Summary:

- AQN’s strategic review has resulted in a decision to seek a buyer for its renewable energy segment, driven by the company’s precarious financial status.

- Even after a re-rating of its remaining regulated operations in-line with peers, the company shares do not appear undervalued.

- I rate AQN shares an avoid. Even if shares do not appear overvalued, investors should look elsewhere or wait for a significantly better entry point.

DNY59

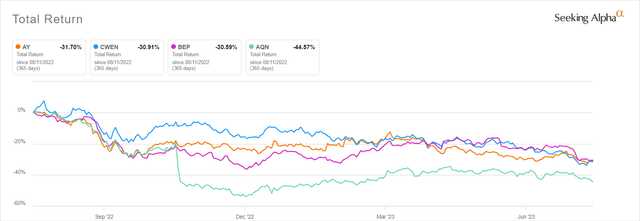

Following the publication of the 1H23 company results, I am taking a fresh look at Algonquin Power & Utilities Corp. (NYSE:AQN), a Canadian renewable energy and utility business. My interest in AQN comes primarily from my ownership of Atlantica Sustainable Infrastructure (AY) shares. As readers may know, Algonquin is AY’s sponsor and majority owner, with a 44.2% stake (41.5% voting) in this sustainable infrastructure company. Now that Atlantica’s price has fallen almost 50% from the highs of January 2021, I think shares trade at attractive levels, although its connection to AQN doesn’t seem to help toward a potential upward re-rating.

Seeking Alpha

To be fully clear, I don’t believe Algonquin’s recent developments (more on that in a moment) represent an overhang to AY shares. Looking at the 1-year total return of closest peers Clearway Energy (CWEN) and Brookfield Renewable Partners (BEP), results show a shockingly similar negative performance of -31%. For all these names, the likely downward trend was fueled by 1) higher risk-free rates, as these are income vectors seen as bond substitutes, and 2) cooling of the ESG / renewables investing frenzy, with money possibly flowing instead toward AI-related ideas and managed funds. Nevertheless, a healthy sponsor represents an operational advantage for YieldCos. AY, which started its listed company journey as Abengoa Yield, knows this fact very well. Unfortunately, after surviving the bankruptcy of its former sponsor, it seems AY needs to endure the grueling pains of its second one as well. Even after a substantial dividend cut, AQN’s operations and outlook remain challenged. After reviewing the financials and the ongoing strategic overhaul, the company is a hard pass to me.

Strategic review outcome: Sell!

Algonquin’s fall from grace is one more unexciting example of what can go wrong with acquisitive companies intent on growing assets over profits. I will not give a detailed review here; suffice it to say I am not a fan of skyrocketing leverage coupled with chronic operational underperformance, especially when the “cure” for the illness, as prospected by management, is each time going bigger and bolder on M&A… until the inevitable blow up.

Rapidly rising rates and the failed attempt to buy Kentucky Power (AEP) may have been triggers that hastened the fall, but AQN’s business model already appeared unsound. The inevitable outcomes have been the 40% dividend cut announced in November 2022 and the initiation of a strategic review for the Company’s Renewable Energy Group in May.

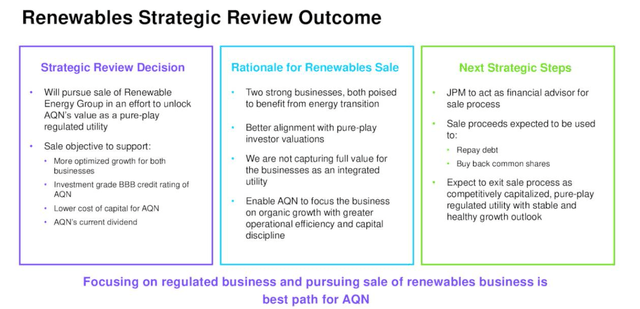

AQN has informed shareholders of the results of such strategic review in conjunction with the 2Q23 earnings release, the (very predictable) outcome being a sale.

AQN 1H23 presentation

The outcome of the review is, unfortunately for AQN shareholders, driven by the precarious financial status of the business rather than the possibility of earning top dollars from the sale. As discussed at the beginning of the analysis, the whole peer group’s valuations have contracted significantly. Elsewhere in the market, Eni (E) is having difficulties offloading even a simple 10% stake in its Renewable generation arm Plenitude, constituted by arguably even more palatable assets. Atlantica itself has had a strategic review ongoing since February, but so far, crickets.

Unquestionably, someone with enough appetite for M&A can be found somewhere in the market, but at what multiples? Under the current market conditions, it is unlikely that AQN will fetch anything more than 8x-9x EBITDA (including the assumption of related debt).

The 1H23 results

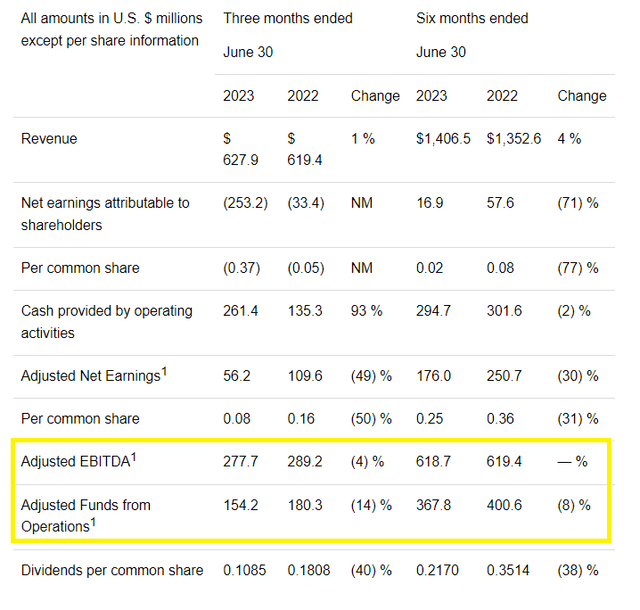

AQN started the first quarter of 2023 on the right footing, with an adjusted EBITDA increase of 3% from $330.5 million to $341 million. However, this quickly reversed in 2Q23: with the company earning $277.7 million in Q2 of this year vs. $289.2 million in 2Q22, the overall 6-month EBITDA was flat (actually, sporting a tiny decrease of $0.7 million from $619.4 million to $618.7 million).

The “culprit” of this decrease was renewable energy, with the DOP of the segment decreasing by double-digits (-18%) to $197 million, with regulated services failing to compensate fully for the loss despite a 12.6% increase in DOP to $469.7 million (please note the sum of these two doesn’t match the EBITDA figure 100% because of corporate overhead elimination).

AQN 1H23 press release

The operational results were again hardly impressive, and the only item standing out in this report was, in my opinion, interest expenses. Interest expenses for the second quarter ate $89.6 million (against an operating income of $93.7 million), a 39% YoY increase and 40% for 1H23 vs. 1H22. Sequentially, interest expenses were further up QoQ by 9.5%.

Notably, management cited during the Q2 earnings call that a sale of the renewable business will allow AQN to move to an FFO-to-debt, lower than the 14% targeted as an integrated entity while maintaining the BBB rating:

One of the things that will be an opportunity for the business is that the FFO-to-debt will be able to be reduced as a result of being a pure play-regulated business (Chris Huskilson)

The obvious caveat here is that, under the current situation and without a transaction, AQN could face a downgrade sooner rather than later. Long-term debt is now crossing the $7.5 billion mark, and adjusted EBITDA could end up flat for FY23 at $1.24 billion. Interest expenses are ramping up to $360 million a year (2Q23 x4), which leaves $880 million FFO and a 12% ratio.

Valuation

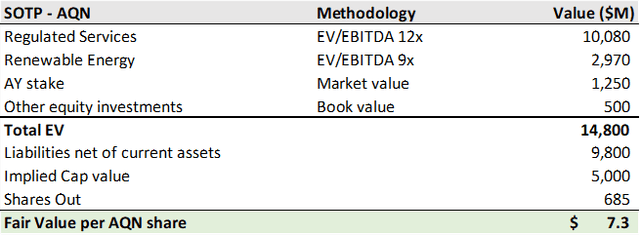

Considering the plans to reorganize the business, the best way to look at Algonquin could be from a “sum of the parts” (SOTP) perspective. This kind of analysis often tends to uncover significant conglomerate discounts that the simplification of the business could theoretically unlock. I looked at the various parts that constitute AQN, but my conclusion is that, in this case, the company seems fairly valued at best, and shareholders should not hold their breath for the breakdown.

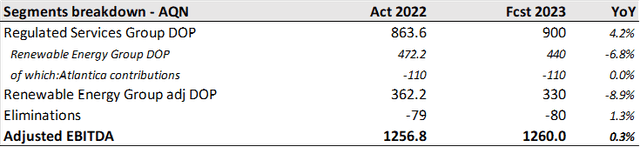

The company earned approximately $1.26 billion in adjusted EBITDA for FY22, and we already know 1H23 vs. 1H22 was roughly flat. I am forecasting more of the same for the second part of the year, although the regulated services segment should see some growth for the year while the renewable energy segment sees some decline. I netted out the AY dividend contributions to avoid double counting (as I value the AY stake separately), and, for simplicity, these are flat YoY (although there is a slight increase). So, the overall EBITDA for FY23 should also come roughly at $1.26 billion.

And Value For All

Because I need to split corporate overheads, I am reducing the Regulated services EBITDA by $60 million and the Renewable Energy EBITDA by $20 million. While the method is crude, it roughly aligns with the gross split. I am assigning a 12x EV/EBITDA multiple for the Regulated Services segment and a 9x for the renewable energy segment, thus implying a 33% premium valuation for Regulated Services vs. Renewable Energy generation.

For the Regulated Services valuation, there’s not much of a leap to make since Canadian peers like Fortis (FTS) or American ones like American Electric Power, Dominion (D), or FirstEnergy (FE) all trade within the same narrow range. Some might argue that 9x for the Renewable Energy segment is low, as CWEN trades at 10x. However, if AQN goes through with the sale in the following months, I’d argue the price is fair and don’t see many chances of getting much more than that: AY and TransAlta Renewables (RNW:CA) already trade at 9x fwd EV/EBITDA. Also, AQN is trying to get rid of these assets, and not vice versa, someone actively seeking them: it is a buyers’ market, so forget about premiums.

And Value For All

From this back-of-the-envelope calculation, my derived fair value for AQN is $7.30 per share, implying no meaningful margin of safety or conglomerate discount against the current market valuation.

Investors Takeaway

Overall, I rate AQN shares an avoid, if not an outright sell. I see little reason for investment, and even if shares do not appear significantly overvalued, investors should look elsewhere or wait for a significantly better entry point. Management’s plan to seek a buyer for the renewable energy segment faces execution risks and adverse market conditions, and even if it were to go through at the currently prevailing multiples, the upside for AQN seems non-existent.

In the meantime, the company remains saddled with a considerable amount of debt, the potential for a credit rating downgrade, which would further raise borrowing costs, and, more in general, a history of overpromising and underdelivering, brushed under the carpet with M&A, debt issuance and share dilution. While not terrible, operational results for the first half of the year were also unexciting. As an investor in AY shares, I am pleased to see there seems to be value left in the company, and AQN shouldn’t go the way of Abengoa soon, but that’s about it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.