Summary:

- Berkshire Hathaway’s latest 13F disclosure reveals that Warren Buffett kept adding Apple shares to its already enormous position.

- In the meantime, both Apple and Berkshire have announced plans to continue share buybacks.

- These transactions make the Apple-Berkshire combination overpowered.

- Returning capital via these transactions is far better for shareholders of both companies (than say dividends). It is a textbook example of 1+1>2.

- The 4% buyback tax Biden proposed won’t change the equation too much.

Popartic/iStock via Getty Images

Thesis: The Apple-Berkshire Combo

I hold sizable positions in both Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) and Apple Inc. (NASDAQ:AAPL). And a frequent question I receive from our marketplace service members is why. More specifically, members asked if I am worried about overexposure, since BRK.B already holds an enormous AAPL position. In this article, I will compile the Q&A exchanges I had with our members in a more coherent way and explain why I am not worried at all.

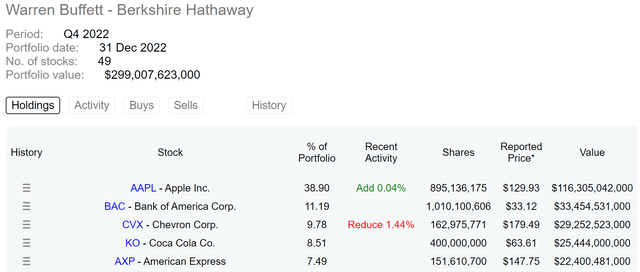

This article is also triggered by Berkshire Hathaway’s latest 13F disclosure, which revealed that Warren Buffett just added more Apple shares to its existing substantial position (see the chart below). As seen, Buffett added about 0.04% to BRK’s existing position in the past quarter. All told, BRK now holds more than 895M AAPL shares, translating into about 5.6% of all AAPL’s outstanding shares. In the meantime, both companies have been aggressively repurchasing their own shares – making the BRK’s effective holding of AAPL even more concentrated than on the surface.

In the remainder of this article, I will explain why BRK stock and/or AAPL stock shareholders like myself, instead of worrying about the overexposure risk, should only welcome such transactions to continue. I will explain why returning capital via these transactions is far better for shareholders of both companies (than, say, dividends).

BRK and AAPL: Compounding on Steroid

I have written a series of earlier articles arguing why both BRK and AAPL are perpetual compounders. Here, I will further the argument and explain why their compounding power is even more potent given: A) BRK’s continued addition of AAPL shares as just mentioned above; and B) the aggressive repurchases at both places. I will revisit A in more detail in a late section. And in this section, I will examine B in more depth first.

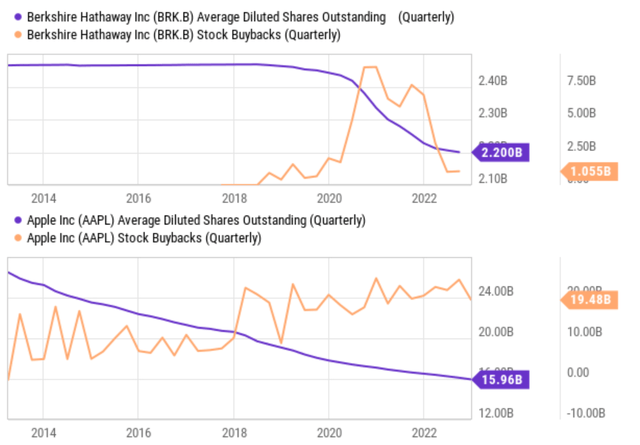

Berkshire Hathaway had repurchased a significant amount of its own stock in recent years since it first announced a share repurchase program in 2011. As seen in the top panel of the chart below, in 2019, it repurchased about $2.2 billion of its own stock during the third quarter of that year, which set a record for the company at that time. After that, Berkshire Hathaway continued to repurchase its own stock aggressively. The buybacks totaled more than $24 billion for 2020. All told, its share counts (in terms of equivalent B shares) shrank from about 2.46B in 2018 to the current 2.20B shares, a more than 10% reduction in about ~ 3 years.

AAPL’s repurchase history is even longer and more aggressive, as you can see from the bottom panel of the plot above. AAPL has been buying back its shares at a steady and gigantic pace in the past decade. It has been spending on average about $20B on a QUARTERLY basis nonstop buying back its shares since 2013. As a result, the number of its outstanding shares dropped from ~27 billion shares in 2013 to only 15.96B shares now, a reduction of ~41%. As its CFO Luca Maestri expressed in a recent earning report (“ER”) session, the company has no plan to deaccelerate this pace. As seen in the quote from this ER below, (Note: The quote has been slightly edited for clarity and emphasis by me), buybacks will be the main mechanism for AAPL to get to cash-neutral. And with $110+ billion of free cash flow per year, that means A LOT of buybacks going forward.

In terms of cash deployment, obviously, we like to look at the capital return program over the long arc of time. And we have done, since the beginning of the program, we’ve done over $550 billion of buyback at an average repurchase price of $47. So, the program has been incredibly successful.

We are still in a position where we have net cash. And we said all along, we want to get to cash-neutral at some point. Our cash generation has been very, very strong over the years, particularly last year… I mentioned in the prepared remarks, we did $111 billion of free cash flow. That’s up 20% year-over-year. And so, we will put that capital to use for investors.

The Overpowered Double Buyback

After examining their buybacks separately above, now let me show why the double buybacks, especially when combined with BRK’s continued addition of AAPL shares, would be even more overpowering. In his 2021 shareholder letter, Buffett already discussed the overpowering nature of these transactions. The quote below is again slightly edited for clarity and emphasis by me.

Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here,

our ownership is a mere 5.55%, up from 5.39% a year earlier. That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job. It’s important to understand that only dividends from Apple are counted in the GAAP earnings Berkshire reports – and last year, Apple paid us $785 million of those. Yet our “share” of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud.

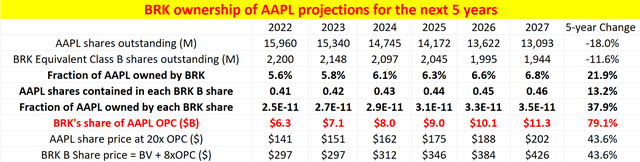

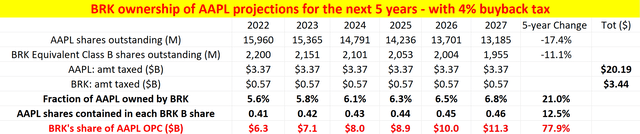

Next, I will elaborate along this line of thought, and project the outcomes in a couple of years if these transactions continue. My projections are summarized in the next table below. These estimates were based on a few simple assumptions. Justifications for these assumptions are scattered in my earlier articles. So here I think it is a good idea to briefly summarize them in one place.

Author Based on Seeking Alpha Data

Regarding AAPL, the key assumptions are:

- It will continue using a constant percentage of its operating cash flow for share repurchases (and the percentage was assumed to be 78%, which is the average in recent years).

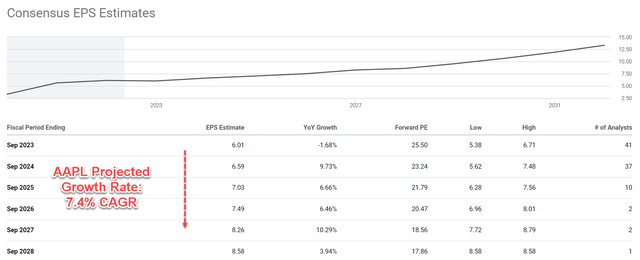

- The company’s profits are projected to grow at a 7.4% CAGR according to consensus estimates (see the second chart below). Although as repeatedly argued in my earlier articles, I think a 7.4% growth rate is a bit conservative given AAPL’s ROCE of 100%+, plenty of cash for reinvestment rate, and its pricing power to easily beat the inflation factor.

- I also assumed the average repurchase price to be 20x its operating cash flow.

Author Based on Seeking Alpha Data

As for BRK, the key assumptions are parallel to those invoked for AAPL above. And the differences are in the specific numbers. First, the percentage of operating income spent on repurchases is taken to be 68%, which is the average between 2019 and 2022. Second, the repurchase price is assumed to be its book value (“BV”) plus 8x of its operating cash flow. See my earlier analysis for details of this valuation model.

Based on these assumptions, AAPL’s outstanding shares are projected to decrease by another 18.0% over the next 5 years. At the same time, BRK’s share count is projected to shrink by another 11.6%. As a result, BRK ownership of AAPL would increase from the current 5.6% to 6.8%, a 1.2% increase. Buffett did a good job above to contextualize such an increase: each 0.1% of AAPL earnings amounts to over $100 million. So, a 1.2% increase translates into an additional $1.2B of ownership of AAPL’s earnings!

When growth is considered, BRK’s ownership of AAPL’s earnings would reach a staggering $11.3 billion in five years, as highlighted in the 6th row highlighted in red and bold. This represents an almost 80% (79.1% to be more exact) increase in BRK’s claim to AAPL’s total earnings compared to its current share of $6.3 billion – all thanks to the overpowering combo of their repurchases and BRK’s addition of AAPL shares. Notably, the 79.1% increase is much more than the simple sum of their individual repurchases (18.0% for AAPL and 11.6% for BRK). That is why in my view, this is a textbook example of 1+1>2.

The 4% Buyback Taxes and Final Thoughts

Risks specific to either company have been discussed by many other SA authors, and I won’t further add on here. Here, I will concentrate on the risks specific to the type A and B transactions (i.e., BRK’s ownership of AAPL shares and their buybacks) analyzed in this article.

A main risk involves the possibility of a higher buyback tax. President Biden recently proposed quadrupling the 1% tax on stock buybacks (with the intention of encouraging companies to invest more in growth instead of boosting the returns for shareholders). Such a proposal, if indeed signed into law, could impact the potency of the double buybacks. And the following results are my estimate of the potential impact.

As seen, under the same assumptions made before, a 4% tax is projected to cause AAPL to pay a total of $21.03B in taxes in the next 5 years on its repurchases and BRK is projected to pay a total of $3.58B. And their amount spent on repurchases would shrink by these corresponding amounts. These are certainly substantial amounts. However, the overall impact would be minor for both companies. To wit, with a 4% buyback tax, AAPL’s share shrinkage is projected to be 17.4% in 5 years, slightly lower than the 18.0% projected without the tax hike. And BRK’s share shrinkage is projected to be 11.1%, again also lower than the 11.6% projected without the tax hike.

Author Based on Seeking Alpha Data

To conclude, as quintessential perpetual compounders, BRK and AAPL are both good companies to hold for the long term in their own right. When considered together, they just become even more overpowering. Consider a final detail from my above projections, BRK’s claim to AAPL’s earnings would exceed $11.3 billion in 5 years if current buybacks continue. And BRK’s operating cash flow has been “only” about $20 billion in recent years. When that time comes, AAPL won’t be BRK’s runner-up 4th giant. It would be BRK’s largest cash cow.

That is why, as a BRK and AAPL shareholder, I don’t worry about overexposure. Instead, I wish their current transactions to continue and become an even more concentrated owner of both companies’ shares.

Disclosure: I/we have a beneficial long position in the shares of BRK.B, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.