Summary:

- Airbnb is the category-defining leader in the travel industry.

- It suffered throughout the pandemic, but came back roaring in 2021 and beyond.

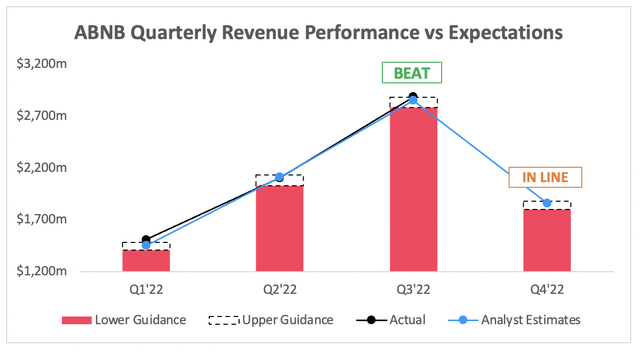

- It just reported its Q3 results, and beat analyst estimates on both the top and bottom line despite several macroeconomic headwinds.

- Airbnb has now made a staggering $3.3 billion in free cash flow over the past 12 months, and this business should continue to be a cash printing machine.

- I think this quarter is evidence of Airbnb being a truly high-quality business, and I am upgrading my previous ‘Buy’ recommendation.

Justin Paget/DigitalVision via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB) is the category-defining leader in the travel industry, with an incredibly strong brand known all around the world. The travel industry has been a difficult place to be for the past few years as the world ground to a halt, but the easing of lockdown restrictions saw demand for Airbnb come roaring back.

My personal investment thesis for Airbnb is quite simple, and I laid it out in more detail in a previous article. The company has a host of powerful economic moats, including one of the strongest network effects of any business, an absolutely stellar brand, and a high level of pricing power. I think Airbnb has the potential to truly transform the way we live, and its summer release demonstrated some of the different approaches it’s taking to holiday rentals. It has a stellar balance sheet, Co-Founders in leadership with an incredible amount of skin-in-the-game, a huge opportunity to continue growing, and a business model that oozes free cash flow. All in all, there’s plenty to like about Airbnb.

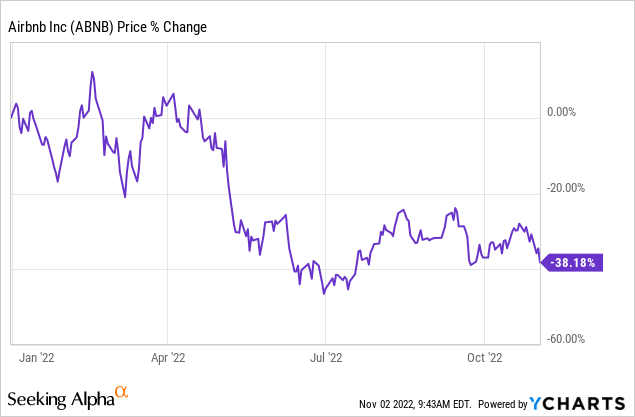

Yet it’s been a tough year for investors in ‘growth’ companies, and Airbnb is no exception, with shares down by around 35% so far in 2022.

Shareholders will now be hoping for some positive news coming out of Airbnb’s Q3 results, particularly as the backdrop of soaring inflation and a macroeconomic slowdown has made some investors more cautious about the travel industry.

So, how did Airbnb perform? Let’s take a look.

Airbnb Q3 Earnings Overview

Starting from the top, Airbnb’s Q3 revenue grew 29% YoY to $2.88B, coming in ahead of analysts’ estimates of $2.85B. As with many businesses this earnings season, foreign exchange headwinds hit Airbnb’s revenue pretty hard; on a constant currency basis, revenue grew by an impressive 36%.

Looking ahead to revenue for Q4, and analysts’ estimates of $1.86B sits solidly within management’s guidance of $1.80-$1.88B. This would represent YoY growth of 17-23%, or 23-29% on a constant currency basis. This may be a deceleration in growth, but I still think it’s impressive given all the headwinds that businesses like Airbnb continue to face, combined with some difficult YoY comparisons.

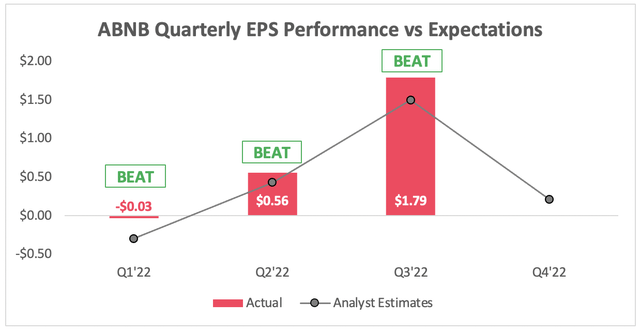

Moving onto the bottom line, and Airbnb posted EPS of $1.79, which came in ahead of analysts’ consensus estimate of $1.50.

Airbnb is a seasonal business, and Q3’22 is always when it has its peak for revenue and net income. Q3 is generally the holiday season (July-September), which is when Airbnb would recognize all the revenue for stays during that period, even though they were probably booked months in advance.

Yet take nothing away from Airbnb’s stellar profitability, posting a whopping Q3 net income of $1.21B at a 42% margin, compared to net income of $834m on a 37% margin in Q3’21.

In my eyes, these are very strong headline numbers for Airbnb in an environment where plenty of more ‘recession resistant’ businesses have struggled. The revenue guidance appears to have underwhelmed the market slightly, but given all the headwinds, I’m certainly not complaining.

Plus, let’s not ignore the financial fortitude that Airbnb demonstrated this quarter.

Incredibly Strong Financials Despite Currency Headwinds

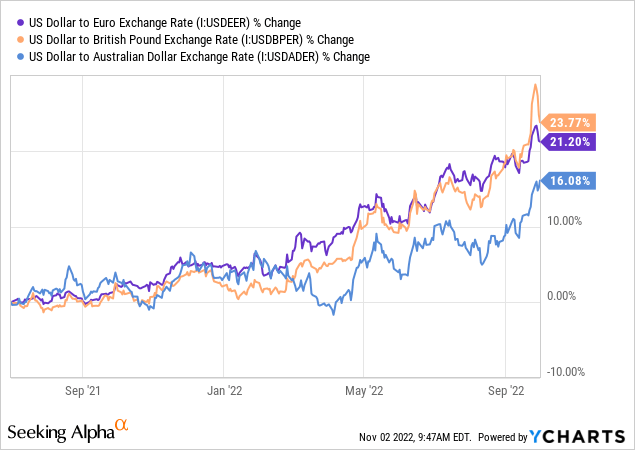

As mentioned, the strengthening US Dollar has pummeled results for several companies so far this earnings season, and Airbnb was no exception. The below chart outlines just how much the dollar has strengthened against some of the world’s major currencies.

With many US businesses, this has led to a severe margin compression. Most of these companies see a higher portion of expenses paid in US dollars compared to the income they bring in from across the globe, and so a stronger US dollar decreases revenue more than it decreases costs.

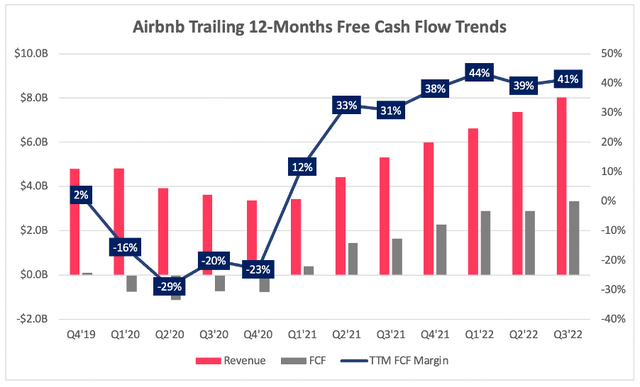

That is what makes Airbnb’s quarter even more impressive, because it continues to print cash for fun. The company has now generated over $3.3B in free cash flow over the past 12 months, with an FCF margin of a whopping 41%.

Here’s what CFO Dave Stephenson had to say when an analyst congratulated Airbnb on its stellar performance during the Q3 earnings call, and asked what we can expect to see in the future:

Excellent. So yes, the free cash flow, I’m really proud of our delivery of the free cash flow and the free cash flow margin. So thanks for calling it out.

I mean we’ve just made substantial improvement in the overall profitability of our business, right? We’ve radically adjusted our marketing expenditures to be substantially lower. We’ve made metronomic improvement in our variable costs. We’re seeing great leverage in our fixed costs. We’re being incredibly disciplined in our fixed cost growth, and that will continue going forward.

And so all of those will be tailwinds to being able to maintain or even increase our free cash flow margins over time. As average daily rates could moderate next year, that does put a little bit of a headwind towards our margins. But I think the improvements in our variable costs and the fixed cost leverage should enable us to maintain or even increase free cash flow margins over the longer-term.

In short, he’s basically saying that this is not some one-off increase in margins due to a post-pandemic spike in demand; these strong free cash flow margins are here to stay, and may even increase in the future.

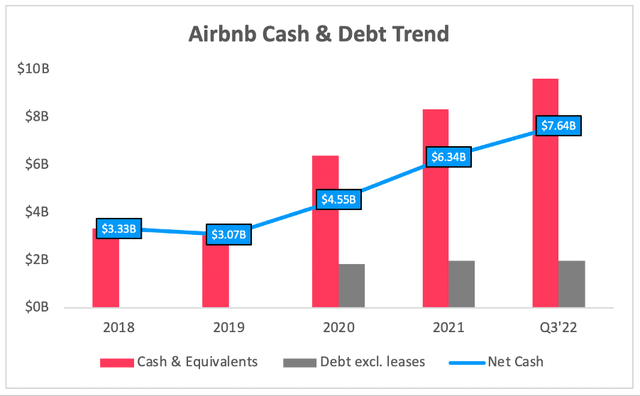

Some investors think of Airbnb and assume it’s another unprofitable technology company, but clearly this is not the case. There are few companies in my portfolio with the financial fortitude of Airbnb, a company that makes cash for fun whilst also having an impeccable balance sheet, with a net cash position of $7.64B.

This was a quarter where Airbnb truly flexed its operating leverage muscles, but this is not a company that has peaked; there is plenty of opportunity for revenue growth in the future, and so expect that free cash flow to keep increasing for years to come.

Demand Remains Surprisingly Strong

I think plenty of investors were expecting Airbnb to be struck badly by the macroeconomic headwinds that economies across the globe are experiencing, particularly because travel is a luxury expense that can easily be cut if consumers have less money in their pockets.

Now the strong revenue for Q3’22 doesn’t dispel this theory; these revenues are for holidays booked 3, 6, or even 9 months ago – they don’t necessarily reflect the consumer’s current behavior or financial situation.

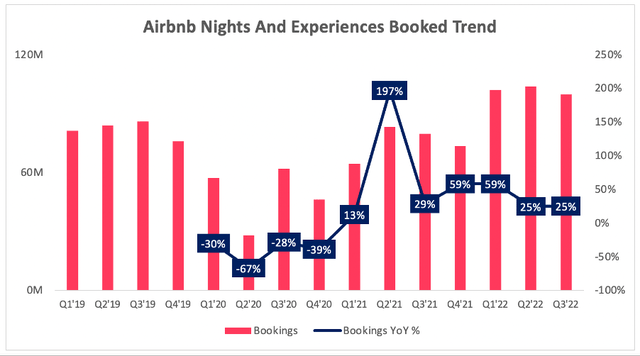

Thankfully, Airbnb does provide us with data on the number of nights and experiences actually booked during Q3, which is a much more immediate measure of demand.

As per the above graph, bookings still grew by 25% YoY despite the difficult macro environment, and gross booking value increased 31% YoY (or 40% on a constant currency basis), which is even more impressive – this means that, once again, consumers are spending more money on their bookings with Airbnb; yet more evidence of the pricing power that I believe Airbnb possesses.

CEO and Co-Founder Brian Chesky spoke to the trends on bookings going forward, and it should fill investors with confidence:

So one of the things that we have seen is, despite a lot of consumers pulling back on spending, the one area that I haven’t seen them pullback on as much is travel. And in particular, like travel, where you can go and see your friends, see your family, more inspirational type of travel, in other words, meaningful travel and not just mass travel.

And I think the reason why is just because many people are now working from home, the mall is now Amazon. The movie theater is now Netflix, people still want to get out of their house. They still want to have memories. They still want to have meaningful experiences. And I think that’s why they continue to turn to Airbnb. And so just like people continue to travel this quarter, we expect really strong demand for Airbnb next year.

Essentially, consumers are still choosing to spend their money on Airbnb despite having to cut back spending in other areas. This is a really promising sign, and shows that Airbnb is likely to remain fairly resilient even in an economic downturn.

ABNB Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Airbnb is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

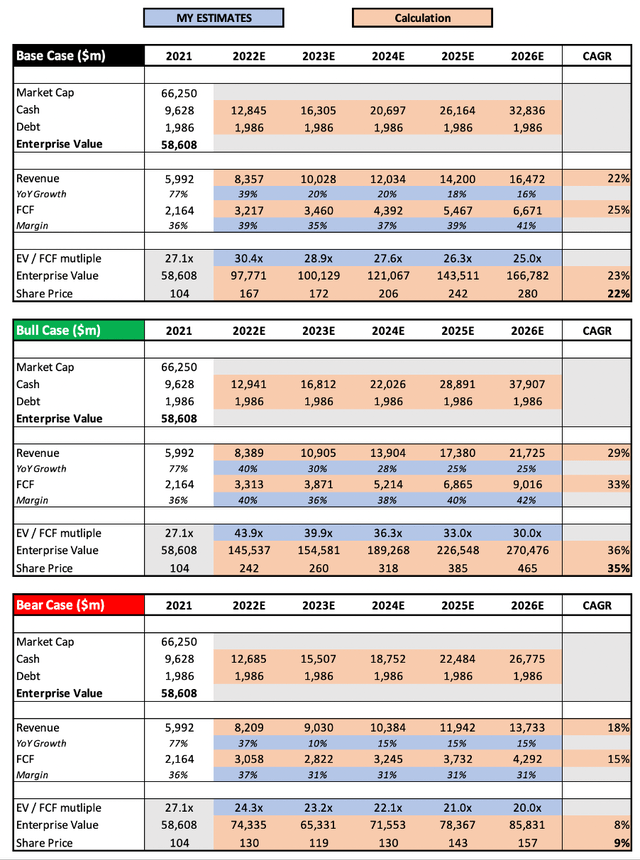

I have used the same assumptions as in my previous article, with a few updates. The main change has been to the free cash flow margin assumptions, as I had been far too conservative on these previously. I have also slightly boosted the expected revenue for 2022, in line with the results for the first 9 months of this year, plus analysts estimates for Q4.

Put all that together, and I can see shares of Airbnb achieving a CAGR through to 2026 of 9%, 22%, and 35% in my respective bear, base, and bull case scenarios.

Bottom Line

This was a fantastic quarter for a brilliant business that showed immense strength in an environment where so many others have failed. Airbnb is not immune to the macroeconomic difficulties, and there’s no denying that a recession will likely hit the travel industry hard, but this company has the leadership, business model, and financial profile to come out of the other side stronger – it already managed this once after Covid, and I would bet on the company to do it again.

Given the consistently excellent execution, staggering free cash flow margins, very attractive share price, and all-round greatness of Airbnb, I am upgrading my rating on the company from ‘Buy’ to ‘Strong Buy’.

I am aware, as any investor should be, that we could be heading into a recession, and this could have a short-to-medium term negative impact on Airbnb’s share price. But this company has continually delivered despite the difficult circumstances over the past few years, and I think it has all the hallmark traits of a fantastic long-term investment.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.