Algonquin: 4 Insiders Step Up To Buy

Summary:

- Our warnings on Algonquin played out as the company folded under the extremely heavy debt load.

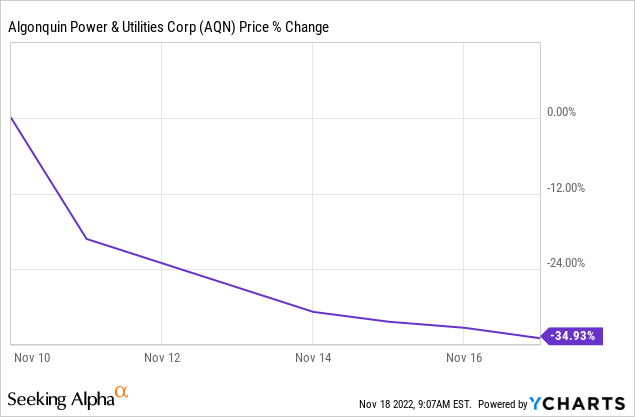

- The swift and brutal correction has now made the stock extremely oversold.

- Four different insiders started buying the shares.

- We look at whether that signal has some merit and whether the valuation is compelling enough.

LeoPatrizi/E+ via Getty Images

Algonquin Power & Utilities Corp. (NYSE:AQN) had a stunning drop in reaction to it not meeting Q3-2022 estimates.

We have a 3-day rule and depending on the depth of the drop, we will usually not buy a security for three days. The movement though is a material change in the thesis. This drop was also coupled with a couple of interesting events. We go over what those are and what should be considered for a long position today.

Outlook For 2023

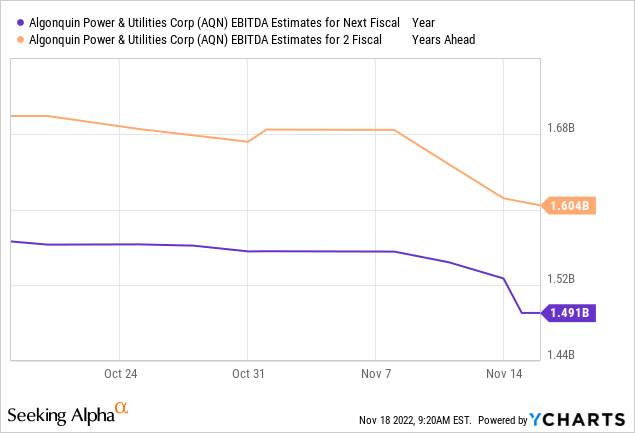

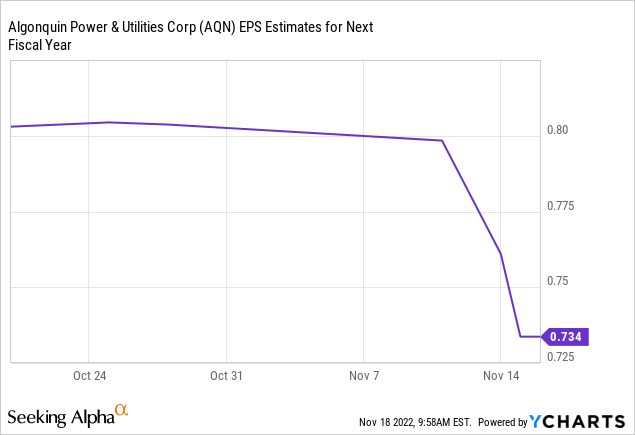

One tell, we have often used to see what is priced in is to look at estimates for the year ahead and see whether the company can actually beat those. In the case of AQN, estimates have moved lower rapidly as analysts have rushed to downgrade, but they still appear completely outlandish. For 2023, consensus is still expecting almost $1.5 billion in adjusted EBITDA.

For context, Q3-2022 adjusted EBITDA was just $276.1 million or about $1.1 billion annualized. The $1.49 billion number includes the Kentucky Power acquisition in Q1-2023, but based on the numbers we have seen, the assumptions are still extremely optimistic. A more realistic number (and investors should check back on our accuracy when the dust settles) is closer to $1.375 billion in adjusted EBITDA for 2023.

There is a very huge delta in earnings as you move from $1.50 billion in EBITDA to $1.375 billion. You have about 683 million shares outstanding so the delta on the earnings is about 18 cents a share if we are correct. So, the $0.734 consensus is looking more like a $0.55 number to us.

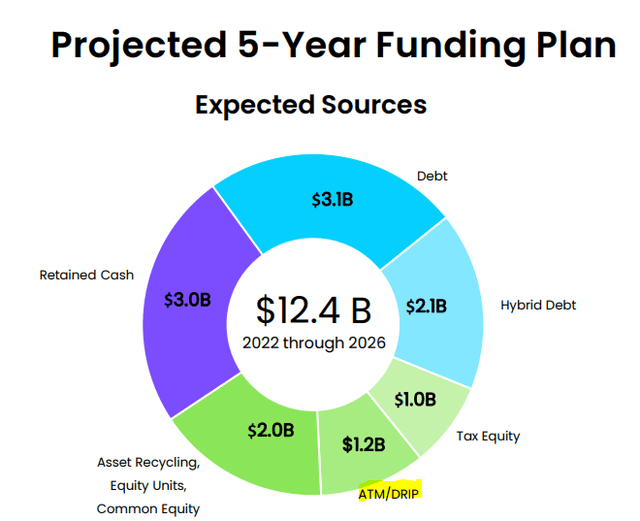

Hence while the stock may have run down quickly, the downgrades are not yet done. AQN also has to figure out if it can issue equity directly or via DRIP in this environment.

AQN Presentation

Issuing equity here will be definitely detrimental to earnings. Not issuing will get the credit agencies to notice and they might come after the investment grade ratings.

Insider Buying

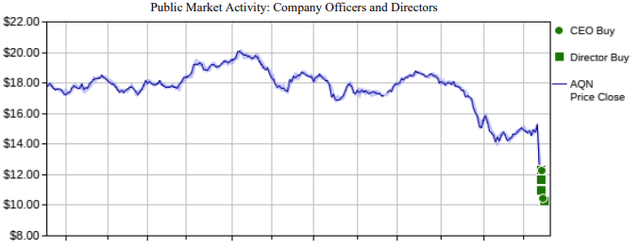

From the other side of the pond, a key new pillar for the bullish narrative is the change in behavior of insiders. While they once stood on the sidelines, they are jumping in head first. Those green dots below are all insider buys.

Insider Ink

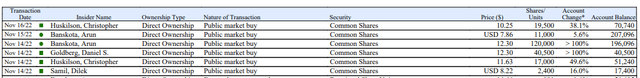

Six different transactions took place, and four different insiders were involved.

Insider Ink

The total buy value of the CEO’s purchases was over $1.55 million, and he increased his share holdings by over 100%. These are positives, and the signal is strong for two reasons. The first being that four different individuals stepped up. This is definitely better than an isolated board member doing a token purchase. The second reason is that these are not individuals who buy every single month regardless of price. So, change in behavior is important. While not a complete knock down of the bear case, it does suggest that bears have to be extra cautious this deep below the 200-day average with insiders stepping to the plate.

Verdict

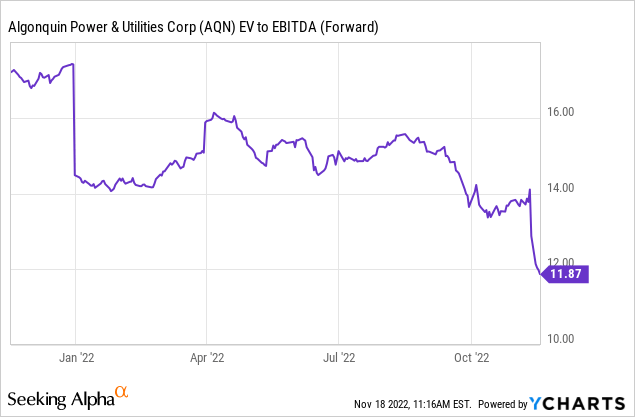

On a sum of the parts basis, AQN is starting to look modestly attractive. The bulk of the assets outside of the Atlantica Sustainable (AY) stake are regulated distribution assets and from that point, the EV to EBITDA is moving into competitive territory. Keep in mind that the sub 12X number is unfortunately still built up a $1.5 billion EBITDA run rate, that we think will happen in 2025 and not 2023.

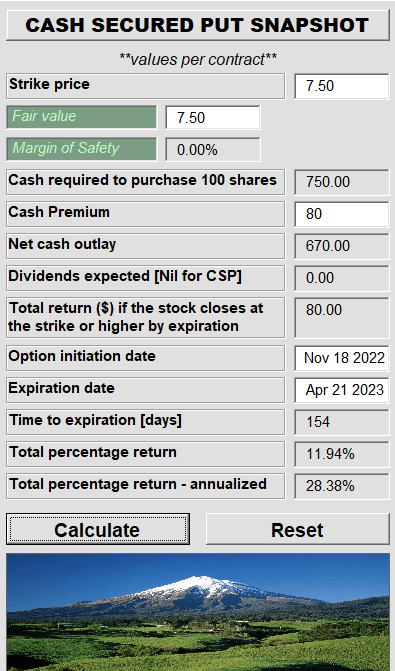

On the earnings front, AY looks cheap if you buy the consensus 73 cents number. 10X earnings for regulated assets is bargain basement level. If you use the 55 cent number, which we think AQN delivers, it looks ho-hum. If we were to engage in a long position we probably would use options. The $7.50 cash secured puts for example offer a decent yield for a flat price.

Author’s App

Alternatives

Of course, we won’t be doing those, and the reason is that there are just too many better alternatives. While AQN may go up and we are certainly open to the idea from here, we don’t see it as a good play relative to its risk. We will go over a couple of alternatives below to make our point.

1) Pembina Pipeline (PBA) (PPL:CA)

If you are looking for certainty of cash flows with low debt, PBA fits the bill. The dividend yield is far smaller but we are 100% certain that it is safe. Yes, PBA is a midstream company but we think it has assets that are just as needed as regulated assets. We also like it because its debt to EBITDA will be close to 3.6X in 2023, vs AQN at close to 8.0X (based on our estimates).

2) AltaGas (OTCPK:ATGFF) (ALA:CA)

If you have a crush on regulated assets, and the heart wants what the heart wants, we like ATGFF in that sphere. We wrote a detailed piece here and investors can examine the merits of that case. Again, the dividend yield is lower, but we think the valuation case is very compelling.

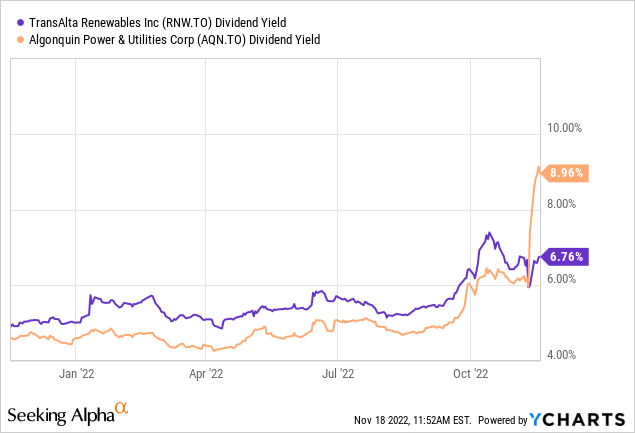

3) TransAlta Renewables (OTCPK:TRSWF)(RNW:CA)

In the renewable sphere, TRSWF wins in a landslide. The main reason to love it is that TRSWF has the lowest debt to EBITDA among all of these companies that rings in at about 2.7X for 2024. It also offers the most competitive yield out of the three choices.

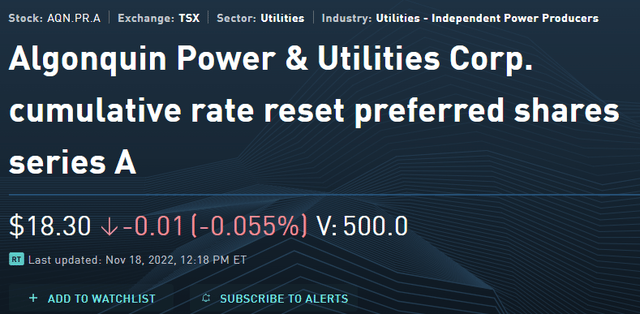

4) Algonquin Power & Utilities Corp. cumulative rate reset preferred shares series A (TSX:AQN.PRA:CA)

Even if you want to stick to AQN and not mess with options, TSX listed preferred shares are one you can consider.

TMX

The current yield is 7.05% and it resets in December 2023 at Government of Canada 5-year benchmark yield plus 2.94%. This excellent article looks at this security in more detail.

There are a lot of alternatives and these just scratch the surface of the possibilities out there. We want to stress that Algonquin Power & Utilities Corp – Units (AQNU) is not an alternative. Due to its mandatory convertible nature, your total return should be identical or almost identical to AQN by June 2024. Whatever you gain in extra dividends, you will give up in conversion. Investors should do their due diligence and see which one best fits their investment objectives.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields.

We focus on being the house and take the opposite side of the gambler.

Risk levels are provided for each trade, accompanied by transparent tracking of performance.

Explore our method & why options may be right for your retirement goals.