Summary:

- Alpha Metallurgical Resources, Inc. is the largest met coal producer in the U.S., with a good mix of met coal and a strong export market presence.

- Q2 2024 results showed declines in adjusted EBITDA and net income, but the company still reported a respectable free cash flow.

- Despite a weaker stock performance year-to-date, Alpha Metallurgical Resources has a robust balance sheet, low debt, and the potential for more aggressive buybacks in the future.

Monty Rakusen/DigitalVision via Getty Images

Overview

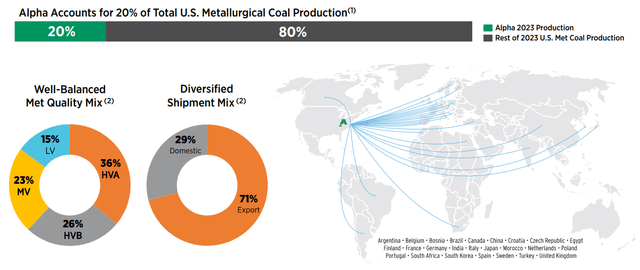

Alpha Metallurgical Resources, Inc. (NYSE:AMR) is a U.S. pure play metallurgical (“met”) coal producer. It is the largest met coal producer in the U.S. and accounts for 20% of total production in the country. The company has a good mix of met coal and sells most of its coal on the export market.

AMR earlier today released its Q2 2024 results, which this article will focus on. There will also be a conference call throughout the day. I have covered the company quarterly over the last year, and my prior articles on AMR can be found here.

Figure 1 – Source: AMR Corporate Presentation

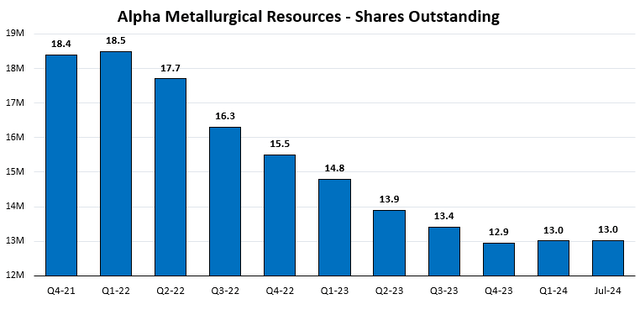

The long-term stock price performance of AMR has been spectacular due to a period of stronger met coal prices, excellent operating performance, and the company having aggressively bought back its shares.

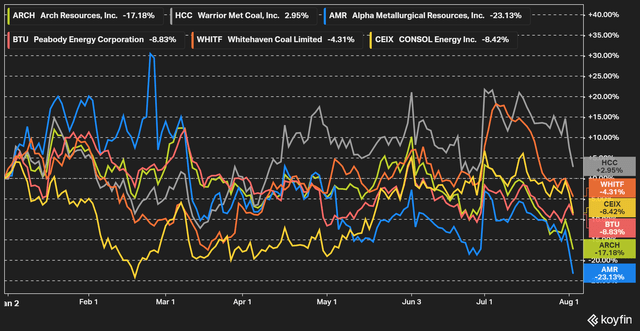

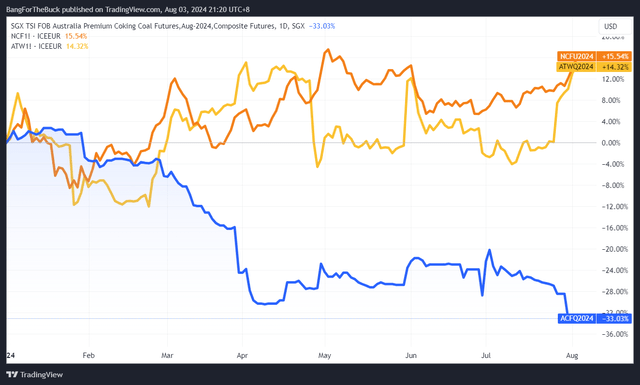

Year-to-date, the stock has had a poor performance, underperforming most Western larger coal mining companies. AMR has a high beta to international coking coal prices, which have been rather weak lately, while international thermal coal prices have held up better in 2024. That, together with minimal buybacks lately, has likely weighed on the stock this year.

Figure 3 – Source: TradingView

Q2 2024 Result

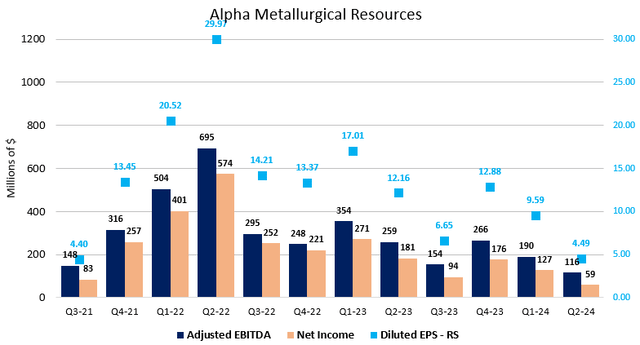

AMR reported an adjusted EBITDA of $116M and a net income of $59M during Q2, which were notable declines compared to the prior quarter. Adjusted EBITDA declined by 39% compared to Q1 and net income declined by as much as 54% QoQ. Q2 was, however, expected to be much weaker than Q1. $59M in net income translated to $4.49 in earnings per share, which was almost on par with the consensus estimate of $4.46 for the quarter.

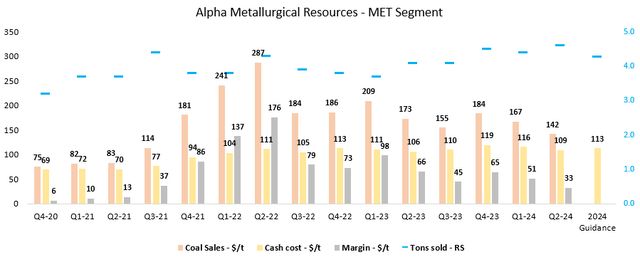

Figure 4 – Source: AMR Quarterly Reports

The company reported 4.6Mt of coal sales during Q2, a 5% increase compared to the prior quarter. The sales price was $142/t and the cash cost was $109/t, cost was slightly below guidance. This led to a margin of $33/t, which is the lowest margin we have seen in 3 years. So, it is fair to describe the current market as rather challenging for AMR and others met coal producers.

Figure 5 – Source: AMR Quarterly Reports

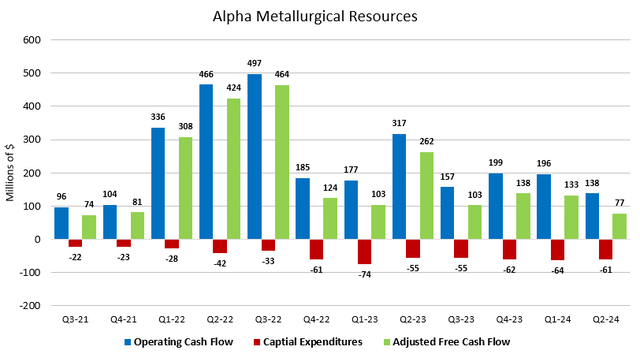

Despite a challenging quarter in a historical context, AMR still reported $77M in free cash flow, which is a respectable figure in the current market environment.

Figure 6 – Source: AMR Quarterly Reports

AMR has been extremely aggressive with its buybacks over the last few years, decreasing the share count by 29% since the end of 2021. However, the company has in the last few quarters not bought back any material amounts of shares but has allowed the cash position to increase. Based on how the share price has behaved, this looks to have been the prudent approach. There were 13.0M basic shares outstanding as of the end of July 2024.

Figure 7 – Source: AMR Quarterly Reports

The balance sheet remains extremely robust for AMR, with $336M in cash and only $8.6M in debt. Given AMR is still generating positive free cash flow in the depressed coal price environment and doesn’t have any large capital commitments, we can expect it to pick up the buybacks in the second half of the year. This is especially true if we see more weakness in the stock price.

Valuation & Conclusion

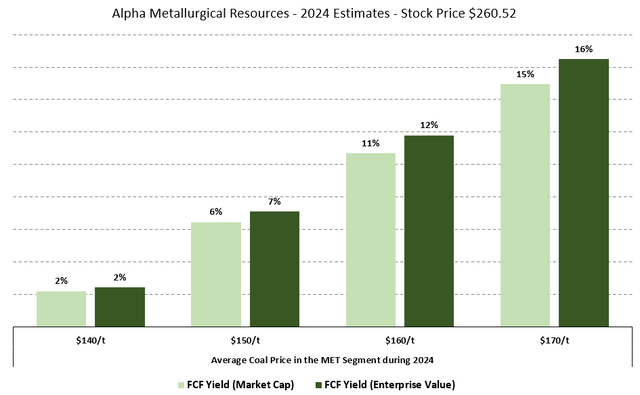

The below chart is based on the latest share price, financials and guidance as of Q2 2024. There haven’t been any changes to guidance lately. It is worth noting that AMR has priced 73% of the expected 2024 sales at $150.36/t. Now, the market is presently very weak, but the above figure does also include 100% of the thermal byproduct sales in 2024.

Figure 8 – Source: My Estimates

Based on the latest figures and current prices for coking coal, AMR is trading with a free cash flow yield of 5-10% for 2024. Now, that isn’t particularly impressive based on recent history, but it is based on some very depressed coking coal price assumptions. So, if we see more of a rebound in coking coal prices, we are probably back with a free cash flow yield in the 10-20% range and 100% of that free cash flow going to buybacks over time.

So, for anyone who missed the run in Alpha Metallurgical Resources last year and has been waiting for a more pronounced pullback, this feels like a solid buy the dip opportunity. AMR has had one of the most impressive operating histories lately and has a stellar management team that understands the importance of capital allocation. The company is still committed to returning 100% of the free cash flow to shareholders over time, even if there might be deviations in some quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AMR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article and are interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio has had the following returns: 81% in 2020, 39% in 2021, -8% in 2022, 12% in 2023, and 14% YTD2024.