Summary:

- Algonquin Power & Utilities Corp. trades at a discount to utility peers with a solid portfolio of generating assets.

- The company is focused on simplifying and streamlining its operations.

- Algonquin is selling its renewable energy business to capture the valuation uplift and secure future investment grade bond ratings.

kitiwan mesinsom

Algonquin Power & Utilities (NYSE:AQN) trades at a notable discount to peers. A divergence from its historical patterns where it often commanded a premium. This change suggests an opportunity here, and I believe there is.

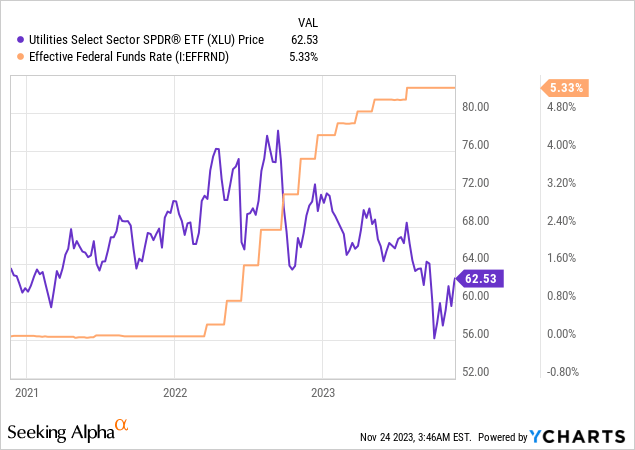

The share price has tanked after a large acquisition attempt that shareholders didn’t like and regulators thwarted. The rising interest rate environment didn’t help either, although we can’t put the blame for AQN’s woes solely there. The chart below shows the utility sector getting smashed as rates reached 2%+

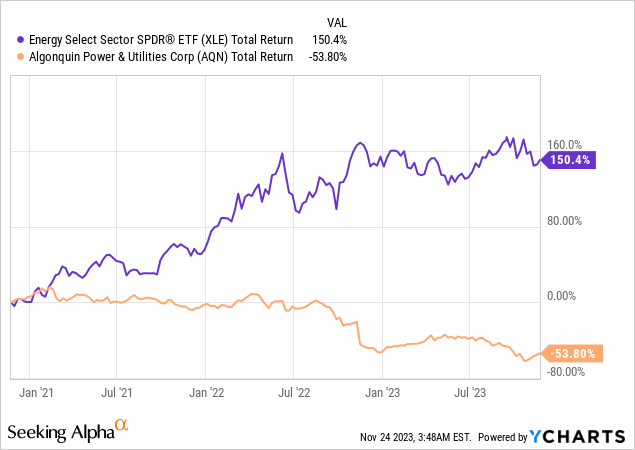

Algonquin’s performance stands in stark contrast to that of the broader index of utilities:

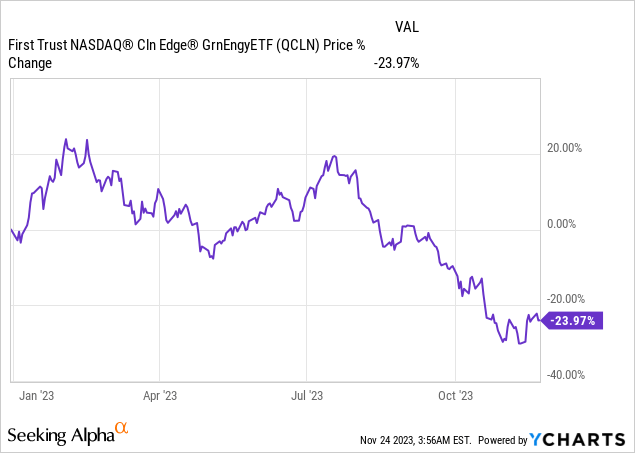

The company isn’t purely a regulated utility and has a renewable energy group. This segment operates unregulated and was intended to capitalize on the growing demand for clean energy. These stocks have recently gotten trounced as well.

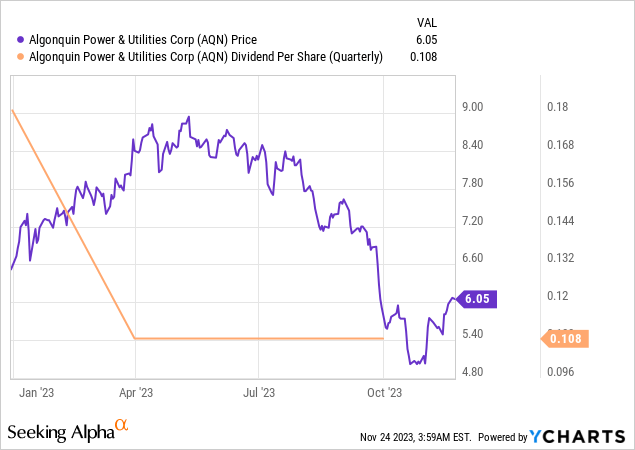

At the start of this year, AQN was doing alright despite all headwinds, but then it halved its quarterly dividend, and the stock started falling shortly thereafter. Utility stocks are traditionally favored by income-focused investors, particularly retirees, for their reliable dividend payouts. They tend to be avoided by fund managers because growth is usually low, and they aren’t in the S&P 500. Because the shareholder base is not very well diversified, it is more likely there will be an outsized price reaction after something like a dividend cut.

If it sounds like a lot went wrong lately, I think that’s fair to say. This attracted activist attention and Starboard Value acquired a 7%+ stake. I think it was instrumental in pushing for the sale of the renewables business and the board is also looking for a new CEO.

The interim CEO is pushing forward with selling the renewable business and plans to maintain a BBB investment grade rating and the dividend at the regulated utility. The forward dividend yield is ~7.17%. Per the most recent earnings call:

We have now kicked off the formal sale process for our renewable energy business. We are, of course aware of the dynamic market environment. That said, we are seeing continued inbound interest from prospective buyers. We own a sizable fleet of high quality renewable assets and an extensive development pipeline. And by no means will our assets be sold at a buyer sale price.

The average multiples for renewable assets (according to Microcap.co) in 2023 are approximately:

- Revenue multiple: 5x

- EBITDA multiple: 18x

- Earnings multiple: 33x

It’s important to note that specific multiples can vary widely depending on the company’s particular characteristics, market conditions, and geography. The earnings multiple tends to be much higher because these companies tend to carry a lot of debt.

AQN trades at 5x sales, 12x EV/EBITDA, and a non-GAAP P/E of 12x. Most of the AQN revenue growth is in the renewables group, which is taking its wind generation from 300MW to 450MW this year, while solar will grow to 400MW.

That’s not to say there’s no revenue growth in the rest of the business, but rate increases drive that, and since this is a regulated business, these are more likely when there is ongoing industry-wide cost inflation. We’re in an environment like that, and it will be easier for utilities to get rate increases. Future prices don’t benefit from utilities toppling over left and right or slashing all expansion plans. The rise of interest rates and their impact on energy costs is undeniable. Per the earnings call:

In total, the Regulated Services Group has pending rate reviews totaling $90 million across four of our utilities. These rate cases reflect our continued commitment to invest in our utilities and recovering these investments.

Our Renewable Energy Group’s divisional operating profit was $66.2 million, down $5.2 million or 7.3% from the same period last year. The decline was primarily driven by unfavorable weather affecting wind and solar of production, offset by an increase from Deerfield II, which came online earlier this year.

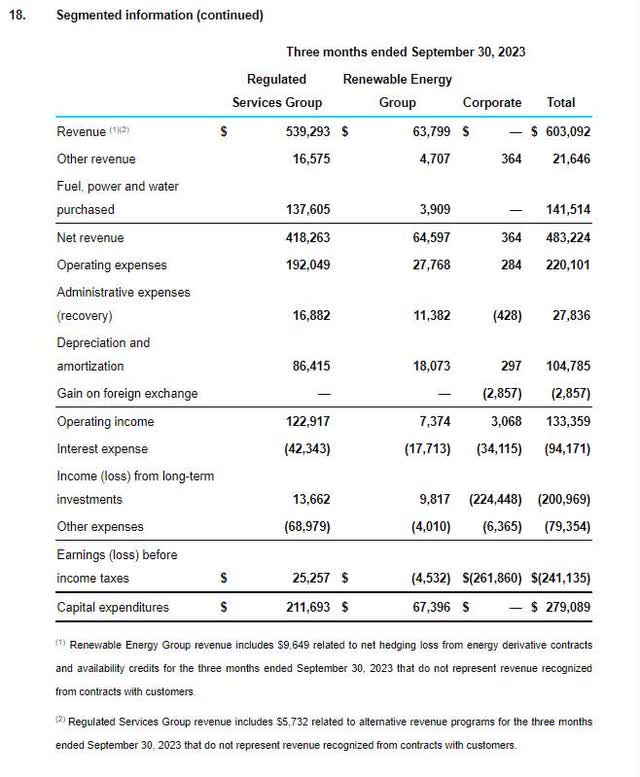

The regulated segment is currently clearly much larger:

AQN segment revenue (AQN filings)

The renewables segment is costlier in terms of interest rate expenses (basically infrastructure financing), while the regulated assets are obviously costlier in terms of fuel.

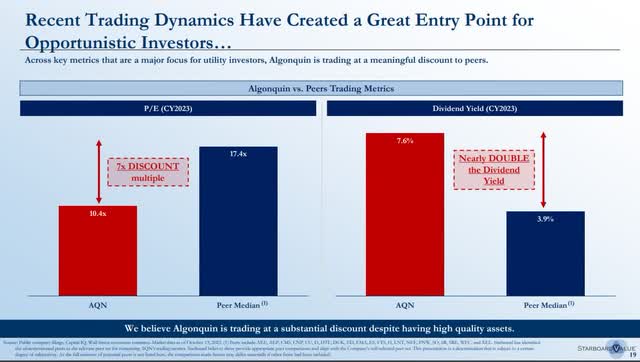

Starboard made the case in its recent presentation the company is trading at a massive earnings discount to other utilities:

Starboard Value slide on AQN valuation (Starboard Value)

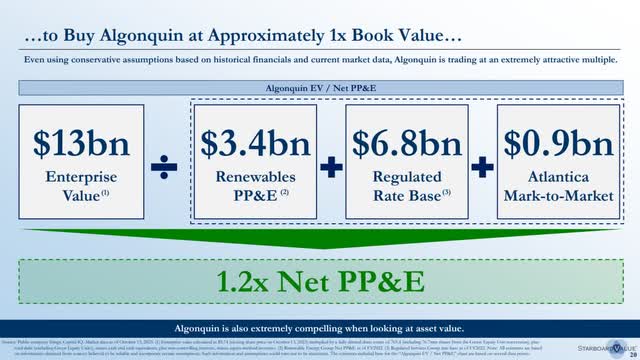

The activist also argues the firm trades at only 1.2x property, plant, and equipment.

Starboard Value valuation slide 2 AQN (Starboard Value)

Because this gets amortized, it is attractive to acquire PPE&E at solid values.

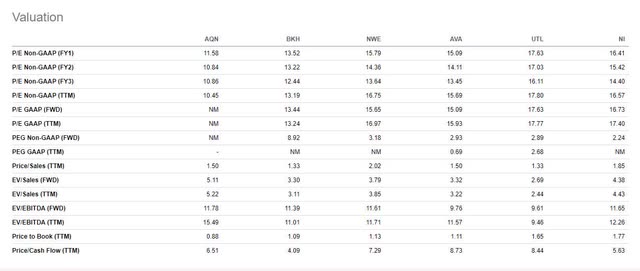

I pulled up a peer group valuation from the Seeking Alpha platform. The discount to book value is immediately confirmed. Regarding P/E, the firm also trades at a discount to this group of utilities. In price to sales, the difference is less evident. On EV-to-sales, the company trades at a premium. Regarding EV/EBITDA, the company trades in-line or at the higher end of the range shown here. There are arguments to be made for AQN deserving a slightly higher multiple because it has no coal plants and a significant and still growing portfolio of renewable assets. As often happens this isn’t really reflected in the multiple of the consolidated entity.

AQN peer valuation (Seekingalpha.com)

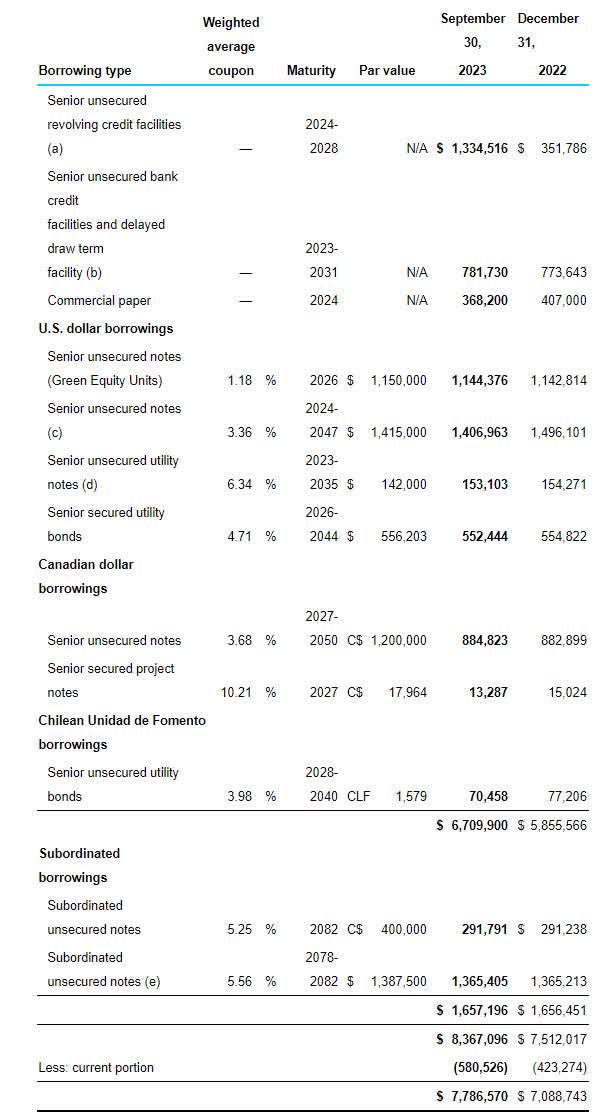

One thing that concerned me was the debt load of the company, which is somewhat higher than its peer group. Going through its filings, I found a couple of interesting things:

AQN filings debt stack (AQN)

First of all, interest costs are rising compared to previous years. The company attributed about 1/3rd of the increase to floating rate increases. I was surprised it was only 1/3rd, but the CEO indicated that only 15% of its debt is floating. Per the earnings call:

Yeah. We have one of the metrics that we closely monitor is our fixed to, our fixed to variable, our fixed to variable rate, and 85% is the target on that, that we have internally as a, as a guardrail, and we’re at 86% this quarter. So, we’re in a, we’re in a decent place on that at this time, and we’ll continue to manage that.

Second, some of the interest rates and maturities look very good. Like senior secured maturing in 2047 at 3.36%.

Third, there is some “green” financing in there. I expected more because this market attracted a lot of money in the past. It may also be attractive to sell the renewable business for that reason. Within a pure-play renewable shell, it may be easier to attract green funding and finance the portfolio of assets at a lower cost. It is a key input cost that greatly benefits its profitability. I can see why a strategic would pay a premium over the AQN multiple.

We likely need some patience before the renewables business will get sold as per this exchange(emphasis mine):

Sean Steuart

Thank you. Good morning, everyone. A couple of questions. First, let’s start with the process to sell the non-regulated power business. Little context on discussions you’ve had with various stakeholders, what’s convinced you that this is the right time to proceed given pronounced valuation headwinds for the group? And any updated thoughts on timelines towards completing the process?

Christopher Huskilson

It’s Chris, thank you. Thank you for your question. I guess, first of all, when we think about our business, it’s a very strong platform of renewable development. And so I guess it’s our view that if there’s a buyer out there who wants a strong platform, who’s ready to invest in renewables for the future, who wants to invest around the Inflation Reduction Act, all those kinds of issues, you know, we think that that platform is a unique offering that we believe people will pay for. And so regardless of what’s happening right now in the cost of capital regime, we think that the platform is something that is quite valuable. And so when we look at it through that lens, and also when we look at the fact that we’ve actually had lots of inbound interest in the platform, we say, we should absolutely continue and go to market. And so if you see what’s happened right now, we’ve put the initial teaser into the market and we’re in the process of now responding to buyers who are interested. And we still would expect that we can get something done here in 2024.

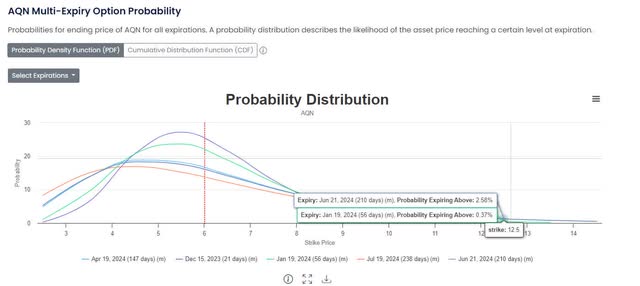

I call out this exchange because, for some people, there could be an opportunity to sell December-covered calls on their position. If you sell a $7.5 call, it seems very unlikely that the share price will close above that. The January call may be even better. If I look at the option price implied probabilities, it suggests a 10% chance the share price closes above $7.5 and a 14% chance it closes above $7.5 in January. That’s a 24% move up. I think the company will be hard-pressed to up that much. It has done well recently, but the market started pricing at lower rates. It seems unlikely the Fed will cut rates or signal a deviation from its higher-longer strategy between now and December. Even if the Fed does, there’s still 24% to go. The January close includes a late December dividend, which will decrease the share price by roughly $0.10.

AQN option implied share price probabilities (optioncharts.io)

There is a greater risk that the renewables business will get sold, and the company will trade up before the January expiry. Still, I think this will be challenging to accomplish before this date, given the stage of the talks and all the holidays in between. I’m not going to be selling any covered calls myself because my trading costs are far too high compared to the premium on out-of-the-money calls I can get here. I don’t want to sell any in-the-money calls because I’m actually constructive on the company’s prospects. I like the valuation, I think the debt stack looks manageable, there are solid prospects for earnings growth due to rate increases, and there’s an activist keeping tabs on things. I don’t think a takeout of the renewables business is imminent. When it gets sold, I expect this to happen at a premium to the company’s valuation and result in a modest uplift.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AQN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.