Summary:

- Algonquin Power faces challenges from higher interest rates, which resulted in a 40% dividend reduction.

- The attempted acquisition of Kentucky Power raised regulatory concerns and was canceled due to potential debt escalations.

- AQN’s strategic response involves selling its Renewable Energy Segment to boost financial flexibility.

- Key risks include regulatory changes, dilution, and influence from activist investors, potentially hastening decisions.

- Lower interest rates could alleviate financial pressure, allowing AQN to focus on dividends, buybacks, and growth initiatives.

Thapana Onphalai

All figures are in $USD unless otherwise noted.

All financial data is from Capital IQ unless otherwise noted.

Investment Thesis

Algonquin Power (NYSE:AQN) has been battered by higher interest rates which resulted in them slashing their dividend by 40%. The share price was not excluded as prices have continued to fall. With management’s plan to support the share price through the sale of their renewables business, I believe prospective investors should be cautious to jump into AQN until the picture for their future becomes clearer.

Business Overview

Algonquin operates in two segments

- Regulated Services Group

- Renewable Energy Group

Regulated Services provide distribution services to approximately 1,256,000 customers and consists of $8.76 billion in assets (57.8% electricity, 20% natural gas, 18.8% in water and wastewater, and the rest in other). Operating profit for the first half of 2023 was $469.7 million compared to $417.2 million for the same period in 2022.

Renewables consist of hydro, wind, solar, and thermal production. The segment generated 3,990.5 gigawatt-hours in the first half of 2023 resulting in revenue of $159.6 million compared to 4,490 gigawatt-hours and revenue of $171.9 million. Operating profit was $197 million in the first half of 2023 compared to $240.2 million in the same period of 2022.

Background & Recent Developments

In October 2021 Algonquin Power announced an agreement to acquire Kentucky Power Company which at the time would have added over $2 billion worth of regulated rate base assets. The magnitude of this transaction necessitated regulatory approval, given the significant market share Algonquin would have gained. Although local regulators granted their endorsement, the Federal Energy Regulatory Commission expressed reservations, contending that Algonquin’s assurances regarding the acquisition of Kentucky Power were insufficient to guarantee the avoidance of elevated transmission rates.

Algonquin Power, like many utility companies, carries a large amount of debt. Their debt-to-equity ratio currently stands at 113.9%, up from 106% at the end of 2022. As interest rates around the world started to increase, Algonquin felt the impact. The evolving macroeconomic environment and pressure from shareholders prompted AQN to mutually cancel the deal with American Electric Power (AEP) as it would have added a significant amount of debt to Algonquin.

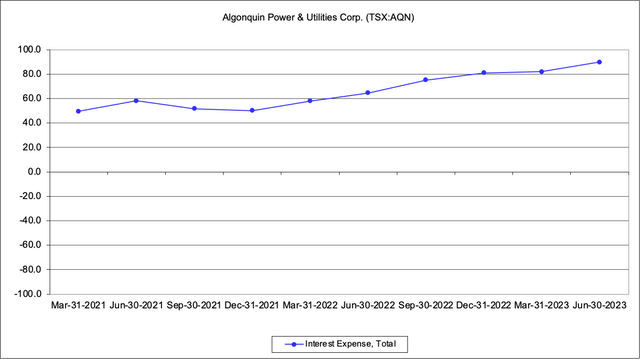

During the final quarter of 2021, Algonquin had a quarterly interest expense of approximately $50.1 million. As the trajectory of interest rates shifted upwards, this prompted a surge in their interest expenditure, soaring by around 79% to $89.7 million in the most recent quarter, Q2 2023. In my evaluation, Algonquin’s decision to terminate the agreement was prudent, as its implementation would have imposed significant strains on the company’s financials within the immediate and foreseeable future.

AQN Quarterly Interest Expense (Capital IQ)

The convergence of escalating interest rates and declining operating profits created a constricting environment for Algonquin’s stock value, which plummeted from $14.41 on November 1, 2021, to $7.20 as of the close on August 18, 2023. The aftermath of the Q3 2022 earnings announcement saw the share price shrink by 14%, triggered by interest expenses eroding operational gains and casting uncertainty upon the sustainability of Algonquin’s dividend. Consequently, in early January 2023, Algonquin opted for a 40% reduction in their dividend, aimed at conserving capital for debt reduction.

Fast forward to their most recent earnings report on August 10, 2023, Algonquin is still struggling with higher interest rates. With pressure from activist investors and shareholders, Algonquin’s management is making efforts to reduce their debt load. Following a strategic review, Algonquin is now searching for buyers for their renewables business. While such a deal would give Algonquin a significant amount of capital to reduce debt, the high-interest rate environment may make it difficult to sell these assets at an attractive valuation. Duke Energy (DUK) completed a deal to sell their renewables business in early June and the valuation multiples weren’t as attractive as hoped. A deal to sell their renewables business would effectively convert Algonquin into a pure-play utility company.

Algonquin’s renewable business has a gross generating capacity of 2.7 gigawatts across 46 facilities, 11 U.S. states, and 6 Canadian provinces. In 2022, the renewable energy segment generated Algonquin $379.4 million in revenue. The sale proceeds are expected to be used to repay debt and buy back common shares.

Year to Date Update

Algonquin has achieved revenue of $1.407 billion year to date compared to $1.353 billion in 2022 representing an increase of 4%. Revenue primarily increased due to rate reviews in their electric facilities (+$62.4 million), offset by decreases in their natural gas segment (-$10.9 million) and decreases in their renewable energy group due to lower energy production (-$22.8 million).

In the most recent quarter, one of Algonquin’s key strategic investments in Atlantica (AY) which is a renewable energy group decreased by $167.9 million and they also took an impairment charge of $43.8 million related to Kentucky Power. The resulting impact landed AQN a net loss of $253.2 million for the quarter. For the first half of the year, net earnings were $16.9 million compared to $57.6 million in 2022. Some of this can be attributed to a $49.1 million increase in interest expenses compared to the same period in 2022.

Catalysts

Sale of Renewables Segment

The sale of their Renewables Segment would provide Algonquin with a significant boost to their financial flexibility as well as help simplify the business structure, hopefully resulting in cost synergies. Given the macroeconomic environment, the hopeful sale price may be lower than expected but management has indicated the sale would unlock AQN’s value as a pure-play utility company.

I feel that it’s critical for AQN to not fire-sale their assets at a lower price to appease activist investors. Using the average EV/EBITDA multiple within the renewable energy space of 14x and assuming the 2022 EBITDA of $472.2 would imply a sale price of over $6 billion. Total operating income YTD at $233.7 million less interest payments made YTD leads to an operating income after interest of $62.1 million.

As debt stands at just over $8 billion, a sale price within that region would bolster Algonquin’s ability to cut down their debt resulting in lower interest payments. It should also provide a meaningful improvement in the balance of their cash from operations.

Lower Interest Rates

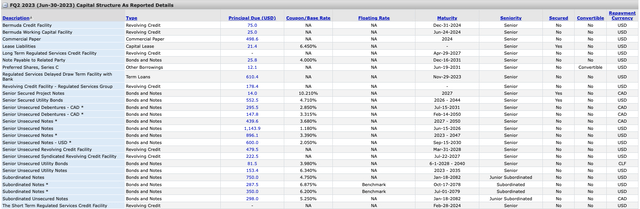

Algonquin has paid $171.6 million in interest expenses in the first half of 2023. The average debt in the capital structure has been $8.035 billion making their average weighted interest rate approximately 4.27%. Applying the same method to 2022, interest expense was $278.6 million and average debt was $7.531 billion resulting in an average weighted interest rate of approximately 3.70%. The increase in interest rates is due to higher rates in both the United States and Canada. The current debt breakdown is:

AQN Debt Structure (Capital IQ)

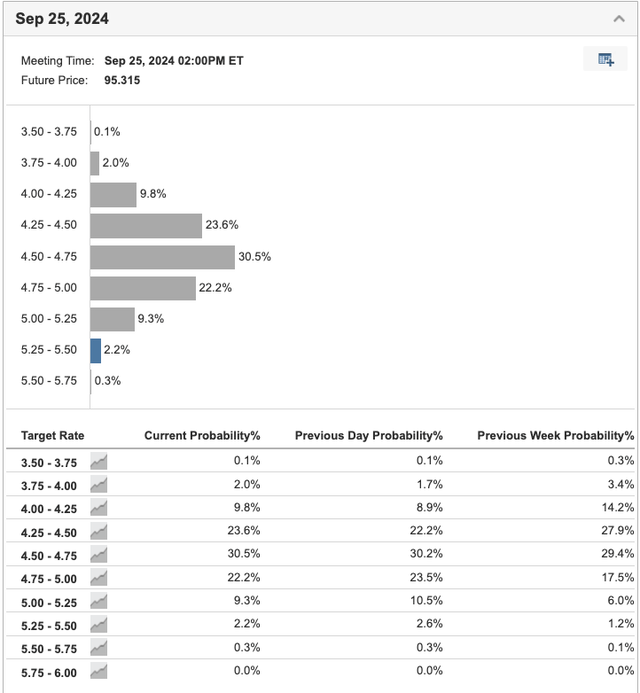

Using 30-Day Fed Funds futures prices, we can extract the probability of a rate hike/decrease. The current predictions suggest a rate of approximately 4.62%, down from the current 5.5%.

Predicted Fed Funds Rate (Investing.com)

A decrease in interest rates for Algonquin would provide significant benefits as it would free up capital to increase dividends, buybacks, and growth initiatives. Most of the net losses attributed to Algonquin came from changes in investments held at fair value, one-time charges, and higher interest rates, I feel that Algonquin’s business will benefit as we move forward through this macroeconomic environment.

The utility business is significantly less volatile than other cyclical businesses and as Algonquin transitions to a pure utility company it should benefit from falling rates and stable operating profits.

Risks

As I have already discussed most of the key risks including higher interest rates and failure to sell their renewables business, other key risks include regulatory changes, dilution, and pressure from activist investors.

Rate Reviews

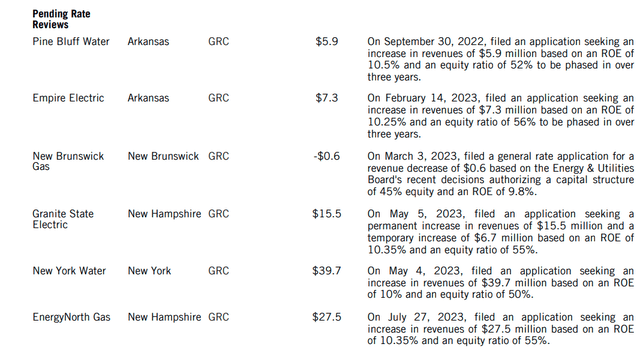

Algonquin requested a $34.8 million rate request on their BELCO utilities located in Bermuda. In April 2022, BELCO filed an appeal to the supreme court of Bermuda challenging this request, and judgment is expected in late 2023.

Pending rate reviews total $95.3 million across 4 key jurisdictions and 6 different locations. These rate reviews if processed would have the impact to increase revenue substantially. However, if these rate reviews are rejected, it could significantly impact Algonquin’s future revenue growth.

AQN Pending Rate Reviews (AQN Q2 2023 MD&A)

As inflation is still high, it would be beneficial for Algonquin to focus on having these requests approved. Cost inflation may erode operating profits in the future making it a key risk to watch for.

Dilution

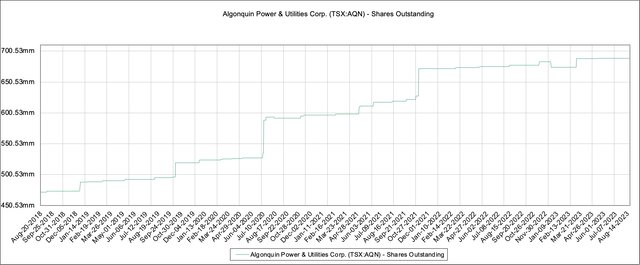

Algonquin has used a significant amount of equity funding to grow their business and maintain operations. They have increased the number of shares outstanding by 45.87% over the last 5 years from 472.19 million shares to 688.8 million as of August 20, 2023.

AQN Shares Outstanding (Capital IQ)

The prospect of funding future growth projects as well as other short-term liquidity needs through equity raises is a key consideration for prospective shareholders.

On August 15, 2022, Algonquin re-established its “At-The-Market Equity Program” allowing them to issue up to $500 million in shares on the open market. Given the recent developments and efforts to sell other non-core assets, I don’t foresee dilution being a huge worry for shareholders however, the program is in place for them to dilute and it should be considered as any major growth opportunities may require significant funding.

Activist Investors

Simply put, activist investors tend to be large shareholders that build up a position in a company in order to influence the board of directors and the company’s future goals. If done successfully, they can unlock value for shareholders and they benefit from their own positions.

The two key activist investors in Algonquin are Corvex Management and Starboard Value. Corvex is a hedge fund run by Keith Meister who was trained by Carl Icahn (a very successful activist investor) and Starboard Value is another hedge fund run by Jeffery Smith.

Corvex Management’s larger activist plays have included Yum! Brands and Energen. Their track record isn’t speculator as the CEO has been sued multiple times and AUM while initially increased rapidly, has drawn down. Their stake in Yum! Brands was not as successful as investors had hoped and was clouded with impatience. However, the stake in Energen was very lucrative. Elliot Management (a successful activist firm) also had a stake in Energen.

Starboard has a decent track record with 84% of their activist campaigns being successful from 2002-2014.

I see these activist investors as a risk because their influence on the board to raise the share price may be done too quickly. Corvex has struggled with this before and given the push to sell the renewables business coupled with the current environment, it seems the activist investors could be rushing the sale.

Conclusion

As Algonquin Power works to navigate a challenging landscape defined by higher interest rates and strategic shifts, prospective investors are advised to tread cautiously. The company’s ability to manage its debt and interest expenses, execute its divestment plan, and navigate the complex world of activist investors will shape its future trajectory. Amidst these dynamics, the path forward for AQN could hold the promise of transformation and resilience, but the ultimate outcomes are yet to be fully realized.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article should not be considered investment advice. Investors and potential investors should consult a professional and/or do their own due diligence before placing trades.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.