore I believe Airbnb is now benefiting from a more open minded diversified traveller, who will book in their home country, cross border, rural areas, cities etc. Airbnb also did a big push towards “longer stays” with its advertisements during 2022, in order to try to benefit and partially create a cultural shift in how people travel. I believe this was a positive strategy as the rise in remote working, has meant many employees can effectively work from anywhere so why not make it somewhere more exotic. This strategy also highlights Airbnb’s unique selling proposition, as few people would wish to stay in a hotel for multiple weeks. This would be both expensive and not practical due to the lack of cooking facilities, space etc. Gross nights (over one week) have increased by 40% since Q4,19. Whereas nights booked from longer stays (over 28 days) was in line with the prior year at 21% of total gross nights booked. I believe the recent flatlining has mainly been driven by macroeconomic uncertainty, as opposed to customer preferences. As of course staying more nights does cost more money, which many people cannot justify at this time. The positive is as economic conditions improve I forecast an increase in longer stays, as per the prior trend. Just as a side note, I did some research on Airbnb’s website and discovered many hosts offer between 10% and 50% (informally) for longer stays, thus the incentive for a guest to book these is there.

Airbnb Monthly Discount (Author research)

Airbnb Discount Monthly (Author Screenshot Airbnb)

As a comparison I compared a 1 night stay to a 30 night stay at the Hilton hotel and discovered the price was virtually the same, as charged on a per night basis, ~$326/night or AED 1,239 as in Dubai. Thus Airbnb is much more competitive for longer stays and/or groups.

Hilton Hotel Dubai (Author Research 30 night stay)

Overall, Airbnb’s Gross Booking Value [GBV] was $13.5 billion, which increased by a solid 20% year over year or 26% on an FX neutral basis. Airbnb has experienced some foreign exchange headwinds (like most companies with internationally derived revenue). A positive is the U.S looks to have peaked in strength in September 2022, versus both the British pound and the Euro. Therefore I expect, the headwinds should be less moving forward, as the currency markets tend to be cyclical by nature.

Internationally, Airbnb reported strength across all regions with particular strength in the Asia Pacific. Airbnb has exited from China, but still focuses on “outbound” travel from the region. I believe exiting China is a positive in the short term (due to hard lockdowns etc), but I would like to see the company return at some point. From research online I discovered its competitor Booking.com, offers close to 7,000 properties in China. Given the country has a population of ~1.4 billion and a growing middle class, I believe this would make sense for both Chinese customers and inbound international travellers. Of course given the political setup in China, the company may have to partner (or at least get approval) from the government.

I believe the launch of Airbnb’s AirCover in its “Winter Release”, helped to solve many of the psychological pain points regarding booking an Airbnb. Often a fear many people have is turning up to an Airbnb in the middle of the night and either nobody is in or it doesn’t look like the images. A positive is the insurance policy includes a booking protection guarantee and a 24 hour safety line. On the host side, the policy also includes guest identity verification, and up to $3 million in damage protection. As somebody who has ran a range of Airbnb’s in the past, I can tell you the damage protection gives major peace of mind. Many guests often book Airbnb’s in large groups and things can get wild, I once walked into an Airbnb with a table snapped in half after guests stayed. Airbnb Setup, was also launched recently which helps non tech savvy hosts setup their homes for Airbnb easily.

Profitability and Balance Sheet

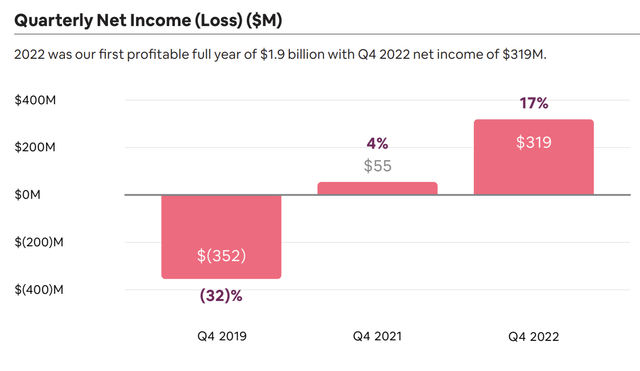

Airbnb reported its most profitable quarter ever with $319 million in net income at a 17% margin in Q4,22. Earnings Per Share [EPS] was $0.33, which beat analyst expectations by close to 46% (Google Finance data).

Net Income (Airbnb)

These results were driven by solid revenue growth as well as rigorous expense cutting. Airbnb’s expenses made up 87.6% of the total revenue in Q4,22. This is an improvement from the 95% of revenue in Q4,21, according to my calculations. Therefore the business has started to demonstrate operating leverage, despite total expenses increasing by 14.4% year over year.

Airbnb Expenses (ABNB)

Airbnb slashed 25% of its workforce during the lockdown of 2020, which was painful at the time but looked like the right thing to do. Airbnb has since continued to grow its workforce steadily with its headcount down only 5% since 2019. Airbnb is now much leaner and although I feel bad for those let go Airbnb did offer an extremely generous severance package with over 3 months base pay, assistance to find a new Job and they even got to keep their work Apple Mac laptops. I believe this will mean prior employees should have a positive taste in their mouth for Airbnb, which should be great for future talent hiring and retention.

Airbnb has a strong balance sheet with $9.6 billion in cash, cash equivalents, short term investments and restricted cash. In addition, the company has ~$1.987 billion in long term debt, which is manageable.

Valuation and Forecasts

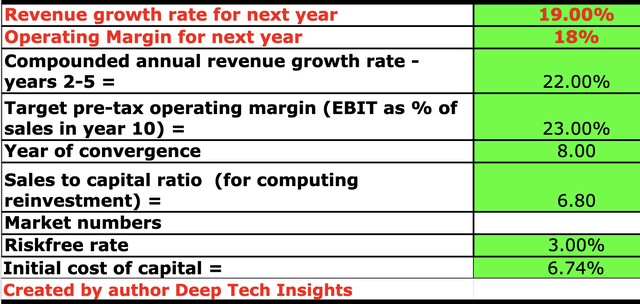

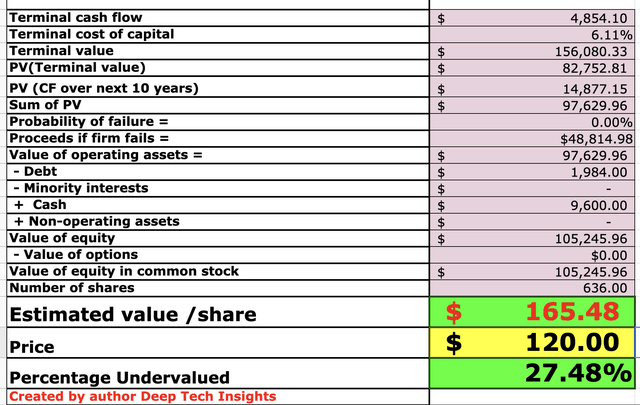

In order to value Airbnb I have plugged its latest financial data into my discounted cash flow valuation model. I have forecast 19% revenue growth for “next year” which is the next four quarters in my model and based upon a managements guidance of between $1.75 billion and $1.82 billion, for Q1,23 which I have extrapolated out to the full year. I forecast this to be driven by market share gains in Latin America, as per the current trend. In addition, to continued recovery and growth in the Asia Pacific. In years 2 to 5, I have forecast a faster growth rate of 22% per year. I expect this to be driven by improving economic conditions (and the psychological fears surrounding them), which should help to boost the number of long term stays and overall travel frequency. I forecast Airbnb to continue to benefit from growth in cross border, city and local travel, as per the current trend.

Airbnb stock valuation 1 (created by author Deep Tech Insights)

To increase the accuracy of my model I have capitalized R&D expenses which has boosted net income. Over the next 8 years I have forecast the company to increase its operating margin to 23%, which is the average of the software industry. This is assuming revenue continues to grow faster than expenses, and the company benefits from increased operating leverage and economies of scale.

Airbnb stock valuation 1 (Created by author Deep Tech Insights)

Given these factors I get a fair value of $165/share, the stock is trading at ~$120/share at the time of writing and thus it is ~27.48% undervalued, according to my model and forecasts.

The stock price will likely be on the move upwards, after Airbnb’s strong results. Therefore I expect this valuation gap to close slightly. My current trading volume data indicates Airbnb is up 9% in pre-market trading. However, that would mean it would still be below the intrinsic value level highlighted.

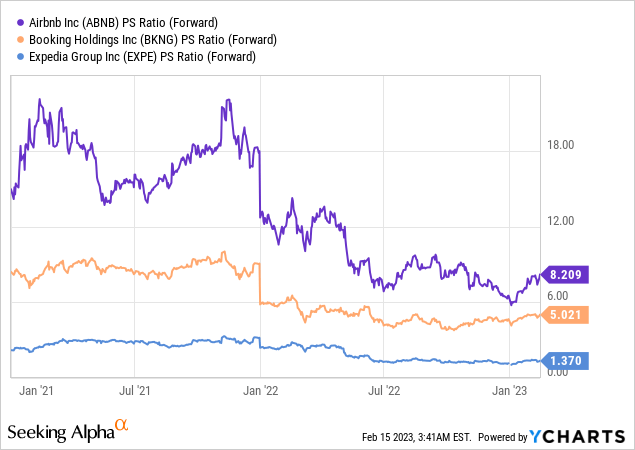

Airbnb also trades at a price to sales ratio = 8.2, which is cheaper than its 2021 level of over 20. However, the stock does trade slightly higher than competitors Booking Holdings (BKNG), P/S ratio = 5 and Expedia, P/S ratio = 1.37.

Risks

Recession/Travel Demand Drop

Many analysts have forecast a recession in 2022. Therefore it would not be a surprise if travel demand was muted as consumers aim to save. This is not a certainty given the current trends and pent up travel demand, but it is a possibility.

Final Thoughts

Airbnb has executed tremendously in 2022 and benefited from a continued surge in travel demand. I believe Airbnb’s founder Brian Chesky has been a key driver of this success, as he has reacted fast with cost cutting, while also releasing new features and improving Airbnb’s brand/marketing. The market wants “profitability” during this tense economic backdrop and Airbnb has delivered. Its unique business model means its scalable, while also being flexible. The company is in a strong position now and thus it could be a great long term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.