Summary:

- Airbnb has become a cash flow machine with a broad moat and is still just getting started.

- I consider the stock to be undervalued at the moment.

- The single biggest risk for Airbnb is a reluctance to spend on travel in light of the likely coming recession.

Dragonite_East/iStock via Getty Images

Investment Thesis

I’ve been watching Airbnb (NASDAQ:ABNB) for a while now, waiting for the right opportunity to get in. After the sell-off following the quarterly numbers, I think it’s finally here. This article is not about the Q3 numbers since several other good articles cover that in detail. I want to focus on long-term catalysts for the company that will provide further upside this decade and make it an excellent long-term buy-and-hold stock. Given the long-term opportunities, I consider the stock to be undervalued.

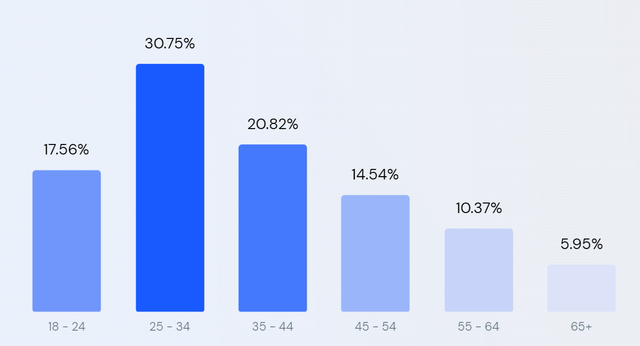

1. Airbnb users are young

Airbnb is a truly disruptive company, the likes of which rarely exist, and such a movement usually starts with younger people. This is also the case here. They will probably continue to use the service as they get older, bringing it more and more into the middle of society. We are already at that point. The fact that Airbnb users are so young increases the likelihood that the company will take even more market share away from traditional hotels in the future.

Moreover, the current users are slowly entering the phase of life where they generate more and more income, end the university, and so on, and therefore will afford better and better accommodations in this decade. Those who can afford it will undoubtedly prefer to take the luxurious fancy villa rather than a shared cheap accommodation. In summary, this does two things. Airbnb increases long-term market share compared to hotels, and the average purchasing power of users increases as they get older.

These are the numbers for airbnb.com. In other countries, users are even younger. On airbnb.fr (French version), for example, 20% are 18 to 24. On airbnb.de (German version), even 21%. In total, 51% of German users are under 34 years. On the Brazilian website, 54% are under 34.

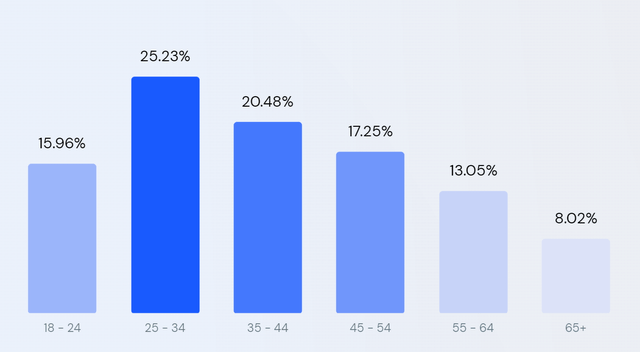

Below are the figures for Expedia.com (EXPE) for comparison. Booking.com (BKNG) is in between. Overall, Airbnb users are the youngest in this comparison.

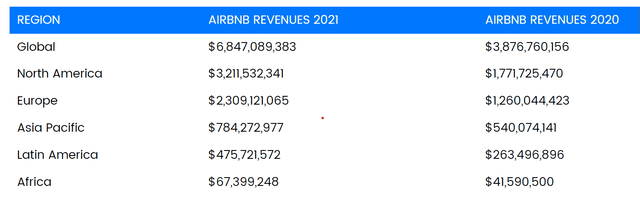

2. International expansion

North America and Europe are the most important markets for Airbnb. And yet, I’ve often been surprised by how few people in Europe know about Airbnb and even consider using it. Especially the generation, I would say, from 40 years old. They have often heard of Airbnb but would not even consider booking their vacation accommodation through it. Of course, this applies mainly to more rural areas and people and less to metropolises like Paris and London. But most people live there and not in Berlin or Barcelona. These are the people who are traveling to these cities.

I am currently in Thailand and will use Airbnb more often in the coming months. After long pandemic years, there is finally a tourist upswing, and compared to pre-pandemic times, I can say the listings have become much more numerous. When I was here the last time, there was hardly any choice on Airbnb. And yet it’s still only a fraction of the possible listings. When I drive around locally here on my island and look for accommodations, there are thousands; on Airbnb, the vast majority of them have yet to be found. This shows the potential the platform has to expand its customer base and the number of listings. I have taken Thailand as an example because I know this country well and have traveled here for years, but the same applies to Southeast Asia, South America, and Africa. Asia Pacific showed the strongest growth this quarter, with 65% YoY. But Latin America was also very solid, with 33% YoY.

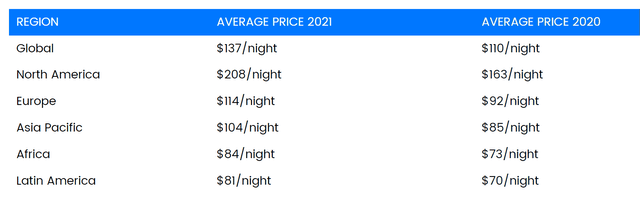

Also, in terms of price per night, these regions are significantly cheaper and still have much potential upwards. The average price is lower because there are comparatively more affordable options, but luxury villas and apartments are still available in many areas. Therefore, the circle closes with my first point that the younger users of Airbnb are also slowly getting older, have more money, and will be more likely to afford these villas in the future. Therefore, I expect that the average price per night will increase.

3. Longer stays by remote workers

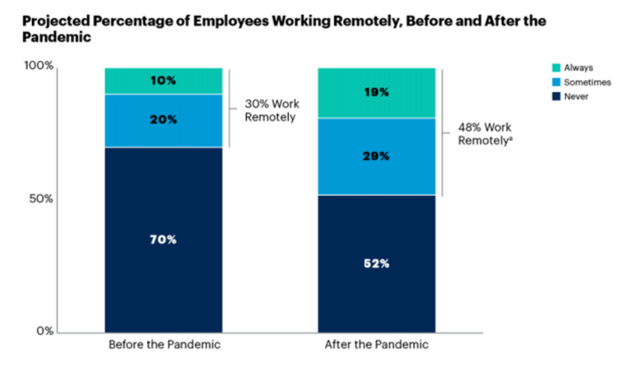

Here in Thailand, I’m one of those people who works online and doesn’t want to spend the energy-scarce winter in Europe. That’s why Airbnb will be earning money from me over the next few months. The fact that this is more and more possible has not just started since the pandemic but is a long-term social trend. And it’s not just remote working for companies that make this possible now; it’s also more self-employment in general. Twenty years ago, the professions of YouTuber, freelancer on Fiverr, influencer, dropshipping business, and thousands of other things didn’t exist. Will these self-employed job opportunities become more or less in the future? Of course, more and Airbnb will likely benefit.

We believe new use cases, including long-term stays and non-urban travel, are here to stay as millions of people have newfound flexibility in where they live and work. Guests continue to stay longer on Airbnb. Even with more companies requiring employees to return to the office, nights booked from long-term stays remained stable from a year ago at 20% of total gross nights booked. While the majority of long-term stays occurred in EMEA and North America, we also saw long-term stays become substantially more popular in Asia Pacific compared to a year ago.

Valuation

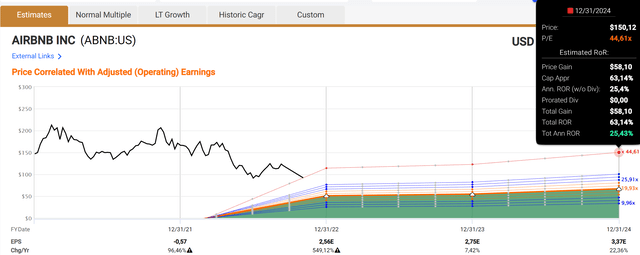

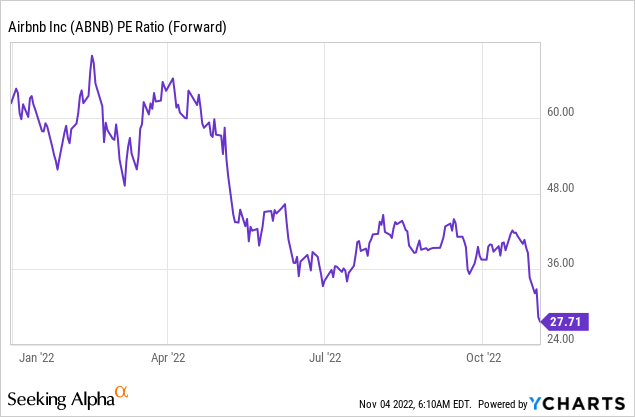

The current P/E ratio is about 44, but the forward P/E ratio is lower than ever. Of course, it depends on the extent to which the company buys back shares; recently, they authorized a $2B share buyback program. As well as the company is doing now, they will have to do something with their money.

We generated $960 million of Free Cash Flow and $3.3 billion of TTM Free Cash Flow.

According to FAST Graphs, the stock is currently trading at 19 x free cash flow, and if it stays at that level, a 15% annual return would be possible until the end of 2024. On a P/E basis, the expected return depends strongly on the P/E ratio at which the stock will trade in 2024. The return would be an excellent 25% if it remained in the same range. However, if I lower it to 28, the expected return would be 0.

I have also created a discounted cash flow model with three scenarios. Of course, such models always contain many estimates and cannot be precisely accurate, but I find them helpful in getting a general sense of where the stock currently stands. At least extreme under- or overvaluations could be seen here. It consists of a normal case, a best case, and a worst case. The normal case is weighted with 60% probability, and the other two with a combined 40%. According to this calculation, the current fair value would be around $105, which would mean that it is currently undervalued by about 14%.

Risks

I think the single biggest risk for Airbnb is a reluctance to spend on travel in light of the likely coming recession. While the company itself says at the moment that it believes its users are not saving on travel, who knows what it will be like next year. It’s important to remember that we’re still just coming out of the pandemic, so the desire to travel is high. Once that need is satisfied, it could be different. People will still travel, but they could choose cheaper accommodations.

Nevertheless, it must be said that every recession has passed so far, and sooner or later comes an upswing. Since I see Airbnb as a long-term investment, this risk is not as significant. In any case, it is likely not existence-threatening but only creates the possibility that even more favorable entry points could come. I will then probably use these to buy more shares.

Conclusion

Airbnb has been a fast-growing emerging startup over the past ten years and has become a cash flow machine. I particularly like the company’s strong, globally recognized brand and broad moat. I don’t even know of an alternative to it.

I think, given the tailwinds for the company, it’s still just getting started. At the current price, Airbnb is a very attractive buy. Of course, the P/E is still not low, but I think it’s unrealistic to assume that the company will be trading at a P/E of under 20 in the near future, so you have to get in at some point, and now is the best time since the IPO in my opinion.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.