Alphabet: Deepening Into Marketing Recession

Summary:

- The online advertising market has already faced a recession, but we expect the trend to persist in H1 2023.

- The lower user engagement cost is the main trigger for a further slowdown in the revenue growth of Alphabet and other ad companies.

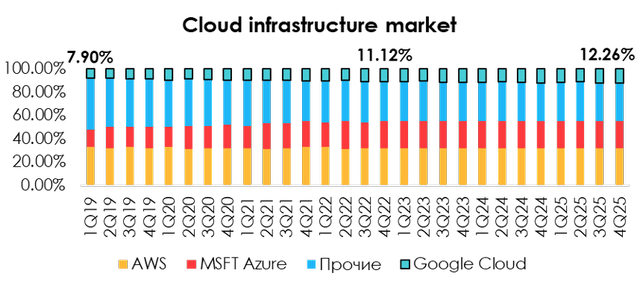

- The cloud infrastructure market is also slowing down: high levels of enterprise customer engagement as well as declining profits are causing companies to abandon or postpone the digitalization of business units.

- Google has presented a clear cost-cutting plan – slower hiring and layoffs will support the company in future years.

- While Google continues to be fundamentally undervalued, we observe certain factors favor even cheaper market prices, so we will wait for the better entry point. HOLD.

400tmax

Investment Thesis

The strong growth in Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) 2020-2021 financial results is gradually being overshadowed by the recession in the online marketing and a slowdown in the cloud infrastructure market. Although we don’t think the company will have much trouble given the online ad market’s recovery as early as H2 2023, the slowdown in revenue growth could create a more attractive entry point. Despite the persistent upside, now we give HOLD status to the company.

Online advertising is outracing economy in terms of recession

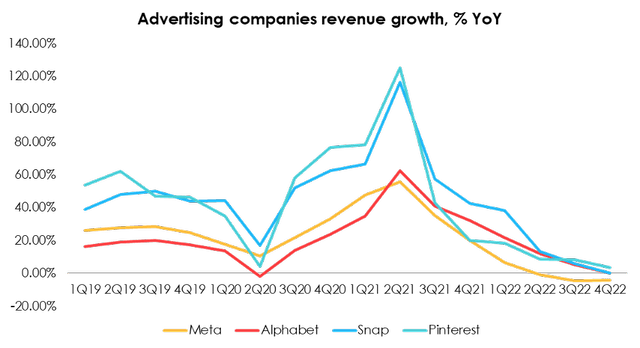

The online ad market continued to decelerate in Q4 in line with expectations. Google’s ad revenue fell by 3.6% YoY for the first time since Q2 2020, even though the number of interactions (clicks) increased by ~6% YoY in Q4 and by 10% YoY in 2022.

Financial statements of other industry players (Meta, Snap, Pinterest) also show signs of a considerable slowdown, so we can state that a recession in the ad market has taken place.

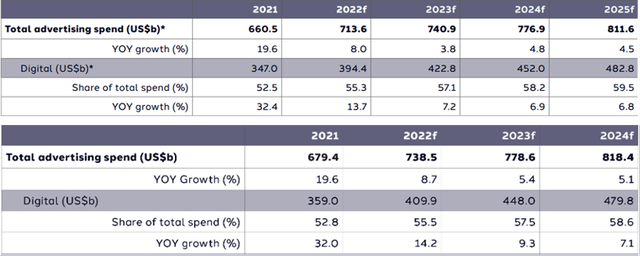

Analyst agencies have revised their forecasts for the online ad market in 2023-2025. According to Dentsu, the growth rate of total marketing spending will slow to 3.8% YoY in 2023 and that of digital marketing spending to 7.8% YoY. In mid-2022, the agency projected overall ad market growth in 2023 at 5.4% YoY and online advertising at 9.3% YoY.

Difficulties faced by representatives of the online ad sector remain unchanged:

- Falling demand for marketing services due to the revision of marketing budgets by companies and, therefore, the cost of interaction with the user (CPC, CPV, etc.)

- Negative impact of high USD exchange rate on revenue from international markets

Marketing remains the most flexible budget item, it is easy for producers to reduce spending or postpone its execution: if they expect demand to slow down and their profits to fall, they can easily reduce or postpone the execution of the advertising budget, especially when it comes to buying traffic. Since the number of users is not decreasing, it is reflected in a drop in the cost of user engagement (CPC, ARPU, etc.)

We still expect the ad market to decline at its peak in H1 2023. Advertising budgets are largely based on corporate expectations and often outpace the dynamics of the real sector, so we expect a gradual market recovery in Q3 2023.

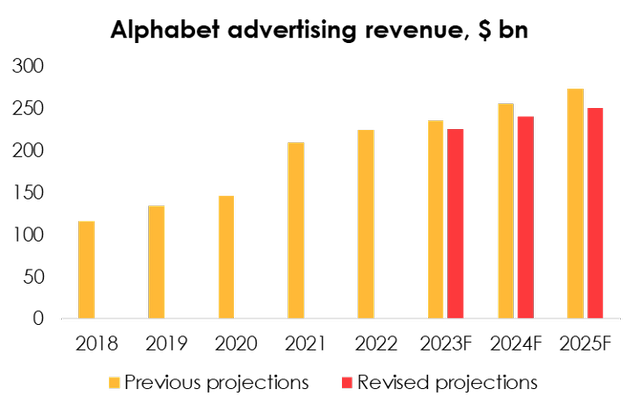

Nevertheless, given the revised forecast for the future growth rate of the online ad sector, the continued negative impact of the high USD exchange rate in Q1-Q3 2023, as well as shift of expectations for a peak market decline from Q1 2023 to Q2 2023, we have revised our forecast for Alphabet’s ad revenue from $235.8 billion (+4.7% YoY) to $226.1 billion (+0.8% YoY) in 2023 and from $255.5 billion (+8.4% YoY) to $240.4 billion (+6.3% YoY) in 2024.

Cloud market huge penetration is achieved, the market is slowing

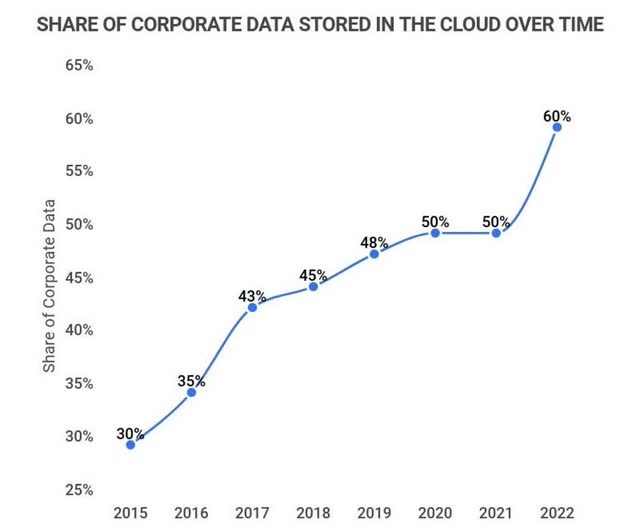

The cloud market is also showing signs of slowing explosive growth from 2018-2021. This is largely since the biggest potential customers from B2B markets are already using cloud infrastructure. According to Zippia, in 2022, ~90% of companies in the U.S. are already users of cloud infrastructure, and ~60% of corporate data was stored there.

The largest companies in the sector (Amazon AWS, Microsoft Azure), with a combined market share of ~55% according to Canalys, are also indicating a slowdown in demand and expect the trend to persist into 2023. Amid a massive drop in profits, customer companies are starting to give up or postpone digitalization of certain business units, leading to lower market growth forecasts.

Alphabet is a relatively small player and has a share of ~11% as of Q4 2022. Nevertheless, Google has been actively growing over the past five years, significantly outpacing the broad market, so we believe that the product’s versatility for enterprise customers and Google’s active investment in development (including AI implementation) will help the company continue to increase its presence in the cloud market.

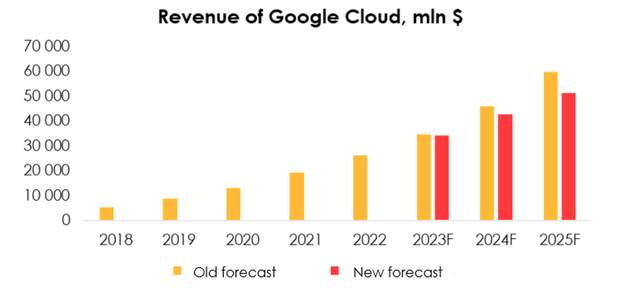

Nevertheless, the decline in the broad market forecast affects the lower the Google Cloud revenue forecast: we have revised the Google Cloud revenue forecast from $34.7 billion (+30.3% YoY) to $34.3 billion (+33.4% YoY) in 2023 and from $45.8 billion (+31.9% YoY) to $42.7 billion (+24.6% YoY).

2023 margin expansion

Alphabet’s operating margin decreased sharply from the highs of 2021 due to lower CPC, strong growth of salaries and a greater share of low-margin segments in the revenue structure – reached 23.88% (-5.15 pp YoY).

However, the management made it clear that it will focus on profitability over the medium term: The company plans to lay off about 12 000 employees (about 6% of the company’s staff) and meaningfully slow the pace of hiring starting from Q1.

Alphabet also looks to exit some lease agreements for office space in view of the plans to reduce headcount.

Staff reductions will cost the company about $1.9 bn in on-off expenses, and it will incur about $500 mln in further costs related to lease exits.

Excluding the additional expense items in 1Q 2023, our outlook for Alphabet’s profitability growth in 2023-2025 remains unchanged: We are forecasting operating margin to reach 26.64% in 2023 and rise to 28.07% in 2024.

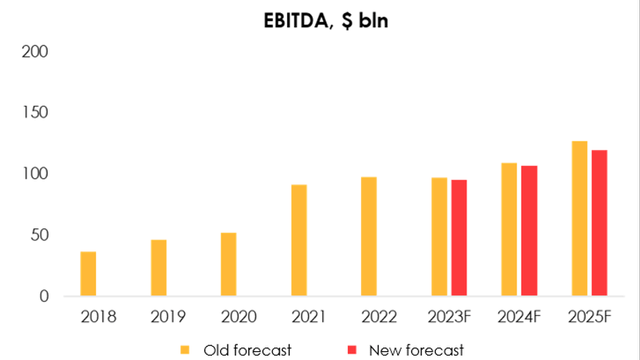

We are lowering the EBITDA forecast from $97.0 bn (+6.2% YoY) to $95.3 bn (+5.0% YoY) for 2023 and from $109.1 bn (+12.4% YoY) to $106.5 bn (+6.2% YoY) for 2024 due to:

The reduction of the forecast for Alphabet’s revenue from 301.7 bn (+6.9% YoY) to 294.3 bn (+4.0% YoY) for 2023 and from $334.5 bn (+8.4% YoY) to $317.4 bn (+7.9% YoY) for 2024.

Reflecting the one-off expenses of $2.4 bn, which are to be incurred in Q1 2023, in the operating income forecast.

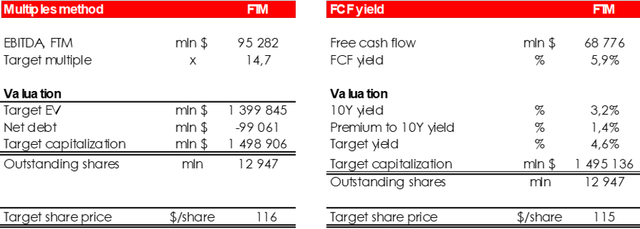

We are evaluating GOOGL target price based on FTM EV/EBITDA multiples & FCF Yield. We are maintaining the rating at HOLD

We are raising the fair value price for the shares from $112 to $116 due to:

- The reduced EBITDA forecasts for 2023-2024;

- The shift in the FTM valuation (we earlier included the period from 4Q 2022 through 3Q 2023 into the forward 12 months EBITDA forecast, while now the forecast period runs from 1Q 2023 to 4Q 2023).

Conclusion

While Google continues to be undervalued, we maintain a neutral view on the stock. We think the stock price will become more attractive amid a likely overall decline in indices and investor reaction to further slowing growth: the online ad market shows strong weakness, and we believe that the peak decline is yet to come, while growth in the cloud infrastructure market will slow significantly due to high market penetration.

To manage the position, we suggest keeping an eye on financial statements of Alphabet and its competitors (Dentsu, eMarketer, McKinsey) and industry research.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.