Summary:

- Altria Group, Inc. will report its first-quarter 2024 earnings on Thursday, April 25, before the market opens.

- In this earnings preview, I share my thoughts on MO’s previous earnings and what can be expected from the upcoming report, as well as longer term.

- I explain the tobacco company’s key challenges, but also point out some bright spots.

- In particular, I will take a look at Altria’s performance in 2023, industry metrics and how I believe Altria can achieve its stated growth target for the period 2024-2028.

FOTOKITA

Introduction

Tobacco major Altria Group, Inc. (NYSE:MO) will report its first-quarter 2024 earnings on Thursday, April 25, before the stock market opens and will hold the corresponding conference call at 9 a.m. Eastern time. Things are not going too well for the cigarette industry in the U.S. in general and for Altria in particular. High inflation is causing consumers to turn to cheaper branded or discount cigarettes, and the increasing availability of (often illegal) e-vapor products and oral nicotine products are also contributing to the current well above average decline in cigarette volumes.

In this update, I share what to expect from Altria’s Q1 earnings report on Thursday and, more importantly, what to expect from the company in the longer term. I explain MO’s key challenges, but also point out some bright spots. As Altria recently announced the partial sale of its stake in Anheuser-Busch InBev SA/NV (BUD, OTCPK:BUDFF), I will also discuss the implications of the recently increased share buyback authorization and what a sale of the entire stake would mean for Altria investors – especially in light of management’s longer-term growth guidance.

How Were Altria’s Previous Earnings And What To Expect From Q1 Earnings?

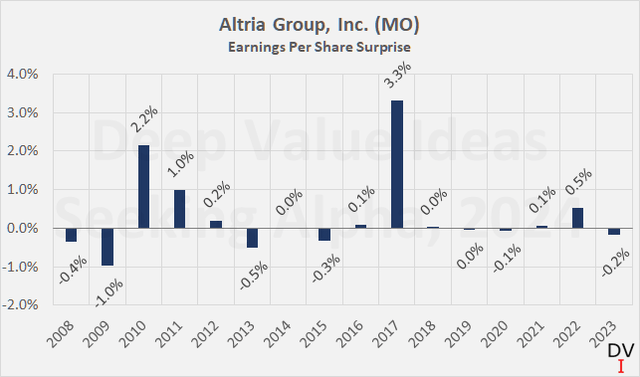

Altria has a history of delivering earnings in line with estimates, with a slight tendency to beat expectations. On a one-year forward basis, Altria has delivered an average earnings per share (EPS) surprise of +0.3% (standard deviation 1.1%) over the last 16 years (Figure 1).

Figure 1: Altria Group, Inc. (MO): Earnings per share surprise on a one-year-forward basis (own work, based on data from Seeking Alpha)

On a quarterly basis and taking into account the last 16 quarters, the average EPS surprise was +1.3% and therefore also slightly above estimates. The pronounced standard deviation of 3.2% is due to the positive EPS surprise of 10.4% in the first quarter of 2020 against the backdrop of the start of the COVID-19 pandemic.

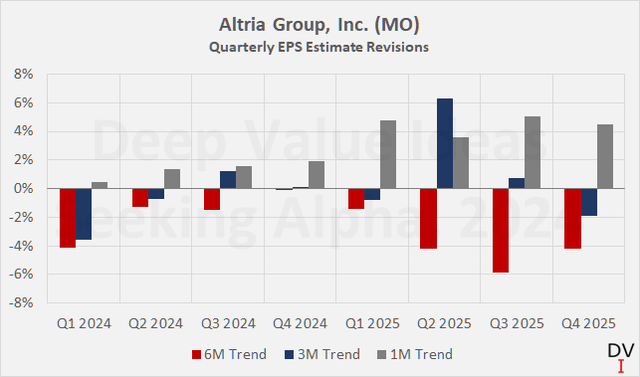

Revisions to quarterly EPS estimates have been slightly negative in recent months (Figure 2), but this is largely due to management guidance published in February 2024 when the full-year 2023 results were released (more on this later).

For the first quarter, which is traditionally the weakest quarter of the year, analysts currently expect Altria to report EPS of $1.15, down 2.5% from a year ago. Net revenues are expected to be $4.73 billion, down 0.7% from a year ago. For the full year, management expects adjusted earnings per share of $5.00 to $5.15, representing growth of only 1% to 4%. The analyst consensus is currently at $5.07, representing growth of 2.5%.

Figure 2: Altria Group, Inc. (MO): Quarterly earnings per share estimate revisions (own work, based on data from Seeking Alpha)

Overall, I think it’s reasonable to expect Altria to once again beat on EPS estimates, especially given the somewhat weak guidance from February. However, in terms of revenues, it’s quite possible that Altria will miss estimates – in the last four years, Altria has come in below estimates 11 out of 16 times. Since the beginning of 2022, when interest rates began to rise in an effort to counter inflation, Altria’s net revenue has been 1.8% below estimates on average.

Let’s now take a look at Altria’s longer-term outlook.

What Are The Longer-Term Prospects For MO Stock, Also Against The Background Of The Impending Menthol Ban?

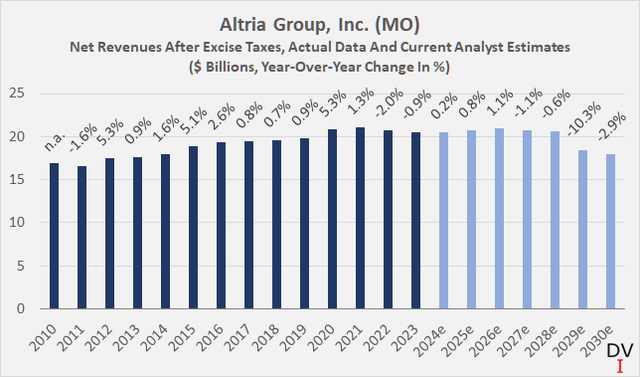

While the near-term EPS revisions were quite negative, analysts significantly raised their expectations for the coming years, especially for 2027 and 2028. This is partly due to the likely delayed menthol ban in the U.S., but also to the company’s longer-term guidance. Analysts currently expect the menthol ban to impact Altria’s sales from 2029 onwards, and they currently model a 10% decline that year (Figure 3). Personally, I don’t see things as negative and have detailed my expectations regarding the menthol ban in a separate article. Instead of the menthol ban, I expect the cross-category movement to be the more important headwind (e.g. see slide 7 of Altria’s CAGNY 2024 presentation). Recall that Altria has only recently begun to include this factor in its assessment of volume decline trends in the cigarette industry (which is published along with other quarterly metrics).

Figure 3: Altria Group, Inc. (MO): Net revenues after excise taxes, past data and current analyst estimates (own work, based on company filings and data from Seeking Alpha)

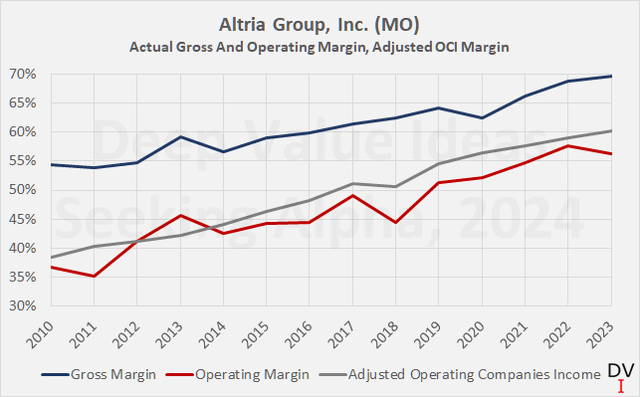

Altria expects adjusted EPS growth in the mid-single digit range in the coming years (i.e. the 2024 to 2028 period), partly by maintaining an adjusted operating margin of 60% (Figure 4, gray line), which raises the question of how growth is to be realized – especially against the backdrop of steadily and sharply declining volumes.

Now let’s take a closer look at how Altria will be able to achieve this kind of growth and what the challenges are.

Figure 4: Altria Group, Inc. (MO): Gross and operating margin based on GAAP data and adjusted operating companies income margin (own work, based on company filings)

Where Are Altria’s Challenges And How Can It Achieve Its Stated Growth Goal?

I explained in detail in a separate article why I believe that the headroom for growth through price increases and margin expansion is increasingly limited. As a result, I believe it will be difficult to maintain growth in the mid-single digits.

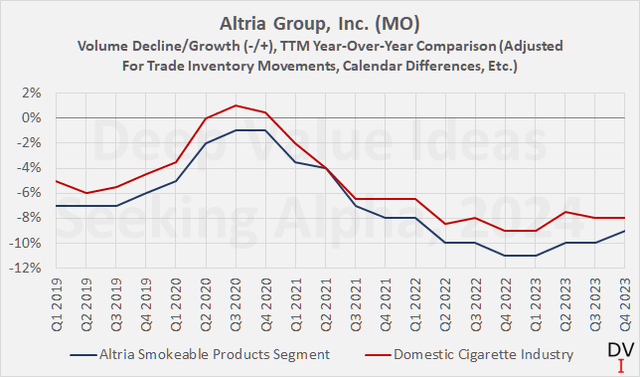

Admittedly, it looks as if the acceleration in volume decline has bottomed out and has recently shown a tendency to reverse (Figure 5). But of course, this does not mean that cigarette volumes are stabilizing, only that the decline has slowed somewhat in recent quarters. Against this backdrop, Altria needs to raise prices relatively quickly to maintain earnings growth, which negatively affects the price elasticity of demand.

Figure 5: Altria Group, Inc. (MO): Quarterly change in volume of the U.S. cigarettes industry and Altria’s Smokeable Products segment (own work, based on company filings)

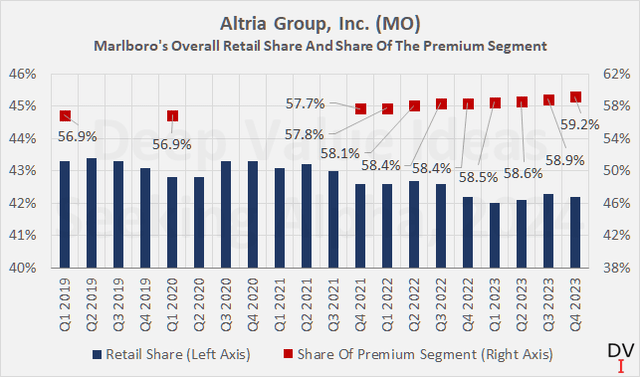

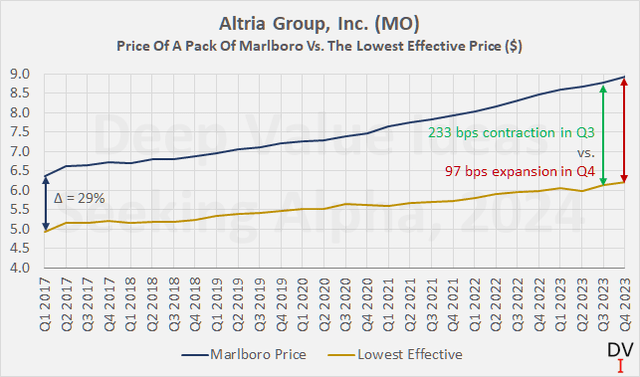

But of course things are more complex than that. As Marlboro (which accounts for more than 90% of cigarette shipments in 2023) continues to gain market share – most recently 59.2% – Altria is increasingly dominating the high-priced cigarette segment (Figure 6). At the same time, Marlboro’s overall share of the cigarette market is declining, albeit slowly, and there are signs of a bottoming out (blue bars in Figure 6).

Figure 6: Altria Group, Inc. (MO): Marlboro’s overall retail share and share of the premium segment (own work, based on company filings)

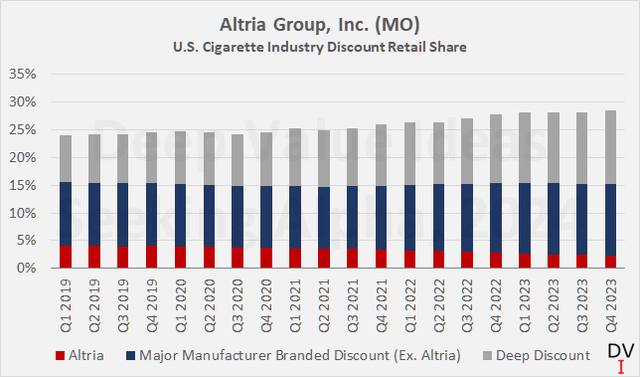

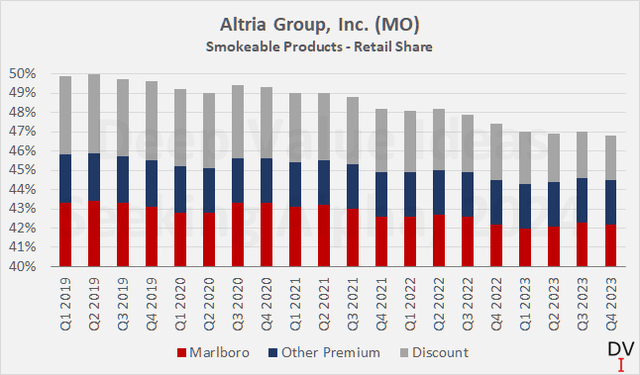

With high inflation, consumers are increasingly gravitating towards discount brands, and Altria continues to lose market share in this segment. This in itself is not a major problem as the contribution to total volume is very small (5.2% of cigarette shipments in 2023), but the fact that discount cigarettes continue to gain market share is hurting Altria (Figure 7, note in particular the deep discount segment, gray bars). As shown in Figure 8, Altria’s total retail share declined from 50.0% in Q2 2019 to 46.8% in Q4 2023.

Figure 7: Altria Group, Inc. (MO): U.S. cigarette industry discount retail share of Altria, other branded discount brands, and deep discount cigarettes (own work, based on company filings)

Figure 8: Altria Group, Inc. (MO): Smokeable Products segment – retail share (own work, based on company filings)

Taken together, it is clear that Altria will continue to rely on price increases to offset volume declines – both in terms of overall industry decline and declining market share. The latter suggests that the bottom has been reached, but it remains uncertain whether Altria will be able to return to a volume decline in line with that of the domestic industry (or possibly even slower).

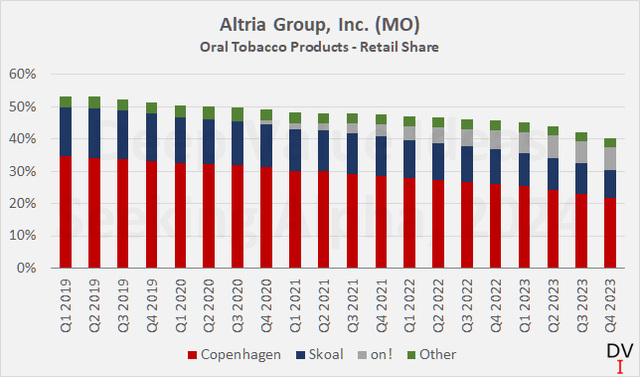

It is unlikely that cigarette alternatives will make a significant contribution to Altria’s growth over the next years. On the one hand, it will take time for the company’s heated tobacco and e-vapor products to make a meaningful contribution to the top- and bottom line. On the other hand, oral nicotine products such as Copenhagen and Skoal continue to lose market share (Figure 9), with shipment volumes having declined by 6.5% and 9.1%, respectively, in 2023. On!, on the other hand, recorded solid growth of 38.5% year-over-year and its retail share improved by 180 basis points to reach 6.8% in 2023.

Interestingly, Altria also plans to market some of its smoke-free products (oral products and SWIC, heated tobacco) internationally, with near-term efforts focused on the nicotine pouch category, in particular on! (slide 44 ff., CAGNY 2024 presentation).

Figure 9: Altria Group, Inc. (MO): Oral tobacco products, retail share of Copenhagen, Skoal, on!, and other products (own work, based on company filings)

However, despite a 2.2% decline in shipment volume, the Oral Tobacco Products segment’s operating income grew 5.5% year-over-year and accounted for 13.9% of total reported operating income. Going forward, if Altria’s Smokeable Products segment operating income remains flat (0.2% decline on a reported basis in 2023) and the Oral Tobacco Products segment continues to grow at the current rate, consolidated internal growth would only be 0.8%.

Against this backdrop – and I realize this reads rather pessimistically – it could prove difficult to achieve mid-single-digit growth by 2028. But there is another lever that Altria can pull – and has recently pulled for the first time: the sale of part of its stake in Anheuser-Busch.

For now, Altria has decided to sell up to 40.25 million BUD shares (depositary receipts and common stock), which would reduce its stake by about two percentage points to 7.8 percent.

In total, the transaction is valued at between $2.15 billion and $2.48 billion, depending on the number of BUD shares actually sold. Altria recently announced the expansion of its existing $1 billion share repurchase program (authorized in January 2024) by $2.4 billion. The company entered into a $2.4 billion accelerated share repurchase program on March 15, 2024, most of which has already been completed. Altria expects to complete the entire $3.4 billion buyback program by the end of 2024.

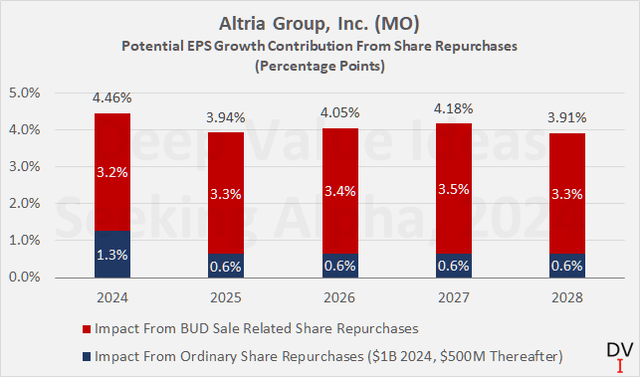

Conservatively assuming an average price per repurchased share of $45 (7% above MO’s current share price), the program would retire 75.6 million shares, or 4.3% of Altria’s shares outstanding at the end of 2023. Put differently, and excluding dilution from performance shares granted or options exercised, Altria’s 2024 earnings per share would grow by 4.5% from share repurchases alone. No wonder management has raised its EPS guidance for the full-year 2024.

However, the increase in guidance from $5.00-$5.15 to $5.05-$5.17 was rather insignificant considering that the $2.4 billion increase in buyback authorization would boost EPS growth by more than three percentage points. Of course, Altria will receive a lower dividend from Anheuser going forward, but at a payout of €0.75 per share (approx. $0.80), Altria’s cash flow will only decrease by about $32 million. More importantly, the full impact of the $3.4 billion buyback program will not be fully visible until 2025, as earnings per share are calculated based on the weighted-average number of shares outstanding.

Nevertheless, the fact that EPS guidance was only raised by 1 percentage point (low end) and 0.4 percentage points (high end) suggests continued weakness in cigarette volumes. However, it is also possible that Altria is under-promising in order to set itself up for a solid earnings beat next February. For now, analysts seem to be largely ignoring this aspect, with the full-year 2024 consensus at $5.07 (range of $4.95 – $5.14).

In my view, it is well possible that Altria gradually sells its stake in Anheuser-Busch over the coming years and spends at least $500 million annually on additional buybacks (currently $1.6 billion of after-dividend free cash flow, assuming $1 billion for debt reduction). This way, underlying earnings could actually remain flat and Altria’s EPS would still grow in the mid-single digits (Figure 10). For simplicity, I have assumed that the shares are bought back at the beginning of the year, thereby resulting in an immediate impact on the weighted-average number of shares outstanding.

This would, of course, also be very beneficial for the dividend payout ratio, which would decline from a low 80% to a high 60%. Conversely, an increase in the dividend in the mid-single-digit range would not have a negative impact on the payout ratio, even if earnings and cash flows on a company level stagnate over the coming years.

Figure 10: Altria Group, Inc. (MO): Potential contribution of share repurchases to EPS growth (own work, based on company filings and own estimates)

Conclusion

Altria Group will announce its first-quarter 2024 results on Thursday, April 24, before the market opens and hold a conference call at 9 a.m. Eastern Time. In my view, investors can expect the tobacco company to report another beat on EPS estimates. The consensus currently stands at $1.15 for the quarter, down 2.5% from a year ago. Net revenue is expected to be $4.73 billion, also slightly below the Q1 2023 level. For the full year, however, Altria is expected to grow EPS by at least 1% to 4%, and management recently raised its guidance from $5.00 to $5.15 to $5.05 to $5.17, or 2.0% to 4.4%.

Altria’s core business continues to be impacted by an above-average decline in cigarette volumes. The rate of decline in Altria’s Smokeable Products segment has improved slightly in recent quarters, indicating a possible bottom, but the company continues to rely heavily on price increases and margin expansion to achieve at least flat internal performance. Marlboro, Altria’s key cigarette brand, continues to gain market share in the premium segment, although the price gap has widened again (44.0% in Q4 2023, up 97 basis points sequentially, Figure 11), thereby confirming the strong pricing power. Overall, however, the company’s retail share peaked at 50.0% in the second quarter of 2019 and has since fallen to 46.8%.

Figure 11: Altria Group, Inc. (MO): Price difference between a pack of Marlboro versus the lowest effective price on a quarterly basis (own work, based on company filings)

Cigarette alternatives have so far made only a small contribution to Altria’s results. On! continues to show promise, unlike Copenhagen and Skoal, but the company’s heated tobacco (Ploom and SWIC) and e-vapor (NJOY) products will most likely take significant time before they make a meaningful contribution to the bottom line. Interestingly, Altria also plans to market some of its smoke-free products (oral products and SWIC) internationally, with near-term efforts focused on the nicotine pouch category, in particular on!.

Given the ongoing challenges related to cigarette volumes, the increasing price elasticity of demand, the limited scope for additional margin expansion and the still early stage of the smoke-free portfolio (as well as mounting competition from Philip Morris International Inc., PM), it seems worth asking where the expected mid-single digit adjusted EPS growth can come from over the next few years.

In my view, Altria’s growth will rely heavily on share buybacks, largely funded by the gradual sale of its stake in Anheuser-Busch and excess free cash flow. The company expects to repurchase $3.4 billion worth of shares in 2024, which could reduce the number of shares outstanding by approximately 75 million or 4.3% of the shares outstanding at the end of 2023. If Altria buys back $500 million worth of shares each year – funded via after-dividend free cash flow – and sells its stake in BUD by early 2028, underlying earnings could remain flat, and the company would still be able to deliver mid-single digit EPS growth. In this way, the dividend could also be increased in the mid-single digits without increasing the payout ratio.

All in all, I think it is the right decision to sell the BUD stake and buy back Altria shares at the current valuation. The balance sheet remains solid, and the debt maturity profile is very balanced (slide 55, CAGNY 2024 presentation), so there is no immediate need to deleverage. I maintain my “Hold” rating as per my previous articles and remain confident in my substantial position in Altria stock.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.