Alphabet: 3 Lessons Google Should Learn From Meta To Become Strong Buy

Summary:

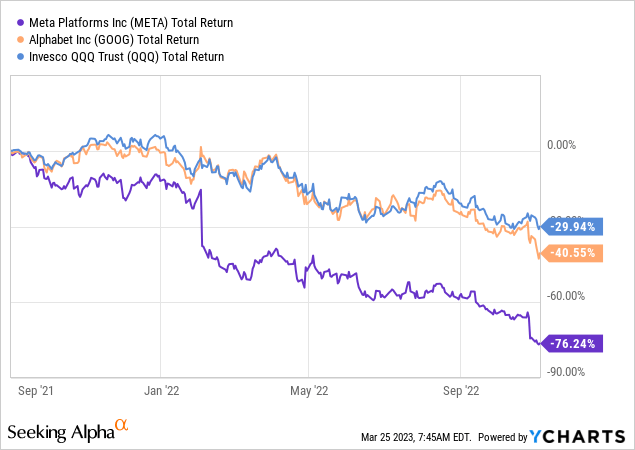

- After peaking in 2021, Alphabet and Meta experienced sharp sell-offs due to a mix of revenue slowdown, decreasing margins, and well-deserved negative market sentiment.

- In 2022, both companies took inefficiency to the extreme. Meta and Google increased headcounts well in excess of revenue growth, which resulted in a significant decrease in earnings.

- Both companies have failed to bring to market a new significant and profitable product for many years, and still rely heavily on their legacy ad businesses.

- Better late than never, it seems Sundar Pichai and Mark Zuckerberg have received the memo – investors want profits. The respective company leaders have declared massive layoffs seeking just that.

- Meta’s stock responded with a 134% surge from its lows, while Alphabet is only up 27%, not much better than the Nasdaq index. If Alphabet learns from Meta, it could become a Strong Buy.

400tmax

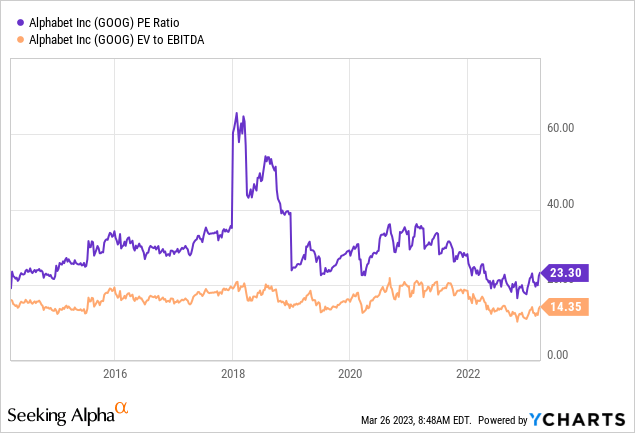

Meta (META) has quickly transitioned from being the scapegoat of big tech to becoming one of the hottest stocks in the market, providing the second-largest YTD returns among S&P 500 constituents. Similar to Meta, Alphabet (NASDAQ:GOOG) has seen its Q4-21 peak fade away, but unlike Meta, Alphabet didn’t significantly outperform the market since its November 2022 lows. Meta is now trading close to its 5-year average multiples, while Alphabet is still far away from that level.

For a multiple expansion to take place, I believe Alphabet must learn 3 important lessons from Meta. Alphabet needs to go more aggressive regarding layoffs and cost-cutting. It needs to provide investors with more clarity and define a detailed path to become a more efficient organization. Additionally, Alphabet should cut unnecessary investments and focus on its core, profitable activities.

I estimate that just like with Meta, if Alphabet signals to investors it is planning to deliver on the above, the market will reward the stock with a multiple expansion, which should result in a 20.2% upside in the short term.

Meta & Alphabet – More Similarities Than You Think

Both Meta and Alphabet heavily rely on their ad businesses, which are based on essentially the same strategy, famously known as – “If you’re not paying for the product, you are the product”.

Meta provides its 2.96 billion daily active users with free-to-use applications under Instagram, Facebook, and WhatsApp. It then sells ad space to more than 3 million unique advertisers, according to estimates. Alphabet doesn’t provide a formal user number. Still, throughout its huge suite of free services – Google Search, Gmail, Google Workspace, Waze, YouTube, Android, and Google Maps – just to name a few, estimates are Alphabet has at least a couple of billion daily active users and more than 5 million different advertisers on its platforms.

Advertisers pay Meta and Alphabet for showcasing their goods and services to the billions of people who use their platforms every day. Both companies specialize in targeted ads and provide customers with analytics and other ancillary services. In 2022, Meta generated $113.6B in advertising revenue, which comprised 97.4% of its total sales, whereas Alphabet generated $224.5B in ad revenues, which amounted to 79.3% of its total sales.

Besides the similar business models, Meta and Alphabet share a common flaw. Neither of them control a significant form of direct access to their end users. Alphabet does have its Pixel phone and other hardware products, and Meta has its Meta Quest, but these take a very small share of their markets, and both Alphabet and Meta have long lists of discontinued unsuccessful products. The wide majority of their users engage with their platforms through iPhones, laptops, and other smart devices, which aren’t made by Meta or Alphabet.

This is why Apple’s (AAPL) privacy policy changes were detrimental to Meta, and this is why Alphabet spent almost $49B on traffic acquisition costs in 2022. Both companies spend a lot of money to secure their platforms as the most attractive destination for advertisers. In essence, this makes Alphabet and Meta more vulnerable compared to other big-tech peers, which are vertically integrated with their users.

Even though the services the companies provide to users are mostly different, as Meta is mainly a provider of social media platforms and Alphabet is leaning more towards productivity services, the two ad giants compete for similar customers and similar budgets. They have many differences, but share a lot of the same risks, and are affected by a lot of the same market trends.

A Weird Kind Of Moat

The two advertising giants possess an unquestionable moat. According to most estimates, people spend an average of 19 minutes a day on YouTube, 29 minutes on Instagram, and 33 minutes on Facebook. Google has become a synonym for internet queries, and Meta owns the two largest social media platforms in the world. Almost every person with internet access is engaged with the companies’ platforms. It’s almost impossible to imagine our world without Alphabet or Meta.

However, users are not the direct source of revenue for these companies. While their active user numbers are constantly increasing and engagement is extremely high, Meta and Alphabet are seeing a slowdown in revenues. YouTube reported negative revenue growth in Q4-22, and Meta reported a total revenue decline for the quarter and for the entire year. That is a consequence and a “side-effect” of their unique business models.

When it comes to Meta and Alphabet, their competitive moats regarding user time and engagement are almost unparalleled. However, their competitive moat regarding their actual customers isn’t as bulletproof.

Even though the activity of users on the companies’ platforms is steadily growing, recession-proof and non-cyclical, the return on their advertisers’ investment is cyclical and very sensitive to the overall economy. Thus, in the current macro environment, advertisers have been scaling back expenses due to many reasons outside the reach of Alphabet and Meta. As financial conditions deteriorate and the economy slows, the consumer gets defensive and the ROI on advertising decreases. This in turn causes lower ad budgets and lower revenues for Alphabet and Meta.

Another flaw with their customer-facing moat is increasing competition for a share of the advertisers’ wallets. Netflix (NFLX), Disney (DIS), Spotify (SPOT), and many other streamers are increasingly engaged with ad-based offerings, as well as other big-tech peers like Amazon (AMZN) and Microsoft (MSFT) who offer unique and more targeted user base to advertise to. These are added to traditional ad-sellers like TV and radio stations, newspapers, etc.

As Meta and Alphabet user-facing moats are extremely strong and in my view unbreakable, I believe their platforms will remain attractive destinations for advertisers. However, advertisers’ demand is more cyclical and more elastic, as they do have some legitimate substitutes.

Explaining The Sell-Offs

After peaking in the fourth quarter of 2021, both Alphabet and Meta experienced sharp declines until they reached their November 2022 lows, with Meta clearly at the worse end of that. Both companies performed worse than the Nasdaq 100 index (QQQ) during that period.

In order to understand the recovery, we need to first understand the reasons for the sell-off. As Covid-19 started to become less of a factor, the global economy experienced a rebalance. Rising interest rates along with supply chain constraints and demand shifts resulted in lower advertising budgets, and lower CPMs.

Despite the worse environment, both Alphabet and Meta over-hired employees to the extreme, which resulted in their headcounts increasing in excess of revenue growth. In 2022, Meta increased its total employee count by 20.1%, while its revenues decreased by 1.1%. Meanwhile, Alphabet increased its headcount by 21.6%, while revenues increased by 9.8%.

This led to financial results investors were not used to seeing, as both companies saw negative operating income growth. For the full year, Meta’s operating income decreased by 28%, while Alphabet’s operating income decreased by a smaller 5%.

As revenues and profits began to slow down, Meta and Alphabet started receiving increased scrutiny from investors with regard to their non-core activities. Alphabet’s investments in other bets like WayMo, and Meta’s shift in focus to become a metaverse company, all contributed to the already lit fire.

Sentiment Can Change Very Fast

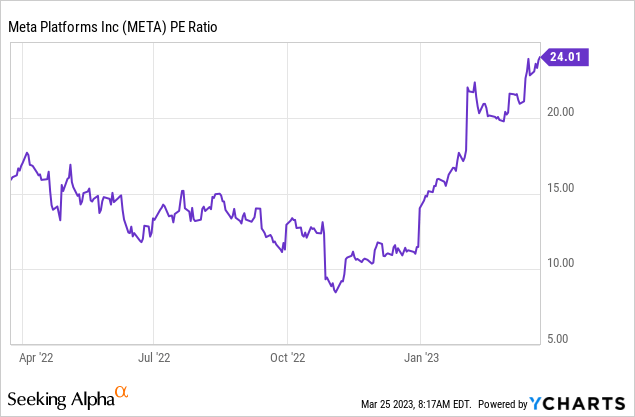

Just when everything seemed doom and gloom and Meta’s P/E dropped to single digits, Mark Zuckerberg announced the first round of layoffs for Meta in November 2022. It was the first of many cost-cutting announcements for the company, which included less focus on the metaverse, hiring freezes, and another round of layoffs.

Meta was smart enough to quantify its cost-cutting plans, reducing its initial guidance from $94B-$100B in total expenses to an updated $86B-$92B range.

And boy, how the sentiment has shifted. From the November 2022 lows, Meta’s stock has more than doubled, with a whopping 134% return in less than five months. All of a sudden we’re seeing investors claiming the fair P/E ratio for the company is higher than 30, and everyday news comes out about another Wall St. analyst raising his price target for the stock.

I do believe the surge in Meta stock was justified, but I am not going to discuss my evaluation of Meta in this article. Rather, I want to examine what we can learn from the Meta case in order to assess if Alphabet has the potential to provide the same opportunity for investors, as Alphabet’s stock is still relatively deflated and recovered only at the market pace.

We don’t want to be the ones that missed a chance for 2X returns with a company like Alphabet right?

Is Alphabet Next?

After the recent surge, Meta is now officially more expensive than Alphabet based on the companies’ P/E ratios, as Meta is trading at a 21.5 forward Non-GAAP P/E compared to Alphabet’s 20.7. Additionally, Meta is trading at a 24.0 GAAP P/E (TTM) ratio compared to Alphabet’s 23.1, and the former trades at a 1.7 PEG ratio compared to the latter’s 1.2.

Putting aside regulatory factors, which are currently positive for Meta with the potential TikTok limitations and negative for Alphabet with antitrust clouds over its head, I believe there are other reasons Alphabet trades at a discount compared to Meta. These are fixable, but investors await a sign from the search giant that the healing process has begun.

First Move – Significant Layoffs

The first move is very simple. Between the two layoff rounds which it announced and the hiring freeze, Meta is planning to let go of 23,000 employees, which is more than 26% of the company’s headcount. Alphabet, on the other hand, announced a less significant layoff of 12,000 employees, which is approximately 6% of its headcount.

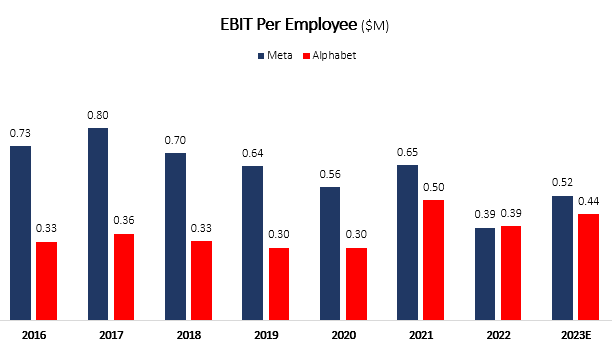

Created and calculated by the author using data from the companies’ financial reports and Seeking Alpha consensus

After many years of significantly trailing Meta, Alphabet got very close to Meta’s EBIT per employee in 2021. In 2022, both companies raced each other to the bottom, as Meta experienced a 40% decline in EBIT per employee, while Alphabet saw a 22% decrease.

Taking the announced layoffs into account, consensus estimates, and Meta’s updated guidance, Meta is expected to take the lead once again in 2023, as it’s expected to outgrow Alphabet by 22 percentage points.

The first move Alphabet must make is to let go of additional workers. So many of the new hires are redundant. Not only do they dilute EBIT per employee, but many of them are not additive to EBIT at all, as they are not generating incremental revenues for the company. If news comes out for another round of layoffs, I’m positive the stock will see an immediate increase.

Second Move – Quantifiable Transparency

When a stock is underperforming, investors start to scrutinize the company’s management on aspects they didn’t seem to care about when the stock was only going up. When it comes to the differences between Meta and Alphabet, one of those aspects is providing investors with quantifiable projections.

For years Alphabet hasn’t provided investors with any sort of material guidance regarding its P&L outlook. During the last earnings call, the only specific guidance provided by Ruth Porath, Alphabet’s CFO, addressed capital expenditures.

The most transparent move a company’s management can undertake upon itself is to provide clear and detailed guidance. This is a risky move however, as a company that cannot meet its own guidance will be even more criticized than a company that didn’t meet analysts’ expectations.

I don’t expect Alphabet to give overly detailed guidance, because the company heavily relies on unpredictable revenues, as customers initiate, enhance or reduce advertising campaigns on very short notice. However, I believe it’s not too big of an expectation to receive a formal goal from the company regarding cost cuts. This could come in a form of a margin target for the near term, or a forecast for how much savings the layoffs will produce.

Almost every other company that announced layoffs included at least information regarding the extent of the severance costs, something Alphabet failed to deliver. As a second move, I believe that if Alphabet provided more transparency for investors with regard to its efficiency targets for the near future, the stock would rise materially.

Third Move – Cut Unnecessary Investments

Looking at Meta, a lot of its problems started with the app tracking transparency (ATT) initiative by Apple. Unwarned in advance, Meta had to quickly accelerate investments in AI capabilities in order to mitigate the impact of ATT on their ad-targeting capabilities. Additionally, Mark Zuckerberg shifted a lot of focus to his building the metaverse ambition, which to this day many investors don’t fully understand. This sudden change resulted in a huge increase in the company’s expenses, as well as its capital expenditures.

Today, in addition to the clear and defined cost-cutting initiatives Meta has taken, it’s clear Mark Zuckerberg is increasingly more focused on Meta’s core offerings. In his letter to employees, he barely mentions the metaverse. Instead, he focuses on the mistakes the company made with its inefficient uncontrolled growth.

Since we reduced our workforce last year, one surprising result is that many things have gone faster. In retrospect, I underestimated the indirect costs of lower priority projects.

It’s tempting to think that a project is net positive as long as it generates more value than its direct costs. A leaner org will execute its highest priorities faster. People will be more productive, and their work will be more fun and fulfilling. We will become an even greater magnet for the most talented people. That’s why in our Year of Efficiency, we are focused on canceling projects that are duplicative or lower priority and making every organization as lean as possible.

— Mark Zuckerberg, CEO, March 14th Letter to Employees

The main reason investors are now bullish on Meta is not a sudden change in conception regarding the metaverse. No, it’s the fact they now trust Mark Zuckerberg to prioritize Meta’s proven profit-making products. Terry Smith said it best – “If they stopped spending on the metaverse today… we would have a business on a single-figure P/E that’s one of the top two digital advertising businesses in the world… I think if they just stop it, the share price would roof”. Well, his prediction was spot on as Meta’s stock is up an additional 15% since Mark Zuckerberg’s latest announcement.

Meanwhile, no similar action appears to happen in the Alphabet headquarters. Investors are hearing news about a $2B investment in NFL Sunday Ticket and essentially no word regarding a specific cut in unprofitable projects. The company did announce however a change in its segment reporting so that its AI expenses will be excluded from its operating segments and instead reallocated to its corporate costs. This, to me, is a major red flag.

As the company is dealing with fierce competition from Microsoft’s ChatGPT and its related AI-based products, Alphabet is forced to answer with its own generative AI solutions. Thus far, its Google Bard product has been demonstrably inferior, at least in the eye of investors, and the company seems to be playing passive defense. It seems Alphabet is essentially forced to invest heavily and quickly in AI, although it was considered to be a leader in that field for many years. As such, I believe the main reason the company is making this reporting change is so it could keep or increase margins in its operating segments, while the overall consolidated margin will be damaged by accelerated expenses on AI.

Unlike Meta, which seems to have full control and a clear path to efficiency, Alphabet seems, for lack of a better term, all over the place. The third move that I believe could change market sentiment is a reorganization, as investors seek a clear and defined vision regarding Alphabet’s strategy. In addition, it’s obvious the stock would benefit from cutting low-priority projects as well.

Conclusion & Valuation

Alphabet is trading around decade-low multiples, both EV / EBITDA and PE. If the company returns to its 5-year average multiples, which is what happened with Meta, then there’s a significant upside in the stock. Meta is currently trading at a 21.5 forward P/E ratio, compared to its 5-year average of 22.8. Meanwhile, Alphabet is trading at a 20.7 P/E forward P/E ratio, compared to a 5-year average of 26.4. If Alphabet is rerated similarly to Meta, there’s a 20.2% short-term upside in the stock.

However, for a Meta-like rerate to occur, investors would need to see three major moves from Alphabet’s management. First, another round of layoffs in the path to becoming a leaner and more profitable organization. Second, more clarity regarding cost-cutting initiatives, either in the form of quantified guidance or actual results. This should be watched carefully as the company is changing its segment reporting. Third, a significant shift in focus from low-priority activities to highly profitable core activities.

Overall, Meta taught us that market sentiment can change very fast. In my view, Alphabet’s core businesses are still among the best in the world, and a change in focus could quickly send the stock back to historical valuations, which means a 20.2% upside in the short term if Alphabet’s management delivers.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.