Summary:

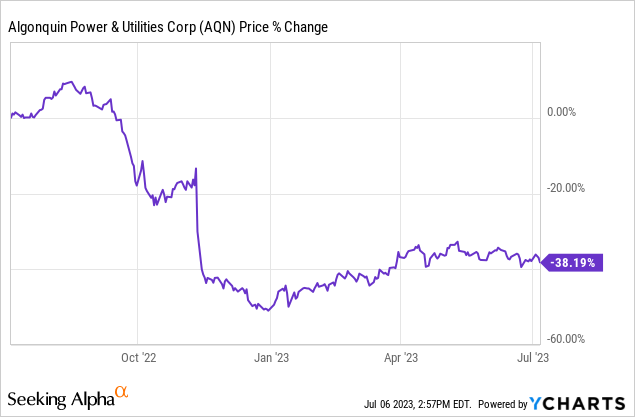

- Algonquin Power & Utilities’ stock has declined by 38% in the last 12 months, partly due to a 40% cut in its dividend in March.

- The company’s higher cost of capital due to increased interest rates has impacted its performance, with interest expenses jumping by $84.2 million (or 40%) from 2021 to 2022.

- Despite a 6% increase in Q1 2023 revenue, adjusted earnings declined 15% to $119.9 million, indicating higher operating costs, including interest expenses.

- Because there are higher-quality utilities out there, we rate Algonquin as a “Hold”.

xijian

Algonquin Power & Utilities (NYSE:AQN) (TSX:AQN:CA) stock has declined about 38% in the last 12 months, as shown below. There are multiple reasons for the big drop.

One reason that’s sticking out like a sore thumb is it slashed its dividend by 40% in March. In fact, the market saw it coming because the stock bottomed in late 2022/early 2023.

(The company reports in U.S. dollars and pays a U.S. dollar-denominated dividend, so the figures in this article are in US$ unless otherwise noted.)

Higher Interest Rates

A rapid increase in interest rates since 2022 has been a big drag on Algonquin, which has most of its operations in the United States. It has two core business groups: regulated utilities and a non-regulated renewable energy portfolio.

It has regulated utilities for natural gas distribution, electrical distribution, and water distribution and wastewater collection, serving about 1.26 million customer connections. Approximately 85% of the regulated utilities revenue comes from the U.S.

Its renewable energy portfolio is comprised of hydro, wind, solar, renewable natural gas, and thermal generation with a gross capacity of about 2.7 GW (net capacity of ~2.4 GW). Although non-regulated, this segment has about 82% of the electrical output under long-term contracts, with a weighted average remaining contract of roughly 10 years. This segment generates about 74% of its revenues from the U.S.

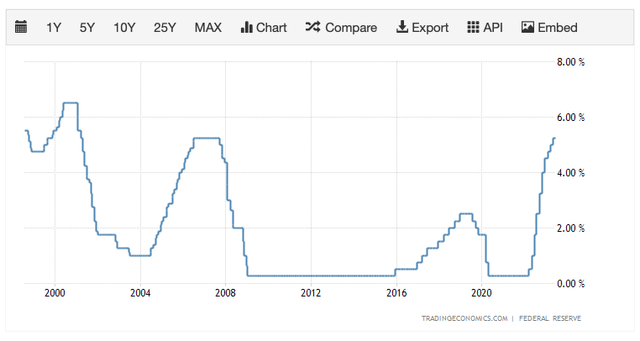

As you can see in the 25-year chart below, the Federal Reserve benchmark interest rate was close to 0% at the start of 2022, but had a swift increase since then.

Utilities are innately debt-heavy because of the large capital investments required. Algonquin happens to be a more leveraged utility, which currently has an investment-grade S&P credit rating of BBB. So, Algonquin would have a higher cost of capital. Investors have a lot of choices for higher-quality utilities out there, with S&P credit ratings of BBB+ to A-.

From 2021 to 2022, Algonquin’s interest expense jumped almost $84.2 million (or 40%). Also, its debt-to-asset and debt-to-equity ratios rose from 54% and 1.55 times, respectively, to 59% and 2x. Particularly, its stockholders’ equity shrunk no thanks to its reporting a net loss of almost $212 million in 2022.

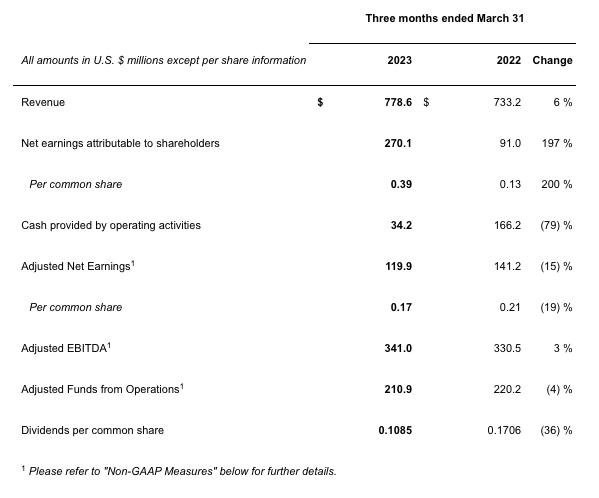

Algonquin Q1 2023 Press Release

Q1 Results

Algonquin reported its Q1 2023 results on May 11. Specifically, revenue climbed 6% to $778.6 million. However, adjusted earnings declined 15% to $119.9 million, which suggests higher operating costs, including interest expenses. Adjusted earnings per share dropped 19% to $0.17, adjusted EBITDA (a cash flow proxy) rose 3% to $341.0 million, and adjusted funds from operations fell 4% to $210.9 million.

Certainly, the results could have been better. At least after the dividend cut, the lower quarterly dividend of $0.108 per share has better coverage, with the Q1 payout ratio at about 64% based on adjusted earnings. Its annualized payout ratio is estimated to be sustainable at about 74% for this year.

Outlook

Management reiterated the 2023 guidance of adjusted earnings per share at $0.55-0.61. The midpoint of $0.58 would suggest a drop of about 16% from the prior year and, as noted earlier — a sustainable payout ratio of about 74%.

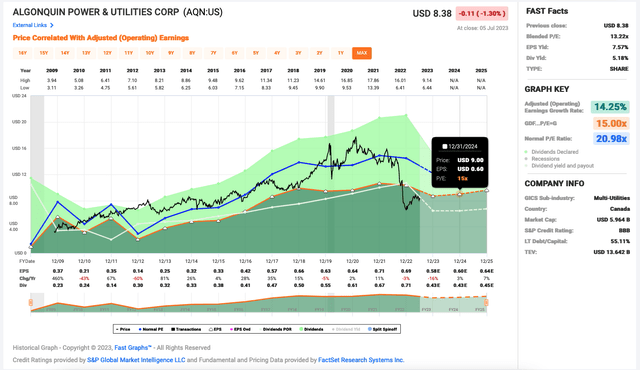

Because of a higher cost of capital, investors should also expect more moderate growth than the past decade. From 2012 to 2022, increased its adjusted earnings per share at a compound annual growth rate (“CAGR”) of about 17.3%.

In the current higher interest rate environment, Algonquin may be able to grow its adjusted earnings per share at a CAGR of 4-5%.

Some people believe it’s a good thing Algonquin terminated the Kentucky Power transaction so that the company could focus on deleveraging.

Valuation

Its price-to-earnings chart shown above suggests a good ~18-month target of about $9, which is based on a very moderate earnings-per-share growth of about 3% next year and a target price-to-earnings ratio of 15. This suggests the stock is fairly valued at $8.22 at writing.

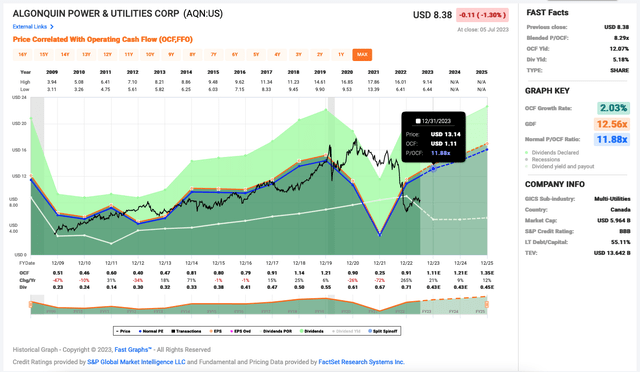

The price-to-cash-flow chart indicates that the stock could be more undervalued, particularly, if interest rates revert lower, which would be possible in a recessionary environment. It shows the possibility of returning to the $13 level, which would represent a discount of about 37%.

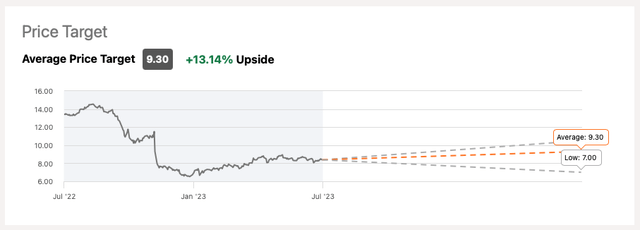

Analysts are siding more with the more conservative target. They believe the stock trades at a discount of about 12% from the average price target of $9.30 per share, which also suggests a near-term upside potential of 13%. Analysts generally think the stock trades at a slight discount.

Investor Takeaway

Algonquin offers a dividend yield of almost 5.3%, which appears to be sustainable. In a higher interest rate environment, its growth has slowed. Based on its reasonable valuation, it could still deliver reasonable long-term returns of more or less 10% per year over the next five years if it executes well.

Given that there are higher-quality utilities with more solid balance sheets and execution history out there, we’re more inclined to rate Algonquin as a “Hold” instead of a “Buy”.

Remember, risks come with every investment. For Algonquin, continued interest rate increases or even it staying at current levels would be a dampener on its growth outlook. Additionally, the utility also has acquisition and execution risk. For example, it might overpay for acquisitions, or it could experience cost overruns for project development and construction, which would lower its bottom line.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.