Algonquin: It Really Comes Down To April 26

Summary:

- Algonquin Power & Utilities Corp. reported Q4-2022 results that beat the street.

- Guidance for 2023 contained no surprises and the capital allocation shows management has found religion.

- We go over the results and tell you at what price we would like to buy this and why it will only happen towards the end of April.

rarrarorro/iStock via Getty Images

On our last coverage of Algonquin Power & Utilities Corp. (NYSE:AQN), we appreciated the steps the company was taking to repair the problems it had. The dividend cut was great and the company had a more definite plan to address the debt load. Specifically, we said,

In the shorter term, it is anybody’s guess where Algonquin Power & Utilities Corp. stock goes. In the medium term, we expect a lot more downgrades as analysts are way offside relative to actual earnings potential. We rate Algonquin Power & Utilities Corp. stock a hold/neutral. As investors know, we reserve our sell ratings only for actual shorting, and we don’t think the current setup deserves that.

Source: 40% Dividend Cut And Lowered Guidance, A Good Start.

The stock rebounded off the lows and darted even higher after the Q4 results. Is this the turnaround you are waiting for?

Algonquin Power & Utilities Q4 2022 Earnings

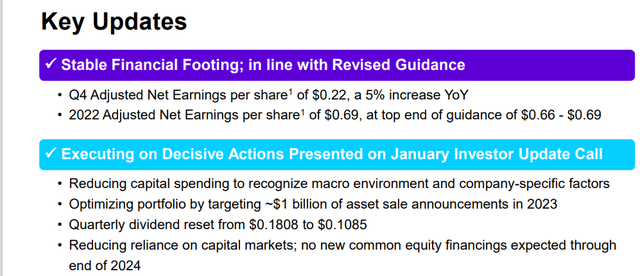

AQN exceeded analyst estimates by a solid berth in Q4 2022 and delivered 22 cents a share. The number was at the top end of their guidance was well.

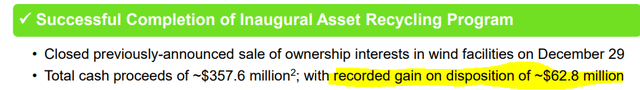

One reason analysts struggled with was the gain on sale, as those are very hard to estimates

That was 8 cents a share and closed on the last working day of the quarter. One thing, therefore, to keep in mind is that the base business produced just 14 cents a share. This was after all three unregulated segments (wind, solar and hydro) generated power above long-term averages. So why the big drop in baseline earnings per share?

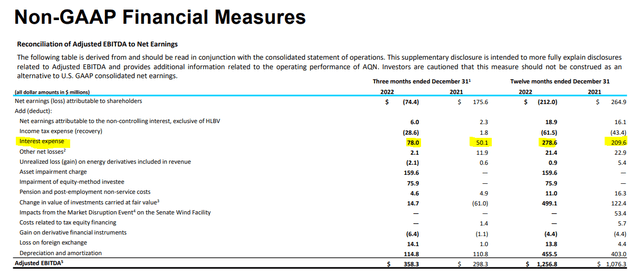

The major culprits here were the change in interest expense, lower pricing on renewable energy, and the expanded share count. Interest expense was notable, as it jumped by more than 55% year-over-year in Q4-2022.

The company’s run rate for 2023 will be close to $400 million in total interest payments if the Kentucky Power purchase goes through. So, interest expense continues to be the most critical component of AQN’s bottom line.

Algonquin 2023 Guidance

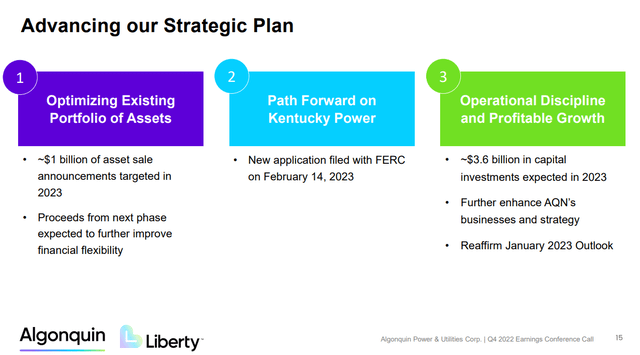

AQN reiterated the earnings guidance for 2023 in the range of $0.55-$0.61 a share. That would be a solid decline from the $0.69 reported but still good considering that the base business produced only $0.14 in Q4-2022. The other updates related to the 3 elephants in the room.

The first is that AQN plans to continue is asset sales and aims to generate an additional $1 billion in 2023. We think that is extremely optimistic in this market, but we will give management the benefit of the doubt on that.

The second elephant is actually bigger (think Palaeoloxodon Antiquus) and relates to the Kentucky Power acquisition. While management and dividend groupies were excited about this in 2022, today the thinking is radically different. What worked with rock bottom interest rates alongside an endless expansion of the share count looks far less favorable when things are normal. Here, AQN got thrown a huge bone with FERC saying “no” to the acquisition. AQN filed a revised application to FERC on Valentine’s Day to get an approval, but we believe everyone is hoping that FERC stays firm on its commitment and allows AQN to walk away. The critical date here is April 26, 2023.

Naji Baydoun

Okay. That helps. Thank you. And just a question on Kentucky. Is there a scenario where we get past the April 26 deadline and some updates or positive updates on regulatory approvals? Just any thoughts on what happens then? What are kind of your options at that point?

Arun Banskota

Sure, Naji. So look, with the December 15 denial by FERC, obviously, to be put in for management need to be looking at all options. But at the same time, as under our — all of our obligations and our commitments if we will continue to use reasonable best efforts to close this transaction all the way until the outside date. And before that, it will probably not be potent from me to speculate on the what if.

Source: AQN Q4-2022 Conference Call Transcript.

If the transaction does not close by then, AQN could potentially walk away. We think it would be extremely imprudent for management to try and make this work beyond that. The next FERC meeting is on April 20. AQN could potentially pressure a lowering of the acquisition price as well in return for extending the deadline. This is a big event and one that will influence the equity returns for at least the next 5 years.

The final elephant here is the capex. Gone are the days that you could spend whatever you liked and explain it in 4 presentation slides with bold words like “growth,” “renewables” and “ESG.” The $3.6 billion number shown above includes the Kentucky Power purchase and hence is extremely low in our opinion. About $600 million is being spent outside of this purchase (assuming it goes through) and that is some remarkable capital discipline from AQN. That discipline also means that 2024 earnings will be flat relative to 2023.

Outlook & Verdict

We wish that our outlook did hinge on a single event but unfortunately it does. If the Kentucky Power purchase goes through then AQN is dead in the water for the next 3 years at least. We see a debt to EBITDA on 2023 exit as close to 8.0X and that number going into a potential recession is about as far from acceptable as one can get. If your theory is that the Federal Reserve will chop rates and blow up yet another bubble, then you are free to speculate on that. We won’t. Even in that scenario, we think valuations will crater initially as the trigger for such cuts will be severe economic weakness.

Now, if the transaction does not go through, AQN becomes mildly interesting at these levels. We say “mildly” as there is still not much to write home about on the valuation front. On an EV to EBITDA basis, AltaGas (ALA:CA), ATCO Ltd. (ACO.X:CA), TransAlta (TA:CA)(TAC), and even Boralex Inc. (BLX:CA) trade far cheaper. We recently wrote about Brookfield Renewable Partners L.P. (BEP), (BEPC), (BEP.UN:CA) and at the price we would get long, BEP looks extremely compelling relative to AQN.

So our conclusion is to tell investors that you can make Algonquin Power & Utilities Corp. part of a diversified portfolio, if two conditions are met: You are sure that the transaction will not go through; and you are not interested in buying anything that is a better value today. For our part, we missed out on the recent rally, but then we also exited the stock at almost twice the price that Algonquin Power & Utilities Corp. stands at today. So we are happy not being involved here and would only consider Algonquin Power & Utilities Corp. under $7.00 a share alongside the Kentucky Power transaction being called off.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TAC, BEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long position has covered calls sold against it.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.