Summary:

- British American Tobacco p.l.c. writes down value of its U.S. brands from $80 billion to $50 billion, jolting the U.S. tobacco stocks.

- Marlboro continues gaining market share slowly but surely.

- Reinvesting at this level is likely to recoup original investment in 7 years or less.

- Altria Group, Inc. stock is weak technically and may breach the $40 mark should the weakness continue.

Mario Tama

Investors in tobacco stocks are likely to spend the rest of the week sweating as British American Tobacco p.l.c. (BTI) has written down the value of some of its U.S brands, which was valued at $80 billion for a long time but has now been written down to about $50 billion. Seeking Alpha has covered this developing news item here.

As a long-term investor in Altria Group, Inc. (NYSE:MO) and Philip Morris International Inc. (PM), I am of course very interested in this development and a bit concerned about how it may affect my holdings. My biggest holding, Altria, closed the day down more than 2% pre-market, but I feel a lot better in the schadenfreude that BTI was down nearly 10% at one point. Ouch.

While analysts are already defending BTI, the damage is already evident for the tobacco stocks, especially when you consider that BTI writing off the value of their brands in U.S does not necessarily shrink the (already shrinking) U.S tobacco market. If anything, I’d argue that this may make the Marlboro man stronger than he already was when it comes to brand recognition. In 2017, Marlboro held 40% of the U.S. market share, and in what maybe a surprise to the readers, this number has inched up to 42.50% in 2022. While it is undeniable that the total market size is shrinking, Altria’s share of the shrinking pie (as a percentage) has slowly but surely inched upwards. And I am willing to bet that Marlboro will continue to maintain its brand value, just as it has done from 1972 to 2015 to 2020.

So, what is my point? My point is that if you have basic trust in the company’s management, like I do, and believe the core tobacco consumers are likely to stick with their trusted brands even while the ones on the fence stop smoking, Altria is making too much sense as an investment right now. Obviously, this is just a coincidence that I am using to prove my point, but Altria declared its quarterly dividend of 98 cents/share on the same day the stock got hammered.

Okay, that’s a lot of words so far. So, let’s look at some numbers. The table below takes into account the following:

- The company’s current annual dividend of $3.92

- a moderate 3% dividend growth rate, well in-line (below I should say) with the company’s stated goal of mid-single digits dividend growth.

- An investors buys 100 shares of Altria Group at the current market price of about $41 for an initial investment of $4,100 and reinvests the dividends.

Using the above data points, the table below shows the yearly dividend snowball effect. Read the rows as

- “Shares” – shares at the beginning of the year. Let’s call this (A1)

- “Div/Share” – Altria’s assumed dividend at the beginning of the year, with the 3% dividend growth assumption. Let’s call this (B1)

- “Total Div (Before Reinv)” – A1 times B1. Let’s call this (C1)

- “Shares Accumulated” – B1 divided by $41 (assumed reinvestment price). Let’s call this (D1)

- “New Shares Count” – A1 + D1. Let’s call this (E1)

- “Total Div Income (After Reinv)” – E1 times B1. Let’s call this (F1)

| Year 1 | Year 2 | Year 3 | |||

| Shares | 100 | Shares | 109.56 | Shares | 120.35 |

| Div/Share | $3.92 | Div/Share | $4.04 | Div/Share | $4.16 |

| Total Div (Before Reinv) | $392.00 | Total Div (Before Reinv) | $442.36 | Total Div (Before Reinv) | $500.50 |

| Shares Accumulated | 9.56 | Shares Accumulated | 10.79 | Shares Accumulated | 12.21 |

| New Shares Count | 109.56 | New Shares Count | 120.35 | New Shares Count | 132.56 |

| Total Div Income (After Reinv) | $429.48 | Total Div Income (After Reinv) | $485.93 | Total Div Income (After Reinv) | $551.27 |

| Year 4 | Year 5 | Year 6 | |||

| Shares | 132.56 | Shares | 146.41 | Shares | 162.16 |

| Div/Share | $4.28 | Div/Share | $4.41 | Div/Share | $4.54 |

| Total Div (Before Reinv) | $567.81 | Total Div (Before Reinv) | $645.95 | Total Div (Before Reinv) | $736.92 |

| Shares Accumulated | 13.85 | Shares Accumulated | 15.75 | Shares Accumulated | 17.97 |

| New Shares Count | 146.41 | New Shares Count | 162.16 | New Shares Count | 180.14 |

| Total Div Income (After Reinv) | $627.13 | Total Div Income (After Reinv) | $715.46 | Total Div Income (After Reinv) | $818.60 |

| Year 7 | Year 8 | |||

| Shares | 180.14 | Shares | 200.70 | |

| Div/Share | $4.68 | Div/Share | $4.82 | |

| Total Div (Before Reinv) | $843.16 | Total Div (Before Reinv) | $967.60 | |

| Shares Accumulated | 20.56 | Shares Accumulated | 23.60 | |

| New Shares Count | 200.70 | New Shares Count | 224.30 | |

| Total Div Income (After Reinv) | $939.41 | Total Div Income (After Reinv) |

|

Total Dividend Returns After 8 Years (adding up all the bolded values from above, the F1s in the explanation above): $5,648.65. Original investment: $4,100.

Mic drop.

Potential Risks and Conclusion

Obviously, Altria stock’s risks are well known. The company (and industry) lives under constant regulatory threats. The company’s struggles with transitioning to e-cigarettes is well-documented as well with monumental failures in the likes of JuuL. It remains to be seen if NJOY will bring joy to investors, but I am not counting too much on that.

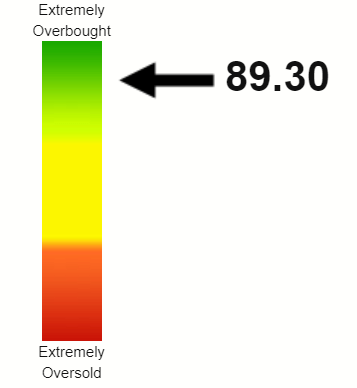

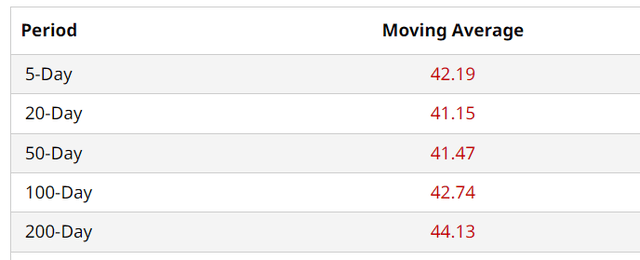

From the technical perspective, Altria stock is way overbought, with a Relative Strength Index [RSI] of almost 90 ahead of today’s selloff. So, it can be argued that a selloff was due anyway, and the BTI news just proved to be the trigger. In addition, ahead of this selloff, Altria stock was just about to sail past the 100-Day moving average but is now firmly below all the commonly used moving averages. It won’t be surprising to see the stock breach the $40 barrier and move into the high $30s before finding a bottom.

To conclude, unless you believe the total tobacco market in the U.S. will get wiped out within the next 7 to 8 years, the math here makes too much sense to pass on Altria Group, Inc. as a dividend holding.

Altria RSI (Stockrsi.com) Altria Moving Avgs (Barchart.com)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.