Summary:

- We’re upgrading Airbnb, Inc. to a hold.

- We think the current macro headwinds are now priced in.

- We now expect sales to return to QoQ and Y/Y growth in 2HFY23 as we begin to see a recovery in consumer spending on travel.

- While we don’t see a significant near-term catalyst for the stock in the current macro climate, we believe expectations are low enough for the company to slightly outperform consensus estimates.

- We would recommend Airbnb investors remain on the sidelines and explore more attractive entry points.

AlSimonov

We’re upgrading Airbnb, Inc. (NASDAQ:ABNB) to a hold; we now believe the current macro headwinds have been priced into the stock. Airbnb stock is down 13% over the past month, underperforming the S&P 500 (SP500) by 12%. Additionally, we think the sequential dip in gross bookings value and Nights and Experiences bookings in 2Q23 confirms our investment thesis in March regarding financial performance moderating due to weaker consumer spending. We now expect Airbnb sales to rebound to QoQ and Y/Y growth in the second half of FY23, as we’re seeing consumer spending on travel increase.

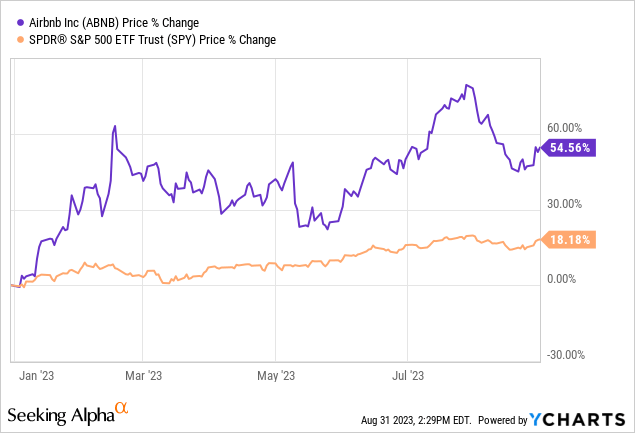

Airbnb rallied 56% YTD, outperforming the S&P 500 by 37%. The stock is down from $154 per share high to $132. We now see a more balanced risk-reward profile for the stock.

The following graph outlines Airbnb’s YTD performance against the S&P 500.

YCharts

No near-term catalyst, but earning beats

Airbnb beat on top and bottom lines this quarter, reporting revenue of $2.48B, up 18.1% Y/Y and from $1.8B in 1Q23. Management guided revenue for Q3 higher than consensus at $3.3B-$3B4B versus consensus at $3.22B. Our upgrade to hold is partially driven by our belief that Airbnb can slightly outperform the lower consensus estimates resulting from the uncertain macro environment. Additionally, we’re now more optimistic about consumer travel spending increasing in 2H3, driving higher QoQ and Y/Y growth in 2HFY23. Research reports by Bloomberg highlight that “spending has accelerated faster than the group forecast last year on more stable global economic conditions…” and that global travel earnings this quarter reflect that consumers are willing to pay higher prices to travel overseas. We expect the recovery in travel spending to be slow due to the volatility of the current macroeconomy. Still, we think the macro headwinds have been factored into the stock and see Airbnb accelerating higher-double-digit revenue growth in 2024.

Nights and Experiences booked increased 11% Y/Y this quarter to 115M, lower than last quarter at 121.1M; gross booking value or GBV also declined sequentially to $19.1B from $20.4B in 1Q23, but both were up Y/Y. Management is forecasting better-than-expected Nights and Experiences for Q3; we think Airbnb is well positioned in the market to contribute solid Y/Y and QoQ increases in Nights and Experiences booked and GBV into 2024. Additionally, we’re constructive on Airbnb’s improving profitability; net income this quarter was $650M versus $379M, Adjusted EBITDA grew 15% to $819M, and Free cash flow was $1.6B, up 32% Y/Y.

We’re upgrading the stock to a hold rather than buy as we don’t see any near-term catalyst driving outperformance in 2H23. We’re constructive on Airbnb’s introduction of Rooms, a more affordable monthly stay option as it adapts to the current tight budget consumer, reducing fees for stays longer than three months. However, we think 2Q23 results and outlook for next quarter confirm that Rooms won’t be a growth catalyst in 2H23.

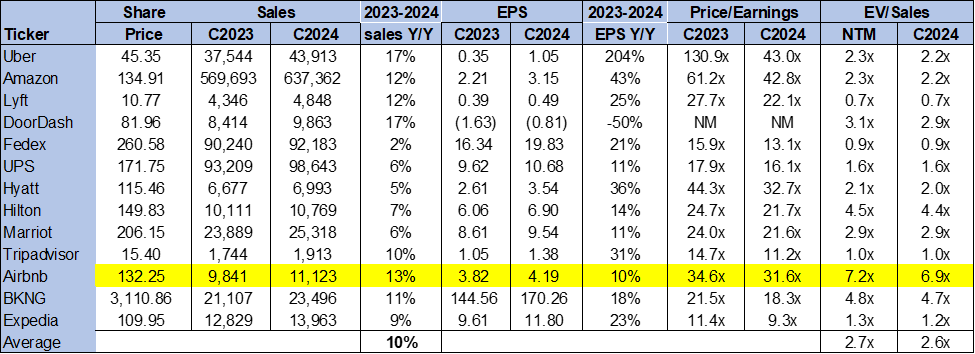

Valuation

We think Airbnb is overvalued, trading well above the peer group average. On a P/E basis, the stock is trading at 31.6x C2024 EPS $4.19 compared to the peer group average of 23.6x. The stock is trading at 6.9x EV/C2024 Sales versus the peer group average of 2.6x. We think the stock is trading at unjustified premium multiples relative to growth and don’t see attractive entry points at current levels.

The following chart outlines Airbnb’s valuation against the peer group.

TSP

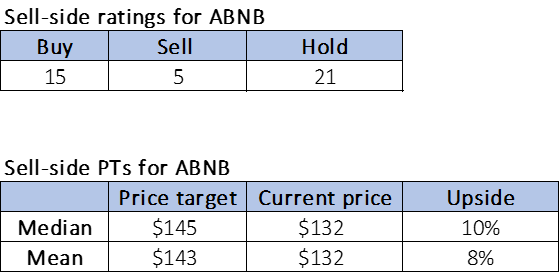

Word on Wall Street

Wall Street shares our bearish sentiment on the stock. Of the 41 analysts covering the stock, 15 are buy-rated, 21 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $132 per share. The median sell-side price target is $145, while the mean is $143, with a potential upside of 8-10%.

The following charts outline Airbnb’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re upgrading Airbnb, Inc. to a hold from a sell. We now see a more favorable risk-reward profile for the stock into 2024 as consumer spending on travel increases in spite of the uncertain macro environment. Still, we see no near-term catalyst driving outperformance in the near-term. We expect Airbnb to be able to beat consensus in the current macro environment; we recommend investors stay on the sidelines and explore favorable points down the line.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.