AltaGas Vs. Algonquin: Discounted Utilities With Ominous Similarities

Summary:

- AltaGas & Algonquin have a lot of similarities.

- The companies have assets in two sectors but there are big differences in their fundamentals.

- Algonquin is tracing a similar path to AltaGas after its WGL acquisition.

- We make a prediction for the bottom if history continues to rhyme.

yangphoto

We all like things that fit. The stock market is no different. That is why companies that fit the mold, get good valuations. On the other hand, conglomerates holding assets in 5-10 sectors, often are discounted. We have seen the same discount in two stocks we follow, but for different reasons. We compare the similarities between Algonquin Power & Utilities Corp (NYSE:AQN) and AltaGas Ltd. (OTCPK:ATGFF) and tell you why we strongly prefer one over the other for 2023. We also trace back the history of AltaGas and show you why AQN might be tracing a similar path.

The Similarities

Both AQN and AltaGas are first and foremost regulated utilities.

AQN’s regulated assets are due to be expanded with the Kentucky Power acquisition in early 2023. Post this, we estimate about half the gross asset value will be from regulated utility services. The balance form AQN comes from renewable energy projects where AQN has no “guaranteed profit”.

AltaGas is another regulated utility powerhouse. But here the second half is the midstream energy segment.

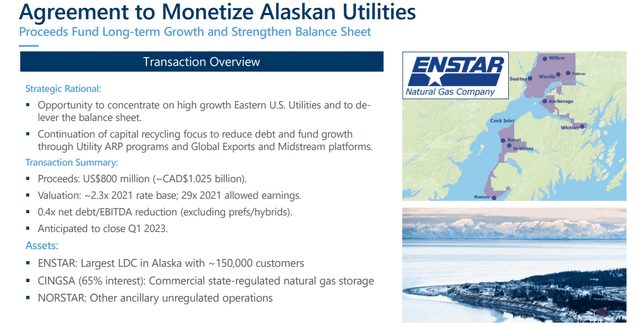

AltaGas Presentation

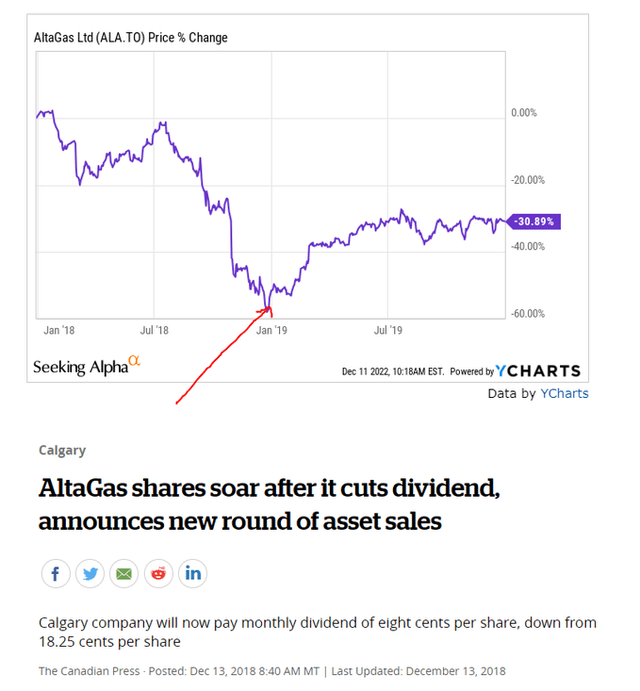

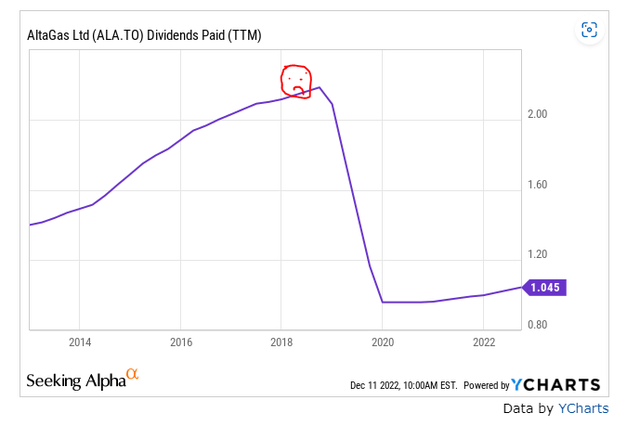

The similarities don’t end there. AQN and AltaGas also share a similar history of taking on too much debt to expand. In the case of AltaGas it was way back in 2018 when they bought out WGL at a silly price. It was an extraordinarily bad deal at stupid valuations which we panned with wild abandon. AltaGas spent the better part of the last 5 years repairing that mistake. That involved a big axe to the dividend and selling prime assets.

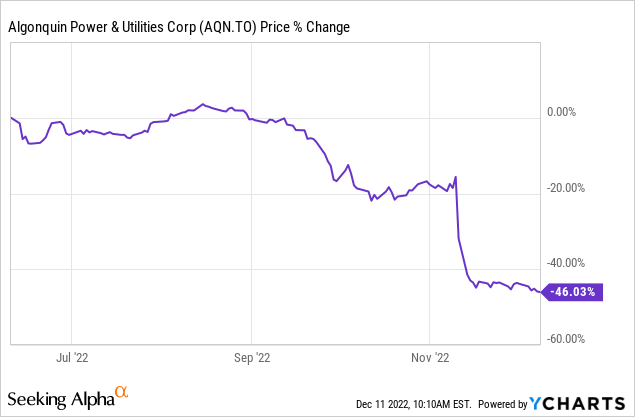

AQN is now in the same shoes as AltaGas post the WGL purchase. The market has been swift to punish the company for taking on extraordinary levels of debt and then failing to execute to perfection.

Current Valuations

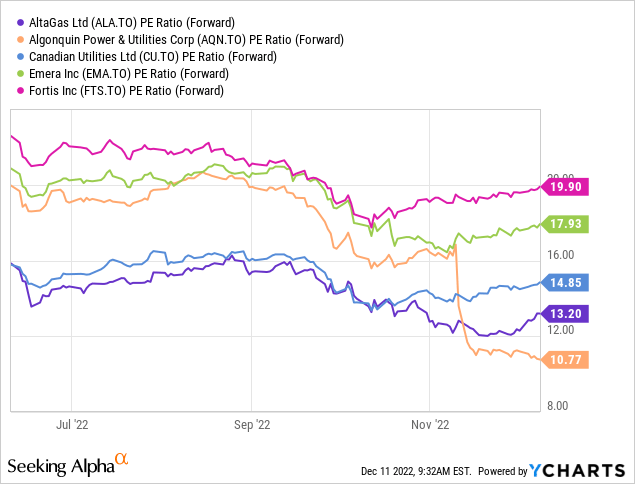

The key reason we are of course focusing on these two is that they stand out in the utility space. The direct comparatives here of Canadian Utilities (CU:CA) (OTCPK:CDUAF), Emera Inc. (EMA:CA) (OTCPK:EMRAF) and Fortis Inc. (FTS:CA) (FTS), all are significantly more expensive.

Of course, a direct comparison is cheating a little. The two have other assets that are hard to blend into a conventional P/E metric. But let’s see if we can flesh the numbers out a bit better.

AltaGas

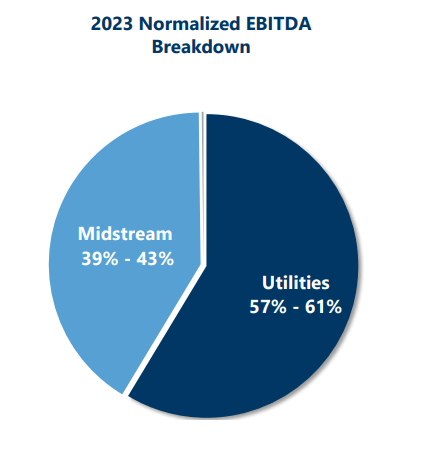

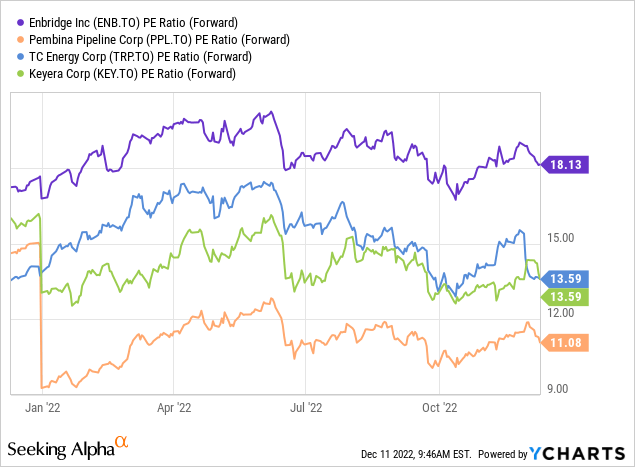

The apparent problem here was that we were lumping in midstream alongside regulated utilities. But this really is not that much a problem as the market tends to value Canadian midstream companies like Enbridge Inc. (ENB) (ENB:CA) at similar P/E multiples.

So here, using a blended valuation (P/E multiples across two segments) continues to show that AltaGas is still cheap. The company’s only fault here, if we can find one, is that it tended to hold more debt than the rest of its midstream peers. That of course had come about thanks to the horribly expensive WGL purchase. AltaGas debt shedding has been proceeding really well though and the final piece is due for 2023.

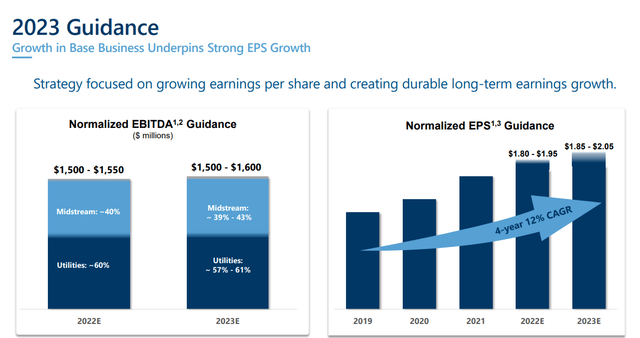

The sale price of Alaskan Utilities was close to 17X EV to EBITDA and that means that AltaGas will drop its debt below 5X EBITDA. The company guided for strong earnings in 2023 driven by continued strength in utilities and a rising midstream sector.

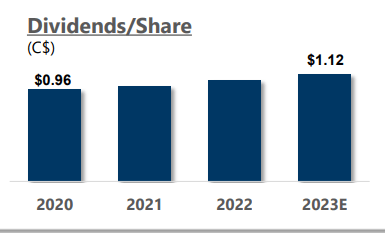

It also gave what all investors were craving, a dividend hike.

AltaGas Presentation

Before we look at AQN, a key thing to put context on this dividend is the fact that AltaGas was paying $2.19 CAD per share in 2018 before it bought out WGL “for growth”. We have done our best to show you when they made that mistake.

Y-Charts Plus Author’s Rembrandt Level Artwork

That is how errors like this play out. Repairing takes a long time and you get pretty poor returns in the interim.

Algonquin

Algonquin’s discount on P/E multiples needs to be similarly resolved before we reach a conclusion on the valuation. The power/renewable energy segment has historically been valued by analysts on an EV to EBITDA multiple. It trades at about 13.8X on EV to EBITDA basis (source). This compares to sector wide valuations of about 12X on average. This is of course after a historic drubbing.

That just goes to show you that the company was quite expensive to begin with. Blending the two metrics together shows that AQN is nowhere near cheap, even now.

Verdict

We reiterate our buy rating on AltaGas as the stock is truly cheap and remains our top pick in the Canadian regulated utility segment. Yes, the dividend is modest, but safe. We also love that the capex is full covered from cash flow and gives company a lot of flexibility. The company has no crazy ambitions any more about spending massive amounts of dollars to grow. That is exactly the kind of utility you want in your portfolio. Investors interested in an even safer yield can consider the AltaGas Ltd. RED PFDSHS SER E (OTCPK:AGEEF) (TSX:ALA.PRE:CA). The current yield on that is 6.57% and it resets in December 2023 at Government of Canada 5 year bond yield plus 3.17%. This issue makes sense for those bearish on bonds for the next year.

For AQN, a shorter term rebound is possible as the stock remains hopelessly oversold. This may happen after tax loss selling gets done. Post that, a bounce 20% higher looks probable. For a longer term trajectory, we take direction from AltaGas. Note below, where the bottom came.

Identical dates not withstanding (that cut came on December 13, 2018), we think a 60% drawdown from the 2022 starting price looks likely. That puts us closer to $5.60 for a final bottom. Watch for the dividend cut announcement which we think is two shoes in for 2023.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have a beneficial long position in the shares of ENB.PRN:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.